userabcd

Member-

Posts

2,523 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by userabcd

-

FX letter for condo purchase issues

userabcd replied to sikishrory's topic in Real Estate, Housing, House and Land Ownership

The banks follow BOT regulations, I don't know why they should exceed that.. Also I would think the developer/land office should have knowledge and experience of foreign buyers requiring the FET to purchase the property. They perhaps should not be accepting money before an FET is in place for a foreiger purchase. "I'm not sure how i could escalate any higher than that. " Maybe inquire at the banks head office. -

FX letter for condo purchase issues

userabcd replied to sikishrory's topic in Real Estate, Housing, House and Land Ownership

Maybe try escalate the matter in the local bank. Consider another lawyer. I trust you have a written receipt acknowledgment from the developer that the payment has been made/transferred. Should you not obtain an FET before transferring money to the developer? You have made a foreign transaction to your local bank account, for whatever reason you specify to get your money back out again they should issue an FET. this is what should be done, so if the local bank is causing problems in violation of BOT rules then escalate to someone in BOT. How to obtain a Foreign Exchange Transaction Form (FET)? While transferring money into Thailand for the purchase of real estate may seem like a mundane and straightforward process, foreign buyers need to follow a specific set of procedures. In order to obtain an FET Form that complies with all the Bank of Thailand’s regulations and Land Office requirements, foreign buyers will need to ensure the following: 1. The full purchase price of the condo is remitted in foreign currency. It is important to note that the foreign currency remittance must be converted by the receiving Thai bank. 2. The transfer should mention the foreign purchaser’s name either as the sender, receiver or at least in the purpose of transfer. 3. Mention purpose of transfer in the bank application form of the remittance transfer. Here is an example of a purpose of transfer note: “Money Transfer for the Purchase of [Unit Number], on [Floor], in Condominium [Full Condo Name] on behalf of [Mr. /Ms. Full Passport Name]” -

Swedes and Thais fight each other over traffic rule in Phuket

userabcd replied to webfact's topic in Phuket News

Those are quite risky odds considering 20 to 22% of Swedes are not blonde haired and blue eyed. -

The browser you use is unimportant, inside all web browsers you can choose the search engine to use be it google, bing, yahoo, duckduckgo etc.... Try opening the local search engine of the one you want to use with .co.th. Try also clear cookies and clear history and on the location in the web browser. To find the store selling the goods from a general search, it would be better to input the name of the store eg home pro khon kaen and then it would produce more accurate results.

-

Difference Between Web Browser and Search Engine Web Browser Search Engine A web browser is a software application used to retrieve data from webpages or HTML files present in servers. Search Engine is kind of a website where a user can search for information and the results based on the same are displayed on the screen. A web browser used Graphical Interface to help users experience an interactive online session on the World Wide Web A search engine has three main components: Search index Crawler Search algorithm No database of its own. Only comprises a memory to store cache and cookies It has its own database Multiple Web Browsers can be installed on a single device You do not need to install a search engine in your system Examples of Web Browser are: Chrome Firefox Mosaic Internet Explorer Opera Examples of Search Engine include: Google Yahoo Bing Ask

