-

Posts

29,148 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Pib

-

I remember reading in some news article a few months ago that the Thailand Elite Visa Company felt they had too many PE visa choices which can possibly confuse potential applicants and the company wanted to streamline/update (i.e., reduce) the number of different PE visas...and while doing this they could also slip-in updated (i.e., increased) prices. I think the article said they were considering going to only 5 different types of PEs vs the 7 or 8 they currently have.

-

Below Hawryluk Legal website that is a Elite Visa agent published below article in early April. And it was sourced from the following Thai language news website....see this article for the Thai language version. ttps://www.prachachat.net/tourism/news-1249510 English Language Version at Hawryluk Legal website https://www.thailandelitevisas.com/thailand-privilege-card-to-undergo-major-rebranding/ April 4, 2023 in Thailand, Thailand Elite, Visa by Admin Thailand Privilege Card To Reduce Card Types For Better Market Fit The “Thailand Privilege Card,” also known as the Thailand Elite Visa, is going to undergo a comprehensive makeover. The company will concentrate on proactive marketing in each country, reduce the types of Elite Visa cards, price and benefits adjustments to reflect the current situation, addressing the demands of clients from the next generation. They plan to unveil a new image at the end of this year and hope to exceed 50,000 card sales. Mr. Manatase Annawat, General Manager of Thailand Privilege Card Co., Ltd., a company that produces special membership card projects including the Thailand Privilege Card (also known as the Elite Card), has announced plans to rebrand. The company aims to improve the image of the Thailand Privilege Card by reducing the number of card types, adjusting prices, and amending the benefits for every type of membership card. This is intended to make it more relevant and in accordance with the lifestyle and market of each country’s members. It’s currently in the process of examining the details at this time. In the last quarter of 2023, the program is expected to unveil a new image. Expected changes include adjusting the marketing strategies to be more proactive and focusing on each country to reach the target audience more directly. Currently, the company advertises in significant places and major events overseas, such as Times Square billboards. They are also willing to collaborate with international media and influencers on public relations. In an effort to improve its customer relationships, the company is developing a new CRM system that will focus on communication through social projects (CSR) while incorporating ESG principles in its management practices. Additionally, they are planning to increase service efficiency by leveraging technology, such as by implementing a call center to streamline organizational management. Mr. Manatase reported that the “Elite Easy Access” card is the top choice among foreign travelers, contributing 42% of the total memberships. The price is set at 600,000 baht. However, based on the current market trend, it was determined that foreigners are paying more attention to family cards. The company plans to lower the percentage of revenue derived from these types of cards to 38% while increasing the proportion of sales for other types of cards instead. According to Mr. Manatase, immigration patterns are evolving globally, and with the relaxation of border controls, Thailand continues to be among the top choices for foreign travelers. This is good news for businesses that operate in the tourism industry. However, based on recent reports, Mr. Manatase revealed that foreigners who enter Thailand illegally are capable of applying for a Thailand Privilege Card. In the past, the company used to thoroughly examine the applicants. However, when such a problem arises, the company conducts even more extensive investigations, which may delay the card authorization process. The Thailand Privilege Card company carries out a criminal background investigation on every applicant. Once the application is received, the details are forwarded to the immigration office in Thailand. In some other countries, like China, the information needs to be provided to the government intelligence agency. This process typically takes 7 to 15 days, while an additional 45 days are required to verify the applicant’s criminal record and other relevant data. In other news, Mr. Manatase Annawat, General Manager of Thailand Privilege Card Co., Ltd. paid a visit to Hawryluk Legal Advisors, one of the top Thailand Elite Visa agents in Thailand today (April 4, 2023). During his visit, he discussed several important topics to improve the elite program; extra benefits to make memberships cater to privileged lifestyle inside of Thailand, the potential increase in Elite visa fees, streamline of 90-day reporting, and more. Hawryluk Legal Advisors is known for its personalized approach to each client, ensuring that their needs are met through a careful and thorough evaluation. Their clients can rest assured that they are receiving top-tier legal services and expert guidance throughout the Elite Visa application process.

