-

Posts

12,533 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by khunPer

-

Thai Hotels Struggle as Mid-Priced Rooms Fail to Attract Tourists

khunPer replied to snoop1130's topic in Thailand News

Higher flight prices might be a reason why the budget travellers aren't coming, while travellers in the higher financial level both can afford and expects better accommodation than budget travellers. I've noticed the same trend on Samui for a while, many-star hotels are busy, budget resorts seems to have many vacant rooms.- 64 replies

-

- 14

-

-

-

-

-

800k in Bank when I apply for extension early?

khunPer replied to Barley's topic in Thai Visas, Residency, and Work Permits

Yes, but there are around 6,000 expats living on the island...😉 -

800k in Bank when I apply for extension early?

khunPer replied to Barley's topic in Thai Visas, Residency, and Work Permits

Samui Immigration, Surat Thani Province. -

800k in Bank when I apply for extension early?

khunPer replied to Barley's topic in Thai Visas, Residency, and Work Permits

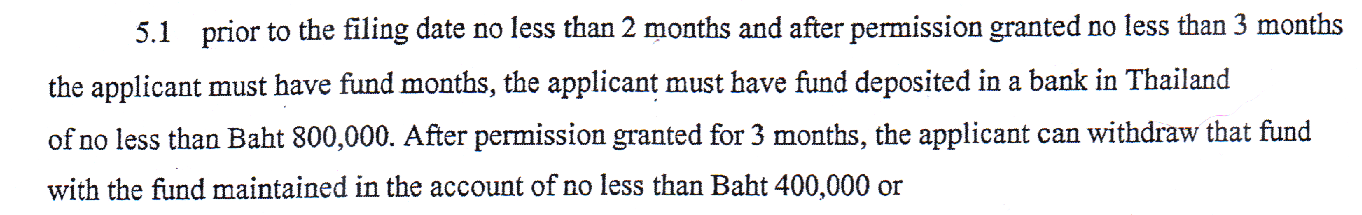

It's 3 month "after permission is granted", which can be later than application date; at the immigration office I use it takes about a week or little more to have the "permission granted". -

What was your job (profession) when you moved to Thailand

khunPer replied to still kicking's topic in General Topics

Before moving to Thailand, I was self-employed within the music industry for 30 years, before I've saved enough for an early retirement. I kept the publishing part of the business. I was educated in navigation and have a commercial pilot theory, worked for 10 years with operational planning for a major airline. Before that I played rock music, was a DJ and stage manager in a theatre. I also toured one summer with a larger circus, doing advertising. -

Any one doing the OMAD diet ( One Meal a Day )

khunPer replied to MrScratch's topic in I'm Too Fat Forum

I've been living like that for many years. Normally the talk is about an 8-hour eating window within 24 hours. I can for example eat some fruit one a day besides my major dinner-meal or a piece of cheese with a cracker later, if I didn't had fruit. However, diet alone is not the solution, you both need some level of exercise and the stuff you eat at your major meal of course need to be kind of healthy; i.e., mainly variated food. My BMI is 19.1. Another point of view is that it's important to fully enjoy your daily major meal. Personally I make a variety of mainly Mediterranean dishes for dinner and drinks a glass of wine of two with it. Whenever weather allows it – which is luckily often – I'll sit outdoor for a cosy candlelight dinner... -

Samui 2024 - Whats happening !

khunPer replied to khunPer's topic in Koh Samui, Koh Phangan, Koh Tao

September 13th to 15th, Samui Summer Jazz Festival 2024 SKÅL International Koh Samui, in collaboration with the Tourism Authority of Thailand (TAT), has announced the dates for its annual ‘Samui Summer Jazz Festival 2024.’ This year’s festival, titled ‘Late Summer Groove,’ will run for three events from Friday to Sunday, September 13-15, 2024, at three luxurious 5-star venues. Now in its 4th year since its reinstatement in 2021, the Samui Summer Jazz Festival brings together a world-class lineup of international jazz artists from Europe and the Americas, alongside the crème de la crème of Thailand’s local jazz talent. The festival features a superb program of jazz and world music hosted at three of the island’s premier 5-star resorts: Six Senses Samui, SALA Samui Chaweng Beach, and Kimpton Kitalay. Each of these venues promises a sublime seafront setting, offering a stunning event of gourmet dining, socializing, and music that caters to all tastes in jazz, all performed under the stars. Leading the event will once again be the internationally renowned Dutch tenor saxophonist, Alexander Beets, supported by a fantastic group of musicians and vocalists. They will perform a diverse range of jazz music, including Brazilian bossa nova, blues, soul, and swinging ‘big band’ jazz classics. As they say in the jazz world, “When the name Beets is mentioned, jazz lovers listen.” Programme: September 13th [Friday] at Six Senses Samui – ‘BRAZILIAN VIBES’ Kick off the Samui Summer Jazz Festival at Six Senses Samui with Brazilian Vibes, featuring the renowned Fleurine. A vocalist, composer, and lyricist, Fleurine is an authority on Brazilian music, celebrated for her “warm, enveloping sound and gentle rhythmic drive” (Los Angeles Times) and her “cunning brand of vocal wizardry.” •Doors open: 6:00 pm •Show starts: 7:30 pm •Options: Sit-down dinner or casual cocktail-style September 14th [Saturday] at SALA Samui Chaweng Beach – ‘JAZZ UNDER THE STARS’ Experience an unforgettable evening in the beachside garden of SALA Samui Chaweng Beach with Jazz Under the Stars. Enjoy Blues & Soul with Baer Traa, a multi-award-winning vocalist and pianist from Maastricht, alongside Thailand’s leading jazz saxophonist, Koh Mr. Saxman, and his band. •Doors open: 6:00 pm •Show starts: 7:30 pm •Options: Sit-down dinner September 15th [Sunday] at Kimpton Kitalay – ‘GRAND FINALE JAZZ BRUNCH WITH SWINGING CLASSICS’ Join tenor sax supremo Alexander Beets, the festival director, as he leads an ensemble of international jazz musicians in a spectacular Grand Finale Jazz Brunch at Kimpton Kitalay. Special guests include Charlie Philips (Netherlands), Fabio Lannino (Italy), Chukiat Srisakul ‘Pui’ (Thailand), Jihee (South Korea), and Miguel Rodrigues (Spain). Enjoy an extraordinary afternoon of live jazz while overlooking Samui’s stunning Choeng Mon Beach. •Doors open: 12:30 pm •Concert starts: 1:00 pm •Options: Full-grazing buffet brunch or casual lounge area Ticket Information: All three events offer a choice of Dinner & Show Tickets at THB 2,500 or Entry Only Tickets at THB 1,000. (Advanced booking seems to be needed) -

