UKresonant

Advanced Member-

Posts

1,350 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Everything posted by UKresonant

-

Provided basis remains remittance, but it would probably always need some non-resident years. (This is all hypothetical for me on current plans as the earliest year I could be tax resident is 2027, the main thing is to to start recording taxed income, buffered / saved for later remittance). It's probably more do-able once over 65 and the additional allowance become available.

-

I'm horrified by the potential complexity it could become, as all my pensions are taxed in the UK. If the over 180 days over rides the tax residency in the UK, I would still need Thai RD to allow a tax credit on 10% of income remitted, and potentially they may issue a tax credit asking me to claim it against UK Taxes on the other 90%. I might be tax resident in UK and Tax resident in Thailand, maybe 270 days in UK tax year and 260 days in Thailand tax year, at the extreme, the tax years don't align. May need a Tax float of 150000baht to cope with interim double taxation. This assumes that only fully taxed pension is remitted and that is the only scope of a Thai return. It's just a headache waiting to happen. Would be flip a coin perhaps if the UK tax authorities would issue me a Certificate of Residence or not.

-

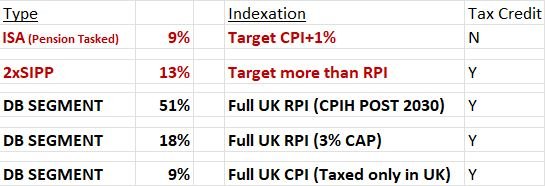

The Investing Year Ahead

UKresonant replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

I can be a bit more aggressive on that bit which is providing 22% of my current income stream, but want to improve the numerical yield as target, whilst the percentage yield is reduced in those portfolios, so the numerical escalation becomes increasingly more certain in theory. [They financial advice was to resist the apparently big Money opportunity back in 2018, so quite happy on some one else is worrying on the 69% and the 9% is straight out the Treasury Much lower Cash stash, Vs more secure and escalation of income stream. Will have to do until the next segment (probably State pension) arrives in six years (seems so far away at the moment ) Interestingly (or not) all the DB segments are from the same continuous employment, but I think Thai RD will only accept the 9% as being always taxed in the UK, if I had to file. Lower cash stash makes the Thai interface more difficult now perhaps, but set in stone and avoids temptation, the advisor was correct I think.] [Some folk that are/were in 'safe' Lifestyle Defined contribution pensions, which had been increasing bonds as a share of the portfolios, as their customers became older, got a bit of a shock when the 'safe' bond prices dipped in to 2023! Can we retire?=No (or get burned.] -

Oh I hope not, that tax clearance Cert was a PITA when it was on the go before and much happiness was expressed when it was no longer a thing. Imagine an urgent matter arises and you get a call on a Friday evening to come home (country) a.s.a.p, then there is a public holiday on Monday, you can't confirm your flight until you get an audience and get that stupid bit of paper

-

Yes 5th July to 31st December will become an additional season to consider for TAT statistics Or just multiple trips, with a balance of Days up to 31st Dec (Dad has kept below the 180 Day limit for about 20 years now , January, April May, August Sept and balance of the days in December which can be adjusted should any of the other trips have any slight unforeseen overrun).

-

The Investing Year Ahead

UKresonant replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

Don't think BR will be back in until late Q3 Moving from GPB to USD investments would need to be at 1.35 I think, which it is not, so don't see any attraction. expanded to Japan with the currency ratio seemed less risky even if the index figures were not the incentive to do so. -

The Investing Year Ahead

UKresonant replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

I think I'm 80% equities US 37% UK 20% EU 14% JP 12% 17% PacExJP and many fragments. Got rid of 99.9% of gold March 2022 (giving +14% compared with when when I went in 6 months before, and a corresponding -16% on the Equities it was moved to, just after the obvious Russian wipe-outs became apparent). -

The Investing Year Ahead

UKresonant replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

Not sure about the S&P, but with the Elections in both the USA and UK, I've moved more towards long standing Global Investment Trusts and Funds over the last two quarters. They probably do have a substantial US element, but have tried to go for more of a kinda NATO countries and far east/pacific friends Geographical breakdown in their holdings list. I still have a disproportionate bias towards the UK & Japan though (still liked to have at least some index linked bonds). Will look but not touch again probably, until well into 2025. -

I was in a Sushi Cafe in Pattaya back in August, went to pay for the meal, "Scan" only, couldn't even use a Thai debit card. had to borrow the wife's iPhone to pay! Bonchon chicken in the Siam Centre Bangkok, at least still allowed payment by card. There must be a few tourists for which this causes a problem. I still like to always have a cash option, as some day a good probability of the system or power will not working.

-

Yes, like the SRT park in Bangkok, have to hire the bike though if you want to cycle, but you can walk round optionally, great excersise facilities (similar in many parks other locations, like and the cycle paths south of Hua Hin.) By mentioning double pricing, I think it represents a disappointing factional attitude, for which I could not guess as a percentage, except much less than 100%. As some ticket sellers cringe a bit. Whilst others exude a different body language, the kind of posture that hopefully RD shall not have....

