Mike Teavee

Advanced Member-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Mike Teavee

-

Online Report . Room number.

Mike Teavee replied to DrJack54's topic in Thai Visas, Residency, and Work Permits

Just submitted my latest 90 Day report & like you I used autofill to complete my address details, Address format I used looks exactly the same as yours... ... and like you, never had a problem using this format in the past... Will be interesting to see if it is accepted. TBH I have until (Friday) 13th May & am heading to the UK on (Monday) 15th May so if it doesn't work I probably won't bother doing a report this time & start again on my return. -

UK tax status if permanent move to Thailand

Mike Teavee replied to keithkarmann's topic in UK & Europe Topics and Events

I'm assuming the OP's pensions alone will take them over the £12,570 personal allowance with any additional income attracting more tax so there are a couple of good reasons to be Non-UK Resident for Tax Purposes... No Capital Gains Tax on assets (excluding Property) sales, the CGT limit was reduced from £12,300 to £6,000 this year so a basic rate taxpayer will pay 10% on any gains over £6,000... Expect this limit to continue to reduce each year. Dividends, again limit was reduced from £2,000 to £1,000 this year (& will be £500 next) so a Basic Rate Tax payer will pay an additional 20% on their dividends (Higher Rate Tax payer will pay 33.75% & 39.35% if you're in the Higher rate additional bracket) -

UK tax status if permanent move to Thailand

Mike Teavee replied to keithkarmann's topic in UK & Europe Topics and Events

Yes you are still eligible to a UK Personal Tax Allowance but under certain circumstances (I doubt they apply here as the OP hasn't mentioned any other kind of Investment income apart from Rent) it can be beneficial to not take the Personal Tax Allowance and have other income considered as "Excluded/Disregarded" https://www.iris.co.uk/support/knowledgebase/kb/ias-10608/#:~:text='Excluded income'%2C also known,and you cannot override this. Once you have your Non-Resident for Tax Purposes status you can ask the company who manages your property to not withhold tax (NRL1 https://www.gov.uk/government/publications/non-resident-landlord-application-to-have-uk-rental-income-without-deduction-of-uk-tax-individuals-nrl1) You will need to complete a Self Assessment form for at least a couple of years, notes/guidelines here... https://www.gov.uk/government/publications/non-residents-and-investment-income-hs300-self-assessment-helpsheet -

Interesting, I was one of the early takers of the Virgin one mortgage (got mine in Jan 2000) & as you mentioned, the “current account” mortgage approach really helps to pay it off quickly. I’ve kept an approx £500 credit balance for the past 18 years as it means they’re paying me a tiny bit of interest but more importantly keeping my mortgage deeds safe for me + technically I have access to a 6 figure credit line any time I need it (though have no cards or cheques that I can use it with). Was a bit annoyed that I had to pay then £100 for a letter to confirm they were happy for me to rent my house out (had been in credit for 4 years at the time) but that is the only thing I’ve ever paid them since getting my account in credit. As an aside, my mate sold the house that he had a mortgage on with Virgin/RBS/NatWest approx 8 years ago & still uses that account for his banking needs in the UK.

-

Barclays moved me to Singapore (was working for them at the time) so knew that I was no longer UK resident... No problems keeping my Bank, Credit Card, Investment, ISA accounts open though I do use my parents UK Address for any correspondence / new cards. Up until a couple of weeks back, the only time I have used my Barclaycard since 2019 is for annual House Insurance renewal, & as it had expired last August I did have some problems getting the new one to work (not least the fact that it's not in my possession so I couldn't use it in the PinSentry reader), but managed to get it working using the Barclays Mobile Banking app (for which I had to have a UK Mobile number (GiffGaff) to get working though as far as I can tell they've never sent me any messages to it). My Mortgage is with Natwest (Was Virgin then RBS now Natwest I believe) and they are fully aware that I'm not living in the UK (& chasing me for my Thailand Tax Identification Number for the £2 pa they pay me in interest) again, I use my parents house for any correspondence. I think the OPs real question is which UK Bank will allow you to open a UK account if you're not UK resident & excluding Offshore / Channel Island type accounts, I don't believe any of the larger banks will.

