-

Posts

10,579 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sometimewoodworker

-

Having just been quoted ฿245,000 which is in addition to the ฿36,000+ for a CT scan to confirm the diagnosis at Bangkok Hospital Udon Thani for an open or laparoscopic abdominal hernia I am seriously considering flying to India to get the procedure, it is likely to be about ⅔ds the cost including everything with better communication and English skills. My question is has anyone tried this route and do you have any comments, that is apart from travel as we can deal with that.

-

This is a situation where you need advice from an expert the Thai regulations who is also expert in the way that your country’s taxation agreements are written. Regrettably there are sufficient differences between taxation treaties that if you are American (I am not)you need advice specific to your nationality. My information is specific to a British citizen, it is generally correct for the majority of countries but country specific advice is probably required if you bring in enough money to get caught by the tax system. However it is still a proposal and there are sufficient very high net worth extremely influential, mostly Thai, who will be paying millions, probably hundreds of millions, extra in tax if it is actually enforced. Your guess is as good as any on the result.

-

I resemble those remarks. However we have SWMBO’s brother who has a partner who has to pay off a car loan of about 12k a month, so as there is no good paying jobs in the village is very motivated to do a good job as we pay double the usual rate. Our house has been newly painted, the garden is maintained and countless other tasks that are on the roundtuit list are getting done. I have come to accept that climbing ladders, running around the roof, lifting heavy stuff, prepping steel for welding, spending time to get a perfect sanded finish are all tasks that brother-in-law and partner are happy to do as it means they can get the car loan payment while not doing really hard labour and I can avoid the things I find boring. All in all it’s a win win for everyone apart from my waistline where I have to try to keep in check.