-

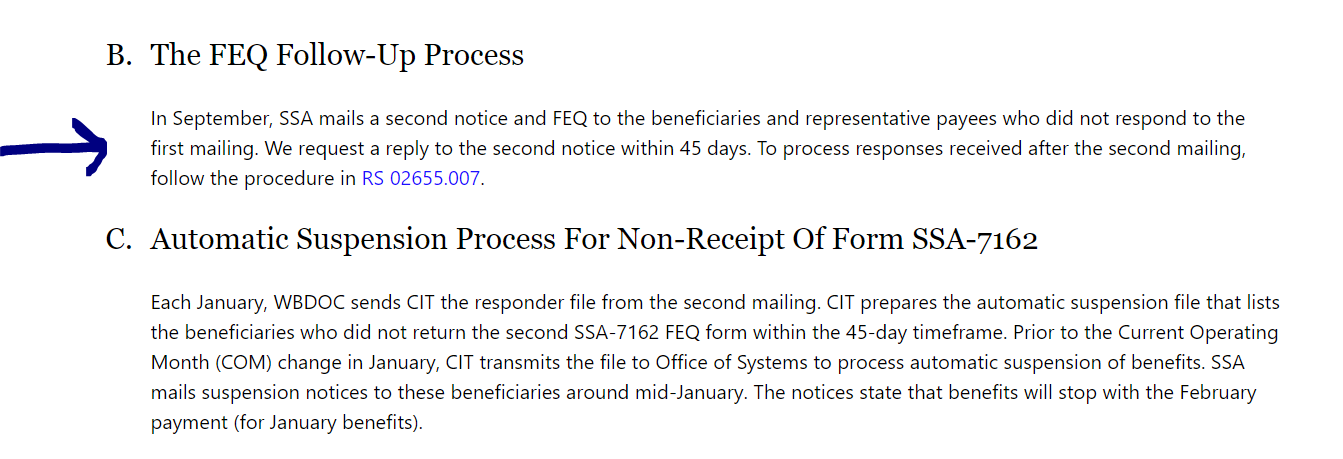

According to the SSA regulation (below) regarding the 7162 2nd mailing (a.k.a., Foreign Enforcement Questionnaire-FEQ) it occurs in Sep....but doesn't say what part of Sep. And I expect whatever "cutoff date" is used before generating that 2nd mailing will be a key date as to whose name appears on the 2nd mailing. Like maybe the SSA will use a 1 Aug "cut off date" to generate the Sep 2nd mailing....or maybe 15 Aug...or maybe 31 Aug....or maybe just the day before the Sep 2nd mailing. Their regulation does not go to that level of detail in specifying an exact 2nd mailing generation date in Sep. I expect various factors (like their IT system capability, how the mailings are printed, whether the govt or contractor prints/mails them, etc.,) determine what cutoff date is needed to ensure a successful Sep 2nd mailing. Just because they can possibly run the retrieval in a few hours or even minutes to determine who didn't respond does not mean the next morning they can printout and mail thousands upon thousands of 2nd notices. One would hope they don't use a cutoff date that's too much before generation of the Sep 2nd mailing. Hopefully they use an end of Aug vs beginning of Aug cutoff date to increase the number of 1st mailings received back/processed which would reduce the number of people appearing on the Sep mailing....or maybe the will use the day before in Sep as the cutoff date....who knows. SSA Regulation/Instruction talking FEQ 2nd mailing https://secure.ssa.gov/poms.nsf/lnx/0302655010

