Phulublub

Advanced Member-

Posts

1,663 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Phulublub

-

Make sure VPN off. Cler cache (CTRL F5), ry a different browser. PH

-

Didnt he also suggest dropping a n uke on a hurricane to make it go away? PH

-

And for how long will these "elites" live underground? Who will maintain their machines? What will they do? Read On The Beach, Neville Chute...published 1957. Or watch the film (1959). 60+ years ago, but still pretty accurate imv PH

-

Can those who have had a colonoscopy in Thauiland give region, hospital and price so others can have useful info if they decide to have one? PH

-

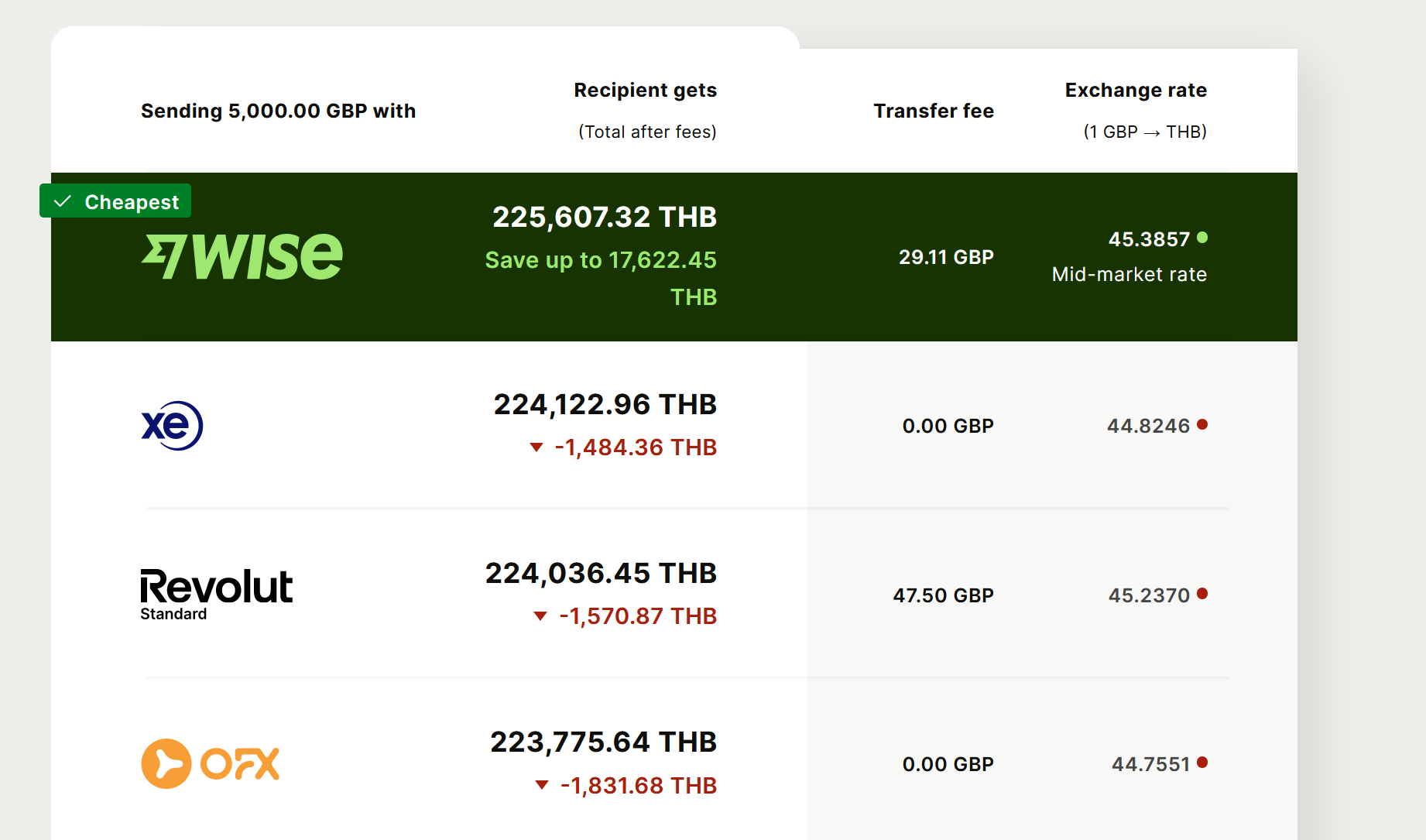

Unless time is absolutely of the essense, then a day or two is pretty meaningless. The most important factor, usually (and IMHO) is how much arrives for the amount sent. If you have several options, it can be worth shopping around to check which is best at that particular moment for the particular amount you wish to transfer. WISE has a handy compare feature that will tell you which method ill currently be best eg: and PH

-

Why do people start topics that are utterly pointless? PH

-

Clearly you know better than the heaps of YT videos and my own experience. Some are open to new knowledge, others are not. PH

-

No knead sourdough does take time - but not yours. Very little involvement and tastes way better than any shop bought. Several YT videos for anyone interested enough Warning: Had to stop making it as I could down half a loaf while still on the rack cooling. PH

