-

Posts

2,128 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by oldcpu

-

non O based on marriage visa extension

oldcpu replied to Lolothai's topic in Thai Visas, Residency, and Work Permits

In Phuket , for my Kor 22 (foreign marriage registration) the update had to be done at the Phuket Municipality office. My wife uses the Thai word: เทศบาล -

Taxation Registration

oldcpu replied to StevieAus's topic in Jobs, Economy, Banking, Business, Investments

Further to this - I had this done during the days when COVID was just starting, so I disliked the idea of travelling to Bangkok (as travel inside Thailand was becoming difficult). It turns out (for foreign marriage certification) there was a translation service company in Bangkok that offered this service. I had to provide them limited power of attorney, courier a bunch of documents (passport copies, original marriage certificate, wife's ID copy ... etc.. ) and they DID ALL THE LEG WORK - going to Canadian Embassy, going to MOFA, doing translations ,etc ... and courier back all official completed/approved documents. Prior to sending such to Bangkok, and I was griping/bitching on this forum that it looked to be a PIA, and Ubon Joe (rest his soul) set me straight, advising me to look for a translation service which for a nominal amount of money would handle all of such. Is that applicable to you? I don't know. Perhaps you tried such already with a service which did not know how to properly do this? or perhaps its not practical. Before doing such my Thai wife and I did carefully communicate with the translation service to confirm they knew exactly what had to be done, and after, before proceeding, that we double checked to confirm what they stated was correct (ie contacted both the Canadian Embassy and MOFA prior) -

non O based on marriage visa extension

oldcpu replied to Lolothai's topic in Thai Visas, Residency, and Work Permits

In Phuket , when I used to be on a Type-OA (and later a Type-O) non-immigrant visa, for my annual extensions, the map I had to draw was directions from the local Immigration office to the Phuket condominium unit where I lived. In the case of Phuket immigration , the Phuket immigration volunteers note on their web page that Phuket immigration asks those going for an extension to provide: "Map to Residence with GPS coordinates" -

Taxation Registration

oldcpu replied to StevieAus's topic in Jobs, Economy, Banking, Business, Investments

It puzzles me because on a different matter getting my marriage (in Canada) to my Thai wife registered in Thailand, i had to: (a) have our Canadian marriage certificate officially translated and certified at the Canadian Embassy in Bangkok (possibly not in that order), and (b) have my Canadian passport (!) officially translated to Thai (c) the above documents taken to a the Ministery of Foreign Affair (MOFA) in Bangkok for their certification of the copies. (d) and other some local detail - not relevant to this thread. The point I want to make, is a Canadian document had to be certified by a Canadian government organization (in this case the Canadian Embassy in Bangkok). I don't understand how the Thai Embassy in London would be qualified to certify a British document. it make more sense to me that a British organization would have to certify such. But I fully concede - i don't know what goes on between Thailand and Britain, and those who have done this before are the best one's to answer. Best wishes in your efforts. . -

Taxation Registration

oldcpu replied to StevieAus's topic in Jobs, Economy, Banking, Business, Investments

Don't forget there is the Thai Revenue Department (RD) documents Paw.161 and 162, where my understanding is they state that any income/savings from before 1-Jan-2024, if brought into Thailand anytime in the future is not taxable (and I believe not assessable income). So if you have enough money in the UK, you don't have to dip into year 2024 nor 2025 income as the money you bring into Thaliand is pre-1-Jan-2024 money. Having to have something certified at the Thai Embassy in London reads strange to me. Are you certain that is not having it have it certified at the British Embassy in Bangkok? . -

