Mike Teavee

Advanced Member-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Mike Teavee

-

Retirement visa renewal at immigration without using an agent

Mike Teavee replied to stargazer9999's topic in Chiang Mai

I believe you're on a "Marriage" extension & am guessing you don't use CW as your IO. As somebody who's on a "Retirement" extension who used to use CW (Jomtien nowadays) amalgamated bank book entries were not (normally) accepted by them & I would (most probably) have been sent away to get a statement from my Bank had I turned up with just photo copies of my Bank Book... As always, the caveat is that you might get a friendly IO officer who will use their common sense to see the balance didn't go anywhere near below twice what was required, but with my luck I'd have got one that would quote the rules & send me away. As it was my agent sorted it all out & I had a very nice holiday around Phuket, Krabi & Phi Phi when I would (at that time) have had to have been at CW doing my extension... -

Can confirm that Danny's Bar was open for the whole of the game, as I suggested would happen, shutters went down around 3am, & music turned off but the game was still on & you could get a beer.

-

Retirement visa renewal at immigration without using an agent

Mike Teavee replied to stargazer9999's topic in Chiang Mai

Last extension I did at CW (2021) I had 2 problems... 1) I rarely update my Bank Book (though it never goes below 800K) so had amalgamated entries not acceptable to Immigration & 2) I wanted to do my extension 45 days before it was due as I had travel plans. Went to see my Agent who immediately spotted the problem with my bank account & took me to a Bangkok Branch to get the required letter/statement & the next day they took me to CW where my extension was processed there & then, 44 days before it was due despite CW only doing extensions 3 days before they were due at that (Covid) time. Without an agent I believe I would have been sent back because of the amalgamated Bank book entries 1st & then again because of the 3 day rule at that time & so would have wasted 3 days of my time & approx 2,400 in transport fees. End of the day it's 8K that I have as a budget line item so doesn't bother me... As I've said before, if it was 80b everybody would be doing it, if it was 800,000b none of us would be doing it. -

Worst Joke Ever 2025

Mike Teavee replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

Fan-dab-idosy -

Sorry, you're saying that that you pay CGT on UK Assets bought 25 years ago!!! - Unless you're talking about Property (and that was pre-2016), you need to sack your accountant fella... I've been Non-UK Resident (For Tax) for 15 years & in that time haven't paid a penny in UK Income, Dividend or Capital Gains Tax, my accountant doesn't bother to ask me about Capital Gains Tax as they know it's a completely mute point (5 year rule).

-

Internet Providers in Jomtien / Pattaya

Mike Teavee replied to Jingthing's topic in Mobile Devices and Apps

I'm currently on TOT/NT (they were the only providers & 50/30 up/down was the best speed I could get from them for my Condo) & noticed that 3BB have been advertising a new Fiber service to my Condo so was considering switching. TBH the TOT/NT service has been great and the speeds more than adequate for watching Netflix / streaming via my Android Box etc... but I'm semi-tempted to swap for the 3BB TV packages are these worth having? Somebody asked about the price of the unlimited 10MB AIS SIM only packages, I'm currently on the 349 Flexi (349B pm + tax) which is no longer available but they are pushing the 449 Flexi (449B + Tax) which is 20MB & 5G - Haven't felt the need to upgrade to it as I've never had a problem with speeds on the 10MB package. -

Netflix’s password sharing restriction has come to Thailand

Mike Teavee replied to webfact's topic in IT and Computers

I don't have the full story as it was my mate's GF who was having the problem but it seems that my Netflix subscription (Premium 419b) has stopped working for them (they're in Bangkok I'm in Pattaya) so he's purchased his own subscription. Will check with the GF's mate who's also using it in Bangkok to see if it's still working for her. Anybody else find that the block on password sharing is starting to take effect? -

That’s a shame as we visited Chiang Mai (& Chiang Rai / Pai) in Feb and the air quality was fine, much better than we had in Pattaya a couple of months back when the AQI was > 150 even at the beach in Wongamat. But the point is you don’t spend 18 years somewhere & suddenly decide the air quality is too bad or taxis are too expensive, you find this out early on & move if you don’t like it.

-

My (rental) agent insists that I need to do a new TM30 every time I come back from overseas to the same Condo we've been living in for 2 years & I keep telling her that I don't. Never had a problem just ignoring her but the day after I got back from my last trip to the UK I was a bit spaced out (jet lag) & she found out from my GF (They're Facebook buddies) that I'd just got back so decided to "Report me". This was 72 hours after I got back so I've no idea if I'm going to get a fine for not doing a report that I didn't need to do!!! [Jomtien IO & Re-entry permit based on Non-IMM O "Retirement" Visa extension of stay]

-

Come on City, I’m a Man U fan but from that side of Warrington where we love to see the Manchester teams doing well???????? Was lucky enough to catch the Chelsea game on my last trip to UK where we qualified for next years CL so maybe it will be us this time next year ????

-

I believe Danny’s Sports bar (Treetown) will be showing the game until their closing time (3am)… Shutters will be closed at 3am, which side of them you’re on is up to you. Do note that Danny’s gets very busy on match day so best to get there early to make sure you get a seat.

-

The fact that your state pension is frozen is hardly Thailand’s fault & whilst I’d admit I didn’t know this until I read it on this forum nor would I have actively sort this information out, the fact is it there are many other countries (e.g. Australia, New Zealand, Canada & India being 4 other counties on the list) where it would also be frozen. If you don’t like the air in Chiang Mai… Move, Don’t like the Taxi Mafia in Koh Samui (never had a problem there myself)… Move…

-

Or be over 50…

-

That's true... You tell them where you're going & they'll stick you in the bus with other people going in that general direction. On the one time we were going to Jomtien we were in with another couple who were going to Pratumnak (& also charged 100b each), am pretty sure if it wasn't for these it would have cost us 200b each.

