dinga

Advanced Member-

Posts

573 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by dinga

-

what money is taxed 2024 ?

dinga replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

I have no interest in an LTR Visa, so at the risk of being accused of scaremongering, I call BS on the claim that dissenting tax advisory companies have not clarified this issue with the TRD. Suggest you look at the material on the Expat Tax Thailand website - here's an extract: Can you please confirm that Wealthy Pensioner LTR Visa holders are exempt from tax on foreign source income remitted to Thailand Yes the Wealthy Pensioner LTR is exempt from foreign sourced income if remitted the following tax year. Category: Visa and Tax Declarations Tags: LTR Visa, Pension, Tax Exemption Amongst that website material is a recording of an interview ETT had with a Senior Lawyer from the TRD Legal Section. My recollection is that the above extract is 100% consistent with the verbal advice from that Lawyer. I just suggest LTR Holders clarify the tax position to their own level of satisfaction. -

We've all overdosed on your asinine comments - pray that you go away and find something useful to do. While I have successfully ignored most of them, I can't ignore the "No extra use of infrastructure...." So who do you think pays for all of the infrastructure & benefits that you expect and use in Thailand? A Freeloader who whinges about making any contribution - no matter how modest - is a powerful advocate for the opposite of what he/she espouses

-

Crossy - see answers IN CAPS below: Are you saying that you see 39V at the input side of the breaker when it is off (open) and that drops to 7V when you turn it on (closed)? YES That would suggest that your pump is now pulling too much current for the panel, or possibly you have a bad connection in your wiring panel to breaker 😞 WHAT IS THE 'WIRING PANEL'???? IS THIS AT THE SOLAR PANEL???? I HAVE NEEDED TO ATTEND - A COUPLE OF TIMES NOW - TO THE MC4 CONNECTORS I'VE PLUGGED INTO THE PANEL CONNECTORS. ....[THINK LAST TIME THERE WAS VERY LOW VOLTAGE AT THE PANEL-SIDE OF THE BREAKER - NOT SO THIS TIME] COULD BAD CONNECTIONS BE THE CAUSE ???? Do you have a couple of car/bike batteries you can connect to get 24V and feed the pump directly? GUESS I CAN TRY AND GET A COUPLE - HOW ARE THE BATTERIES CONNECTED - +VE TO +VE; -VE TO -VE???

-

UPDATE - Help/Advice still Needed! 1. The problem (non-working) pump was retrieved and sent for check by the supplier. Supplier reports the pump is in perfect working order - and attached a video clip to show that. Also confirmed the waterproof seal is intact but there was mixed/no advice about the maximum submerged depth [I had located it at about 11.5 metres] 2. In the meantime, I bought another sub pump [3SYDC 24V / S2.0 - 40 : DC 24V, 300W] which I connected to the existing 340W panel, and which is positioned at a maximum depth of 7 metres in the Wet Season (more like 5 metres now). The pump worked faultlessly for 2 weeks until it stopped pumping 2 days ago. My trusty multi-meter records 39.7 Volts at the input side of the breaker when closed - but this drops to 7Volts when the breaker is opened. Seems to be the problem as before.... Any ideas, guys????

-

world wide income taxation update

dinga replied to Presnock's topic in Jobs, Economy, Banking, Business, Investments

ALL YOU HAND-WRINGING CHICKEN LITTLES...... take a look at today BP where the TRD talks about reducing Income Tax collections globally providing the impetus for countries to move towards comprehensive tax reforms - in the Thai context = including progressively raising the 7% VAT and imposing Wealth Taxes on Thai's who previously had escaped the RTD net by stashing wealth offshore. The latter is the context for the push for disclosure of WW income. Farangs may (eventually) suffer collateral damage but we ain't the targets.... -

What an extraordinary video [and admission] by Hart. The OP's correct summation that 'After a fiery battle Benjamin of "Integrity Legal" seems to have finally been beaten down by the tax debate and came the final conclusion. If Thailand won't enforce laws regarding foreigners operating in restricted occupations why are they going to enforce these tax laws?' I'm flabbergasted that any advisor with years of experience in Thailand can provide professional advice without regard to/understanding of the local - including enforcement - environment. There's a very important takeaway here, folks.