-

-

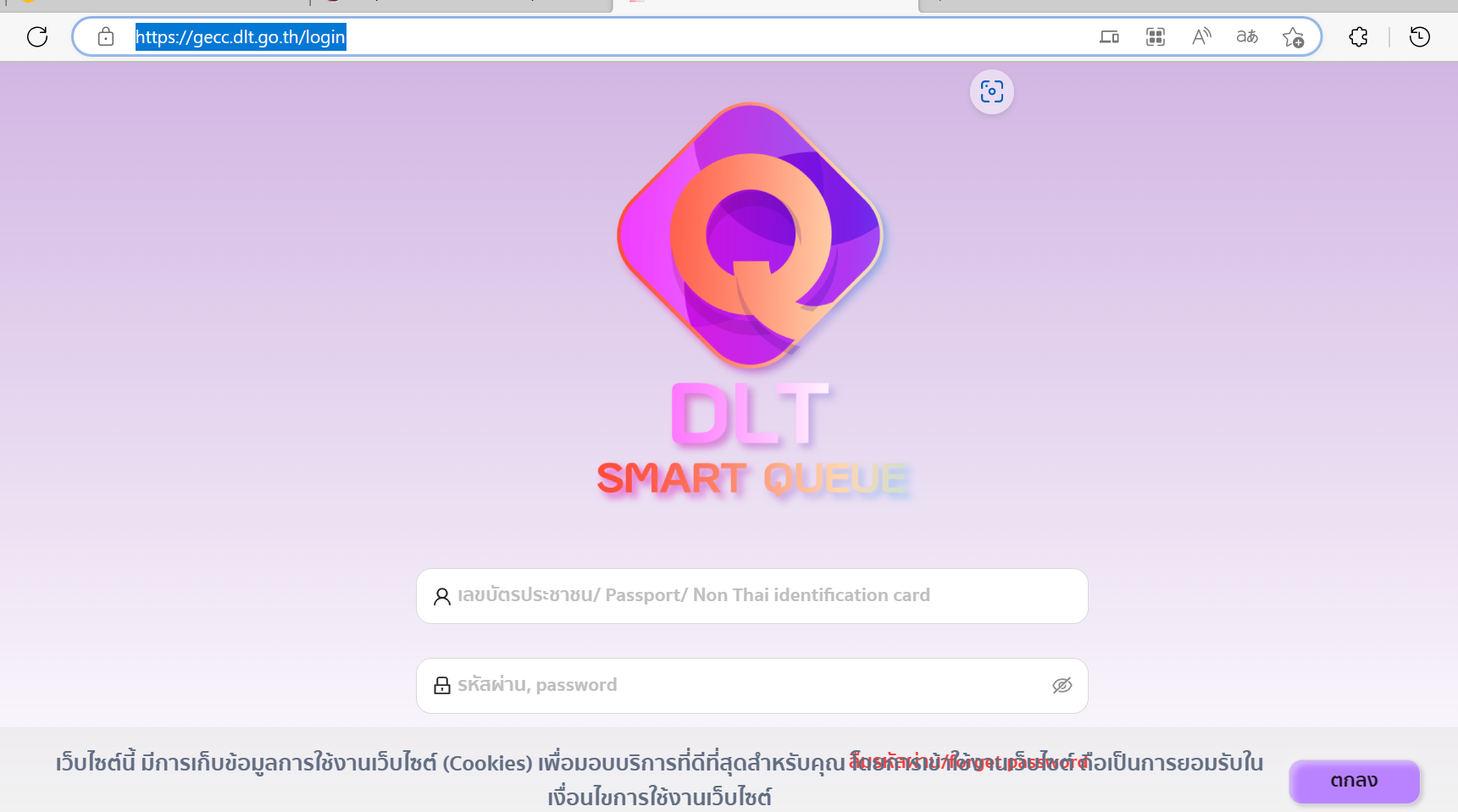

Try this website and then see from the drop down menu if the driving license test near you allows online appointments, most do but for eg Chatuchak in BKK does not allow foreigners to make online appointments. เว็บไซต์จองคิว DLT Smart Queue

-

In the 90's was riding pillion on a motorcycle my wife and I had rented in Phuket. Whilst stopped in traffic a car behind us drove into the back of us and sent us flying. The motorcycle was damaged and fortunately we were not hurt except for some scratches and bruises. Since that day have not and will never ride on a motorcycle again.

-

You make the appointment then go online and watch a video for about 1hr and answer and few questions during the video. At the end of the video save the notice that you watched the video and show it to DLA on your appointment date.

-

Jasmine resort hotels. Priced 3000 to 5000 baht.