non O based on marriage visa extension

oldcpu replied to Lolothai's topic in Thai Visas, Residency, and Work Permits

Ok - apologies - and perhaps topic for a different thread but ... Short form: Have you checked with the French pension office to see if you can change this by a small OFFICIAL pension payment? Long form: I worked for just over 4.5 years in Germany in a Germany registered company, and I initially only contributed to the German pension system for those 4.5 years. One needs to contribute to the German pension system for 5 years (in addition to working for some TBD period (I can't recall details)). I went to the local German tax office (with a German friend who could translate if needed - but as it turns out a translator wasn't needed). The German pension official was very helpful. He noted because of an agreement between Germany and Canada (where I worked for 27 years in Canada) that time working in Canada qualified me for a German pension , IF I would have contributed for 5 years to the German system. The German pension official then did a calculation, and advised if I sent the German government some amount of money (to bring my contribution from ~4.5 years to 5 years equivalent). He printed out on the spot an official letter advising me of this. As soon as I was home that night, I immediately transferred money to the German government, and within about a month or so I started receiving a pension. A few months of pension payments PAID for the amount I gave to the German government. Mind you, I was 20 years older than you. So ok ... at age-45 you are not old enough to receive a pension ... but keep your records here ... and when you have the chance , dependent on your circumstances, it may be worth your while the next time you are in France to visit the government office to see what if anything can be arranged. And if you have already done such - my apologies for (1) suggesting an investigation you have already done , and (2) apologies for slightly side tracking this thread. -

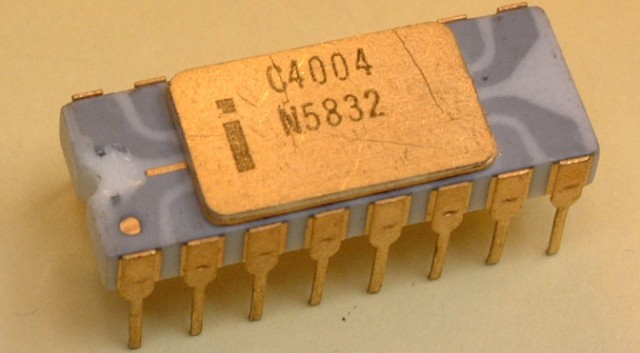

If the money you transfer from outside of Thailand can be credibly shown to have been in place before 1-Jan-2024, then I believe per Thai Revenue Department documents PAW.161 and 162, the (in effect) savings you bring into Thailand is not only not taxable in Thailand , but I believe it is not treated as assessable income. i.e. no Thai tax return needed. No Thai tax ID needed. There are also DTA (Double Tax Agreements) between Thailand and the source country of you income which may mean no assessable income (and it may not - the DTA needs to be examined). As noted , if your money you bring in is from before 1-Jan-2024, then there likely is not need to even think about visibility of such transactions - as I suspect it would be irrelevant. BUT - I am far ... very very far ... from being an expert on this Probably a good approach. Maybe (??) in the next 6 months this should become very clear. I believe many expats are still waiting for the year-2024 Thai tax return forms to show up, so we can see if any important to changes to note, in comparison to the 2023 tax return forms , ... which may provide the clarity we seek (to satisfy ourselves) on this situation. https://www.rd.go.th/english/65308.html I keep checking but I have yet to see an English language 2024 Thai tax form. That is a good 5 years before me. I purchased a USED (not new - USED) Apple-II+ (6502 cpu) back in March-1981. 64 kb RAM and 2 floppy drives (128 kb each). I paid $2,500 CDN$ for it. Even thou used, it felt like a power house at the time.

-

non O based on marriage visa extension

oldcpu replied to Lolothai's topic in Thai Visas, Residency, and Work Permits

Do you have a Thai spouse? Dr.Jack54 is FAR more knowledgeable than myself here, but at age-45 I think you can only go for a Type-O if you have a Thai spouse? -

non O based on marriage visa extension

oldcpu replied to Lolothai's topic in Thai Visas, Residency, and Work Permits

If the the OP goes for a type-O retirement extension, would the OP not be required to stop working briefly in Thailand, until they switched back again to a Type-O marriage extension? -

I don't know if i am fully correct either. I simply try my best. I did decide for the next few Thai taxation years NOT to bring money into Thailand. I have the luxury of already having savings brought into Thailand such that I can do that. My intent is to wait and see what transpires in the next few years - and hopefully it will be VERY obvious then as to what absolutely without question, without debate , must be done. Then again - This is Thailand ... so perhaps one never knows. No. Such transactions are NOT something I delve into. When I travel outside of Thailand in different foreign countries, I use my Wise debit card (where I fund that card from money saved in Canada and/or saved in Germany). When in Thailand I use a Thai credit card ( and I obtain points plus other perks from that Thai credit card). I suspect my situation is very different from yours.