-

Jim, It sure would be nice if BoI could at least implement some alternate locations in Thailand to have a LTR inked into a person's passport. Or, develop an online method probably still managed by BoI but once the online paperwork was blessed by BoI they then allowed a person to go to the immigration office in their province to have photo taken, fingerprints taken, dot the i's & cross the t's.....and then the local immigration makes the entries/stamps into your passport since their system shows BoI has approved visa. Heck, maybe even figure out a "via mail" method. But I expect there are probably obstacles in just how closely some government agencies can work together, have another agency do some of the workload, etc. In a round-about way it already happens in a kinda similar way when a person applies and gets approved for a LTR visa and selects LTR issuance via the evisa system. Now I've never used the evisa system but I expect a person needs to upload to the evisa system his LTR endorsement (approval) document which the evisa embassy folks probably double check in some system (like how immigration checks for OA insurance in a system when applying for an OA extension) and then a visa via email is issued.....then once arriving at the airport in Thailand airport Immigration then puts some LTR entry/permitted to stay stamps into your passport. I guess airport immigration also takes your picture and fingerprints on entry....I haven't entered Thailand in so long I'm not sure of the exact procedure anymore. Yea, it sure would be nice if BoI and Immigration could work out a way which didn't require "in-Thailand" folks to "have" to travel to BoI in Bangkok for the "inking" part because traveling from Chiang Mai/Phuket/Ubon/Pattaya or just any where a fair distance from Bangkok can be an undesired/possibly challenging trip. Kinda like having to make a visa run/border hop. Heck, I live in Bangkok and hate driving to the other side of town due to the typically horrendous traffic. Time will tell.

-

Appropriate Security, Convenience to Be Provide to Thaksin: Wissanu

Pib replied to snoop1130's topic in Thailand News

It's kinda like if a bank robber says he just made an unauthorized withdrawal. -

Thanks for the clarification. Yes, for whatever reason, I was getting the impression you might be saying BoI immigration would not transfer it since the person's first utilization of approx 2 years to the end of his current passport effectively killed the whole LTR visa when his passport expired, therefore, nothing left to transfer to a new passport.

-

Jim, The LTR stamp says in must be "utilized" before date XYZ (which is a date 10 years from the LTR issue date) if the passport remains valid. Now the person did utilize it immediately which would "normally" give a Stay Permit date for 5 years but in this case for only 2 years which is when his passport expires 22 Oct 2024. Now you saying when he gets a new passport probably in early/mid 2024 and goes to transfer the LTR visa stamp from the old to new passport that BoI Immigration will not transfer the LTR visa stamp "AND also not give him a new Permit Stay date? I expect the new Permit Stay date would not be 5 years but probably around 3 years to approx 22 Oct 2027. Those 3 years added to the 2 years on the old passport would equal 5 years taking the person up to the time he needed to apply for the mid term LTR extension to get the 2nd 5 years of the 5+5 year LTR visa. The BoI LTR visa stamp transfer procedure is quote below https://ltr.boi.go.th/page/transferring.html

-

Regarding the BoI LTR website/login uptime reliability when it would often go down for a few hours on some days, maybe the entire weekend, and/or during holidays I haven't notice any downtime for months. This was very frustrating to those trying to get LTR info, submit or update an application, or check the latest status of their application. I was kinda expecting it to go down during this long holiday period beginning with the King's Birthday today/28 July like for a similar long holiday period a couple months ago, but as of this post the website and acct login is still working. I doubt the previous low reliability was due to inadequate capacity/too many applications but due to a lot of system glitches, too much maintenance downtime to fix the glitches, and simply shutting down the system on some weekends and holiday periods. Now I wish they would update the LTR website to show a lot more practical info on LTR management like the sister BoI SMART visa website has. https://ltr.boi.go.th https://smart-visa.boi.go.th/smart/index.html

-

Just a clarification...the LTR "visa" does not expire 22 Oct 2024 as it's still good up to 17 Oct 2032 but the Stay Permit is only good till 22 Oct 2024 since his passport also expires 22 Oct 2024. The Stay Permit date is limiting factor and not the visa date. Works a little differently from a Non Immigrant type extension where the extension/permitted to stay date can not exceed the passport expiration date. When the LTR stamp is transferred to the new passport it will still reflect a 17 Oct 2032 date.

