-

Posts

1,527 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by motdaeng

-

vinny, vinny, are you desperate, bored, or both?

-

The worlds biggest battery maker reveals solid state battery details https://youtu.be/0W6BeL47GkI in just a few more years, there will be only few (minor) reasons left to argue against electric mobility. over the past years, many counterarguments have been debunked, including concerns about sustainability, battery lifespan, fire risk, high costs, lack of charging stations, and more ...

-

an interesting website for people who want more than just surface-level info about ev's ... https://evclinic.eu/ https://evclinic.eu/2024/11/03/which-used-ev-to-buy-a-beginners-guide/ text taken from a review of the Hyundai Ioniq 28kWh: " ...The first-generation Hyundai Ioniq is the only vehicle on which we have not had any type of intervention. Several acquaintances who own and drive them report absolutely no issues, and we have no cases in our laboratory. Prices range from €10,000 to €16,000. The battery system is composed of LGX POUCH cells, which have proven to be durable and high-quality. ... " text taken from a review of the Nissan Leaf 1.gen and 2.gen: " ... This vehicle is responsible for forming all diesel-oriented stereotypes against electric vehicles. It embodies the phrase “the whole battery needs to be replaced when it fails.” It has one of the worst chemical configurations in its battery system, with Pouch cells that are so problematic and irreparable that it’s shameful to even call this vehicle electric. We do not service them at all. The cells, due to the lack of thermal management, overheat and become permanently damaged, often involving all cells in the process. There are no higher-quality replacement cells available. ..."

-

sorry, a little bit off topic, but can changes to the suspension affect the car warranty?

-

would you have made these upgrades to your own car or not? if not, you're paying also for something you don't really want or need. plus, you probably can’t check the quality or price of these upgrades ... by the way, the byd seal has a special discount offer until the end of the month, up to 240,000 thb ...

-

vinn41, give us a break. not everyone is as obsessed with numbers as you are. we’re talking about a few cars and some small differences in % after the coma. if it helps you to let it go, yes, you have a point, if it matters. but honestly it doesn’t ...

-

i thought this topic was about electric vehicles in thailand, not pages of discussion about which statistics are right or wrong. it's starting to get boring and tiring to follow this topic, and i don't see any real value in these arguments over statistics ... suggestion to the members in question: take a break for a month or start your own new topic!

-

i think there's a need (without name-calling) for a new topic: how to calculate the correct number of bev's ...

-

ask your in-laws if someone in their area has an ev and a wall charger. maybe they'd be willing to let you charge your car if it's really necessary ...

-

good morning vinny41 i think most of us wouldn't see this small inconsistencies in the percentage as a problem ... it might be worth trying (at least for once) to just leave a number as it is and let it be ... thank you. wish you and eveyone a nice weekend

-

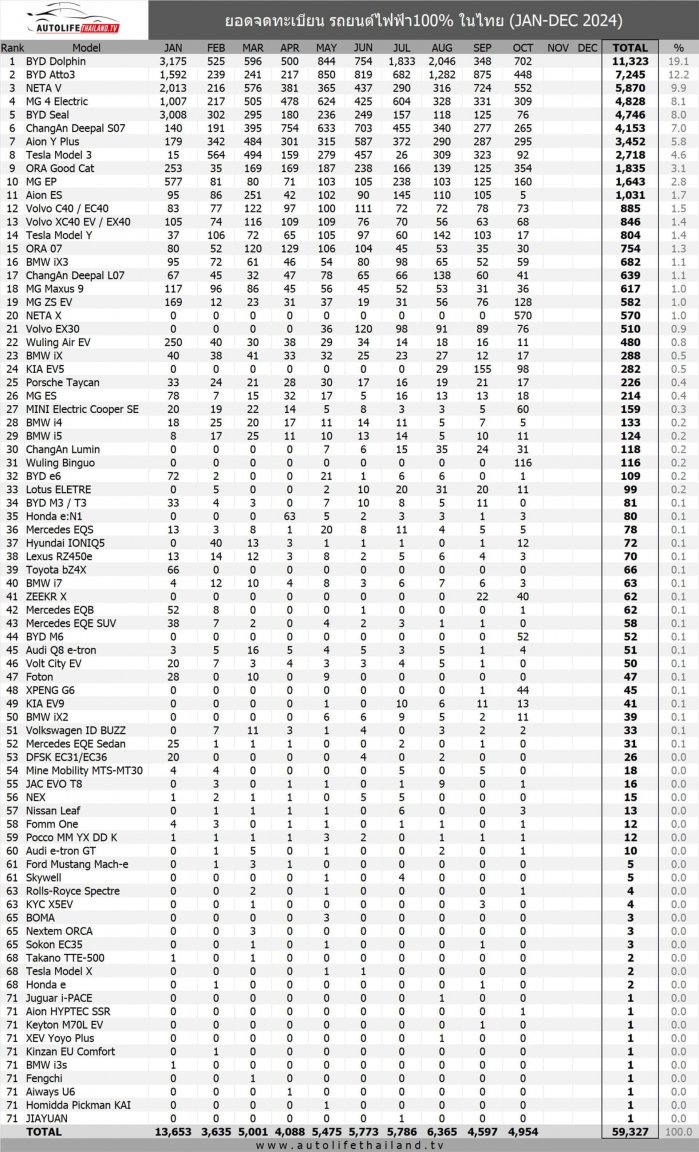

electric train registered in Thailand, October 2024: electric vehicle registration (BEV: Battery Electric Vehicle) October 2024 Total 4,954 (Accounting for 14.2% of the total registered cars in Thailand, R.1, a total of 34,865 vehicles) https://autolifethailand.tv/ev-register-oct-2024-thailand/

