-

Posts

3,852 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by gamb00ler

-

Your favorite.

-

None of them are really seriously stupid... they're just seriously selfish and arrogant.

-

I agree... I just wish they had their own boat.

-

Citibank ATMs in Bangkok?

gamb00ler replied to david_je's topic in Jobs, Economy, Banking, Business, Investments

I only use debit cards that have NO foreign transaction fees. All Visa and Mastercard debit and credit cards use the same exchange rates. The differing results are due to the different foreign transaction fees that the issuing banks add on. Some of those fees are as high as 3%. Some are 0. Visa and Mastercard set the rates once per day (Tue to Sat) at around 7AM Thai time. -

Citibank ATMs in Bangkok?

gamb00ler replied to david_je's topic in Jobs, Economy, Banking, Business, Investments

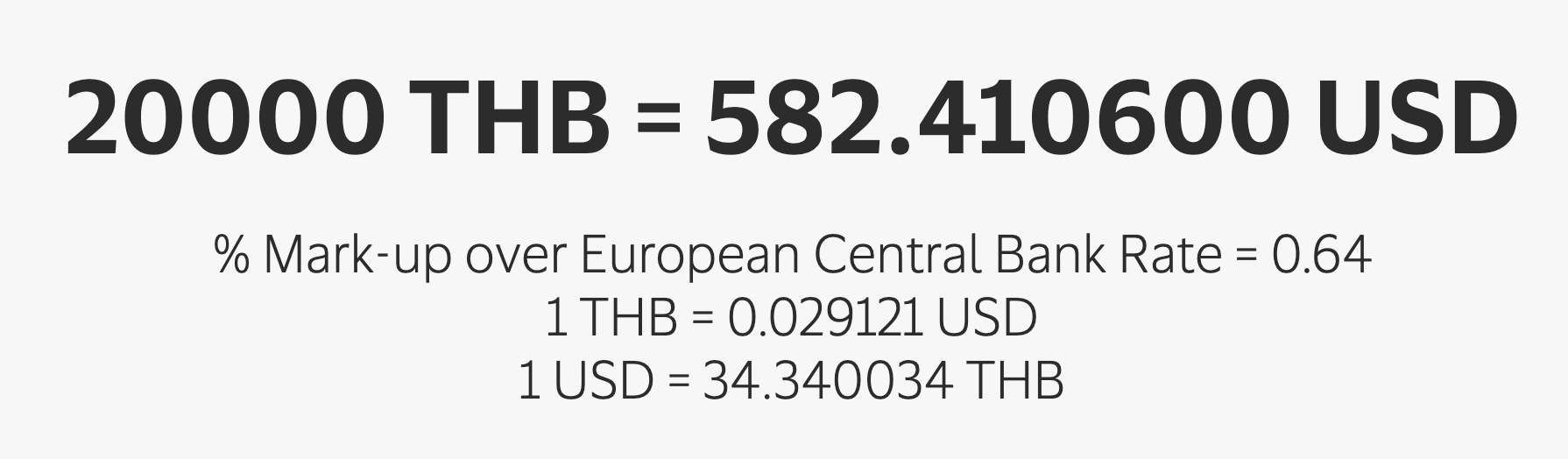

What do you put in the "Bank fee" field"? The difference is due to that fee. Here's what I get when I specify the bank fee is 0%: -

Where to buy Macintosh *re-furbished* in CM?

gamb00ler replied to Old Curmudgeon's topic in Chiang Mai

The basic model of the new Mac mini line is a great deal according to many very experienced YouTubers. I was also considering buying a newer used Mac mini as the wife's is a 2012 model that I upgraded to an SSD. The power and efficiency of the new one is very tempting. I just wish it had a 2.5Gb ethernet port. -

Citibank ATMs in Bangkok?

gamb00ler replied to david_je's topic in Jobs, Economy, Banking, Business, Investments

A small correction on this. For ATM withdrawals, purchases and cash advances on debit and credit cards, the actual foreign exchange rate is set by Visa and MasterCard, not the issuing banks. They do the exchange and then bill your home country bank in its own currency. The rates Visa and Mastercard use can be found at: https://usa.visa.com/support/consumer/travel-support/exchange-rate-calculator.html https://www.mastercard.us/en-us/personal/get-support/convert-currency.html To get the correct rate remember to convert from the currency you withdrew from the ATM to your home currency.... not vice versa. You may also have to adjust the fee percentage per your card's terms and conditions. -

Where To Buy Crown Royal Canadian Whiskey In Thailand

gamb00ler replied to sangtip2's topic in General Topics

I see no reason for you torture the suffering original poster.😉 -

Your Bangkok Bank branch seems inept. My CM branch allowed me to add my Thai tax ID to my savings account and also stopped the annoying withholding on my tiny interest received. I don't have a pink ID so I got a separate Thai tax ID from TRD about 3 years ago. They would not stop the withholding from interest on my fixed account. Have you verified with your bank book that Bangkok bank did withhold 15% from your interest payments on your savings account(s)? It seems Bangkok bank stopped the withholdings the same as they did for me..... only on the savings account but not on the fixed account. That could explain why there was no statement of withholdings (or tax refund) on your savings account.

