Everything posted by ianguygil

-

Opening Thai bank account using an agent.

My pleasure. Glad we could help and thank you for your business and your interest in Bangkok Bank. It is never easy to open up bank accounts in any country when you first arrive and sometimes the language issues cause confusion. I do hope that you enjoy your retirement in this wonderful country. You were very polite and very easy to deal with.

-

Can a Friend use my Card in an ATM

Without getting too deep into this This is not illegal I think. But this does break the terms of service and you would have no protections or sympathies at all if you lost any money or your account or your identity was compromised/ So this is a VERY bad idea indeed What would make sense if you trust this person would be to transfer some funds to be via PromptPay and to have her take the money out of her account. In this way neither of you will breaking the terms of service and this is clean and tidy. I am very sorry to hear about your mobility problem and I do understand. Last year I broke my ankle while hiking and I had a couple of months when my mobility was affected. So while I understand I strongly recommend against sharing your card and your PIN.

-

Opening Thai bank account using an agent.

Please all note that I do not read the posts her regularly and that if you do need my help you should send me a PM

-

ATM withdrawl limits?

There are 2 sides to this Firstly as noted the issuer of the ATM card may (will) have limits which are probably managed by you via Mobile or Internet Banking Secondly the ATM machines have a physical limitation of how many bills they can dispense at once. So for us and for most banks that is 25 bills which means the maximum per transaction is 25,000 THB (25 x 1000 Baht bills)

-

Bangkok Bank - Sterling Account

You need to maintain a monthly average of USD250 for saving account and current account. For fixed deposit account, it should be USD500 per deposit. The bank will charge USD10 per month if your account balance drops under USD250. Note: For other foreign currency, please see Conditions and Fees about FCD services. FCD Account for Non-Residents (bangkokbank.com)

-

Bangkok Bank ATM use/tutorial ?

I was explaining this " I went down to Asoke branch , they really couldn't even get by the 1st one where it talks about a PIN change. (is it the case, that one goes to an ATM and at the ATM creates a new PIN, then next time they try to logon to the website they must create a new pw, eg an ATM is required to be given the ability to change passwords? "You will be given a PIN (personal identification number) which must be changed when you first log on and then you can change your password whenever you like. No one, including our staff will be able to access it."

-

Bangkok Bank ATM use/tutorial ?

Just really quickly to note We give you a temporary password and we force you to change it so that only you know your password. Until you change it we "know it" too even though it is sent in a sealed envelope. Once you change it we never store the actual password only you know it - we store the "Hash" - i.e. the result of a 1-way encryption (in simple terms). When you enter your password at logon we compare the Hash of that stored with the Hash of that entered. In this way your password can never be "stolen". And using Hashing you cannot go "backwards" from the stored Hash to the Password, wheras with Encryption (2-way) you can Decrypt. Just to explain the "why" so things do not remain a mystery.

-

Bangkok Bank account - they want me to have a TIN

if a bank does not comply with FATCA there are all kinds of penalties, including up to 30% deducted from any transfer from the USA into that Bank (deducted by the IRS). We are a reputable and a responsible bank. We do what is required of us in terms of all regulations including those to prevent tax evasion, money laundering and anti-terrorist financing. We do not apologize for that. I have US citizenship and yes I have to give my Passport and SSN.

-

Bangkok Bank Mobile App Upgrade - now no transfers between my accounts?

As I've said many many times - if you need help PM me on this forum and I will get somebody to help via an official Bank channel. This is NOT a bank channel. I do this in my spare time when on a flight or in the car (I have a driver). I won't try to diagnose something in detail here or ask specific questions of a customer here. That would just be silly and break all kinds of compliance rules. As a general comment, ANDROID is Open Source and is far more difficult to ensure it works 100% on every device than iOS which is a classic Walled Garden. Not being political just stating a fact. GOOGLE are working on this, but as with any Open Source product - it is Open Source and implementations will vary widely

-

Bangkok Bank Mobile App Upgrade - now no transfers between my accounts?

-

Opening Thai bank account using an agent.

Thanks , Mike.. He can contact me via PM and I can have somebody contact him and assist him at a branch which is convenient once he arrives. And we appreciate the interest in Bangkok Bank

-

Bangkok Bank app PITA setup when using a new phone

I didn't say you were complaining. Just explained the facts/.