-

The 2nd mailing only gives a 45 day suspense vs 60 days for the 1st mailing. What Wilkes Barre is looking to receive is the "barcoded" 7162 they mailed you. If you have a "really good" copy of the barcoded 7162 you mailed via registered it probably wouldn't hurt to mail them that copy via regular mail. But IMO mailing Wilkes Barre a bunch of copies via regular airmail registered airmail, carrier pigeon, pony express, etc., might make Wilkes Barre get a little suspicious....then again people mailing multiple copies may seem routine to Wilkes Barre. Personally I would just wait to see if you get a 2nd mailing and if so respond via regular airmail.

-

Online Appeal for US Social Security Administration

Pib replied to racyrick's topic in US & Canada Topics and Events

Was it the appeal process talked at this SSA webpage? https://www.ssa.gov/apply/appeal-decision-we-made/request-reconsideration -

I pretty sure that in this mail universe it will not arrive Wilkes Barre by "1 Aug".....and very unlikely you will even see it arriving New York USPS International Service Center (ISC) by 1 Aug much less getting thru the ISC by 1 Aug. But the 2nd 7162 mailing is not until Sep/Oct which means if your 7162 arrives Wilkes Barre by 31 Aug you should be OK.

-

Appropriate Security, Convenience to Be Provide to Thaksin: Wissanu

Pib replied to snoop1130's topic in Thailand News

Below partial quote is from the embedded tna.mcot.net article above. Where the article says "....may lead to different treatment from other inmates...." is another way of saying he'll get 5 star hotel treatment. And this evening's Bangkok Post said if the court is closed that Thaksin will be taken to a special detention center at the Royal Thai Police "Sports Club" in Bangkok where a special facility has been prepared for Thaksin if needed. Nothing worst than being detained in a government Sports Club.....I'm sure all arrests lead to the same special care. ???? -

When you are coming back to the same address a TM30 is not required regardless of visa type...that is, Non O, Non B, LTR, etc. But unfortunately some immigration offices still want to see a new TM30 before accomplishing certain tasks like applying for a extension if the address they see in the TM30 system doesn't match your current address like you stayed at a hotel where they submitted a TM30 on you, etc.

-

Yeap...me too. I have a couple of UM SIMs. I always use a U.S. VPN connection to log onto to accts. About a week ago both numbers started requiring 2FA for acct logon...it will send a text to the UM number and you must respond by typing "Allow" and then about 5 seconds later the logon to your acct completes. Before last week a 2FA challenge was practically never. I think UM has switched to 2FA for every logon.

-

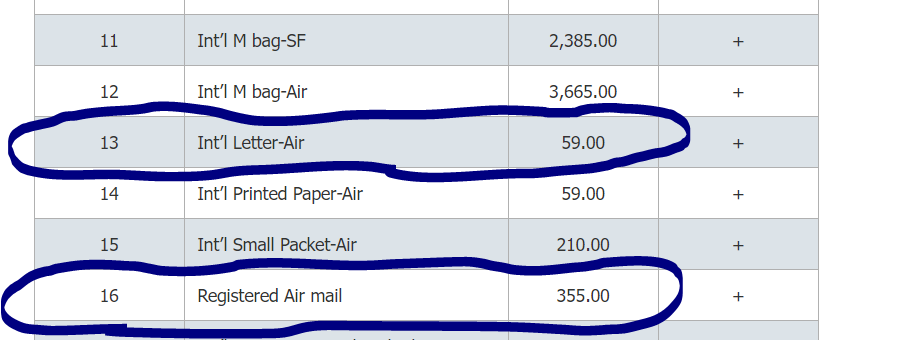

Mailing one envelope via regular airmail plus another one via registered mail to the U.S. "use to cost around Bt200" up until a couple years ago. Then the Thai Postal System raised it rates. As of a few years ago, the rate for an international regular airmail and registered airmail for a 25 gram envelope (approx weight of a 7162 envelope) is Bt59 and Bt355, respectively, for a total of Bt414.