-

Taxation Registration

oldcpu replied to StevieAus's topic in Jobs, Economy, Banking, Business, Investments

I live in Phuket. I don't have any advise. I have some experience, but my situation is very different from yours. My Thai wife, thinking I should get a Thailand tax-ID, applied online for me to get a Thai tax ID. That online application goes to Bangkok based RD office and Bangkok forwarded it to the Phuket RD office. A Phuket RD official phoned our place, my wife answered the call and all the talking was in Thai. My wife told me later she was asked am I staying in Thaliand for >180 days in a taxation year (she answered yes) and what was my income source? My wife says replied I had no Thai income, and only foreign pension income, where at the moment (since before 1-Jan-2024) I was bringing no money into Thailand. The Phuket RD official advised if I had no Thai income and if I was bringing no money into Thailand, I did not need a Thai tax ID number. So he stated he would not give me a new tax-ID. When my wife asked if my pink-ID # could be used for an online Thai tax return, the RD official advised that was possible but that the pink-ID # had to be activated first as an online tax-ID # (to be used for an on-line tax return submission). I am also on an LTR visa and my wife asked if on an LTR visa, and if I then bring current year income into Thailand, can I then get a tax-ID and need to file a Thai tax return? The Phuket RD official advised he never heard of an LTR visa, that he would look into this, and phone back. The Phuket RD official NEVER phoned back. So I can only suppose he (and the Phuket RD office) either doesn't know yet, or they know but can't be bothered to phone me back (possibly - I hope - because on an LTR visa I won't need a Thai tax ID), or possibly because he has been busy and thus forgot about the promise to phone back. My suspicion is the later (he forgot). As for your situation, you ARE bringing income into Thailand. Assuming that you stay >180 days in Thailand in a taxation year , then I believe you need to familiarize yourself with the Double Tax Agreement (DTA) from the source country where you receive your income. That may give further clue as to what your requirment is here in regards to whether you have adequate assessable foreign income to need to get a Thai Tax ID and file a Thai tax return. That is my experience. I suspect you could also go down to the Phuket RD office and simply sit in their office to get 'official' advice. You may need to sit for a long time. I may do the same some time in the (distant) future. Good luck and best wishes in your consideration. -

non O based on marriage visa extension

oldcpu replied to Lolothai's topic in Thai Visas, Residency, and Work Permits

I did a double take on that (working on a Type-O visa) , and then I recalled that those on a Type-O visa, are allowed to be employed in Thailand if they are married to a Thai citizen. Hopefully my recollection is correct. Be certain if going for an extension on your type-O visa to go for a marriage extension (based on being married to a Thai person). Note the approval process for a marriage extension can take a long time (compared to that of a retirement extension - where those on a retirement extension are NOT allowed to work in Thailand). So if you elect to go for an extension, apply as soon as it is possible/permitted to apply. And if my understanding is wrong here, I hope others chime in and correct me. -

Deleted

-

No - nothing you post states RD and BoI are "singing from the same hymn book". That is just your hopeful thinking. I hope the same but I won't let my hope skewer my assessment as what could take place. I still think you miss my point. What I am looking for is Revenue Department confirmation that a Thai tax return is not required.

-

Please point out on that website page where it states that an official Thai RD tax return form (where nominally assessable tax exempt income is to be listed) is not required. Again - I hope you are correct , but I won't do my planning based on a hope. .

