topt

Advanced Member-

Posts

9,945 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by topt

-

Fortunately not - they have a monthly pay option but I pay annually.

-

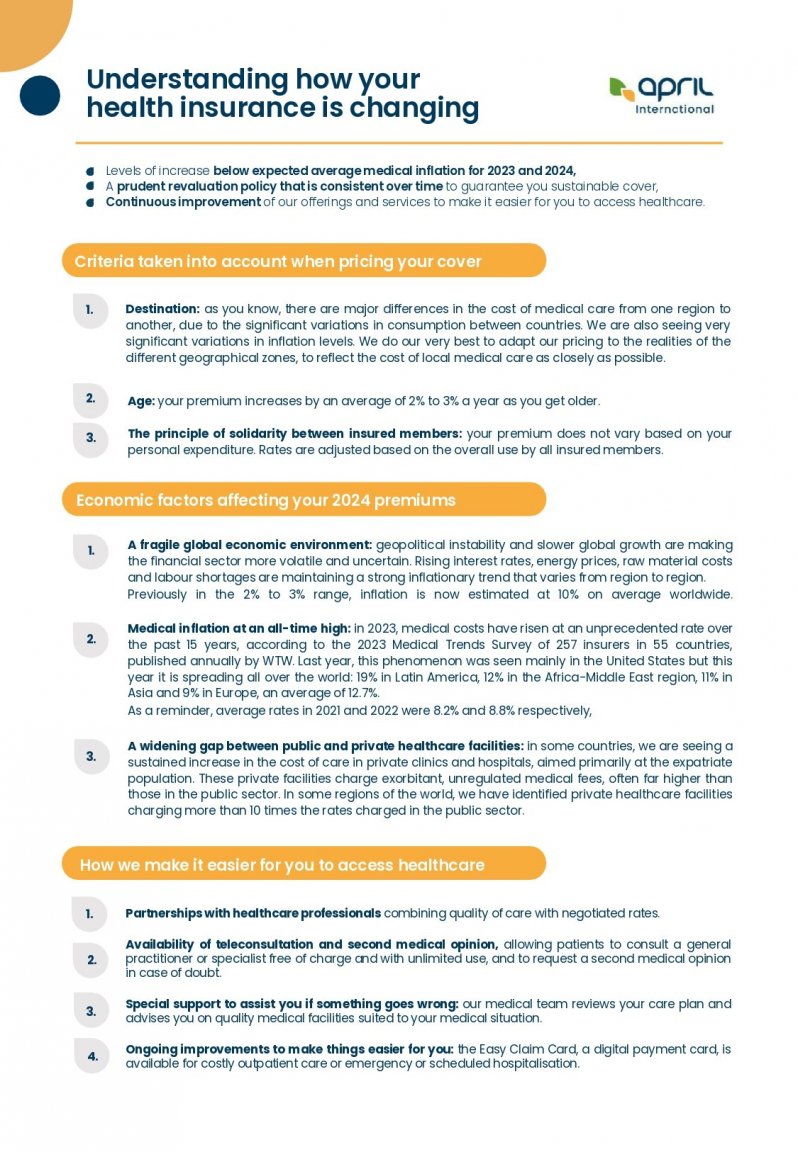

My premium is due for renewal in just over a months time. I queried the level of increase and have had back "canned" reasons for general levels of increase and have had to ask twice if it was because of moving into a higher age banding. Just received this reply today - only took 8 days for them to respond......... I am 65 and increase just seems too high to me as I doubt this will be a one off in the coming years. This was the general letter they sent - I have posted as may be of interest to others.

-

Steak should be cooked with garlic melted into butter.

topt replied to Gobbler's topic in Western Food in Thailand

May I ask from where - as seems almost cheap.......? -

What browser are you using?

-

Possible temporary solution to the "admin" issues you mention. Are you a UK tax payer or have a NI number? If yes give the bank that - unless you have told them officially you now live in Thailand in which case they may not accept it. This won't make any difference to whether you pay tax or not to HMRC. In fact if you are receiving any interest on that bank account you theoretically are supposed to be declaring it to HMRC but that then leads us into the PA etc......... Same with the EU investment account. For many financial operations it just seems to be a box ticking exercise.

-

Replying to your own posts......one has to wonder why I pay taxes to the UK and have had to file for many years as do many others who have commented here. So not foreign at all to many. Being kind you don't appear to have followed much of the extensive discussions which have been ongoing for more than a year..........

-

Thai Finance Ministry Plays the Long Game on Casino Plans

topt replied to webfact's topic in Thailand News

Didn't Chidchob have a recent meeting with TS during which he said he was against it? oh only a week or so ago - -

Why not buy your own router and get True to put their modem/router in bridge mode (if it can be done with that model)?

-

You will probably find that they all have a resident Thai lawyer under who's auspices any "advice" rather than an opinion is given. Unfortunately The Pattaya Mail has published at least 2 articles supposedly written by Thai tax "experts" that were at best misleading and in one case factually incorrect.......

-

Plenty of stuff online to help you get rid of it although I agree it does take some tenacity. We even had a thread on here some/many months ago about doing just that.

-

yes here is something from Ask Woody Also an interesting take on other "options" for extended life....... https://www.theregister.com/2024/10/16/windows_7_eol/

-

I have to confess I never gave it a good run - was on my gf's laptop at the time and compared to 7 I just found it frustrating. I am even using Open Shell on my Win 10.