-

Bangkok Bank app PITA setup when using a new phone

We are complying with a central bank requirement (BOT) to restrict it to 1 device. Before this ruling we allowed up to 5. I can't speak for SCB.

-

Bangkok Bank app PITA setup when using a new phone

I spend my own time helping on here and am not inclined to spend time on people who give me attitude like this. I have helped many people here but only if they are polite and at least to some extent grateful. Thank you.

-

Bangkok Bank app PITA setup when using a new phone

I work for Bangkok Bank. How do you know what our reason is?

-

Bangkok Bank app PITA setup when using a new phone

It may be that your information at Bangkok Bank was expired whereas your data at SCB had not. It depends on when you did each of them. Comes down to the old Causation v Association when understanding any problem. We are just complying with the regulations which is not optional.

-

ATM/Debit card and electronic transfers not working

Just to be clear, we often have to "sunset" a version of ANDROID (and less often iOS) based on known security defects or on the lack of support for a newer technology. Other drivers which are less important are the number of users on a particular version, because the testing of new functions and the regression testing of old functions, while automated, is time consuming. Most people update their phones every 2-3 years so this normally affects a very small number of people (the sunset of an older version of ANDROID).

-

ATM/Debit card and electronic transfers not working

As Mike correctly says, there are some circumstances and some accounts where the US SSA requires us to have the person turn up to ensure they are not dead and to prevent other fraud. Honestly I don't have the detail on this, and I can get somebody to give an explanation that I can point to here. However, please note that we are the only Thai bank will a banking license in the USA and the only Thai bank authorized to process such payments straight-through without any manual intervention. And as both a moral and ethical bank we adhere to all regulations. There is no "wiggle room" with us on this which is how we intend to be. So please do contact me as Mike says below if you need help. I am already dealing with Barry via my official Bank email - which I will not post here. If you want to contact me please do so initially via PM Thanks, Mike. Ian

-

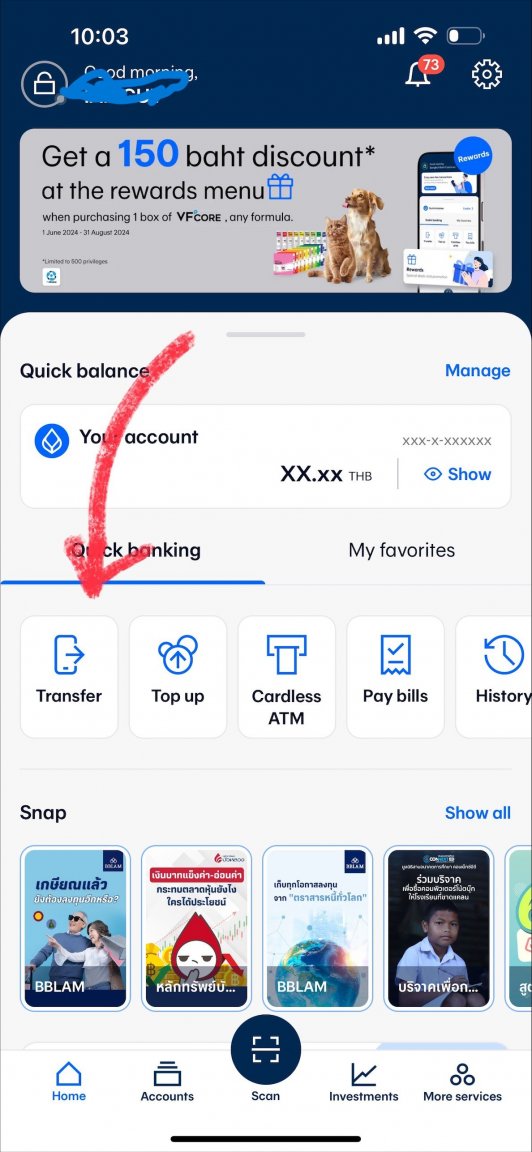

Kasikorn K-Plus Bank App Users Can Now Make Cardless Withdrawals at Bangkok Bank ATMs

