-

Posts

3,917 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by gamb00ler

-

How is your math? It's not hard to figure it out given the purported diameter of the Earth. Start here: https://www.geeksforgeeks.org/chords-of-a-circle/ Show your work!

-

Jethro said it best with his album.. Thick as a Brick.

-

but... .density has no effect without gravity

-

I grew up in a light pollution free area. On moonless nights my siblings and I would sometimes lay on the ground and look up at the Milky Way and occasionally we could see a satellite traversing. @rattlesnake do you believe in/understand gravity?

-

What Trump certainly doesn't realize is that maps using the Mercator projection method severely exaggerate the size of Greenland. Even though he loves to downplay climate change, Trump figures that soon Greenland will be prime waterfront property. Don't forget he's the greatest at whatever he does or even thinks about.

-

Debit Visa Card BBL

gamb00ler replied to NE1's topic in Jobs, Economy, Banking, Business, Investments

My mistake.. I haven't looked at my ATM card for many months... it is indeed MasterCard... sorry for the error. -

Debit Visa Card BBL

gamb00ler replied to NE1's topic in Jobs, Economy, Banking, Business, Investments

I've had a Bangkok bank VISA debit card since Oct. of 2020. Since I learned how to do cardless withdrawals, I don't carry around my Bangkok bank ATM card. That's my excuse for thinking it was VISA when it is in fact MasterCard. Sorry! -

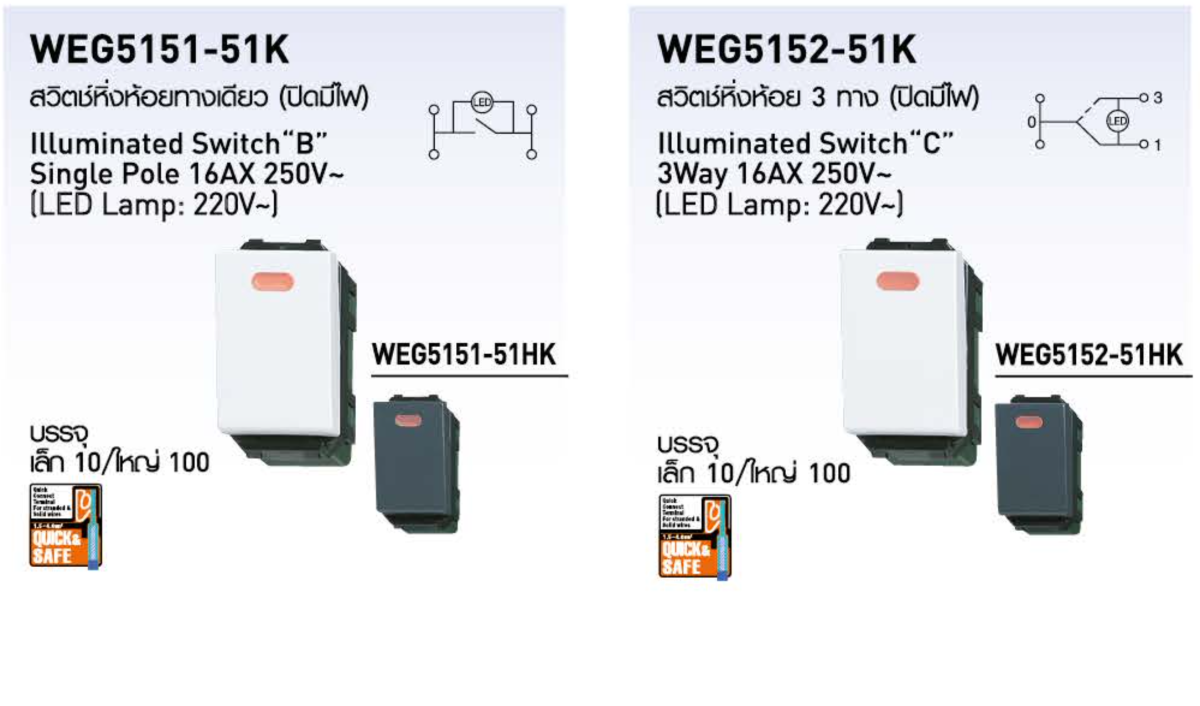

We have 3 light switches (Panasonic) in our house that are in a location where you can't see if the light is on or off. For one of the switches that's OK because it is the only switch for that circuit and the physical switch position is sufficient. However the other two are both in 3-way circuits so a switch's physical position is not indicative of circuit power. I bought a Panasonic illuminated 3-way switch thinking that's the solution. It does work but the indicator LED is illuminated when the light is off and dark when the light is on. I want the opposite functionality. Google tells me what I have is referred to as locator switch so you can easily find it in a dark room. The functionality I want is called a pilot light switch. I don't think Panasonic sells that type. I'll just have to get used to using reverse logic when using the indicator light to make sure the circuit is not powered. I wonder how the switches indicator LED is powered when the light circuit is not. Would it be feasible to rewire the switch from locator to pilot light mode? I don't know if the switch would survive disassembly.

-

Boonthavorn has a good selection of mixer faucets for the kitchen. I bought two Franke brand for our house. They have detachable spray heads but are not the tall kind you showed. I prefer lower ones as it's easier to prevent the water splashing outside the sink.