-

Who says that? The BoI website is clear. Remitted foreign income is tax exempt . The BoI website says NOTHING about tax return requirements. Only one person on AseanNow saying some unknown BoI officials ?? official ?? expressed an opinion. And was it one official? A junior official? A senior official? More than one? Serious? Anyway , I expressed my caution. I hope others succeed in their approach, as I have no bad wishes here. Take care.

-

BoI officers now? There is more than one? Which ones? If so clear why don't they post this on their BoI website? How about Thai tax law? Law that states Tax residents with foreign assessable income over a certain threshold (with no DTA exclusion) must file a tax return. And a Royal Decree that says remitted foreign assessable income is tax exempt, while at the same time Thai RD provide a tax form where taxation exempt assessable income is supposed to be listed. So what you typed doesn't help. I do thou very much appreciate your intent. My plan is to simply wait this out - and I am fortunate to have the luxury of waiting it out. For what it is worth, I hope YOU are right - but I will NOT do my financial planning based only a hope. I have learned the hardway in my lifetime, that planning on only a 'hope' without taking other measures is not a good course of action for me. Again - I do hope you are correct.

-

I was explaining WHY I stated "the jury is still out". I had not planned to go into detail ... but when asked I thought it necessary to explain. I am not trying to 'beat a dead horse' (and for certain this is not a dead issue. It is very pertinent). no ... it is EXEMPT from Tax. .... There is a BIG difference. Answer this please. Why is there a separate form in the Thai tax return where one lists 'exempt from taxation' income? Why does the RD bother with such a form to list tax exempt income? If what you stated is true, there would be no need for such a form. BUT there is such a form - once again - a form where tax exempt income is listed. OK? Is this clear to you now? I concede you disagree. Fine! Further I hope your view is correct. But for DAMN CERTAIN I will not do my financial planning based only on hope. No . BoI expressed an opinion on this and when it comes to matters of taxation, it is the Thai RD, following Thai tax law and the Thai Royal decree that matters - NOT some statement of one person ?? from BoI. Do you disagree with that? Do you believe BoI can overrule Thai tax law (ie requirement to file a Thai tax return if one has assessable foreign income - where there is a tax form where tax exempt income is listed), and do you believe the BoI can over rule the Royal Decree where the Royal Decree specifically refers to 'assessable income'? I don't worry. I decided NOT to bring in ANY income (assessable or not) into Thailand for tax year 2024 to 2027 (or longer) until you are proven correct ... which I hope is the case. but once again, for DAMN CERTAIN I will not do my financial planning based only on my hope and your view. My best wishes to all in how they go about this.

-

For my LTR visa I tried two different accounts, which each had cash exceeding the amount required to show self health insurance, but because each of those accounts could also be used for trading equities, they were each in turn rejected. In the end I used a "basic" bank account (money in Euros) which had the pre-requisite amount in cash. No. I believe it won't meet the criteria based on my experience (unless things have changed). You may need to setup a separate account , and put the prerequisite amount in cash in that account. Alternatively, if you already have health insurance, you may be able to get your health insurance company to write a short one page letter noting you are covered to the appropriate amount that BoI want to see. I did not go that route to prove Health Insurance, so my hope is that others who successfully went that route will chime in and state specifically how the letter was worded to meet the BoI satisfaction.