-

I used Asia Visa travel on Suk Soi 24, approx 3 minutes away from Phrom Phong BTS Station to get my 1st TM30, IIRC the cost was 1,500baht as this included the "Fine" despite the fact that I had only arrived that morning. At Jomtien IO I've needed a TM30 for every interaction (1st 90 Day Report after moving here from Bangkok, re-entry permit & extension + re-entry permit done via Maneerat, Certificate of Residency done myself)

-

The Songtaews/Baht Buses at Pattaya N Bus station don't have a "Normal" route, they ask each person which hotel/condo they're staying at & charge 50baht* per person to drop you there. *One time we had to pay 100baht pp as we were staying in Jomtien, obviously this was in the days before Bolt... Nowadays, even if travelling alone, it's worth an extra 30-50baht to be taken in a car straight to my condo rather than having to wait to drop others off.

-

Don't know how true it is, but I was once told that you have to be resident in Thailand for at least 6 months of the year to have a Thai Health Insurance policy. Either way, Mister Parakan ( https://misterprakan.com/intl/main?lg=en) is a good site for comparing insurance policies...

-

It doesn't need to be moved as, unless he has a re-entry permit or a multi-entry visa, his permission to stay will end when he leaves the country & when he re-enters he will get a new permission to stay in his new Passport. It's a different point if he does have a Re-Entry permit or Valid Multi-Entry visa but he explicitly states that he's not looking to move his visa so I'm assuming not.

-

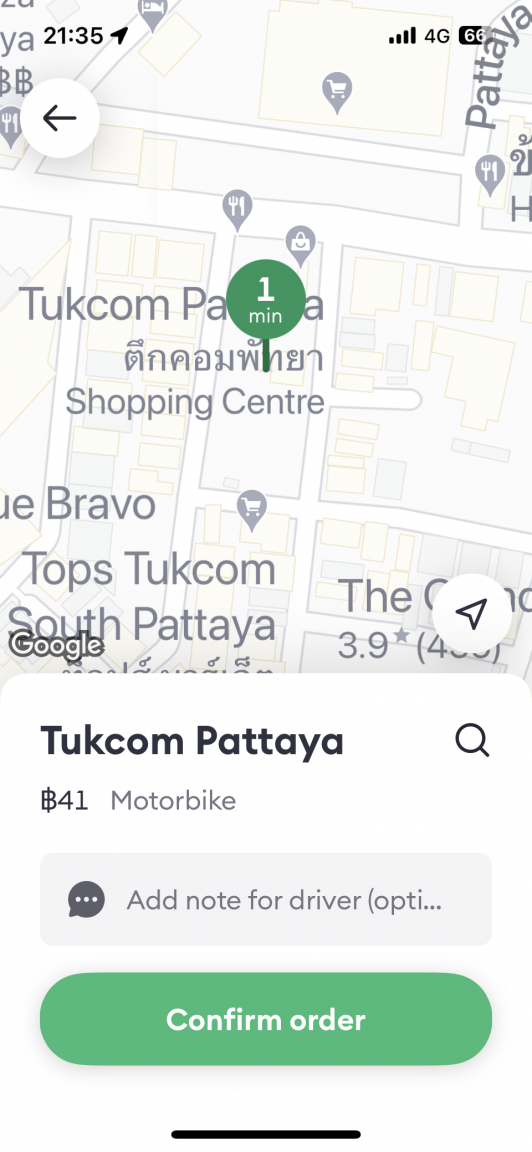

Guessed it might be, as you can see it’s approx 41b to Tukcom…

-

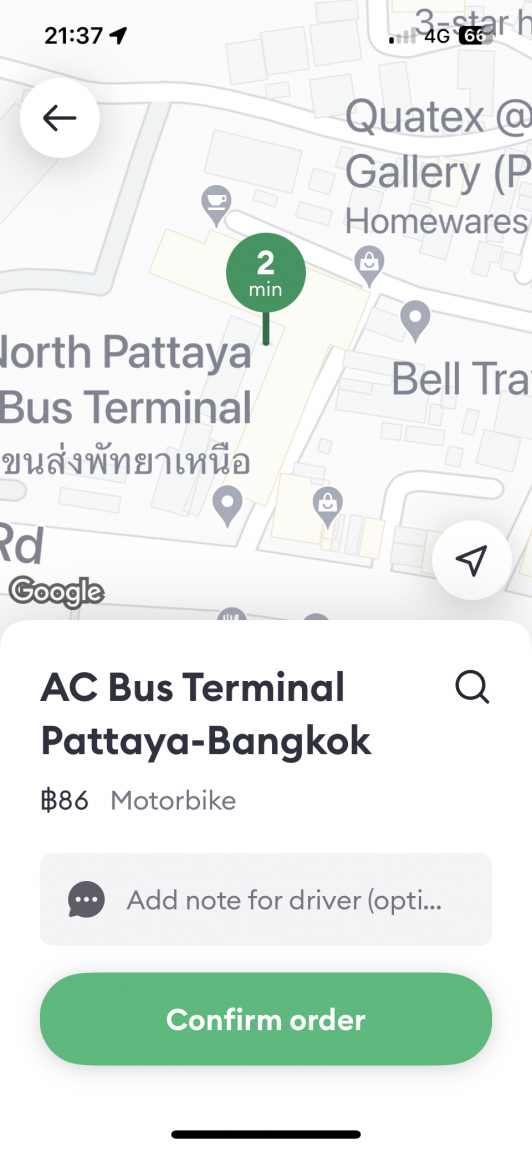

Where is P Dai? Example Bolt Motorcycle fare from Pattaya Nue Bus Station to Tukcom… 41B (sorry got it wrong way around). To Jomtien Night Market… 86B