-

Posts

7,261 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by jerrymahoney

-

House GOP ponders action against DOJ in defense of Trump

jerrymahoney replied to Social Media's topic in World News

The government will not have a record of imaginary documents. -

House GOP ponders action against DOJ in defense of Trump

jerrymahoney replied to Social Media's topic in World News

Since the document in question likely does not exist, he could just as easily be saying: "I can't show you this because it's classified" because if he showed them, they might realize the document he was waving at them has nothing to do with the Gen. Milley type-written letter as described at 34. -- which Gen. Milley has let it be known per CNN he never typed such a letter. "Sometimes aides and visitors weren't even sure if what Trump was talking about on national security or military matters was true or if documents Trump mentioned existed, sources recalled." https://www.cbsnews.com/news/donald-trump-indictment-documents-mark-milley-mar-a-lago/ -

House GOP ponders action against DOJ in defense of Trump

jerrymahoney replied to Social Media's topic in World News

Trump said this is classified map and "not too get too close". Item 35 of the indictment. So the PAC guy can't say what actually was the map. It could have been a map of the local cheeseburger fast food outlets. -

House GOP ponders action against DOJ in defense of Trump

jerrymahoney replied to Social Media's topic in World News

Even if they did, the Government would not have an inventory record for documents that Trump has described to various persons but do not exist: Attorneys for Trump informed the Justice Department that they've not been able to locate a classified document related to Iran sought by investigators that was discussed during a recorded meeting, two people with knowledge of the case confirmed to CBS News. One person said it's not clear if the document with the "plan of attack" exists, or if Trump was misidentifying something to those assembled for the meeting, but said prosecutors have the tape. Sometimes aides and visitors weren't even sure if what Trump was talking about on national security or military matters was true or if documents Trump mentioned existed, sources recalled. https://www.cbsnews.com/news/donald-trump-indictment-documents-mark-milley-mar-a-lago/ -

Trump appeals verdict finding him liable for sexual assault

jerrymahoney replied to onthedarkside's topic in World News

I think the appeal in some measure will say jury instructions should have been: If you find the defendant liable for rape, then go to the damages section. If you find the defendant not liable for rape, then you can go home and thank for your service. -