-

Government Recruits Retirees for Lifelong Learning Program

userabcd replied to snoop1130's topic in Thailand News

After all it is Thailand, their own language, why not get all visitors to learn and converse in Thai whilst in the country. -

Government Recruits Retirees for Lifelong Learning Program

userabcd replied to snoop1130's topic in Thailand News

Did we read this right? Are you describing yourself? -

Cabinet approves tourist fee of 150-300 baht for all foreign tourists

userabcd replied to snoop1130's topic in Thailand News

They started off low. There is ample room to increase it year on year. And it's a little bit here, a little bit there as new ideas in govt how to extract more from the public. It all adds up to a lot. -

Don't know what your earbuds look like but you could try silicon ear hooks ordered on lazada. https://www.lazada.co.th/products/silicone-earhook-holder-for-airpods-1-2-pro-1pair-protective-anti-lost-ear-hook-for-airpods-3-sports-earhook-i3985364793.html?spm=a2o4m.searchlist.list.56.2fc83813YPivfG https://www.lazada.co.th/products/ear-hook-clamp-loop-clip-i4164289990.html?spm=a2o4m.searchlist.list.86.2fc83813YPivfG Another method is to wear a woolen cap pulled down over the ears to keep the earbuds in. https://www.lazada.co.th/products/p-u-m-a-cap-100-i4017937009.html?spm=a2o4m.searchlist.list.173.79fe43a0ZwmByz

-

Revenue Department to tax Youtubers, online vendors and influencers

userabcd replied to webfact's topic in Thailand News

Dont know about US taxes, discussing Thai taxes here and on their website for taxable brackets they write for 0 to 150000 'exempt' ex·empt /iɡˈzem(p)t/ adjective free from an obligation or liability imposed on others. "these patients are exempt from all charges" synonyms: free from, not liable to, not subject to, exempted, spared, excepted, excused, absolved, released, discharged, immune verb free (a person or organization) from an obligation or liability imposed on others. "they were exempted from paying the tax" synonyms: free from, not liable to, not subject to, exempted, spared, excepted, excused, absolved, released, discharged, immune, excuse, free, release, exclude, give/grant immunity, spare, let off, relieve of, make an exception of/for, liberate, absolve, discharge, let off the hook, grandfather, dispense noun a person who is exempt from something, especially the payment of tax. -

Revenue Department to tax Youtubers, online vendors and influencers

userabcd replied to webfact's topic in Thailand News

Pedantics. On the RD website which was posted an extract, they themselves write "exempt" So if someone was earning less than 150000 baht, any tax of those earnings would be exempt from paying income tax. There are also rules about when one is required to submit a tax return. -

Revenue Department to tax Youtubers, online vendors and influencers

userabcd replied to webfact's topic in Thailand News

I guess you know in detail the earnings of Thais??? Below 150000 baht the income is exempt, those are the rules which incorporate most Thais, they are not all rich as some would assume. Tax rates of the Personal Income Tax Taxable Income (baht) Tax Rate (%) 0-150,000 Exempt -

Being taxed whilst waiting for work visa & permit. Fair?

userabcd replied to Deserted's topic in Teaching in Thailand Forum

''Incorrect. You need a work permit to register at the tax office.'' Incorrect, there is no written law or requirement that a work permit is required to get a tax number. All taxable income received in or earned in Thailand should be declared to RD within the tax rules for submission and payment and one can apply for a tax number at RD giving the reasons why one needs a TIN. They will then issue one to pay the tax on savings, investments, CG, dividends, work income or claim a return of interest deducted etc... The op can ask his employer for his registered tax number for which the company is deducting tax and paying over to RD on his behalf. If they do not have it then he could write them to issue it to him or he could visit the tax office with his employment contract and discuss with RD explaining the situation. -

Being taxed whilst waiting for work visa & permit. Fair?

userabcd replied to Deserted's topic in Teaching in Thailand Forum

Depends. Refer to Thai Revenue departments website: https://www.rd.go.th/english/6045.html Also you could ask your employer to clarify breakdown of deductions from your salary income. -

Being taxed whilst waiting for work visa & permit. Fair?

userabcd replied to Deserted's topic in Teaching in Thailand Forum

100% fair. If you are working in Thailand and earning income, it should be taxed. At the end of the tax year you can submit your tax return detailing all income, taxes deducted and allowances etc... And immigration residency, work permit have nothing to do with Revenue department, they deal with tax residency, income and tax.