-

Electric Vehicles in Thailand

sometimewoodworker replied to Bandersnatch's topic in Thailand Motor Discussion

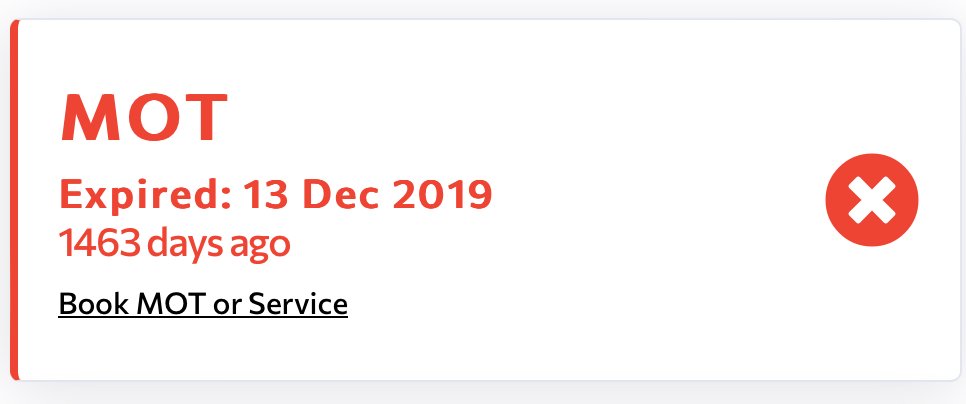

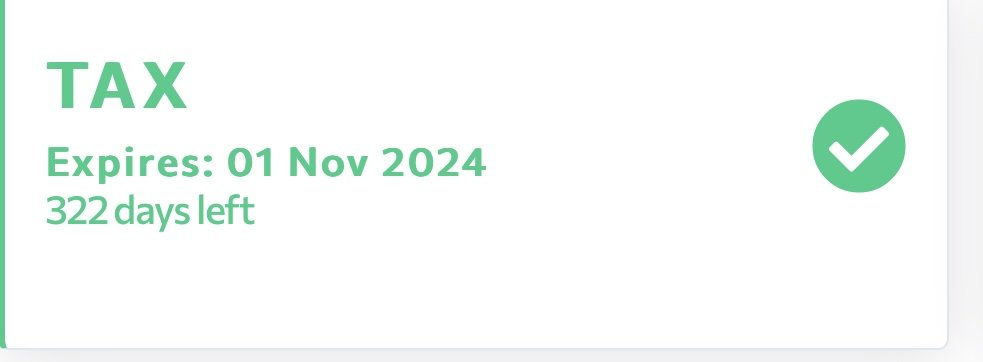

End of story? Not remotely it raises more questions. The vehicle that is showing in the video isn’t clear enough to show the registration. The vehicle showing in the video clearly shows the position of the flames to be coming from the location of a traction battery. The video shows exactly how a traction battery fire would. There is not enough information to be sure that it was the originator of the blaze, though most likely it was. The vehicle in the video is clearly a very dark colour if not actually black. That may have been involved in the fire I don’t doubt. If it was being driven, it was illegal as it had not been MOT tested in the 4 years since the certificate expired it is currently taxed the tax was renewed at the beginning of November over 2 weeks after the fire, this is a rather unusual thing to do for a vehicle that was destroyed by fire weeks before the renewal, isn’t it? However it is NOT the vehicle shown in the video since The Primary Colour is Gold for E10EFL I don’t know enough about body changes to know if the vehicle in the fire is 7 years old. People suggest the vehicle in the fire video is a late model one if so then that proves that the 2 are different -

Electric Vehicles in Thailand

sometimewoodworker replied to Bandersnatch's topic in Thailand Motor Discussion

Have you actually carefully watched the first person video of the vehicle that started the chain reaction? Have you looked at the timing of the claims of the fire Brigade, way to fast a claim that was given before the blaze got to the stage of burning down the structure. Have you looked as exactly how the denial of an EV being the cause and how the claim that it was a diesel vehicle? No mention that from the pictures and videos as far as can be seen, yes it was a vehicle that had a diesel engine it also had a moderately sized battery of probably 38.2 kW. You misunderstand me. Unlike the statements made before fire investigators had had the time needed to allow the car park to burn down and the days required to allow it to cool down I don’t know what caused the fire. Guessing, and clearly stating that it’s a guess, it may have been some kind of electrical fault in some part of the system, it certainly could (though extremely unlikely) have been an actual diesel fire at the beginning, I don’t know. Yes the vehicle had a diesel engine it also had a large battery, What is clear from the video is that however the fire started, whatever the initial cause at the time the video an pictures were taken the nature of that fire certainly involved the battery being in thermal runaway and being on fire. Also it is likely, from the first hand reports, that the first fire extinguisher/s had not controlled the blaze. Exactly how the fire progressed and exactly how many traction batteries, if more than the first one, caught fire I didn’t know. From the reporting some. So 1 and in all probability several to many, more were involved. Did they cause the fire? Unknown and not really important, that they were involved is clear. Was the design poor, in that there were no sprinklers installed? Absolutely. Would have sprinklers stopped the blaze in the early stages or controlled it enough to allow for the fire brigade to control it? Again unknown but quite possibly. What is clear is that the design of current large batteries do not stop them from becoming involved in a vehicle fire if they become damaged or hot enough. They may not cause the fire but once they go into thermal runaway they are impossible to stop. They produce their own fuel! They can and do continue burning under water. There is only 1 reported effective method that can putout an EV or PHEV fire and that involves hundreds of thousands of litres of subzero extremely salty water (-15C or lower) at the moment it is feasible in seagoing vehicle transport vessels SO your vehicle of choice has a very low chance of catching fire, greater for some that include range rovers and BYD but still small. But once on fire or in close proximity to a battery in thermal runaway, the resulting total fire is catastrophically more dangerous than an ICE fire. Because it can not be controlled. EVs have been in safe use for many decades with virtually no problems, change the battery technology to allow tens of kWh, don’t allow for an inbuilt discharge system, don’t research the possible ways of stopping the fire other than just letting it burn out and you have irresponsible capitalism in action. -