-

That makes 2 of us that don't understand....... My understanding of ETT;s advice re. LTR visa holders: 1. If income was earnt overseas in (say) 2023 but remitted to Thailand during 2024 - No Tax Payable on such remittances 2. If income was earnt overseas in (say) 2024 and was remitted to Thailand during 2024, such income is subject to Thai Tax and likely needs to be reported in the Tax Return to be lodged by 31 March 2025.

-

LTR VISA - may not be the panacea folks seem to be assuming. One takeaway from yesterday's ExpatTaxThailand Webinar was that the old Rules (pre-2024) on remittances continue to apply to LTR Visas ie. in order to be Non-Taxable, remittances must be made in any year other than in the year the income was earnt. It will be Taxable if remitted in the same year it was earnt. Must admit that I have not been closely following LTR implications so my takeaway may not be entirely accurate. But it seems to me that there may be widespread misunderstanding based on ETT's clear advice yesterday.

-

Trump on Immigration: "We need a lot of people coming in."

dinga replied to John Drake's topic in Political Soapbox

I hate the moron, but to be fair he DID NOT say he will deport ALL Immigrants. He said he would deport all ILLEGAL Immigrants. Truth Matters -

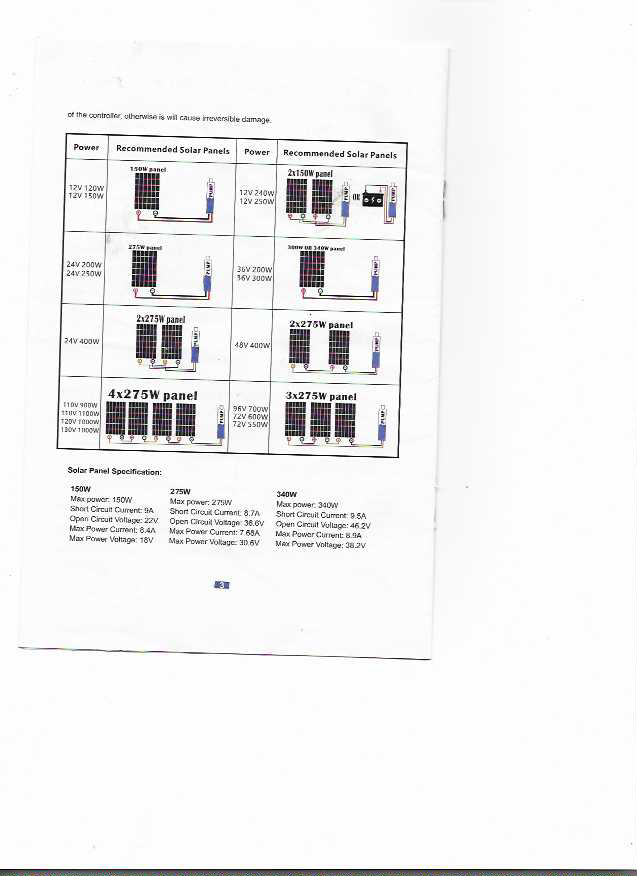

Just to recap.......the Sub Pump is 250W, 24V and 8A. The Solar Panel is 340W, 24V, Imp 8.84A Attached is a page from the Pump manual which recommends a single 275W Panel for this Pump. Based on this recommendation, I shouldn't need a second Panel. Could it be that I need to buy a 275W Panel to replace the current (sic) 340W Panel????