-

Biggest International Pride Event to Take Place in Pattaya in June

Mike Teavee replied to snoop1130's topic in Pattaya News

I have 2 very attractive & kind lesbians living next to me, so kind that they bought me a Rolex for my birthday. I think they misunderstood me when I said... "I wanna watch" [Now that's a joke ???? ] -

I'm all for making life as easy as possible & if it's easier to pay more but do it locally then I'd have probably have done the same thing (as it was, at the time of getting my Non O I was working in SG & only able to spend 3-5 days at a time in Thailand so did a long weekend in Penang & used an agent there to get mine). I do pay an agent (in Pattaya) 8K to do my extensions (have 800K in the bank) so the price quoted for same in Phuket isn't unreasonable, 12.5K would get you an extension without the finances here. Yeah I could do it myself but I value time/stress free processes more than money so get an agent to do it plus get me my multi-reentry permit at the same time, this adds 4K to the cost so 12K all in, 1K pm, approx. 35b per day.

-

I think you quoted the wrong post but you are correct, with no finances in place, (In Pattaya) it's 23,500b to convert a Visa Exempt to Non-Imm O add in another 3-3,500b to open a Bank Account. @Lokiemight have mixed-up doing the conversion yourself & just getting the 90 day Non-Imm O Visa (after which you have to do the 1st extension in the same place that you got the Visa) with using an agent to do the conversion (which gets you the 90 day Non-Imm O Visa + the 1st year extension, so 15 months) after which you're free to do your extensions anywhere.

-

A guy I know does exactly this & it adds 2,500b to the normal cost for extending a visa without having the finances in place (i.e. it costs 15,000b in stead of 12,500b). One point to note is that he does have the finances in place (brings in >65K every month so qualifies on income grounds) BUT the agent won't (or is unable) to just "smooth over" the Insurance part so it's all or nothing.

-

If he can go out on 28th May he can get a direct flight on Thai Airways for the same cost as a Scoot flight (via SG) on the 2nd Bell can be booked online https://belltravelservice.com/ Roong Reung https://airportpattayabus.com/ can probably be booked via sites like 12go but you typically pay a premium for this that will probably make it more expensive than Bell. Should be no problem finding a decent room < 600baht for 17 nights e.g.https://www.agoda.com/sawasdee-siam-hotel/hotel/pattaya-th.html?finalPriceView=2&isShowMobileAppPrice=false&cid=-1&numberOfBedrooms=&familyMode=false&adults=2&children=0&rooms=1&maxRooms=0&checkIn=2023-05-28&isCalendarCallout=false&childAges=&numberOfGuest=0&missingChildAges=false&travellerType=1&showReviewSubmissionEntry=false¤cyCode=THB&isFreeOccSearch=false&isCityHaveAsq=true&tspTypes=3&los=17&searchrequestid=126c44e9-3e29-4186-846b-d5c327a41a66

-

I did a quick search on Mister Prakan for Health Insurance for a 76 year old and it looks like there are some companies that offer policies but as you would expect you will need to chat to them about the specific costs / coverage... https://misterprakan.com/th/health/main?lg=en You can put any email address in on the front page to see the providers, one thing I did note is that a deductible seems to be compulsory on all products & this ranges from 100K - 1Million THB.

-

Exploring the cost of living for retirees in Thailand

Mike Teavee replied to webfact's topic in Thailand News

I couldn’t agree more on both points & it’s especially galling when somebody in Philippines gets the annual rises but somebody in Thailand doesn’t (I know this is because of reciprocal social benefits agreements). I’m fortunate in that, through this forum, I learned that this would be the case & so had time to tweak my pension plans (still 10 years away from State Pension age) but can only imagine the shock for somebody who didn’t know & moved over here, did the “Right Thing” by advising DWP that they’d moved & after a couple of years it dawns on them that costs are going up but their pensions are staying the same. -

Exploring the cost of living for retirees in Thailand

Mike Teavee replied to webfact's topic in Thailand News

Thanks for this, I was trying to point out that the often quoted >183 days wasn’t the be all & end all when it came to being Resident in UK for Tax/NHS/Benefits/Pension basis… -

Exploring the cost of living for retirees in Thailand

Mike Teavee replied to webfact's topic in Thailand News

There’s nothing wrong with that, the Statutory Residence Test is not just spending > 183 days in the UK, in fact you can spend as few as 16 days in the UK & still be considered Resident… https://www.gov.uk/government/publications/rdr3-statutory-residence-test-srt/guidance-note-for-statutory-residence-test-srt-rdr3 -

Exploring the cost of living for retirees in Thailand

Mike Teavee replied to webfact's topic in Thailand News

Way too low, my last renewal (Age 56) for 3.5Million cover with 100k deductible & no outpatients was 30K, I can only dread thinking what it will be when o hit 60. -

