-

Posts

12,429 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by khunPer

-

Report Thailand Waves Goodbye to Costly Scout Uniforms, Eases Parent Woes

khunPer replied to webfact's topic in Thailand News

Girls are not scouts, they are called "guides", so "boy scouts" is correct... -

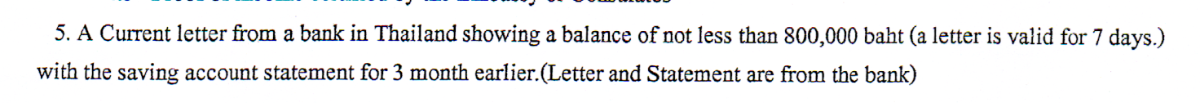

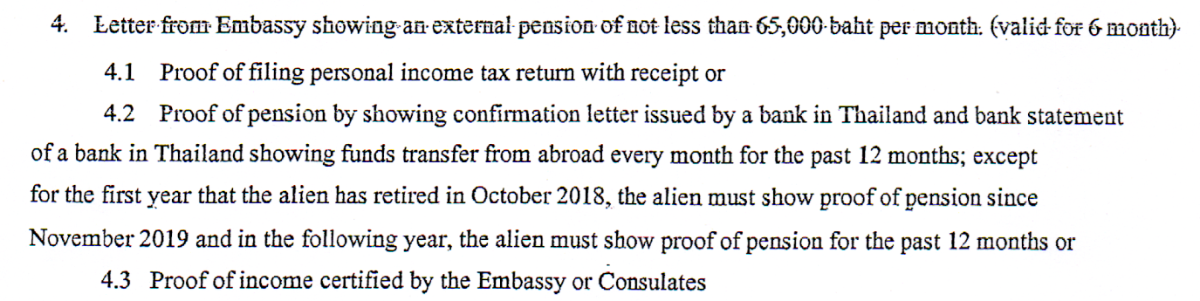

Bank proof of money in the bank

khunPer replied to CPH's topic in Thai Visas, Residency, and Work Permits

No, it's depending of the immigration office. I'm staying on extension of stay based on retirement, and the immigration office that extends my stay every year asks for three month bank statement... However, if you use the monthly transfer of minimum 65,000 baht method, you need statements for all previous 12 months... -

If you apply for an O-A visa you need to show proof of income of at least equivalent to 65,000 baht per month or savings of at least 800,000 baht. Your income can be from Belgium, and your savings acn be in Belgium bank – that's the benefit of the O-A visa, you don't need to deposit funds in Thailand – the Thai embassy in Belgium probably have clear information on their webpage about documentation requirements. An O-A visa has 12-month durability. It means that every time you enters Thailand within that 12-month period period, you will get a stamp with 12 months permitted stay. You need a health insurance approved by Thai authorities.

-

Bank proof of money in the bank

khunPer replied to CPH's topic in Thai Visas, Residency, and Work Permits

And some immigrations asks for 3 month statement for retirement extension. 12-month statement from Bangkok Bank can be ordered in a local branch, but they can only print up to 6 month and need to reorder it from the head office. It takes from three days to about a week to get it. It costs 200 baht; while a 3-6 month statement issued by the branch office costs 100 baht. -

What's happened with cannabis in your areas?

khunPer replied to DontDoubtMe's topic in Thailand Cannabis Forum

Got no idea about prices, but many sells "buy 2 get 1 free"; however, the price for two might be normal price for 3... More and more stores open – there are about double as many in the area where I live, as there are 7-Elevens. There are 3 convenience stores in my close neighbourhood and 6 cannabis shops...😉 You can even get a "free joint" if you dine in one of the local restaurants...👍 -

Beachside bungalows Koh Phangan.

khunPer replied to DrPhibes's topic in Koh Samui, Koh Phangan, Koh Tao

Take a look on Thong Nai Pan, both Lek and Yai. Google Map let you take a virtual walk on both beaches... However, if you look for other activities than rustic bungalows, cosy restaurants and a Bounty-style beach, then you don't need to check these two bays... -