-

Thanks - apols but I'm struggling to understand why there is such a drop-off in Voltage between when the Breaker is Closed and Open. This morning (it was very overcast), and I got the following measurements: * Breaker Closed: Voltage +40.6V; -4.25A [172.5W] * Breaker Open: Voltage: +3.7V; -4.27A [15.8W] If there likely something else at play here??? (realise I need to go back and relook at Fruit Traders Youtube link). Is there anything odd about the Amp readings showing Negative Numbers??? Seems like you're dead right about needing another panel to deliver the 8 Amp to the pump. But if I get another one, am I still going to fall way short Voltage wise (ie. 3.7 V X 2 = 7.4V). Today's readings from my Fountain Pump [0.5HP = 370W; 24V; 13A] are also confounding - and this pump is performing well. * 31V; 3.3A = 102W. Begs the question why the low Amp reading hasn't caused any problems. Sorry to be a pest

-

Thanks. Must admit to being a bit at a loss as to why the pump is designed to not require a controller..... Also, my floating solar fountain pump operates direct from a solar panel, with a breaker in between.....[Confused!} So what do I need - something like these??????? https://www.lazada.co.th/tag/solar-power-controller/?q=solar power controller&catalog_redirect_tag=true Any specific recommendations given the info I've provided above? Am I correct in assuming that the Breaker is no longer required if a controller is used????

-

I'm pretty well ignorant of this stuff, but I don't think that's the problem. Correct me if I' wrong here.... The Specs say the Pump has * Power 250W; * Current: 8A; * Voltage 24-36V. The Panel's sticker says * 340W; * Max Power (Vmp) = 38.5V; * VoC: 46.4V * Current Imp: 8.84V I relooked at the Pump manual which says the Power from the solar panel should be 1.5 times the solar pump power ie. for a 250W solar pump, the panel should be rated 375W. As indicated above, the panel is actually rated 340W. It's only a 10% difference - could that be the problem???