-

O-A retirement medical insurance

Pib replied to Jai Dee 962's topic in Thai Visas, Residency, and Work Permits

For a retirement extension under a OA "or" O visa the deposit requirement is the same if you use the deposit method: Bt800K. Not sure where you are getting only Bt400K deposit is required for a Non O....Bt800K is required. -

@watthong @jerrymahoney Thanks. I expect your 7162s have arrived Wilkes Barre although the tracking seems to have stopped at Scranton which is approx 20 miles/30 minute drive from Wilkes Barre. When the tracking doesn't show delivery it kinda defeats a key purpose of registered mail to ensure/show delivery. Hopefully tracking final delivery will appear in the near future but based on my personal tests discussed a little bit more below sometimes tracking never shows final delivery although final delivery does indeed occur. I advocate the use of regular airmail for 7162s based my personal/multiple tests of regular and registered airmail from Bangkok to Houston in 2019 where the regular airmail arrived twice as fast and was a lot cheaper. In these tests the regular airmail arrived Houston in 11-14 days and the registered airmail arrived in 21-33 days. These registered airmails also went thru the New York USPS International Service Center just like the 7162s going to Wilkes Barre. By "multiple" tests I mean I mailed two envelopes (one regular airmail and one registered airmail) at the same time from the same same Bangkok post office to the same Houston address. Did this 3 times over several months. This Houston address was my mail forwarding address where I get a scanned image via email of each delivery. And 2 of the 3 registered airmails never showed USPS tracking final delivery....just showed out for delivery.....but they were delivered as I received an email scanned image upon delivery from my mail forwarding address.

-

Plung Sungkom Mai party proposes review of coalition MoU

Pib replied to snoop1130's topic in Thailand News

Yeap......the Plung Sungkom Mai party won "one" Parliament seat in the election. -

What's the latest USPS tracking on your 7162 mailed to Wilkes Barre via registered airmail on 22 June? Has it arrived Wilkes Barre SSA yet?

-

What's the latest USPS tracking on your 7162 mailed to Wilkes Barre via registered airmail on 24 June? Has it arrived Wilkes Barre SSA yet?

-

800000 BHT for immigration

Pib replied to fulhamboy's topic in Thai Visas, Residency, and Work Permits

I expect one of the reasons for setting a Bt400K floor and requiring a Bt800K level 2 months before & 3 months after extension application was to help ensure a person has enough funds to live on year-round (what Immigration feels is enough funds for a farang) and did not just borrow Bt800K for a few days to get the extension. After after those few days the person paid back/gave back the borrowed money and is possibly now back to only a few baht in his Thai bank acct and living on much less. And yea I know the short term Bt800K slight of hand is what some visa agents arrange....get immigration to bless. What is suppose to happen if falling below the Bt800K during the 2 months below & 3 months after extension application along with following below Bt400K during the remaining 7 months is you have violated the terms of your extension and it could be immediately terminated and/or when applying for the next extension it would not be approved. A person signs an immigration form notifying of such when processing an extension. Now regarding arrangement of a visa for your father, there is an option where income is not required....see below post/thread talking Rule 2.20 Dependent Extension. -

800000 BHT for immigration

Pib replied to fulhamboy's topic in Thai Visas, Residency, and Work Permits

Actually the deposit change went in effect 1 March 2019....over 4 years ago....time sure flies. See below Jan 2019 AseanNow thread. The link I posted earlier is a later police order that upped the medical insurance insurance requirement effective 1 Oct 2022 and this Oct 2022 police order also reflected the Bt800K deposit requirements from the Mar 2019 order. Or said another way the Oct 2022 order pretty much superseded the earlier order(s). -