-

There is some confusion - probably not helped by incorrect phrases and words being used. If applying for your non-O Visa (Ie you currently do not have one and are here on some other permission), you need 15 days remaining on whatever entry permission that is. In following years, you apply for an extension of stay, not a new visa. This can be done up to the final day of your current extension (or, if for the first extension, the visa itself). PH

-

Had two friends who bought off plan...one sold before moving in, other lasted about two weeks before moving out and selling at a loss. This was pre-covid but was inundated with bus loads of short term stayers (rumours of two double mattresses per studio!) and I understand they had a desk set up in the foyer such was the lack of control from Juristic. Up very early and noisy eating round the pool, with inevitable debris into the water..... A common proble with the very new developments that are bought up en masse for exactly this srt of airbnb type activity. Owners will care not one jot for residents, upkeep, maintenance - quick buck turn around, move on.... PH

-

As he was in 2016. So was Hillary Clinton. And so is (and maybe was) Joe Biden. It is very sad that the US cannot do better. 2008 is probably the last time there were two contenders both worthy of winning. PH

-

We can hope so. PH

-

Would those be hats and sneakers made in China? (remember his tie?) PH

-

Is plastic recycling a hoax made up by Big Oil?

Phulublub replied to flyingtlger's topic in General Topics

Which means that the 20% is actually recycled, which is rather more than the zero percent from those who put it directly in the trash or burn it. PH -

