sandyf

Advanced Member-

Posts

15,919 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sandyf

-

Thailand Introduces Online TM6 as Tourism Fee Faces Delays

sandyf replied to webfact's topic in Thailand News

Sounds like US paranoia, quite obvious you never tried to enter the UK during covid. -

I use the government hospital at Bang Saen and see the doctor every 4 months. Each time there is a blood test but the list varies each time, urine/PSA I think once a year. You have to be registered and results take about hour and a half. The Cancer Hospital at Chonburi also do a package, was 1600 baht each time I have been, but a couple of years now. It was 1300 for a woman which would make the PSA about 300 baht. It is bloods, stool and urine analysis with ECG and X-ray. Unfortunately not walk in, need to register and make an appointment, last time I had to wait about a month.

-

Under Consideration - 2 months

sandyf replied to connda's topic in Thai Visas, Residency, and Work Permits

Indeed, can change as quickly as the staff, but not always problematic. Chonburi DLT always used to accept pink card and yellow book but last time I went they had adopteed the Pattaya policy of CoR. I was due to go to Immigration in a couple of weeks so picked up the cert at same time, 300 baht there and then. Went back to DLT next day and saw same woman, she asked why so long to come back, just said immigration not easy to deal with. Bonus No1 - she asked if I wanted I could do licence in about an hour - great news. Bonus No2 - the delay in returning to DLT crossed my birthday and i got just about 6 years on licence. -

Under Consideration - 2 months

sandyf replied to connda's topic in Thai Visas, Residency, and Work Permits

Wouldn't know, never seen the need for an agent, or a brown envelope. -

My TM30 is dated 2015, been out of the country more times than I remember, had several new visas and a new passport since then. Renewed extension and did 90 day report last week without any question, but one day I expect them to say a bit faded.

-

That is too generalised a question. HMRC told me I do not need to file a tax return, they just collect the same tax every month. Why would it be out of the question for the RD to have a similar policy? I suspect the majority of pensioners have no liability so little point in making a return. Best advice is to wait for further clarification.

-

The "why would they scenario" only applies to a certain part of the expat community. Certain visa types already have to provide tax information as part of the visa process, others have tax exemption from their visa. Why would they chase the Non O category when the chances are that they will get very little. In most cases it would be time and effort for no gain.

-

Under Consideration - 2 months

sandyf replied to connda's topic in Thai Visas, Residency, and Work Permits

I went on 12the Dec with visa extension expiring on 1st Jan. Return date was 10th Jan but had contractors at the house so went on 14th for final stamp. -

Under Consideration - 2 months

sandyf replied to connda's topic in Thai Visas, Residency, and Work Permits

Indeed. I have recently had my 6th in about 8 years, and that was done on the day of application. Got home about 3pm, home visit came at 4pm, didn't help the processing any. Always something different, this time it was witnesses in the photos, good job they live next door. -

Under Consideration - 2 months

sandyf replied to connda's topic in Thai Visas, Residency, and Work Permits

It is not out of the question, mine also goes to BKK and last year it went from the Fri to Wed for collection. When my wife asked about the delay she was told it was due to immigration having to check the financials on agent applications more thoroughly. Agents may have been busy following the holiday period, combined with the introduction of e-visas in neighbouring countries. -

Guidance please on Non O application from UK

sandyf replied to Wyabcp's topic in Thai Visas, Residency, and Work Permits

You didn't read what was posted. You responded to a reference by the OP to the guidance from the embassy on E-visas, nothing to do with extensions. The embassy should refrain from posting the Thai requirements, every time it gets mentioned someone gets the wrong end of the stick and starts talking about extensions. This is what the OP was asking about. Financial evidence showing monthly income of no less than 65,000 THB (£1,500) or having the current balance of 800,000 THB (£18,000), e.g. bank statements, proof of earnings - Applicant’s recent official UK/Ireland bank statement shows your name, address (Screenshots are not accepted). For monthly income of last 3 months no less than £1,500/ month. https://london.thaiembassy.org/en/page/retirement-visa -