-

this short video highlights some good points: Why didn't the West see Chinese EVs coming? https://youtu.be/xSkOi0pUG6s?si=gKfJiQPsgJDgkwdc

-

Just another day crossing the road...

motdaeng replied to brewsterbudgen's topic in Thailand Motor Discussion

so in your opinion everyone who stops on a road is the most dangerous user? before i stop, i also check the back mirror, i do of course not an emergency stop ... and i think we are talking about city traffic ... i think, over 20 years on thai roads without any accidents show's that my driving style seems to be ok ... to be honest, in a few situations i was also lucky nothing happen ... -

Just another day crossing the road...

motdaeng replied to brewsterbudgen's topic in Thailand Motor Discussion

it depends on the situation. if there’s only one lane in my direction, i do stop, but at least 10 meters before the zebra crossing, and i give a hand signal for them to cross (my car windows don’t have any tint or film protection.) i try to do the same when a motorcycle stands in a dangerous position in the middle of the road to make a right turn ... i am aware that this can sometimes lead to dangerous situations, but pedestrians trying to squeeze through moving traffic is not a better solution either. fortunately, in my 20 years in thailand, i’ve never been involved in an accident ... -

GO TRUMP GO - Saving the World from the Woke

motdaeng replied to TroubleandGrumpy's topic in Political Soapbox

that's a really good one ...- 71 replies

-

- 13

-

-

-

-

-

Thailand to tax residents’ foreign income irrespective of remittance

motdaeng replied to snoop1130's topic in Thailand News

i recently completed my 1 year permit (retirement) at immigration. all my papers and documents were complete and in order (they carefully checked everything before i was even given a counter number). but the officer in charge handed me five additional forms to fill out and sign, checked all documents twice for safety, and stamped about 50 times all the document!!! the whole process for my simple 1 year permit (i didn’t have to answer a single question) at the counter took around 20 minutes ... a process that could easily be completed in under 5 minutes! all government offices, banks, immigration, etc., in thailand love to make things as complicated and time-consuming as possible. an extra tax certificate would probably make the immigration officers even happier ... they’d have one more reason to make life difficult for us... -

New affordable EVs at the Nov 2024 Bangkok Motor Show

motdaeng replied to 4myr's topic in Thailand Motor Discussion

i agree with that! the advertised ranges are hard to achieve. only with disciplined driving, not too fast, no hills, the right temperature, no rain, etc. but on the other hand, it's quite similar to the fuel consumption estimates for ice cars ... they're also hard to reach with normal driving ... -

New affordable EVs at the Nov 2024 Bangkok Motor Show

motdaeng replied to 4myr's topic in Thailand Motor Discussion

many new buyers choose a plug-in hybrid car, cause it's easier for long road trips. however, when asked how many long trips (over 400 km) they actually take, it turns out this only happens a few times a year. in my opinion, for those occasional long trips, you can easily charge during breaks without losing much extra time. after all, long road trips aren’t (at least for me) meant to be races! i think, buying a phev instead of a pure bev just for a few long trips doesn’t really make sense. keep in mind, with a phev, you get both the benefits and the drawbacks of both the ice and electric car worlds ... -

How about a solar car port on a budget?

motdaeng replied to Crossy's topic in Alternative/Renewable Energy Forum

what is the reason for stopping export to pea? did you get a digital meter? -

numerous studies and data from trustworthy sources have proven that electric cars catch fire less frequently than internal combustion engine (ice) vehicles. this fact has been discussed extensively on this forum, and you're not the first to repeatedly question it without some serious research ... there's a dedicated topic specifically for ev fires where you can find more detailed information on this subject. please use that thread to support your claim. thanks a lot! https://aseannow.com/topic/1335967-icev-ev-fires-worldwide/#comment-19323800

-

April International - 30% Premium increase

motdaeng replied to topt's topic in Insurance in Thailand

did I read that right, 3'480 usd per month??? that would be 41,760 usd per year ... -

@ all DUI is driving under influence (DUI) in thailand also considered a criminal offense? does that mean i can call (you) those people criminals? by the way, when i was 16, a good friend of mine was killed by a drunk driver ...

-

Thailand to tax residents’ foreign income irrespective of remittance

motdaeng replied to snoop1130's topic in Thailand News

OR ... What happens for you or me today, may not happen for either to all of us -- and anyone else -- tomorrow or the next day or next week or in a few years ...