Trump appeals verdict finding him liable for sexual assault

jerrymahoney replied to onthedarkside's topic in World News

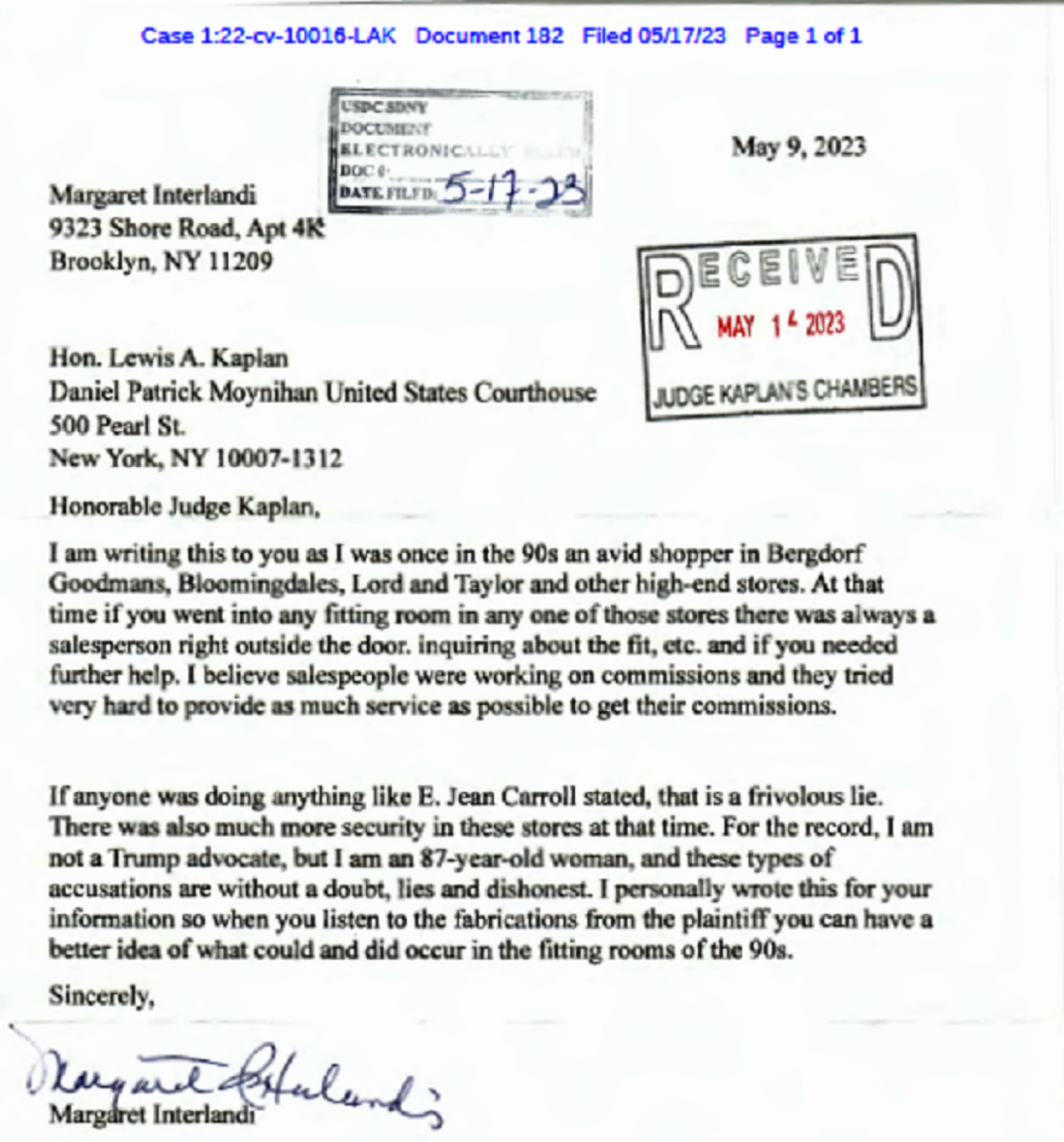

Court filing 26 MAY 2023from United States Court of Appeals for the Second Circuit Civil Appeal Pre-Argument Statement (Form C) Addendum A (1) Nature of the Action Appellee-Plaintiff, E. Jean Carroll’s (“Plaintiff”) contentions arise out of an alleged sexual assault which she claims occurred at the Bergdorf Goodman store in New York, New York on an uncertain date “between the fall of 1995 and the spring of 1996.” There were no eyewitnesses to this alleged incident nor is there any photographic or video evidence of this purported incident at Bergdorf Goodman, which is not surprising since this alleged incident never occurred. By way of one example, Plaintiff claims that there were no customers or staff anywhere to be seen immediately before, during and after the alleged incident. ************* This document is on the court docket of the prior jury trial. The letter is dated May 9. The jury verdict was reached May 9. -

House GOP ponders action against DOJ in defense of Trump

jerrymahoney replied to Social Media's topic in World News

The documents are described in the indictment. If the prosecution can produce them at trial, that is one thing. If it turns out that they don't exist -- as Gen. Milley is on record that he never wrote a document as described in the indictment, that is something else. "The document Trump references was not produced by Milley, CNN was told." https://edition.cnn.com/2023/05/31/politics/trump-tape-classified-document-iran-milley/index.html -

House GOP ponders action against DOJ in defense of Trump

jerrymahoney replied to Social Media's topic in World News

Trump doesn't have to say anything. All the prosecution has to do to prove Trump knew that one or more documents still in his possession post-presidency was still classified is produce the two documents as described in items 33 -35 of the indictment. -