Trhailand is normally a safe place to visit. Of young ladies I see most them travel in pairs or smal groups together as 3-4 girls, but there is also some singles. In general it's a question of common sense and a bit of preparation – i.e., reading/searching – to choose safe areas. It might be a benefit for you, when not an experienced traveller and first time to Thailand, to visit places where other youg people – mainly girls – flocks to. You could have a great chance to meet new friends and fellows that way to share your experience with, or even follow. If you arrives in Bangkok, then Khaosan Road will be such a place, where young people and backpackers use to stay. You can book hotel in the area in advance using common booking sites. Many young folks takes a trip up north to Chiang Mai – once the historical capital of the ancient Lanna Kingdom – which you can reach either by train or plane. Chiang Mai offers lot of great stuff to visit and see, both old buildings, temples and nature. The city is also kind of artistic and cultural center. Two more places the youngs visit are Phi Phi Islands – famous for Phi Phi Lee with Maya Bay, the set for the film "The Beach" – and the islands Koh Phangan and Koh Samui. In Bangkok's Khaosan Road you will for sure meet numerous other young ladies or pairs that are planning to visit those places. Koh Phangan is know for it's monthly Full Moon Party, which is a great cool experience. It was on an invented island close to Phangen that "the bay with the secret beach" in the novel The Beach was situated. Phangan has lots of nature and excellent beaches. Neighbouring Koh Samui – where there is an airport, otherwise you can get there by train from Bangkok on a combination ticket with ferry transfer to the island or combined Lomprayah-express bus and catamaran-ferry – is known as a young folks destination all way back from the early bachpackers arrived during the happy hippie era. Today, it is mainly Chaweng Beach young folks visit. But there are also many other nice beaches on the island where many young folks and both single ladies and small groups of young females stay. You can even live in a cosy beachfront bungalow for a relative affordable price. I live on Samui and I meet lots of young folks here. When you visit tourists areas you can manage fine with English language – most signs are in both Thai and English – and Thais are in general smiling polite and ready to help tourists.

-

I presume great selfies are mainly a question of the right (expensive) smartphone anf choice of filter... I.e., I always choose the "Young and handsome"-filter, which seems to work very well... 👍😎 – my selfies are better than how I look in a mirror – and the shared selfies are at least well enough to interest multiple single ladies with cool sexy profile photos wishing to befriend me on Facebook...🥰

-

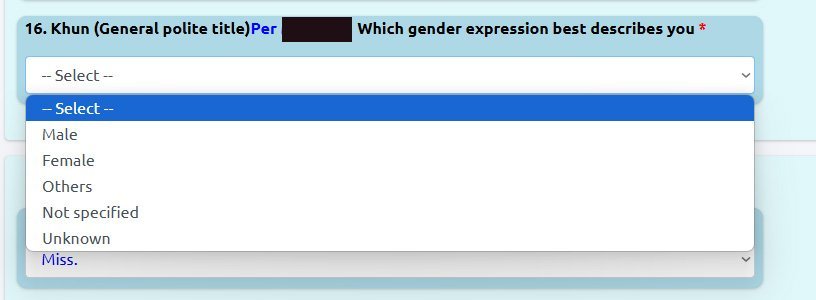

Thailand’s 2025 Census: What You Need to Know

khunPer replied to Georgealbert's topic in General Topics

Not really, as it is about who stays where on April 1st, not who is registered where in a house book. -

Thailand’s 2025 Census: What You Need to Know

khunPer replied to Georgealbert's topic in General Topics

Just do it, then it's done and you can sleep well... However, there is one difficult question underway, where it might be important to hit the right answer in the roll down menu... -