-

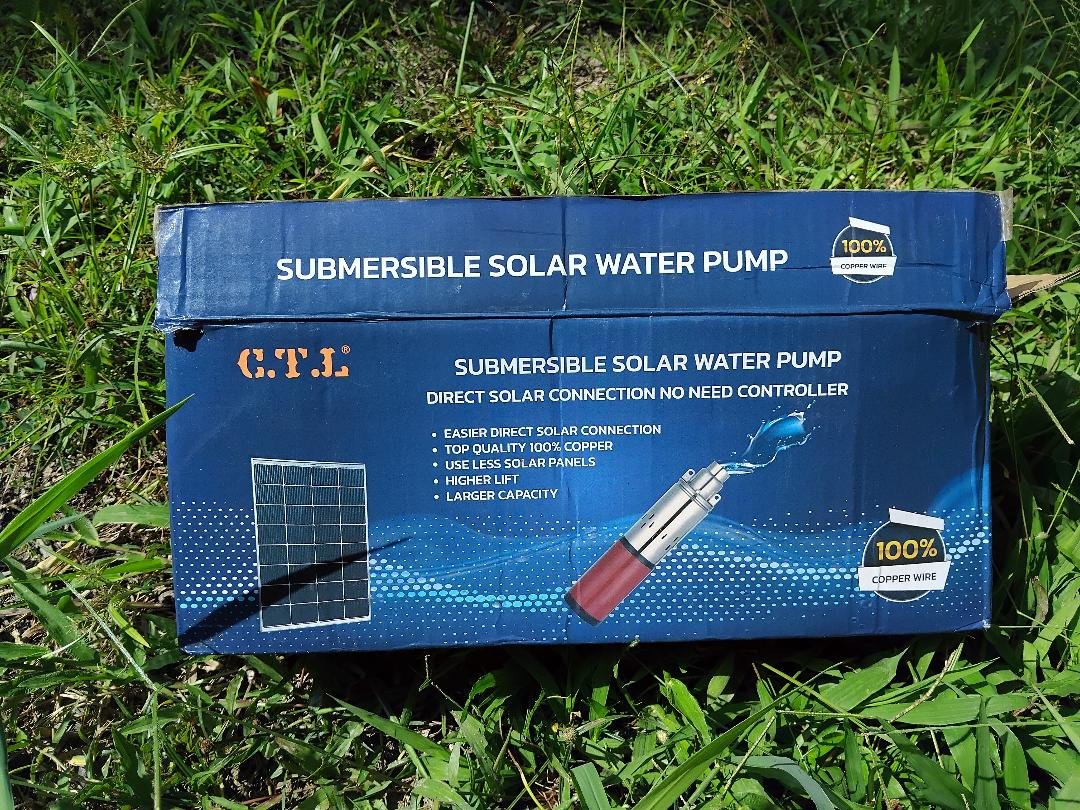

1. The pump is still down the bore (I'm hoping I won't need to pull it out...). Best I can do at this stage is to attached photos of the box it came in and the following Specs from a couple of sales sites https://shopee.co.th/C.T.L-ปั๊มน้ำซับเมอร์ส-DC-12V150w-24V250w-36V300w-บ่อขนาด-3-นิ้ว-ท่อออก-1นิ้ว-i.897800305.25755007784 https://www.amazon.co.uk/NDNCZDHC-3SYDC24V-Electric-Submersible-Fishing/dp/B0C9QQYFZ2 2. There is no controller 3. I also attached a photo of the pond set-up FYI (hubris got me until I've continue to fail to get the pump working...) Any more thoughts????

-

HELP! Colour Codes for Solar Fountain Pump

dinga replied to dinga's topic in Alternative/Renewable Energy Forum

PS Confirmed by multimeter! -

Tks Oracle Crossy!!! 1. Don't think so - the pump stopped operating as soon as I moved from ON to OFF - and the Volatage drop-off occurred immediately I returned to ON. 2. Yes - my new multi-meter confirms all OK at the Panel and the pump-side of the breaker (at least as far as the reduced voltage is concerned. As far as the pump is concerned. I've relied on the red wire and the tag that confirms it's the +ve lead. 3. Sh*t - maybe that's the problem... I thought I ordered the two together but didn't (there were 2 different suppliers). * Panel: 340W; Voc 46.4V; Vmp 38.5V; Imp 8.9A; Max Series Fuse: 15A * Will need to confirm from the pump box tomorrow, but looks like: DC 24V; 250W; 8A. The leads from the sub-pump are 20 metres, and some 20m from the Breaker to the panel. Is my problem the panel and pump are mismatched? If so, how best to proceed - (a) replace either the pump or the panel (assume pump); (b) any other options???? Thanks & best regards