House GOP ponders action against DOJ in defense of Trump

jerrymahoney replied to Social Media's topic in World News

I was responding to this from K. Tug above: "What’s political about stealing top secret information sharing it with people who don’t have A a need to know B no clearance and god knows who else." As to your "You may be right, as it would obviously not be the first time Trump talked B.S." BS is one thing; putting 2 incidents that may well turn out to be blowing smoke and using it as a proof of "state of mind" in a federal indictment which may later turn out to be not as described is something else. -

House GOP ponders action against DOJ in defense of Trump

jerrymahoney replied to Social Media's topic in World News

Re: the events above as noted in items 34. and 35. of the indictment: Attorneys for Trump informed the Justice Department that they've not been able to locate a classified document related to Iran sought by investigators that was discussed during a recorded meeting, two people with knowledge of the case confirmed to CBS News. One person said it's not clear if the document with the "plan of attack" exists, or if Trump was misidentifying something to those assembled for the meeting, but said prosecutors have the tape. Sometimes aides and visitors weren't even sure if what Trump was talking about on national security or military matters was true or if documents Trump mentioned existed, sources recalled. https://www.cbsnews.com/news/donald-trump-indictment-documents-mark-milley-mar-a-lago/ -

Insurance companies checking your medical records

jerrymahoney replied to omnipresent's topic in Health and Medicine

So you are suggesting that being asked by the doctor how much alcohol you drink had nothing to do with your just having a lot of tests? -

“This audiotape simultaneously makes out many of the elements ... of the crimes and simultaneously rebuts and debunks his defenses,” (Preet Bharara, the former U.S. attorney for Southern New York) said. “These are all his own words that he’s using,” (Asha Rangappa, a former FBI special agent) said. “There’s audiotape of him knowing that this is classified information. https://www.nbcnews.com/politics/donald-trump/live-blog/trump-indictment-classified-documents-live-updates-rcna88714 Meadows’ autobiography includes an account of what appears to be the same meeting, during which Trump “recalls a four-page report typed up by (Trump’s former chairman of the Joint Chiefs of Staff) Mark Milley himself. It contained the general’s own plan to attack Iran, deploying massive numbers of troops, something he urged President Trump to do more than once during his presidency.” The document Trump references was not produced by Milley, CNN was told. https://edition.cnn.com/2023/05/31/politics/trump-tape-classified-document-iran-milley/index.html The Bedminster conversation is referenced in items 33. and 34. of the indictment. What happens if/when the defense asks the prosecution for a copy of the memo referenced in 34. and as described by the former FBI agent above?

-

Insurance companies checking your medical records

jerrymahoney replied to omnipresent's topic in Health and Medicine

As long as this topic is now hypothesizing on secret medical record databases, maybe this: The gent says he spent 3 months and 500k baht on his pneumonia stay. That would indicate to me they ran a lot of tests. Was there some indication in those tests that there had been a prior stroke? -

Insurance companies checking your medical records

jerrymahoney replied to omnipresent's topic in Health and Medicine

Well that's the rub, Ms. Sheryl -- this topic is about how not to tell them the truth and withhold some adverse medical history. -

Insurance companies checking your medical records

jerrymahoney replied to omnipresent's topic in Health and Medicine

So this whole discussion is how can insurers find out about some medical event about which you decided not to tell them. -