There is really a lot to answer here and I will just give a few comments and won't respond to individual posts. Too busy... The Channel most affected by the move to Digital in the past years is the ATM. Volumes of cash withdrawal and things like Bill Payment have dropped hugely. Some banks are just not offering ATM's and are moving to paying fees for customers should they incur them, from using other banks ATMs As correctly stated, the Cardless ATM feature involves the App, but also the ATM system. So using a US bank ATM is VERY unlikely to work until some standard based network like VISA or UPI provides this, which is not imminent. We previously allowed AEON customers to use our ATM, now KBANK. ATM networks are expensive to rollout AND to maintain. We need staff to refresh the cash, we need to upgrade them. So leveraging this investment by pumping more volume via other Bank Apps for Cardless makes business sense, on both sides. This should work, but if your KBANK App says the QR Code is not valid then call KBANK (please). FYI, I still have an ATM card because I travel a lot (internationally) and I an not use CARDLESS there overseas. But in Thailand I am 100% Cardless. So bottom line is that this will continue to expand (I think I do not know) in terms of other banks having access to each others ATM via Cardless. Fees are something you will need to discuss with YOUR bank. Not with us. And it should work. As I said we have done for AEON for some time already Thanks

-

Payment QR Codes

Tourists can use cash or card at those few vendors who won't receive cash - like STARBUCKS - they can use a card. Even for small amounts. No country would base their decision on a strategy like trying to formalize the economy on the needs of tourists - even if a major sources of FX revenue. You can just see the huge acceptance and growth in the use of QR Codes by the Thai public to see how popular this is. We see 40% annual increase in volumes with a combination of both more customers and even more markedly each customer using the system more frequently each day largely for QR based payments. I would predict that QR will be replaced by some national or international contactless solution similar to APPLEPAY or GOOGLEPAY but without the exorbitant fees involved. Again, QR in Thailand is free. And (almost) every phone has a camera. I would note that there are many more stores in the UK and in the USA who do not accept cash than there are in Thailand. QR is largely offered and embraced as an option with cash still welcome. In the UK that is not true

-

Payment QR Codes

This (QR) "formalizes" the economy so that the authorities can better see the flows of funds. There is a lot behind this and it is very valuable to tax collection and for economists. It also saves cash because they spend a lot to print banknotes and to recycle. Plus the big Fraud problem on larger notes. Also, this is convenient for poor people because it does not require them to maintain a "float of cash". Like a Noodle seller who may need to get 1,00 Baht in 20's and 1,000 in 100 Baht notes in order to make change at the start of day with cash would no longer need to so with Promptpay for most purchasers. For people like me it means I do not have to go to the ATM - even though I do work in a bank. And it automatically gives me receipts. Which makes it easier for reimbursements. Plus paying bills and transferring is so much easier. You can display the QR code for you for Promptpay and users do not need to know your account number or phone number. And this works for Push and Pull payments. Many benefits and almost no disadvantages I can see as long as you are not running some kind of weird business and do not want the authorities to know about income.

-

Converting large sums of baht without being robbed

Please see this thread. I helped RrtiredThailand. If you need to move a large amount - in the millions of Baht - we can give you a special rate. And as I said I have helped many people on this forum over the years. So PM me if you need to move a large amount. A few hundred thousand Baht will not qualify. This is like buying Wholesale and not Retail.

-

Bangkok Bank App Sending funds to UK

As said so many times before, if anyone needs help please PM me and I will get somebody to contact you on an official Bangkok Bank channel. This is a very popular service. My son is at UCL in London and I send him money ....... often. PM me please if you need help

-

Schwab transfer vs using Schwab Debit (Funds to build home)

Then you should get an FX contract from us and a better rate. PM me please and I will give you my email (please do not share) and then somebody from in the GPS group will deal with you. Thanks

-

Schwab transfer vs using Schwab Debit (Funds to build home)

Please give a rough idea of the amount that you plan to move. If this is over about $60,000 USD, you are better to negotiate an FX rate with us (Bangkok Bank) in Thailand. It is like buying Wholesale v Retail. Then when you send the funds it will refer to this FX arrangement and you will get that rate. But it does need to be above an certain fixed amount. Building a house varies widely in cost and I have no idea of the amount involved. If you go to a branch or to our HQ on the 2nd floor you can ask them for details. This is not complex. PM me if you want more details and I an refer you to the Global Payments group who will deal with you directly. Thanks It is NEVER beneficial to move a foreign currency to THB offshore in a developed country (maybe ok in Myanmar, Lao or Cambodia) Ian