Thailand Eyes US Arms Deals to Slash Trade Surplus Amid Tariffs

khunPer replied to webfact's topic in Thailand News

It is not about custom's duty and tax, Trump is calculating on trade surplus. -

British Man's Urgent Plea to Save Dying Father in Thailand

khunPer replied to snoop1130's topic in Pattaya News

A wound in a foot, which easily can get infected, is a serious matter. I've tried it. I didn't care enough instantly, and later, when the foot began to get a awful dark blue to black colour, I had to spend three days in a hospital on antibiotic-drop. Luckily it helped. I sincerely hope that hospitalization and antibiotics also might help Jonathan Leo's father. However, when moving to Thailand for a happy retirement, you need to take risks into consideration; hereunder health, possibility for heath insurance, funds for self insurance, and not the least, what burden might place on family back home. I.e., in short terms, will you be prepared to died in Thailand? Us expats – when we live here more permanently – don't have any free repatriation to our home country, where we some of us benefits from free health care system. Health, funds for same and what you are prepared for, is probably one of the most important questions, before you settle abroad for longer period than a snowbird with travel insurance and covered repatriation. -

Thai Visa (Retirement)

khunPer replied to wildoates's topic in Thai Visas, Residency, and Work Permits

For monthly income method you shall use a non-O visa from abroad, you cannot change a visa exempt to non-O without a Thai bank 800k baht deposit. And yes, only your name in the bank account for the monthly not less than 65k baht transfer. -

If $1,500 to $2,000 is budget retirement, then yes: That is possible, and depending of your lifestyle – and eventual investment in a home – you can have a great time for that level of money, especially if it's around 60,000 baht per month. However, budget retirement for some is a government pension and nothing else – for some countries it can be as low as 30,000 baht per month – and that might in some cases be a bit of a problem, depending of health and risk of living with a low-level healt insurance or none insurance at all.

-

Australian Teen Dies in Koh Samui Motorbike Collision

khunPer replied to webfact's topic in Koh Samui News

Unfortunately on Samui, many young foreigners – assumed to be mainly tourists – drives around on motorbikes without any protection, including no helmet, and takes huge risk by driving fast and overtake in a traffic culture they might not fully understand. -

Not good... Actually, extremely bad – "Car Reservations Surge by 29%" – I just bought a new car, and I really looked forward to drive around for a month or so with temporary red number plates, and make a huge lot of face, by showing everybody that I can afford to drive a brand new car... But, they are selling too many new cars and ran out of red plates... So, I have to wait for my white number-plates and not making face at all...

-

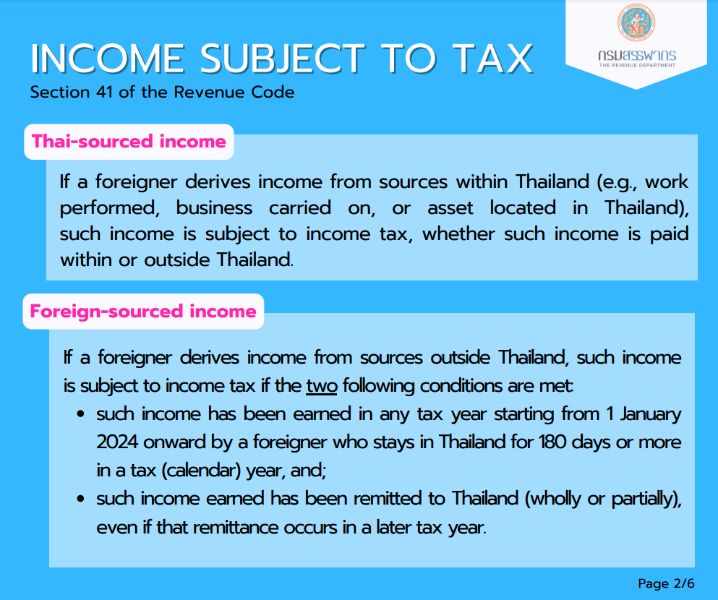

Thai Tax on UK pensions

khunPer replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

-

Topless walking on the beach in Thailand - Legal or not?