Thailand Faces Record Low Births, Sparking Population Concerns

sandyf replied to snoop1130's topic in Thailand News

Bit of a narrow minded perspective. More to do with female education and liberation, some are more interested in a career than a family. I have 2 Thai nieces, both been to uni, one is a doctor early thirties just been sponsored for a 3 year training course. No interest in getting married far less having children. The other is early 20s and works for an event organiser, too busy travelling to have any sort of home life. It is no coincidence that the highest birth rates are in countries with poor education. -

Guidance please on Non O application from UK

sandyf replied to Wyabcp's topic in Thai Visas, Residency, and Work Permits

You are out of context, an E-visa can be obtained in the UK based on income. I know someone who does it every year on his pension. Also in Thailand the absence of an embassy letter does not rule out the income method. -

Guidance please on Non O application from UK

sandyf replied to Wyabcp's topic in Thai Visas, Residency, and Work Permits

I have returned to Thailand a few times with new visa on the return leg of a 2 way ticket, not a problem. When you come to make the application it may say a bank statement or proof £10,000 is required. This is a left over from the days of the 1 year ME visa option, many have got the visa on much less. I believe someone was told by the embassy that something over £1000 was required for the 90 days. The funds for the visa can be located anywhere, be careful not to get distracted by the requirements for an extension which for some reason have appeared in the guidance. When you make the application there are a set of questions that you will need to upload an answer. If you have difficulty or unable to answer, write a note to the effect and upload that. You cannot move on to the next section if there is an upload missing. Good luck -

Is the harsh criticisms of Sir Keir Starmer fair and justified

sandyf replied to Rimmer's topic in Political Soapbox

I lived in Sheffield when the Rotherham situation came first hit main stream media in the early 2000s, although there had been rumours for at least 10 years previous. I can remember statements in the local press from the police admitting that they not followed up on some cases for fear of being accused of racial bias. It should be fairly obvious that those suspected of breaking the law cannot be protected by other legislation, but politicians of all persuasions have been very reluctant to address the issue. Labour were in government at that time and not surprisingly want to steer clear of the fact, after all it was a labour government that introduced the Race Relations Act. -

what money is taxed 2024 ?

sandyf replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

It is you that should do the homework The English language allows for a Non O immigrant visa based on retirement to have an abreviated adjective and can be referred to as a "retirement visa". -

Exactly. Back in 2014 Immigration decided to take a hard line on border runs, this is a comment made at the time. "The changes have caused widespread confusion among foreigners in Thailand with specialist websites such as Thai Visa running lengthy updates on them. Some posters on the site's forum claim they are already being denied visas at some northern checkpoints, despite Pol Lt Gen Pharnu saying the crackdown will not come into effect until Aug 12." Please credit and share this article with others using this link: https://www.bangkokpost.com/thailand/general/410342/border-insecurity-mounts-as-tourist-visa-abuse-is-targeted. View our policies at http://goo.gl/9HgTd and http://goo.gl/ou6Ip. © Bangkok Post PCL. All rights reserved. Within days, not weeks or months, the government asked immigration to take a more flexible approach and the 30 day extension came about. The RD have only clarified how the existing rules should be interpreted but there are those with a vested interest in scaremongering and should be ignored. Those that have a tax liability should already be paying and highly likely nothing will change for those who haven't.