-

Bank Savings Interest Rates 2023

topt replied to kiko11's topic in Jobs, Economy, Banking, Business, Investments

Perhaps not take too long as apparently BOT reduced the main rate by .25% today to 2.25%...... However this being Thailand you never know - The reduction was posted in another thread but I had to really search to find confirmation - https://www.reuters.com/markets/asia/thai-central-bank-unexpectedly-cuts-key-rate-by-25-bps-2024-10-16/ -

Sorry but I don't agree with your "rationale". Everybody reading these posts is well aware (or should be) that you need to be here for 180 days in a calendar year to be tax resident - doesn't matter what else you call it. At the start of the article they state - This, to me anyway, is downright misleading and towards the end of the piece it then states - So there they add the caveat - when remitted into Thailand which is fine but the damage arguably has already been done. So generally I agree with @chiang mai statement that it is misleading. Whoever was responsible (John Spooner to quote you) perhaps should have fact checked it better. It note also that TPN Media effectively disassociated themselves from the content.......not surprising considering they had to print a correction not that long ago from another "lawyer/tax specialist". It is disappointing, to me, that some firms I may have previously considered as reference points, appear a little more than just ethically challenged with the potential monetisation of this particular issue - although at least the fees they quote seem a little more realistic

-

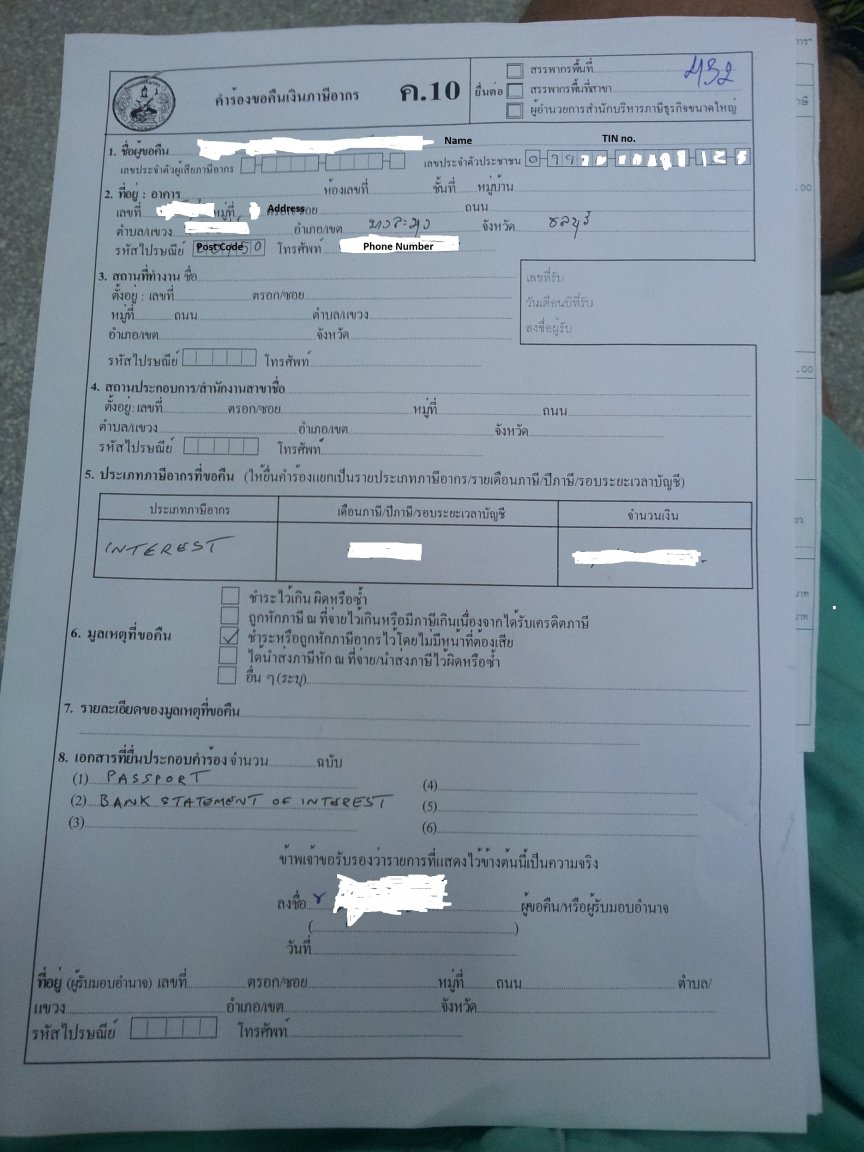

When this was being regularly discussed probably 8 or more years ago the advice was get a TIN first and then claim - which is what I and numerous others did at the time. I only ever 9up to about 4 years ago) completed a 1 page return which I have mentioned before - but had my TIN on it. If I can I will dig out a copy.

-

Thanks. I have seen a number of articles recently as I think there is almost exactly a year to go. I think I may be switching to Mint or similar for the majority of my usage depending on what other options surface in the interim. Especially as MSN effectively switched off Outlook 2007 at some point in the last couple of weeks which I was using as an offline store . Now switched that address to Thunderbird for that. Fortunately Word and Excel don't need web access for me

-

Obtaining a Thailand tax ID #

topt replied to watgate's topic in Jobs, Economy, Banking, Business, Investments

This was only a "suggestion" from the recent/current DG of the Thai RD and if it happens it should take a while to go through the legal process. Really from whom? There was a change in the interpretation of one rule which arguably could have as much effect on Thai's as much as foreigners and then a subsequent ruling allowing savings pre 31/12/2023 to be exempted. Respectfully you may want to read some of the other threads on this subject as what you have written perhaps suggests some miscomprehensions.......