-

Tips on dealing with the regional SSA office in Manila

gamb00ler replied to JTXR's topic in US & Canada Topics and Events

There is an excellent book called Get What's Yours: The Secret to Maxing Out Your Social Security by Laurence Kotlikoff. I bought an actual hardcover version but gave it away and downloaded an EPUB version. Not knowing every nuance of SSA, I can't swear that he does cover it all but I would be willing to bet there's not much left out. It's much better than watching the YTube guy mentioned earlier. That YTuber is not proficient at presenting his content. -

K bank E-mail with Tax Forms attached ?

gamb00ler replied to offset's topic in Jobs, Economy, Banking, Business, Investments

I received the same email at 9:33 Nov. 24 -

You're just a sad and probably jealous money worshipper..... https://www.youtube.com/watch?v=E-P2qL3qkzk&t=115s

-

Given your belief that a criminal conviction (maybe even 34 of them) doesn't really mean much I don't see why you're raising a fuss here.

-

https://www.yahoo.com/finance/news/house-passes-196-billion-social-161533489.html The Yahoo news article did not mention a few details. The bill is H.R.82 Social Security Fairness Act. The bill will cover SSA payments for January 2024 and later. I think at this time SSA Administration is severely understaffed so it could be a substantial wait before the extra funds are paid. From my experience SSA's IT systems are in very poor shape. Those affected will mostly be Canadians given the larger numbers of people who have worked in both countries.

-

K bank E-mail with Tax Forms attached ?

gamb00ler replied to offset's topic in Jobs, Economy, Banking, Business, Investments

It is quite common for a non-US citizen to be considered a US tax resident especially Canadians who have lived and worked in the US. Non-US citizens who are married to US citizens can also be treated as US tax residents. -

yup.... that stalwart citizen, Gaetz, is just the type to fall on his sword for the good of America.

-

For standard definition TV a 4K HDMI cable is overkill, but it will definitely work. You probably don't need a new HDMI cable. If the same group channels are the only ones giving you trouble, it is most likely due to your TV box getting a poor quality input signal from True. Your first step should be to call True for service.

-

Did you ever notice that cockroaches like to avoid attention? Often its only when you move things around and lights are turned on do you notice them.

-

What is a Proper English Breakfast?

gamb00ler replied to 123Stodg's topic in ASEAN NOW Community Pub

Unfortunately if you love bacon, it's hard to avoid added sugar 100%. When they cure bacon, they add some sugar. -

What is a Proper English Breakfast?

gamb00ler replied to 123Stodg's topic in ASEAN NOW Community Pub

Wiki says the Roman version did not use eggs.... hardly the same dish then. The modern name "French toast" refers to the French version called Pain Perdu. The hotel chain Le Méridien used to be owned by Air France. The best French toast I ever had was in the San Francisco Le Méridien hotel across from the Pacific Bell headquarters where I was working on a short IT contract. -

I know.... an old thread but there are always new members that should learn about grapow. The classic recipe for this dish does not include ginger. I've eaten it hundreds of times, mostly cooked by my wife of 25 years. I've also had the dish many dozens of times from others. I'm pretty sure not once did it include ginger. I love ginger also... just not in grapow. Perhaps when an less common protein source is prepared with grapow leaves they add ginger. I enjoy both pork and chicken... but my favorite is a 50-50 blend of both.

-

Weird orange glow illuminates miscreants

gamb00ler replied to gamb00ler's topic in Political Soapbox

it's all in partisan code. -

Thank you #47. In a way that no other person can accomplish you have focused the US's attention on some of the worst miscreants in your flock. You managed to evict one from the House. Hopefully more stellar results will ensue.

-

Earlier in the US/Thai DTA a "resident" was defined to mean a person with the status of tax resident. I think the key to understanding this paragraph of the US/Thai DTA is the use of the word "or". There are two categories of people covered by this paragraph. This paragraph applies to all US SSA benefits. It is applicable to two groups: Thai tax residents OR US citizens in Thailand but not a Thai tax resident Warning: I have no status as a tax or legal expert ... just a taxpayer subject to this treaty as a US and Thai tax resident.

-

/Featured Quiz22nd November - Weekly Featured Quiz - General Knowledge

gamb00ler replied to Crossy's topic in The Quiz Forum

I just completed this quiz. My Score 70/100 My Time 146 seconds