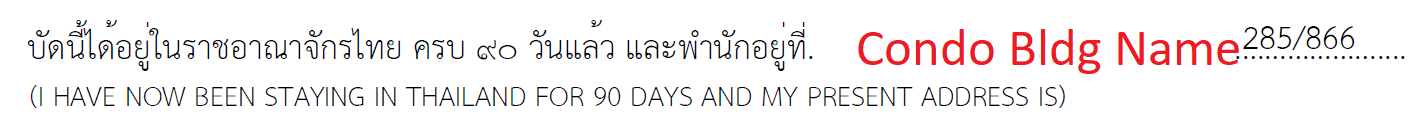

Bad form replying to my own post, but I should have added that the TM30 (Notification of an "Alien" staying at an address) which is what hotels (should) do when you check-in is completely separate from TM47 (90 Day Notification of Address). So you can find yourself in the (ridiculous) situation where you move home so go to your new Immigration Office & do a TM30 & then have to go back a week later to do your TM47!

-

I stayed in 6 different hotels on that trip, 1 in Chiang Rai, 2 in Chiang Mai, 2 in Udon Thani & 1 in Pai (which was the 3rd hotel we checked in ( + ended up doing a spur of the moment 3 night trip trip to Vientiane so as it turned out I didn’t need to do the 90 days) & all took photo copies of my passport, current permission to stay stamp & last TM6 so I’m assuming they registered me. But I’ve stayed in places like Hilton, Dusit, Centeras before & it’s never impacted doing my next 90 day report online. Nor have I ever needed to do a new TM30 when I eventually get back home (even after a trip Overseas).

-

I’m assuming you’re saying that FCO should be telling people to read their insurance policies to make sure they’re covered (& When they’re finished, maybe they could teach their grandmas to suck eggs). Book flights in Thailand, Insurance 99baht… Of course that covers me for everything that will happen… Whoops I’m not insured for falling off my bike whilst not wearing a helmet & with no license to ride it! - Damn those Insurance Companies ????

-

What Movies or TV shows are you watching (2023)

Mike Teavee replied to CharlieH's topic in Entertainment

Apologies if "Time Travel" wasn’t mentioned in this thread (Not that I said it was) but this isn’t the only Thread/Forum I read) but I have seen somebody post about getting confused by the “Time travel” parts Just wasn't sure why somebody would be confused over such a simple premise. -

What Movies or TV shows are you watching (2023)

Mike Teavee replied to CharlieH's topic in Entertainment

I don't understand the confusion or why people mention Time Travel (There wasn't any) - This was about Recurrence... To put it simply, we've all seen & understood Groundhog Day? So this was exactly the same premise but instead of it being a single day it was a lifetime. FWIW, I really enjoyed it from start to finish & felt the ending was excellent as it closed out the story in keeping with the storyline. -

