Phulublub

Advanced Member-

Posts

1,662 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Phulublub

-

How to make San Mig Light taste like real beer...

Phulublub replied to tomster's topic in ASEAN NOW Community Pub

Why are folk suggesting low calorie when OP wants low carb? San Mig zero has zero sugar so almost certanly fewer carbs than others at 1.5g per bottle. (It is also lower in calories) as it happens) PH -

Thai Tax on UK pensions

Phulublub replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

Wrong. The UK State Pension is classed as Assessable Income for thai tax purposes. Article 19 for the DTA is inapplicable here. See https://www.gov.uk/state-pension-if-you-retire-abroad/tax-on-your-state-pension#:~:text=Overseas residents,tax on your pension once. Overseas residents You may be taxed on your State Pension by the UK and the country where you live. If you pay tax twice, you can usually claim tax relief to get all or some of it back. If the country you live in has a ‘double taxation agreement’ with the UK, you’ll only pay tax on your pension once. This may be to the UK or the country where you live, depending on that country’s tax agreement. In the specific case of the OP, it is highly unlikely he will have any Thai liability sicne his military pension is not applicable income and he will already have paid tax on his UK state pensiion. PH -

Isnt that a bit head in the sand? Waiting untit you see others being audited and then finding out you should have been fiing returns will be too late to file those returns and if and when it is your turn, you will be in for a nasty shock. I will be looking at the new forms once they are available and if I have to file, I will - because my assessable income is made up of non-asseable pension and pre-2014 savings, I will not have any tax to pay. Down the line, as I use up my pre-2014 savings, and once my UK State Pension kicks in (should Ilive that long) then I will have a small liability, which I will be content to pay for peace of mind if nothing else. Evasion is evasion and is illegal. Just because you might get away with it does not make it a good idea. PH

-

jwest Accoridng to https://www.gov.uk/tax-on-pension/tax-when-you-live-abroad#:~:text=If you live abroad but,UK tax on your pension. "...If you’re not a UK resident, you don’t usually pay UK tax on your pension. But you might have to pay tax in the country you live in..." (For the avoidance of doubt of others, this refers to the UK State Pension, not private or Government Pensions) you should not pay UK tax on your State Pension. Is that the case for you? if so, id dthis happend automatically when you informed HMRC of your residence status? PH

-

Yes. Whether the system can track and trace all such remittances is besides the point; as has also been said, it is a Self Assessment system where it is up to the individual to report all their income (remittances for most of us). Failure to do so is evasion which, if caught, would result in hefty punishment. PH

-

"Taxed at source" and "UK taxable" are two completely different things!! As i linked earlier: https://www.gov.uk/tax-uk-income-live-abroad You usually have to pay tax on your UK income even if you’re not a UK resident. Income includes things like: pension rental income savings interest wages (not State Pension though - see the link for further details) PH

-

Would you like to quote a reputable source for that statment? It appears to be directly at odds wth this: Your UK residence status affects whether you need to pay tax in the UK on your foreign income. Non-residents only pay tax on their UK income - they do not pay UK tax on their foreign income. Residents normally pay UK tax on all their income, whether it’s from the UK or abroad. But there are special rules for UK residents whose permanent home (‘domicile’) is abroad. From: https://www.gov.uk/tax-foreign-income/residence#:~:text=Non-residents only pay tax,'domicile') is abroad. and this: You usually have to pay tax on your UK income even if you’re not a UK resident. Income includes things like: pension rental income savings interest wages From: https://www.gov.uk/tax-uk-income-live-abroad

-

It isn't a withholding tax, but if you are a basic rate taxpayer, you are laible for tax on dividends at 8.75%. However, those non tax rsident in UK can have dividend (and saving interest) classed as "disregarded income" when calculating the amount of tax due to UK Government. See: https://www.gov.uk/government/publications/non-residents-and-investment-income-hs300-self-assessment-helpsheet/hs300-non-residents-and-investment-income-2024#how-the-restriction-works PH

-

If it is a lie, we should all look forward to the outright denial by Vance, followed swiftly by the defamation suit Vance's former roommate will shortly be served with. Surprising these things haven't happened already really. PH

-

JD Vance is from the Left? Who knew! PH

-

Maybe tell Trump's running mate that....or is calling Trump an American Hitler nit the same thing? PH

-

So why are the Trumpers all so concerned about her getting the nomination? They should be jumping for joy but, strangely, they seem to be tearing their hair out, wailing, gnashing teeth and trying all sorts of tactics to get her barred from standing. KInda strange indeed. PH

-

-

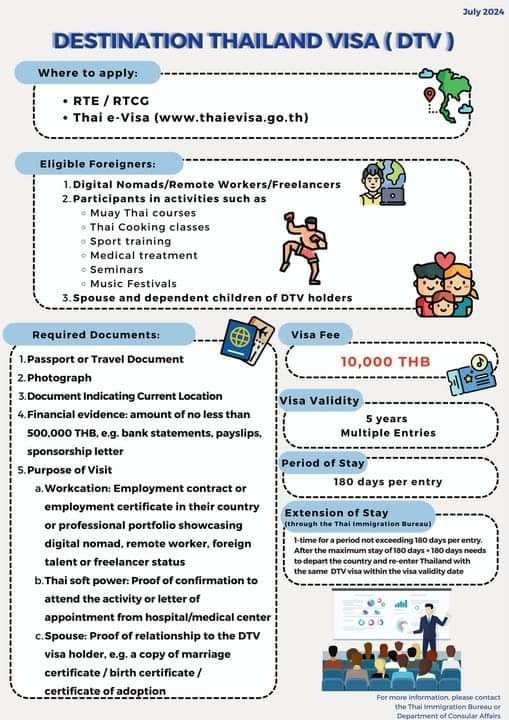

Expats angry at huge concessions in latest Thai visa announcements

Phulublub replied to webfact's topic in Thailand News

So half as often as DTV, or DTV gets same reentry permit which, if they do, will require a preeceding 90 day...) Then again I do both TM30 and TM47 online so take me seconds. You do what you want, let others do the same but FFS stop whinging. PH