khunPer replied to Don Giovanni's topic in ASEAN NOW Community Pub

The "law" might well be depending on where (in Thailand). My Thai lawyer taught me, that an island might be so far away from Bangkok, where the write the laws; so, laws on an island are different administrered, often more in order with what locals used to do and use to do... I'm living next to a beach-resort. When I built my house there were quite a number of quite attractive younger – or young – east European ladies staying in the resort, and most of them were topless on the beach. I had SCG's "Roof Experts" to make my roof. Again and again some "important persons" came down from Bangkok to check the roof construction and take photos, and always together with the group of local management, often 5-6 important people. The were however only three workers making the roof. Numerous photos were taken, but mainly of the beach... The three hard working SCG roof-workers... The island where I live was in the beginning a hippie-destination with numerous girls perhaps diving too deep in magic mushrooms, so they often forgot their top. It's said that you still find many young ditto ladies on the neighbouring island's beaches...😎 -

I did notice that the text said "...the brakes overheated and lost pressure..." – can I imagine that the driver did not use a low gear? – but, it is quite often that Thai news writes about traffic accidents and brake failure. However, when reading news from my home country I never see the cause in traffic accidents as "brake failure". Is it only in amazing Thailand that "brake failure" happens so often, or do news-articles in other countries just not mention it?