-

lol I guess you never heard of that expression. The point, which perhaps you missed, is if you read the Royal Decree, you will read in section-7 and 8 that it specifies the Minister of Finance overseas the Royal Decree. My understanding is the Thai RD is part of that ministry. Further if one reads the Royal Decree, it is clear that it (1) talks of remitted foreign assessable income, and (2) exempts Wealthy Pensioners (and Wealthy Global citizens) from paying tax on that remitted foreign assessable income. WHAT IT DOES NOT STATE is state that remitted foreign assessable income is not assessable. No where does does the Royal Decree state foreign remitted income is not assessable. Now the Thai RD requires remitted assessable foreign income after 31-Dec-2023, that exceeds a certain threshold (that has not been made not-assessable by a DTA) , have a Thai income tax return filed by Thai tax residents (ie > 180 days in Thailand in a taxation year). So that begs the question, ... does Thai income tax return have to be filed (in accordance with Thai RD instructions) for remitted foreign ASSESSABLE income (where fortunately for the noted LTR visa holders that income also happens to be tax exempt)? The Royal Decree also states failure to comply in any tax year with selected clauses of the Royal Decree (such as following instruction of the Director General (Thai RD from my understanding)) will lose their exemption. This potentially is serious. So to repeat : the Royal Decree refers to remitted assessable income. The Royal Decree does NOT state foreign remitted income is NOT assessable. Now I believe everyone, including myself, HOPE that the Royal Decree means a tax-ID # is NOT needed, and hopefully means NO income tax return is required for LTR-WP/WGC visa holders who have no Thai income (over a certain threshold) who remit 2024 income into Thailand. That is what we hope. BoI have even stated such, BUT the Thai RD (who govern this) have NOT stated that. Further, when my wife (with myself) contacted the Thai RD they noted they had never heard of an LTR visa. So the need to file or not file a tax return (for 2024 assessable income remitted to Thailand) by an LTR-WP/WGC visa holder is by no means clear when I read translations of the Royal Decree. For certain there are those in the Thai RD who have not heard of the Visa and hence have not heard of no requirement to not file a tax return of remitted 2024 tax year income into Thailand.. .... That does not mean a return is required - it just means there are those in the Thai RD who themselves may not know. So to use the expression again "the jury is still out".... I suspect sometime in late year 2025 or maybe even 2026 we will get more clarity on this. The Jury is still out.

-

I assume they are referring to income earned only AFTER 31-Dec-2023. Yes - I would agree with that, especially if one can not show the money was earned PRIOR to 1-Jan-2024. It might be interesting to see if the traveling habits of a small % of expats (in spending more time out of Thailand) will change as a result? And if the travel habits do change, will there be an age demographic as well involved? And will there also be a nationality demographic, dependent on the DTAs of different countries with Thailand?

-

I see your point - but I wonder if perhaps they were also just trying to reduce or defer their future work? If say only 2 or 3 blank pages left, and given this is a 10-year visa, they could see that within a year or less, the LTR visa person's passport would be full, and need to be renewed, and the individual might have to come back to their office to transfer the LTR visa over to a new passport. Perhaps (my speculation) is they wish to put that time in the future (when needing to transfer the LTR visa) off in the future as long as possible, for reasons only known to them. Clearly only BoI know the reason - and I suspect they are not telling.

-

Taxation Registration

oldcpu replied to StevieAus's topic in Jobs, Economy, Banking, Business, Investments

I agree that there is more than one than one thread on this topic. I posted many times on my current experience here. What the Phuket RD office told me (via my Thai wife as translator) that as long as I had insufficient assessable income from within Thailand, and if I was bringing no money into Thailand from outside of the country, then I did not need a Thai Tax_ID number (TIN). Further, other factors come into play in assessing whether one's foreign income is assessed as assessable income if remitted to Thailand. Recently (last year) the Thai RD documents PAW.161 and PAW.162 appear to indicate that any savings as of 31-Dec-2023 and earlier, if brought into Thailand after 31-Dec-2023, are NOT taxable (and I suspect not considered assessable income). Hence remitting such money is not enough justification to obtain a Thai TIN. Also, if one has foreign income from a country with a Double Tax Agreement (DTA) with Thailand, dependent on the wording /agreement within that DTA, its possible one's foreign income (such as pensions) may not be taxable in Thailand.... Of course the DTA might say the opposite, so one needs to check their DTA. I guess what I am saying, is this really depends on the specific situation of each person, and its quite possible most expats do not need a to register for Thai taxation. ... BUT in all due honesty - I don't know. I don't know the average financial situation of expats. Every expat needs to examine their own financial situation and make an appropriate determination as to their own requirements. -

I too am puzzled about that. I wonder if this was also one of the last few unfilled pages in the passport?