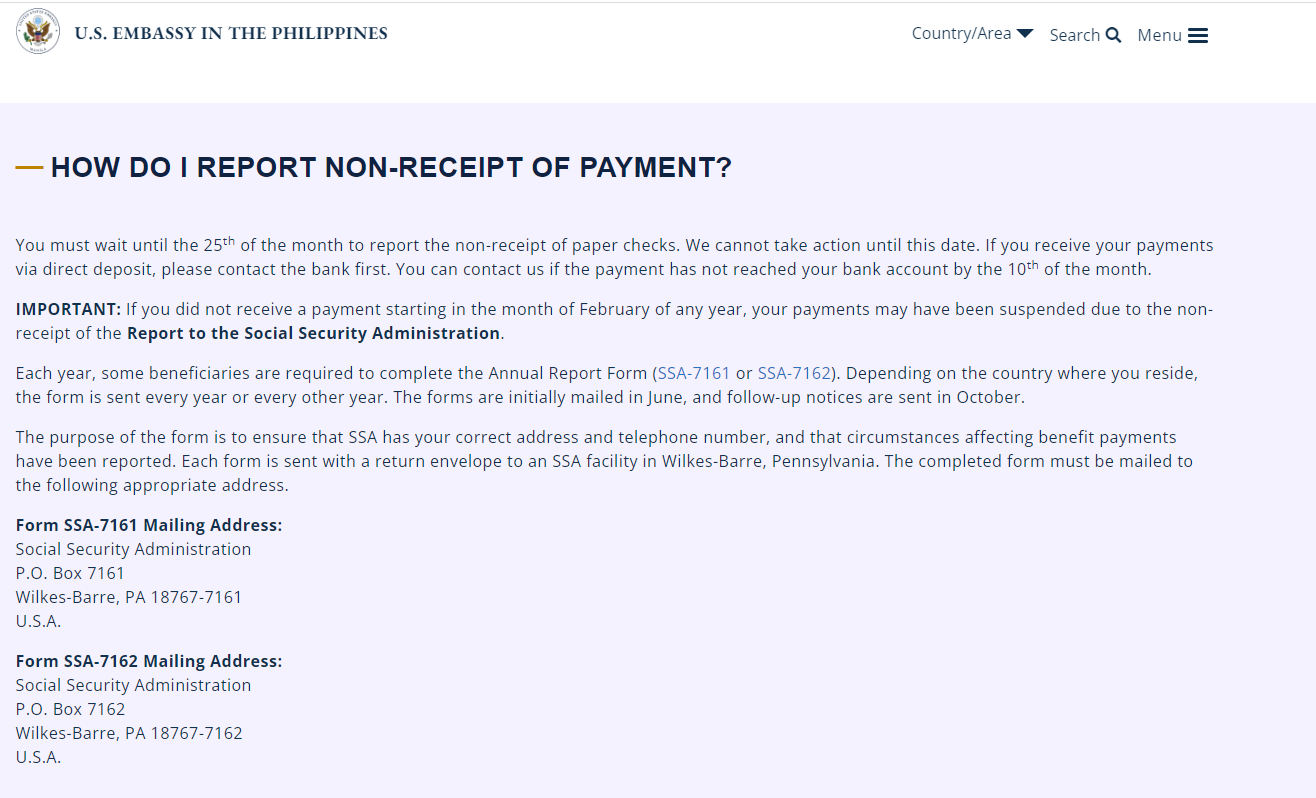

You should be OK. The copy you mailed back should arrive Wilkes Barre within 2-6 weeks. Registered airmail usually takes longer (typically twice as long) than regular airmail. Now even if it don't happen to arrive before the SSA 2nd 7162 mailing in Sep/Oct (for those folks Wilkes Barre didn't get a response to the 1st mailing) you can just mail back the 7162 provided in the 2nd notice....be sure to mail back any 2nd notice even if your tracking showed your 1st 7162 response arrived Wilkes Barre. Recommend you mail it back regular airmail as it should arrive sooner and definitely be a lot cheaper than using registered airmail. And if Wilkes Barre does not get a response to the 1st or 2nd mailing in Jan they will mail out a notice of benefits suspension applying to the 3 Feb benefit payment.. If that occurs you should contact the Manila FBU SSA office who are probably going to instruct you to mail them and/or Wilkes Barre a manually completed 7162 which can be downloaded from the Manila FBU SSA webpage....see their web page below for more info. https://ph.usembassy.gov/services/social-security/faq/