-

Filing Tax Return Form for Foreign Income on Samui

khunPer replied to khunPer's topic in Koh Samui, Koh Phangan, Koh Tao

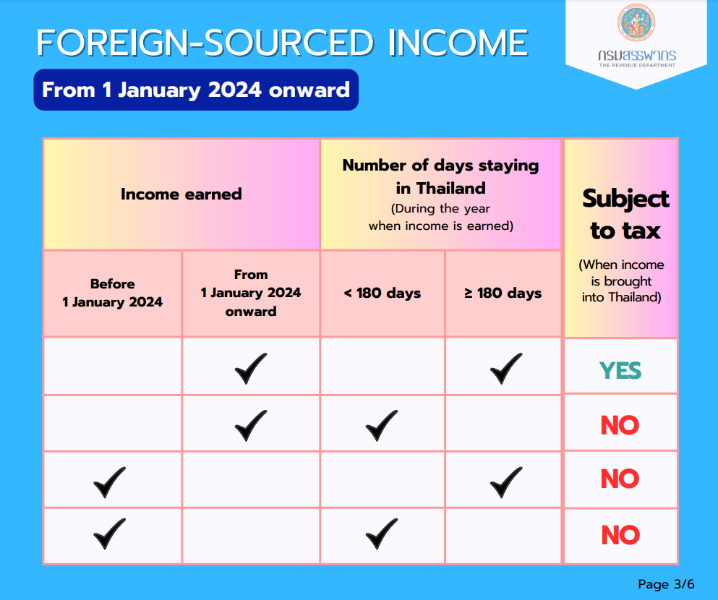

Thanks for your comment, you are welcome. In reply to your question about 300,000 baht foreign income for a person younger than 65 years of age: 100,000 baht expenses deduction, calculated as 50% of 300,000 baht income, but not more than 100,000 baht. 60,000 baht personal deduction. ----------- 160,000 baht deductions in total +300,000 baht income –160,000 baht deductions ------------ =140,000 baht taxable income –150,000 baht tax free bottom level (0% tax) ------------- = No taxable income In reply to: "In paying taxes on the remittance(s), do you need to file a full tax return (like in your own country) or only declare the remittance(s)?" Yes, you need to file a tax return, according to Samui Revenue Department's director and the general information from Thailand's Revenue Department. That is what I mention about in the opening post, it is fairly easy peasy with the online E-filling, if you don't need to pay Thai income tax and don't need deductible income tax from your home country. In reply to: "At any time, did you need to inform Thai Tax Authorities on your financial status in your home country?" If Thailand has a DTA (Double Taxation Agreement) with one's home country, the two states exchange tax information. If you wish to deduct already paid income tax from your home country, you need to show proof. In my case I show my annual home country's tax calculations. I also got a general statement from my home country's revenue department, stating that I am fully taxable of retirement pensions to my home country. If you are living from savings before 1st January 2024, you need to show proof of that. I haven't seen anything official about what "proof" is needed, but I would presume that a full tax-statement per 31st December 2023 including all savings – if one's home country revenue department registers them – would do. I've kept a statement of my savings per that border-date and shows what I transferred of my savings in 2024, as an attachement to my tax report in paper; the latter because I deduct already paid tax from home. In general, I would recommend to keep a statement and notes of, what is transferred of savings, in case some "taxman" at one point would be interested. At present, you don't need to file a tax return when living from savings. However, my Danish home country is World-record holder for high and strict taxation, so for me, it is not at all unfriendly to keep tax-documentation in order... And by the way: A few years ago the Thai "taxman" – in form of two friendly kind ladies – unannounced visited my Samui home. They wished to check if I paid due taxes in my home country. It was by agreement with my home country's revenue department, so they already had some tax information about me. Furthermore they had my Thai tax returns (luckily I had began to file such things). They were also checking all my known country fellowmen on Samui; they actually showed me a list with 20+ names. Danes in other parts on Thailand also mentioned about a visit from Thailand's "taxman". The kind tax-ladies said, that the were doing it by country , beginning with Danes and expats from Finland, as the tax exchange information was so easy to obtain... In reply to: "... a bonus question, if you are feeling generous with your time. I have heard the rumours that Thailand will, in the future, require expats to declare their global income to Thai tax authorities." This was a suggestion from (I think) a politician, hitting the news. So far, it's not in the present political agenda. However, a bit scary for those os us, legally having untaxed home country-income, when we resides abroad. Im my case capital gain, interest and certain feesare not taxed in my home country. So, as long as I keep the money outside Thailand, they are untaxed; and was even savings when they are earned before 2024. The thing is – which makes the suggestion valid – that many countries tax all income, also foreign income, even it is not transferred to the tax residency country. My home country is one of those that does that. For some, a change like that would make Thailand questionable as fully tax-resident destination. For some, the taxation change of what savings are, has already made Land-of-Smiles questionable. It is of course very individual, what the effect will be – in case this scary suggestion becomes real... – but if you are in the high gain level, you might need to consider other solutions. But "always look on the bright side of life": I need to make 5 million baht as income in a year to hit the highest income taxation level of 35% in Thailand – in my Danish home country the lowest income tax-rate is 38%... -

Filing Tax Return Form for Foreign Income on Samui

khunPer replied to khunPer's topic in Koh Samui, Koh Phangan, Koh Tao

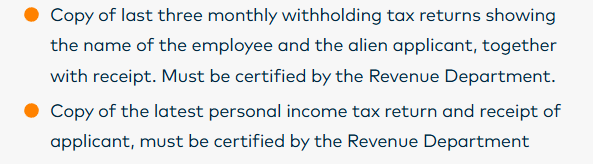

That is correct for Thais with income below the tax limit. But you are tax liable when being a tax resident alien with foreign transfers that are not savings from before 2024. According to the revenue department director on Samui, aliens shall file tax report, even when are below tax limit or has paid income tax abroad – presuming that the revenue department's director is more updated in alien's income tax than an accountant – if you live elsewhere in Thailand, I don't know what the local revenue director says... It's not a big deal to get it sorted out and sleep well... And by the way: Overseas rental income shall be filed in section 40(3). Can you imagine if strict Samui Immigration begins to ask for copy of tax-receipt when extending permission to stay for retirees and other non-O entries, just like you need to show salary and income tax documentation when extending stay based on a work permit...😟 -

And that is where the speed test makes sense, as it tells you what happens on the line to various connection points. Long dropouts will even be visible in the speed-graphics. Using wireless connection – like 5G – can avoid local cable problems; events like squirrels' dinner taste, falling trees and mistaken cut of cable. With a speed between 100 Mbps to 200 Mbps you are generally covered well. You need 20 Mbps for HD-streaming and 40 Mbps for 4K; however, more if several users at same time.

-

PM Paetongtarn Faces Tax Storm: Scandal Brewing Over Shares

khunPer replied to webfact's topic in Thailand News

If my memory serves me right, there has been stories in the news before about tax evasion from shares in the Shinawatra family...