-

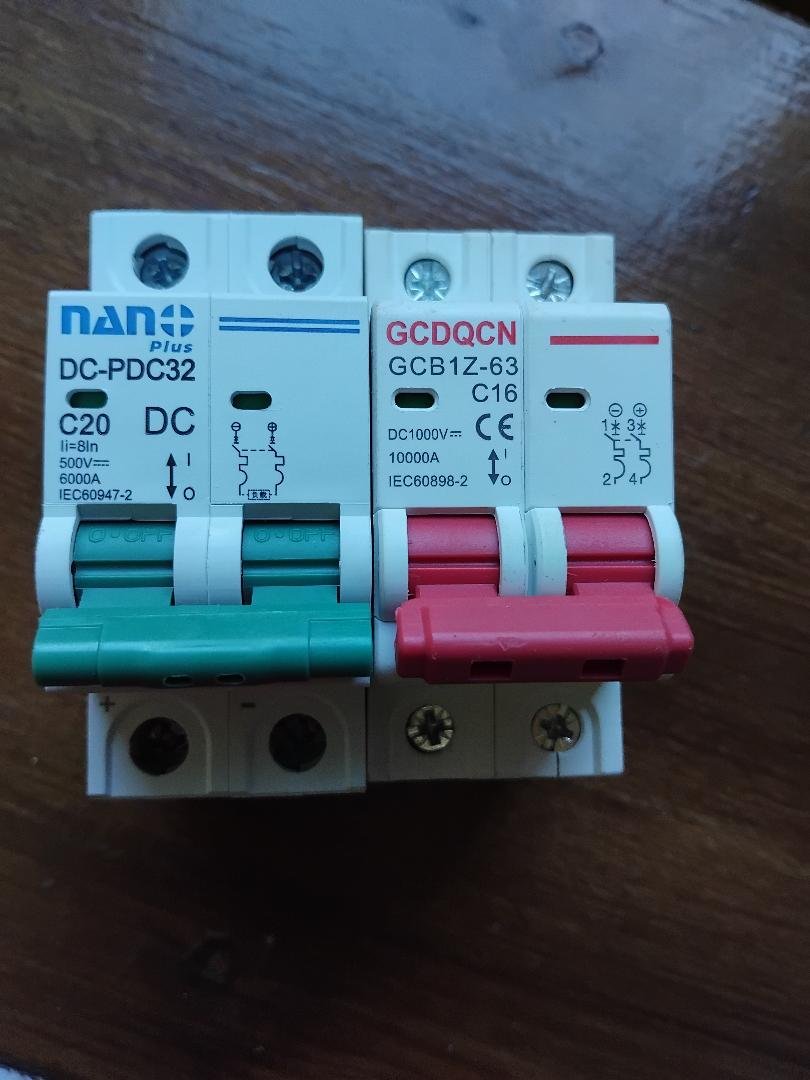

I'm having trouble in getting a solar submersible pump to operate - it is powered by a single 340W solar panel; and I want a switch/breaker between the panel and the pump to be able to turn it ON and OFF (the solar panel is attached to a pontoon that floats on my pond - and the breaker is installed on a post close to the bore). Solved the 1st challenge when there was no power making it to the Breaker - after one bad MC4 connection at the pontoon was fixed, achieved some 39.5V at the input side of the breaker when OFF. Inadvertently left the breaker ON when the connection was fixed and water was being pumped from the bore until I turned the breaker OFF and then ON again. Pumping ceased and would not restart when the breaker was reset to ON. The reading at the breaker having dropped to 6.1V. I thought there must be a problem with the breaker so I tried another one today with similar results [initial reading of 39.7V which dropped to 11.2V after the breaker was switched from OFF to ON]. The attached photos shows both breakers tried to date - the Red being the 1st tried, and the Green being the one tried today. Greatly appreciate any & all advice - do I need just a simple switch rather than a breaker????? [seems a little odd as I installed a breaker (CHNT NXB-63) between another identical solar panel and a floating fountain pump, and all is going swimmingly (!) so far]. Thanks!

-

HELP! Colour Codes for Solar Fountain Pump

dinga replied to dinga's topic in Alternative/Renewable Energy Forum

Successful Conclusion! Repairers advised the Light Blue is the -ve - call me Thomas, but I doubted that up until I connected the pump earlier in the week. Now working - good as new (hopefully): * Grey is +ve * Light Blue is -ve -

Selling gold - taxes

dinga replied to CrossBones's topic in Jobs, Economy, Banking, Business, Investments

URGENT UPDATE Rest Easy - seems there is ZERO Tax Risk. In a Webinar this afternoon, a very active Tax Advisor very clearly stated that, for individuals (Not Traders/Business operators), any Capital Gains on gold bullion sales are NOT assessible for Income Tax. Additionally, in the case of inheritance, the Estate would have no tax liability and that recipients would only be subject to Tax if the Tax-Free inheritance threshold was exceeded eg. 100 million baht per recipient. Very happy now about where this matter has finished - just disappointed about the confusion in reaching this conclusion. -

HELP! Colour Codes for Solar Fountain Pump

dinga replied to dinga's topic in Alternative/Renewable Energy Forum

Thanks Crossie I managed to find the Manual which advises if the Polarity "is not correct, the pump will spin in the opposite direction as it should. Water will still pump out but not to the rated capacity. ........ To obtain the correct polarity, connect the BROWN wire to the +ve side". Very useful given there is no Brown wire (only Light Blue and Grey". I'll get the Boss to call the repairers (bet they can't help much either....) BRs