Electric Vehicles in Thailand

sometimewoodworker replied to Bandersnatch's topic in Thailand Motor Discussion

And you think that the reports of fires in vehicles that are sold in Thailand are irrelevant? It isn’t important that so far there have been no reported incidents since the numbers here are so small. The vehicles sold into Thailand are the same, possibly with cosmetic changes, as are sold in China You will note, if you actually read my posts, I made no claims of battery fires in Thailand. So now you are the thought police? Please do. I will be interested to see the reaction. I will not be holding my breath. just because you are rabidly in favour of rolling out EVs for everyone ignoring the extreme dangers to property that a single runaway EV or PHEV can do with the firefighting abilities of even an advanced country. Just look at Luton Airport and the millions, possibly hundreds of millions, of pounds lost. There the battery that started the chain reaction was much smaller than an EV as it was a PHEV. Yes the chance of a fire is low but get it in the wrong location and you could easily dwarf Luton airport. Get the firefighting abilities to actually put out a runaway EV or PHEV and I will support your ideas. EVs reduce city centre pollution and divert it to the power stations and manufacturing facilities, probably a good plan. They do nothing to reduce the overall lifetime pollution unless you are doing something like running a taxi fleet and even then it’s debatable. -

Electric Vehicles in Thailand

sometimewoodworker replied to Bandersnatch's topic in Thailand Motor Discussion

The reports are leaking out from China, the country that has the widest market. The reports that have seen are all of pure EVs not PHEVs. However even if there were a number of PHEVs included that would hardly be a resounding recommendation for BYD. what ever you decide to buy you need to be sure that your insurance is good and will payout on a total loss, something that is more likely if your EV is just involved in an accident and doesn’t involve rather higher than usual temperatures 2000C-> -

Electric Vehicles in Thailand

sometimewoodworker replied to Bandersnatch's topic in Thailand Motor Discussion

The Chinese are definitely selling well. Though is far better than they would have if the statistics or reporting was in any way transparent. BYD is probably the most reliable of the EV’s but even then they have had a significant number of even brand new top of the range vehicles decided that self immolation was appropriate. These incidents are happening often enough that the news is managing to leak out even past the censorship if the CCP. The numbers of off brand incidents is far greater though less newsworthy and not surprising given the lax of nonexistent controls on EV makers. The top EV’s demise is newsworthy due the high prices, equivalent to top end western models. -

Virtually all tax regimes work in a similar way with income being taxed differently depending on source. However I very much doubt that you are able differentiate between differently taxed income. The important point is that it is a proposal even though it is imminent it may not happen. Also even the major tax advisers do not have the final details as the Thai tax authorities are still working on them. I am reasonably confident in my supposition of the requirements of the Thai tax authority. However this is significantly more complicated by the fact that it is only income received in Thailand that is taxable. Be thankful that you don’t pay tax in the USA, where income world wide is taxable.

-

the advice being given by a major international tax advisor is that all income including rent is part of your tax assessment. It is not unknown for interpretations to differ and for Thai officials to get things wrong it is extremely uncommon for such a major international to make such a major mistake as you suggest, not impossible and advice will change if they find your interpretation is correct, however they makes their business by advising on how to minimise client tax liability not maximise countries tax returns The principle is that you first pay tax in the region of origin, so the rent in the U.K. is taxed in the U.K. along with anything else that is taxable there like pensions. Your income which includes everything that has been taxed in the U.K. is then declared for Thai tax. The dual taxation agreement then kicks in and the tax paid in the U.K. is deducted from the Thai tax liability. This process means that the U.K. gets first bite so retaining tax liabilities for U.K. property as U.K. revenue. This doesn’t exclude the Thai tax authority from collecting revenue if your U.K. tax is less than your Thai tax I never suggested that it did.

-

The performance of the light after 3 ½ hours is probably nothing much to do with the light. It much more likely to do with the battery. It is almost certainly a low capacity one so with an upgrade it will have a much longer life. But with a higher capacity battery comes the need to have a large enough charging panel to recharge it. A 60 watt light should be enough to floodlight your entire garden, however it maybe a 60 watt equivalent so about a 7watt LED. A 650 watt spotlight (if it’s a real 650 watt LED) would be able to light something 300 ~ 500 meters away it will need forced air cooling and the suitcase battery. My opinion on around the house lights are that 3 watt lights are almost too bright, we have 2 ~4 on each of 3 sides and a much more ornamental set of 5 doubles a the front.