Club doing it's illegal stuff in Bangrak.

khunPer replied to Tropicalevo's topic in Koh Samui, Koh Phangan, Koh Tao

Probably a wedding party or other kind of important party, things like that happens now and then in Thailand and especially quite often on Samui. Always look on the bright side of life: Be happy you don't live in a villa at Chaweng Noi-hills...👍 -

Not any more, to my experience and knowledge. Both when I has visitor visa for my girlfriend and later when she had tourist visa, she needed to show her own funds. There is a specific amount per day, depending on type of visa. You normally need to show ticket, insurance and accommodation details when the applicant picks up the visa; however, it might be slightly different rules from country to country. I can only speak for my Danish home country, where accommodation had to pre prepaid, if not private. In the latter case the host needs to provide further details upon request, which also extend the time for approval of visa.

-

Yes, as mentioned above, totally different procedure. You need to apply from homeland – i.e., Thailand – and it likely has to be for a tourist visa, when no one is living in Schengen and invites. Normally you shall apply Schengen visa for the country of longest stay or country of entry. When I applied for my Thai girlfriend – or rather, she applied, as I had already moved to Thailand – the requirements was a full agenda for the entire stay, booked tickets in and out, confirmed hotel reservations, travel insurance and that the applicant has own required funds for the trip (show bank account). However, check present requirements, as it's a few year ago we applied for Schengen visa.

-

Swedish Man Scammed by Thai Woman, Loses Over 300,000 Baht

khunPer replied to webfact's topic in Thailand News

Time has changed: In these online days you don't even need a buffalo... -

Swedish Man Scammed by Thai Woman, Loses Over 300,000 Baht

khunPer replied to webfact's topic in Thailand News

His best friend is Turkish Sven. Yes a common Swedish name today... -

I still see some few, for me attractive, young girls in the nightlife; but agree, most of them I see are also around 30 or more, and if not plump then with (way too) many tattoos. Unfortunately, it's much harder to get the few young girls around 20 to smile back, than it was 20-years ago...😟 –perhaps I've reached a stage, where I need to show my money, to be attractive "handsum"...

-

How likely is another military coup in Thailand 2024 ?

khunPer replied to CLW's topic in Political Soapbox

Not likely at all in 2024, we are too close to year end... -

However, it worked extremely well, so not as ridiculous as you try to state...

-

For a start, read the Double Taxation Agreement between US and Thailand. Income already taxed in US will not be double taxed; i.e., you'll often pay the highest tax rate, and if that is the one in US you will not also be taxed in Thailand. Income not taxed abroad and transferred to Thailand from 1st January 2024 will be income taxed in Thailand; savings proven to be from before 1st January are free from income tax. We are still lacking detail about how this shall be enforced in practise; so, keep good record of your transfer transactions.

-

When you contribute the agreed fee in your area, police will come by and check that the property looks like are in good order, within an agreed schedule, often once per day. There should be a little book or slip in the box, which police signs with date, time and name/signature when checking, so you can see they have been there.

-

The very cheap ones are, as you experienced, not very good. I have for several years used a 70mai dashcam I bought online from Lazada or Shopee... Present online prices are between little more than 2,000 baht and up to almost 4,000 baht.

-

Yes, that the one shown in my photo above...👍

-

Yep, the rent is normally based on the construction price, which is the invested capital to pay interest from or gain interest from. Resale price is normally announced with a profit and often ends a bit lower. An actual example is my neighbour's construction of a villa for initial 25 million baht on a land-plot he bought for 9 million baht. It was offered for 69 million baht as asking price after 8 years ownership – double up of 34 million baht – and ended up being sold for 50 million baht. Trying to sell property at double up, or more, as announced price is quite normal. There will normally be an agent commission of 3% to be paid plus income tax of the sales price, depending on ownership time, and if the property has been used as primary home. Some resale prices are however so high that the property is not sold. The villa mentioned here has been up for sale again for a while, the new asking price $2.5 million As mentioned before, the example of my next door neighbour's 2-bed rental house, the long term rent is 60,000 baht per month. The house construction was little less than 3 million baht, not including the tiny 180 square meters land-plot under it, which at construction time, based on similar land would be in the value of 4 million baht – a 270 square meters plot almost besides it was sold for 5.5 million baht – all together an initial value of 9 million baht. So, 8% fits well to 60,000 baht per month for long term rent. However, that house is also for sale now for 25 million baht – 20 million baht, if the renter wish to buy it – the owner is dreaming of a nice profit for a 15 years old house.