Insurance companies checking your medical records

jerrymahoney replied to omnipresent's topic in Health and Medicine

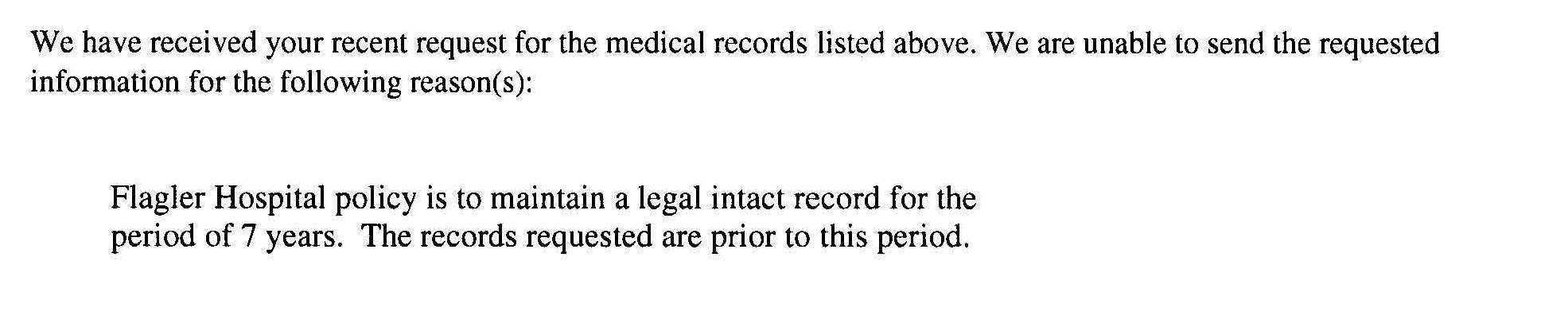

I was once asked to provide a medical record. This is he letter I received from the hospital in Florida (click on jpg to enlarge) -

Insurance companies checking your medical records

jerrymahoney replied to omnipresent's topic in Health and Medicine

That depends whether it 'hurts a little' before or after you took out the insurance. And insurers often define a pre-existing condition as something a prudent person would have consulted with a doctor so the fact that you never consulted a doctor and thus no medical record might not be determinant. -

Insurance companies checking your medical records

jerrymahoney replied to omnipresent's topic in Health and Medicine

If you need an expensive heart operation, an experienced cardiologist may be able examine you and tell just how long this anomaly has existed without ever having to look back for any prior medical records -

Judge Orders Lawyers in Trump Case to Start Getting Security Clearances Judge Aileen Cannon gave the defense team until Tuesday to begin the process, underscoring how classified information will be fundamental to the trial. The order by Judge Cannon, who faced a barrage of criticism last year for issuing rulings favorable to Mr. Trump at an early stage of the investigation, suggested that at least for now she has no plans to recuse herself from the case. It was also a preliminary indication that she has decided to move things forward relatively briskly. The order presaged what is likely to be a pitched legal battle over how to handle the sensitive documents at the center of the case without causing undue damage to national security. https://www.nytimes.com/2023/06/15/us/politics/judge-trump-documents-security-clearances.html https://archive.is/H3aCA

-

From the transcript of Judge Goodman's remarks at the June 13 Miami US Court arraignment: "As required by Rule 5 (f ) of the Rules of Criminal Procedure , the United States is ordered to disclose to the Defendant all exculpatory evidence ; that is, evidence that favors the Defendant or casts doubt on the United States's case as required by Brady vs. Maryland and its progeny ." "The Government has a duty to disclose any evidence that goes to negating the Defendant's guilt , the credibility of a witness or that would reduce a potential sentence." https://www.nytimes.com/interactive/2023/06/14/us/politics/usa-v-donald-j-trump-waltine-nauta.html To which some wags on here and elsewhere would reply: What exculpatory evidence??

-

But the Milley docs that he claimed to be showing off on the tape at least up until now don't exist. Trump might be subject to indictments in multiple venues but the scenarios as suggested above will take years to process and go through appellate stages. I do not underestimate Jack Smith if that was directed at me. But I can read the indictment. And if even one of the claims in the indictment becomes questionable to the jury, that could end the whole thing right there regardless of which judge is running the show.

-

Also from the above: But negotiating those accommodations, which must happen before the trial, can take time — time that in this case brings us ever closer to the 2024 election in which the defendant is now a leading candidate. If the judge says no to compromises like summarizing key documents, the prosecution might decide that some are simply too complex or too sensitive to put at issue in the case.