-

Regrettably there is no direct correlation between number of LEDs in a spotlight and the brightness. There are far too many factors involved. To give a few examples 1 an LED typically is actually several actually LEDs in 1 package you can get a larger physical size COB that has many individual LEDs on a single substrate. The voltage that the LEDs are run at will affect the light output and lifetime of the unit. The quality of the battery will drastically effect the lifetime, both in runtime and total lifetime. All of the above and many more that I haven’t touched on are related. The single factor that generally is useful is the cost of the units. Buy a cheap high power unit and the chances are, the battery will be exhausted soon, an LED will burn out, the power supply will die, the LEDs will change colour etc, you can be lucky. Spend more on a lower powered unit and you generally get better reliability. There is a good reason why commercial units cost multiple times domestic ones.

-

*WARNING* AIS Roaming Charges while Overseas

sometimewoodworker replied to Mr Meeseeks's topic in Mobile Devices and Apps

One of the things you can do is ask AIS to restrict the possible data charges out side a roaming data plan. I did that and my data cap for roaming out side a plan is zero, this means that I can not be blindsided by charges I did not plan for. -

I have no idea what you mean by “DTA”. Your ideas on “income from immovable property must be taxed only in the country where the property is situated.” is wonderful for you to believe however the Thai tax authorities do not agree. Neither does my investment advisor’s taxation specialist. the advice is that ALL income (from any origin including from property) remitted to Thailand WILL be subject to Thai taxation, however dual taxation treaties ( do note all Thai dual taxation treaties are bilateral so no 2 are the same) may reduce the tax payable in Thailand, possibly eliminating it for some people. You also have a rather confused understanding of dual taxation agreements. None of them stop you being taxed in Thailand if the calculations show that your income is high enough and the counterparties tax charged is lower than your Thai tax liability.

-

That is probably incorrect. Since I live rather closer to Udon Thani than KK and have my wife’s relatives there I tried over the last 30 years to book Fly Thru I could never select UTH as a destination or departure point, only ever KKC. @treetops quoted my post referencing the With a non scheduled flight that was, a diplomatic, military or charter flight but as I posted “a scheduled direct flight being wrong for December.

-

It was not a regular scheduled flight. please provide proof of regular scheduled flights or admit that you are wrong. proof of a special flight is not proof that there are regular scheduled flights. Any airport can have a special international flight but that doesn’t qualify. Rather unlike Khon Kaen, as I have taken an international flight from there to Japan a few times, clearing immigration in Khon Kaen and being escorted from the domestic terminal in DMK to the airside international departures. On the return flight I cleared immigration in DMK but my luggage went directly to Khon Kaen where I cleared customs. So Khon Kaen had international flythrough flights before COVID shut everything down. They may well have restarted. The international luggage belt received international luggage from an otherwise domestic flight.

-

I think you are fixated on the term assets and income earned from assets. For the taxation it is not important how the income becomes yours, if you have a job you earn income if you get money from other sources that can be stocks, bonds, property etc it is income. The proposal is that any income brought into Thailand will be taxed whenever it was earned. The current law is that income earned in the current year brought into Thailand in the current year is taxable but income earned in previous years and brought into Thailand in the current year is not taxed. AFIK this is a unique tax law. I know of no other country where just delaying income stops it from being taxed.

-

That you have no assets in Thailand is irrelevant. It is proposed that any income brought into Thailand will be taxable. I have no assets that provide income in Thailand, however I bring in enough money annually that I could be taxed. There are ways through careful planning to reduce, or possibly eliminate, taxable income to under the tax threshold.