-

Best Bread in Chiang Mai (3 Winners; 1 Loser; 1 Wild Card)

gamb00ler replied to Old Curmudgeon's topic in Chiang Mai

I find it unlikely that an AI chatbot could present as so curmudgeonly 🤔. -

Citibank ATMs in Bangkok?

gamb00ler replied to david_je's topic in Jobs, Economy, Banking, Business, Investments

I asked SCB (more than a year ago) if they would do a counter withdrawal on my foreign debit card and they said they can't do it. I only asked at 1 mall branch and didn't ask at a larger SCB branch. TIT, so it's very likely you will receive a different answer at a different branch. Krungsri, according to another AN poster, does not charge for MC debit cards but when I showed my VISA card they said the fee would be 200 ฿. -

Citibank ATMs in Bangkok?

gamb00ler replied to david_je's topic in Jobs, Economy, Banking, Business, Investments

I can't say for sure as I always had it with me for the deposit. If you need it and don't have it, you'll find that out quickly. I think you can also deposit without the bankbook, especially if you have the app on your phone. -

Sure.... the only problem is the government is NOT a business and using business style goals does not produce optimal governmental results. Musk has been focused on what he wants and what's good for himself not what all citizens want and need. Do you think disadvantaged youth are excited about going to Mars?

-

..... and how do you support your opinion? Since the GOP love to reduce government expenditures wherever possible, don't you think they would publish anything they uncovered in terms of mismanagement of SS trust funds? Can you find such reports by your GOP heroes? Since 2001, GOP have controlled the House 9 times vs 3 for the Democrats. That's plenty of opportunity to investigate the use of SS trust funds. Since 2001 the GOP have controlled the Senate for 6 Congresses.... also plenty of opportunity to investigate and report misuse of SS trust funds. If there is misuse, then I would have to say the GOP are incompetent investigators.

-

On this matter I would consider how TRD treated these withdrawals PRIOR to the recent change in treatment of prior year's earnings. I believe that in 2023 and before, the TRD did not consider those withdrawals as assessable income when remitted to Thailand. I think TRD's treatment of those withdrawals has not changed.

-

Best Bread in Chiang Mai (3 Winners; 1 Loser; 1 Wild Card)

gamb00ler replied to Old Curmudgeon's topic in Chiang Mai

In my mooban there is a small cheese factory and shop that also sells baked goods. I only tried it one time but was very impressed with their multi-grain loaf. https://maps.app.goo.gl/eanyQMfxx7a3vpYy5 -

Citibank ATMs in Bangkok?

gamb00ler replied to david_je's topic in Jobs, Economy, Banking, Business, Investments

I have done many counter withdrawals at Bangkok bank but none for about 14 months. I used to do a counter "cash advance" at any BKK bank but now they don't offer that service at the smaller mall branches (according to a teller). I was told by the manager at a standalone BKK bank branch that they would do it if the VISA card had my name on it. The exchange rate for all purchases, ATM withdrawals and counter withdrawals is the same for that day. Make sure your debit card does not charge foreign transaction fees, otherwise they may be better options for getting your US funds to Thailand. Here's how I did it: I would check the VISA web site for the current exchange rate. I would then calculate how much Thai ฿ I could get for a maximum limit withdrawal. I would round that amount down to the closest 1K in ฿. I always planned to deposit the whole amount to my BKK bank account. I took just my passport, bank book and debit cards to the teller and and requested the amount of ฿ I calculated and told them to deposit it all to my account. The teller would run my card through a machine that looked the same as stores used to use for credit card purchases. A slip showing the transaction details would be printed which I had to sign and add my phone # as well. The teller also made a copy of my passport ID page and had me sign it along with the deposit slip. It took about 10 minutes at the teller window. -

Trump’s big fat abject lie …and why he keeps telling it.

gamb00ler replied to Red Phoenix's topic in Off the beaten track

I never claimed that the firms "settled" any theories. I said they applied the science that is settled by researchers. The central core of many aspects of science is "settled" well enough that we entrust it with our lives. Is that well enough settled for you? I bet there are at least dozens of technologies that depend on the correct explanation of phenomena that you trust your life to. Can you deny that? -

Trump’s big fat abject lie …and why he keeps telling it.

gamb00ler replied to Red Phoenix's topic in Off the beaten track

In Sep 2020 we moved to CM from US. Vaccines were not yet available. I needed PCR test results no older than 72 hours before departure, a Fit to Fly letter from a Dr, a 2 week quarantine booking starting on my arrival date. After setting those up we could book seats on one of the rare flights from US to Thailand. My Thai wife need the same except for the PCR test. She did need permission to return on her expired passport. -

Biden indiscriminately commutes 1,500 people

gamb00ler replied to Cryingdick's topic in Political Soapbox

Trump was definitely more discriminating than Biden. Trump only pardoned if he figured he was getting something in return (intangibles were acceptable). -

Trump’s big fat abject lie …and why he keeps telling it.

gamb00ler replied to Red Phoenix's topic in Off the beaten track

use whatever terms you're comfortable with. Many industries are applied science, especially chemical and electrical firms. That science is settled. In case you forget the comment that started this conversation stated "Science is never settled" (my bolding) which is obviously not true. That trope is constantly bandied about by science deniers as gospel.