-

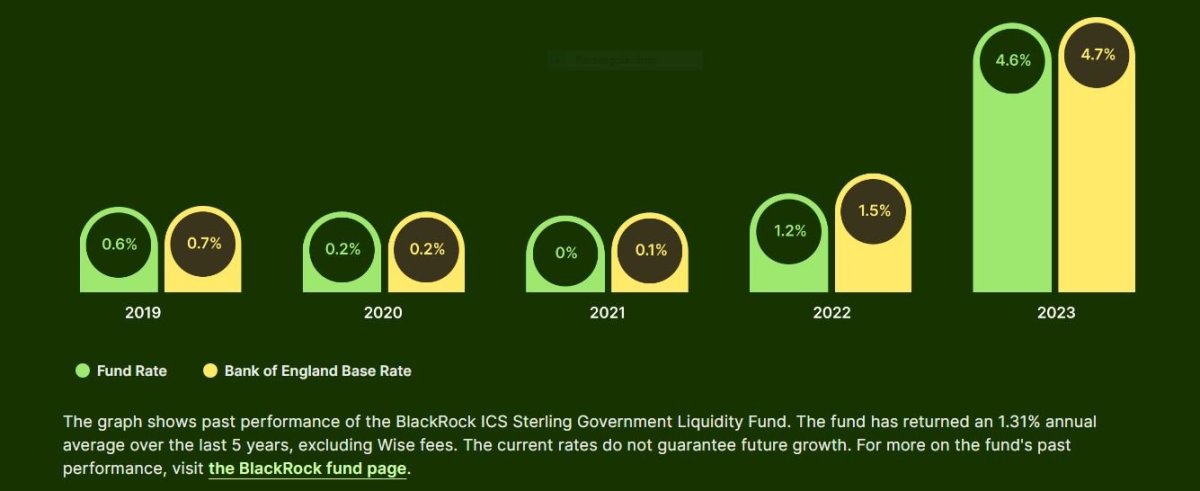

Meet Wise Interest

sandyf replied to CallumWK's topic in Jobs, Economy, Banking, Business, Investments

https://www.blackrock.com/cash/en-gb/products/229239/blackrock-ics-sterling-gov-liquidity-premier-acc-t0-fund -

what money is taxed 2024 ?

sandyf replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

We can only assume English is not your first language. -

Meet Wise Interest

sandyf replied to CallumWK's topic in Jobs, Economy, Banking, Business, Investments

"Currently, you can choose Cash, Interest or Stocks." https://wise.com/help/articles/3luodUQFD9YWzNc8PvIfVK/holding-your-money-as-stocks But not available to everyone at this point in time. EEA Interest is available to consumers and businesses that are residents in Estonia, Finland, France, Hungary*, Netherlands, and Sweden* and is subject to applicable rules and regulations. Stocks is available to consumers and businesses that are residents in Estonia, Finland, France, Netherlands, and Sweden* and is subject to applicable rules and regulations. https://wise.com/help/articles/31thpWvBl38OL54poT6VAE/who-can-use-interest-and-stocks?origin=related-article-GDxZxemd21yDVP4TQmdDJ -

Is the harsh criticisms of Sir Keir Starmer fair and justified

sandyf replied to Rimmer's topic in Political Soapbox

The one point I wouldn't hold him out to dry on is another enquiry. We have known from 2011 what the problem is and we don't really need to spend more time and money on proving it. The tories stuck their head in the sand and labour failed to take the initiative as soon as they took office, now paying for that mistake. Bottom line is they are a bunch of hypocrites, claim to be the party for working people but no interest in those that have been working people. Those that have never contributed to the economy get more consideration. -

What will happen will depend on the circumstances. As has been said if you make a payment for goods in a currency that you hold on the Wise card there will be no fee, as transaction fees are paid by the merchant. I have come across companies that will increase the price if you pay by card to cover that fee. If however the transaction is processed in any other currency there will be a small conversion fee. For example you have GBP, EUR and USD available and you make a purchase in EUR and there is insufficient EUR balance to cover the amount, Wise will take the difference from either the GBP or USD balance, which would mean a currency conversion. Cash withdrawals are a different matter. Wise will allow 2 withdrawals a month up to £200 without fee, fees would be applied to withdrawals outside the allowance. It should be borne in mind that ATM's may impose a fee from the provider which has nothing to do with Wise. I believe all ATM's in Thailand have fees imposed by the provider, some a bit cheaper than others. I have had my card for some time now and find it invaluable when travelling, getting a beer in a foreign airport has become so much easier and cheaper. With my UK bank card, faced with a non sterling transaction fee an their version of the exchange rate.