-

Not yet, it is a proposal. Its a proposal so can change before implementation, if it ever is implemented. The proposal is for anything considered income, this includes capital gains, dividends, pensions, rents etc and the date is calendar 2024, and no, at the moment there is no suggestion that it will cover anything prior to calendar 2024. Any assets sold in a tax year, which are at a loss, cannot be used to offset a gain achieved by selling an asset with a gain in that tax year many countries have dual taxation agreements with Thailand however exactly what is covered is different for each country since they are bilateral treaties. However (and this is my guess so certainly may be wrong) if implemented later than January 1st 2024 it WILL cover anything from calendar 2024. This is why I, and anyone who believes that it may (or will) be enforced, is crystallising my current capital gains by “bed and breakfasting”. If the term is unfamiliar a little research will assist. This is producing a nice revenue bump for investment advisors specialising in long term Thai clients.

-

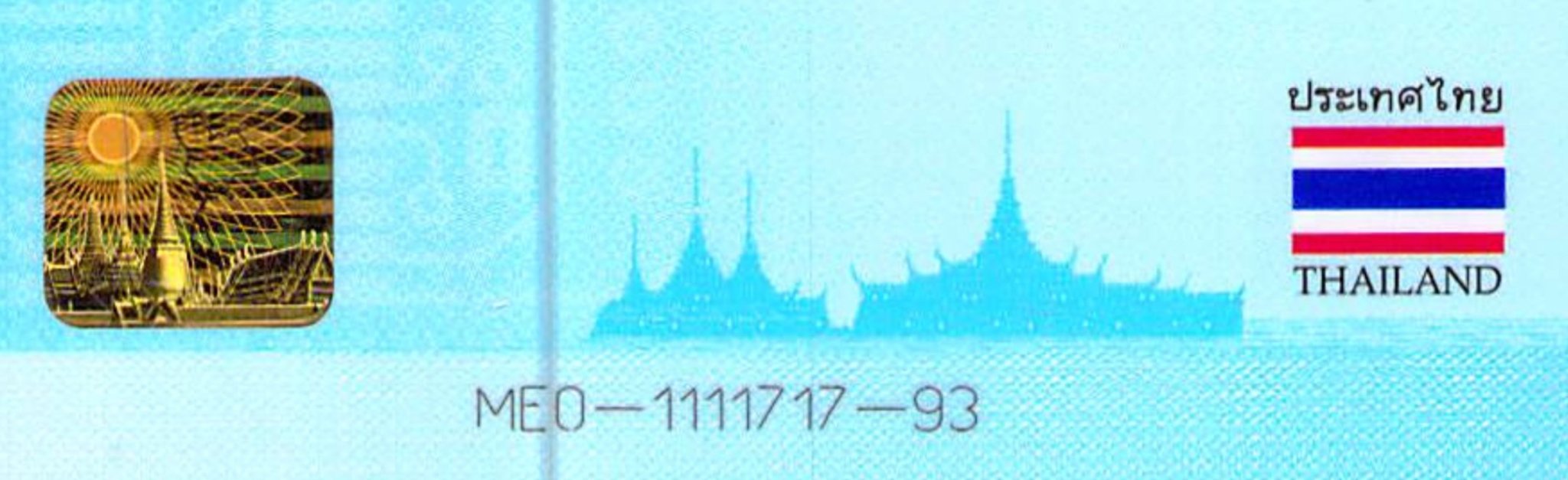

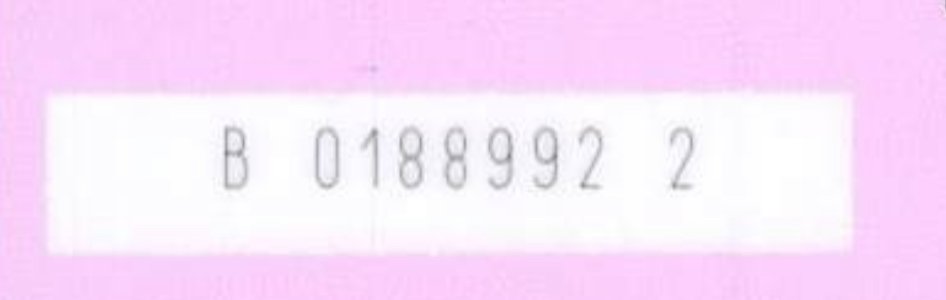

While my pink card DOES have a number on the back it may well be that the way the number is structured is not be the same as a Thai ID card Thai card Pink card

-