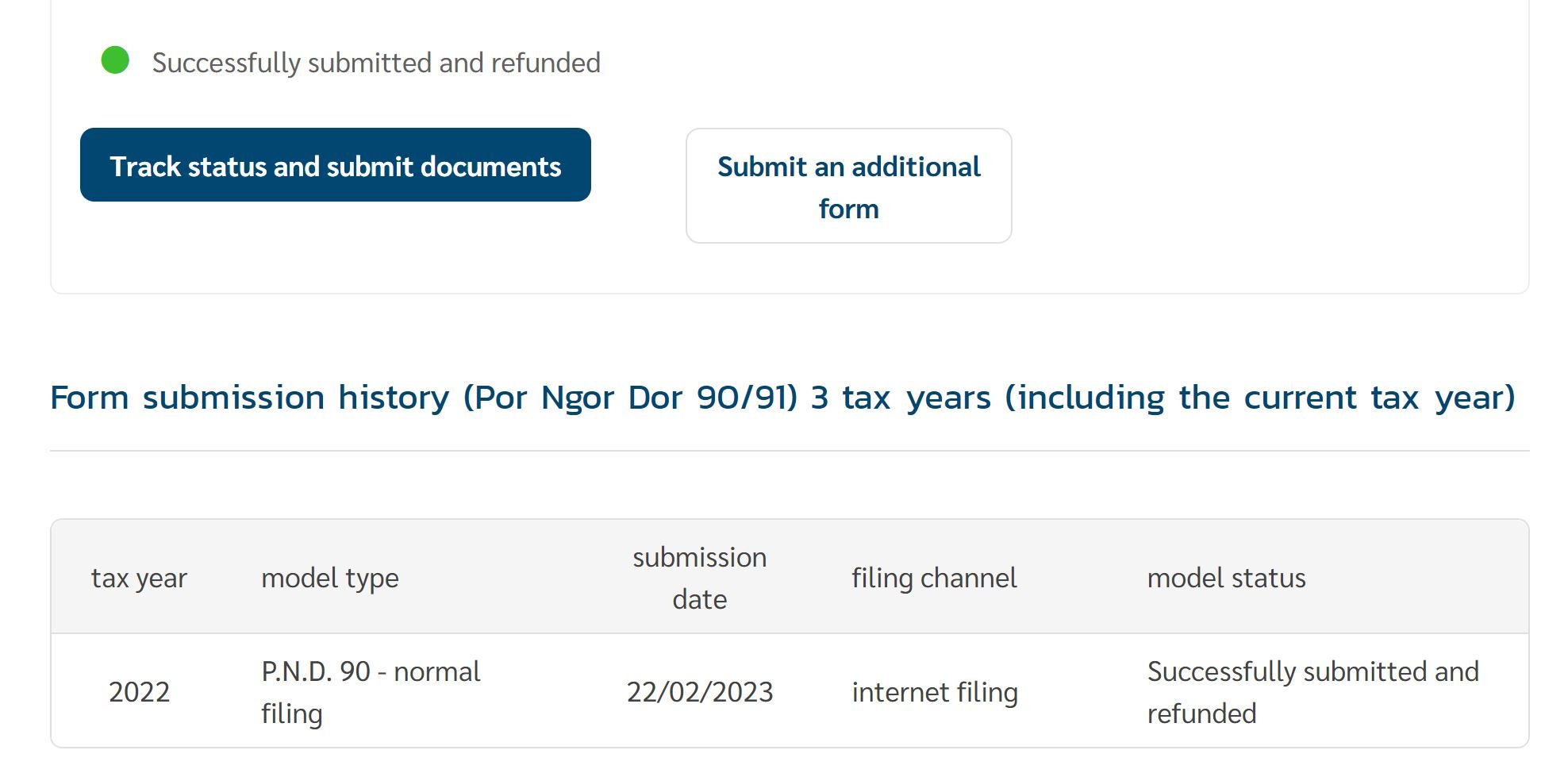

TBH It's only 4,320b but I needed to go through the process of getting a Tax Identification Number (TIN) as my UK Bank(s) are increasingly asking me for proof of where I'm tax registered (e.g. the Bank where I have my Mortgage seems to need to tell the Thai Revenue Department about the < £2 in interest they paid me last year!) Having jumped through the hoops of getting a TIN I figured I may as well try to get back the tax refund that is rightly owed to me, but it seems I might have brought more work on myself than it's worth ???? Will go into the office after Songkran to see what needs to be done to either get it sorted or cancel the claim.

-

Thanks, I'm 57 so the only income I receive is from renting out my UK house & profits/dividends from UK Shares, all of which are taxed in the UK (my accountant files a tax return for me every year). I don't bring money into the country in the same year it's earned (most of my income is re-invested) however I do regularly give my mate money (£2-500 per month + one-off £6,000 per year) in the UK & he pays me back in Thai Baht, so I'm guessing that might confuse things should they want to look through every transaction in my bank book. The GF is still away visiting family so I'll go back to the Revenue Office after Songkran & if I can't sort it out on the day will forget about it.

-

Can anybody help with the process for reclaiming Withheld Interest from Thai Bank accounts... So far I have... Registered for & received my TIN Obtained certificates of Withheld Interest from my Bank for the past 2 years. Registered everything in-person at my Tax Office who also set me up on the E-Filing system Before I went on holiday I checked the status & it said the return had been processed & a refund issued, came back expecting a chq but instead received a letter to say I needed to provide... Certificates of Withheld Interest (Already Submitted at the office but doesn't show on my documents submitted on-line) My Passport + a Photo copy of every passport page (Is this really necessary) Every Bank Account Book with a Photo copy of every page (Is this really necessary, surely the only thing they need are the certificates from the Bank). Certificate of No-Other Income in Thailand (rental income, commission etc...) - What is this? And how do I prove that I haven't recieved something! Sources of Income in the Country & Abroad together (Does this mean they want my UK Tax Return as well!) I've already giving them the 1st 3 at the office & will go back to re-submit them but what are #4 & #5 & how do you go about getting these? As an aside my status still shows Return Processed & a Refund has been issued ???? TIA MTV