-

Health/Accident Insurance for Retirees

UKresonant replied to jaiyenyen's topic in Thai Visas, Residency, and Work Permits

A. 1. not for the non-O, 90 day Single entry visa, based on retirement. (the one year ME Non O-A visa does require it). A. 2. The Health cover for the O-A visa practically is probably going to be a Thai Insurance provider as the certificate they require to be signed by a home country / overseas provider, it may be a little difficult to achieve. Quite likely you may find a clause deep in the Thai providers T&Cs, that says cover is not effective until you have been in 6 months (out of 12) in Thailand. Therefore there may a practical difference between actually gaining cover for your benefit and having a policy to meet a O-A visa requirement. (unless anything has recently changed). "They used to say the links to TGIA companies was sometimes note as "courtesy links. https://longstay.tgia.org https://longstay.tgia.org/document/foreign_insurance_certificate.pdf The certificate does seem to be improved slightly from the last time I looked at it some time ago, it used to say cert i.a.w Thai Cabinet Resolution , blah blah, and overseas company were not keen to sign it! It now has "...the insured person is insured by health insurance in accordance with the law and regulations for foreigners who apply for the Non-Immigrant Visa Type O-A (period 1 year).." so maybe just as difficult, as the non-Thai provider will have no knowledge of that, so can't actually sign. -

I did worry about it for the last 6 years. Within that period, only one year that I exceeded 179 days, and that relied on the remittance from previous years. Potentially and likely an end to simplicity is the way I see it, implemented in just over 50hrs time, with effect sometime in June. (99.9% of my income is automatically taxed, or does not require tax deducted, in home country, so not any avoidance concern). P.s. also, everyone, remember the leap year extra day for counting the threshold

-

That would be the theme I would be feeling, not even a pass to avoid multiple entry fees at various venues, national parks and maybe even some health facilities. The ticket vendors may say that I'm still just on a slightly extended visitors visa, for which I couldn't really dispute that aspect I suppose .

-

Only for his reference to tax just following the timestamp noted. (perhaps his concern may be replicated by other totally character diverse individuals) But I would note that the channel owner noted his lack of concern over the issue, and seems very laidback about it, whilst "the chap" responded that his income was mainly pension related, that may influence his outlook on the subject. Everything else, I make no judgement on him, excepting a comment of the hope she avoids socialising with Thai expat gamblers once in the US, in response to another commenter.

-

Inbound overseas income, remitted during the same calendar tax year has always potentially had the need for a tax return. Depending what amount and type (certainly since I first looked at the subject in any detail back in 2017 / 2018). There was no way I would be over 179 days when taking some retirement benefits in 2018. It was by far a situation to be avoided, to be potentially asked to explain my financial transactions of 2018 in Thailand Always remitted previous years income / savings 2019 until we decided the son would return with me to do his high school in the UK (turned out to be just before COVID ), so a short experiment! What puzzled me was why it did not seem an issue in the past for people for folk directly crediting income in the same year. Maybe the thinking before that was it was a good thing for money simply being sent and spent into the country! (not a bad concept). [ un-related ramble;-Now they feel, it is perhaps better to emulate the inefficiency of other countries politicians and systems, to be part of that social group. Why did they not just step the savings if past years to 24 months initially, rather than midnight at the end of the year. they could in the interim put an 0.25% admin on inward remittance as a quick result, below say 20 million baht, supplemented with a few random checks. Then concentrate on the potentially high yielding targets over 20 million inbound, with CRS etc.]

-

Snapshot of my thinking 1 minute ago on CRS...Till I read something else These example extracts, seems to be a theme ....non- reportable accounts are jurisdiction specific in that what is low risk can vary.. .....the following are to be considered non-reportable accounts: Retirement and pension accounts Non-retirement tax favoured accounts....(within a longer list) As almost all substantial items are parked in these, CRS does not seem to be much of a concern, should I become occasionally tax resident in Thailand in the future. Reported end of year account balances will likely not be spectacular enough to cause concern or curiosity, excepting perhaps siloed savings from 1st Jan 2024 onwards, created from the fully taxed similarly siloed in a separate bank, pension stream, which is the only current source that can going forward be remitted to Thailand I think. and All provided they keep the remittance basis(with the 180 single year definition.. Though should they copy the arrogant tax system of home country in the future (Global), the ball is burst most likely (can only play one half <179, unless they made Tax residency 270 days or more in a single calendar year , unlikely ). Some concern still, would be ending up in any confrontational situation with RD, they want documentation I don't have, or it stamped by someone who knows nothing about it anyway, or impossible to obtain. I watched a Japanese you-tuber who explained that some restaurants at his location in Japan, had signs say no tourists /foreigner, it was not that they did not like them, but wish to avoid any stressful situation caused by language or culture clash. Similar apprehension over a possibility of having to deal with Thai RD perhaps, .

-

The problem may be having them accept pre 2023 savings, that it has been taxed already (non-LTR) Just watched this at time 14:50 where a similar concern is raised. My savings were configured for the old rule, to bring from previous year (if required), but were not isolated or documented for 6 years down the road to prove they were post-taxation.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)