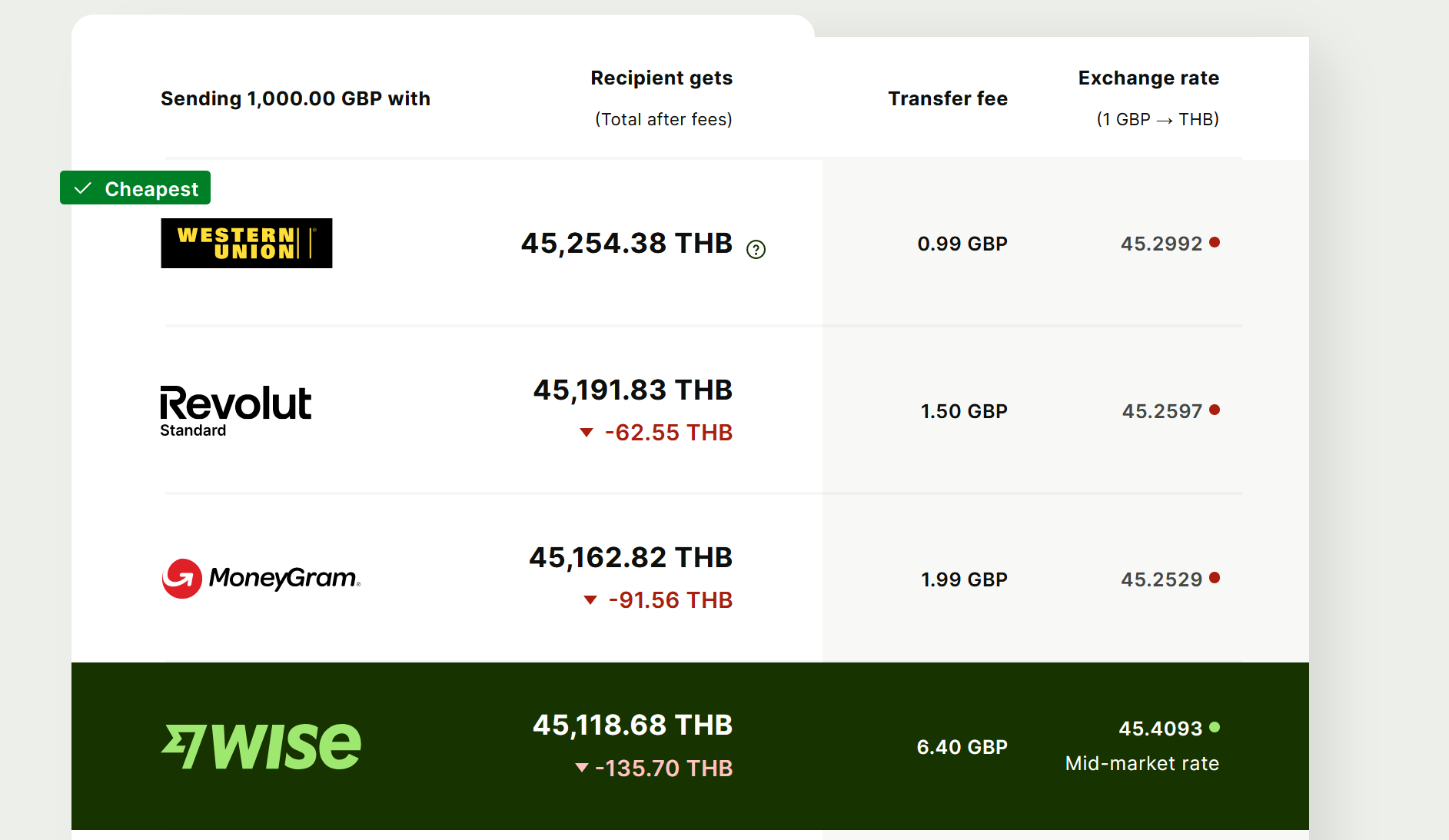

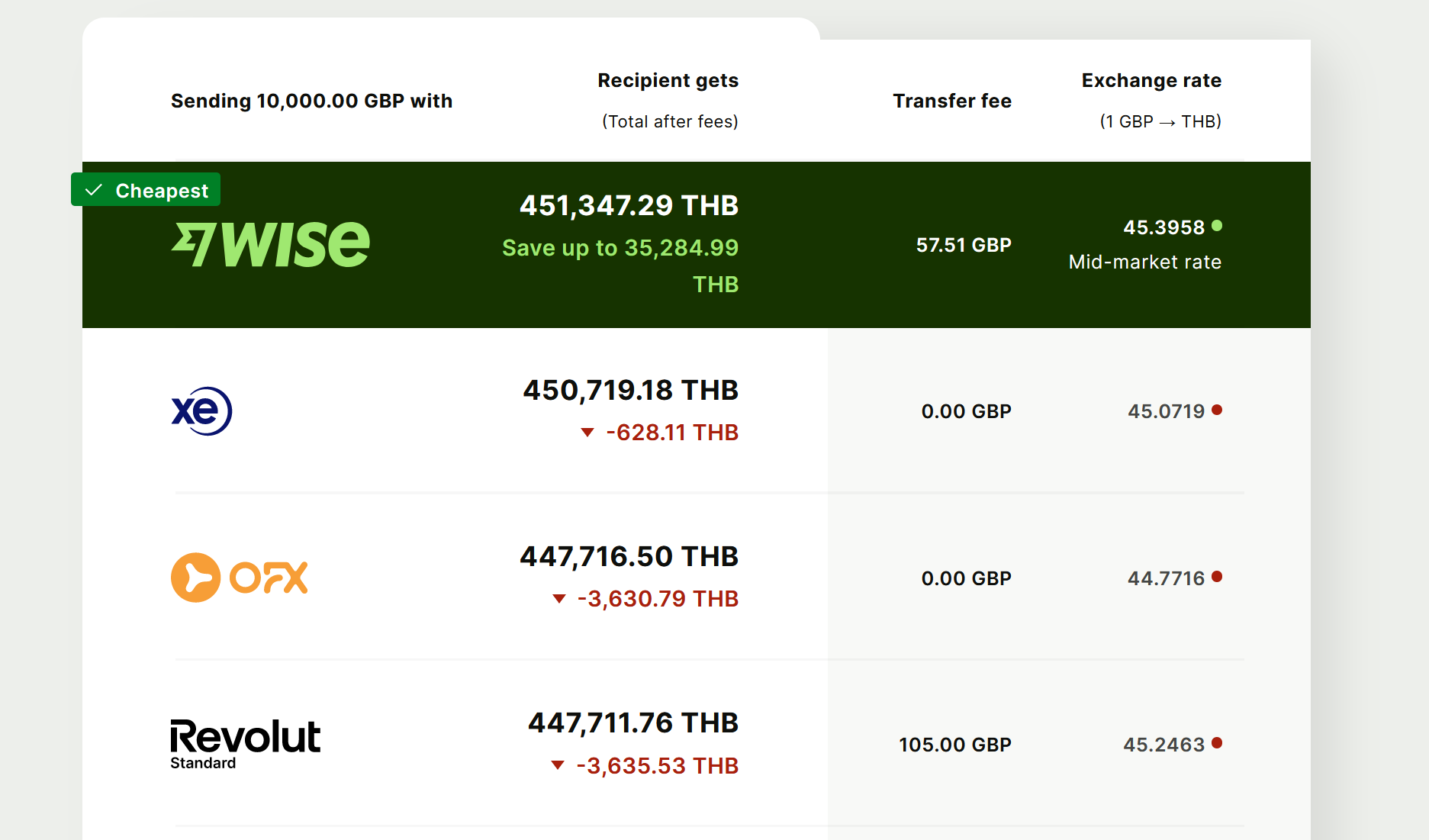

It does, eventually. The ONLY thing that matters is the total THB you receive into your account for the USD you send. The calcualtion can change (ever so slightly!) day to day. WISE gives pretty much the best exchange rate, but charges a %age fee on the amount transferred, so this contiues to increase as the amount transferred increases. I believe Remitly uses a similar formual SWIFT will give a lower exchange rate, but charges (at both ends) will be capped. Western Union can often be the best Just done a compaison on WISE website and WU is showing the best return right now for a £1K transfer: But for £10K, WISE is best: Do you own sums - FWIW I transferred near 3m THB here two years ago for a condo pruchase and WISE was still the best option. PH

-

Is plastic recycling a hoax made up by Big Oil?

Phulublub replied to flyingtlger's topic in General Topics

And if they are paying, then you (or anyone else) REALLY think they are then putting it in landfill? If there is no market, why do we see (in Pattaya) several locals going around diligently sifting through bins to collect plastic and cardboard? And many falang appear to think they have intellectual cspacity way above that of the locals! PH