The Cipher

Advanced Member-

Posts

715 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Everything posted by The Cipher

-

Health Ministry Prepares Serious Defense against Omicron

The Cipher replied to webfact's topic in Thailand News

A serious defense against...what tho? A variant that so far has zero confirmed (or even rumored as far as I've seen) serious symptoms, let alone actual kills? Pretty sure just living life in a normal body would constitute a serious defense here. -

Thailand’s English proficiency plummets: Survey

The Cipher replied to webfact's topic in Thailand News

Can't speak about engineering, but my (international) firm looked at doing an M&A deal with a Thai company a few years ago (was actually my first long-term exposure to the country). All contracts and conference calls were in English and that was the automatic expectation of both parties. I suspect that any kind of cross-border or international project will generally be conducted in English at the decision-maker level. There's just not much alternative, and my experience is that execs in Thailand are fully aware of this. As for why it's important for Thais to learn English, well - it's the language that will open up more of the world for them than any other language they could learn. Both in terms of spectrum of life opportunities and in terms of access to knowledge. Quick illustrative example: there are ~6,414,612 Wikipedia pages in English but just ~134,000 in Thai (2% of the Eng amount). Content quality tends to differ also, with greater detail in English. Sure that info might eventually be available on the Thai internet elsewhere, but good chance that it hits the English internet first. In an information economy, speed and volume of information are critical. It hurts the locals if they have to wait for info to slowly be reproduced in a language they can access. -

Mandatory quarantine required again?

The Cipher replied to Neekerikuningas's topic in Thai Visas, Residency, and Work Permits

You're right, but when have international travel restrictions on Covid ever been logical? Since waaay before the Omicron hype machine even existed plenty of nations with community transmission had lengthy quarantines on arrival in place. Restrictions go up quick but come down slow. -

How Long Before Chinese Warships are Docked in Sattahip ?

The Cipher replied to AwwYesNice1's topic in General Topics

15 minutes, give or take.- 150 replies

-

- 12

-

-

-

Move to Thailand permanently with 20M baht.

The Cipher replied to MrAscii's topic in ASEAN NOW Community Pub

Sorry in advance about shredding you but...the question asked was actually really prudent. How many posts on this forum do we get from retirees living in quiet desperation (they may or may not realize this, but anyone who knows what to look for can see it) because they didn't adequately plan in earlier life. It's folks worried about changes of a few bps in exchange rates or stressing about unexpected new costs (see: any thread related to insurance). Not sure if OP qualifies as 'rich' but the fact that he's actually interested in planning for his future shows that he's brighter than the YOLO category of retiree. In reality wealthier people tend to be involved in extensive financial planning because they ask themselves the questions that (many) normies don't know that they should be asking too. So uh, gonna flip the script on you rq and say that the fact that you think this was a dumb question actually tells your future. ???? -

Move to Thailand permanently with 20M baht.

The Cipher replied to MrAscii's topic in ASEAN NOW Community Pub

To clarify, I also stress tested OP's portfolio under a 3% net real return assumption using the original assets of ฿20M and with the requirement to last through age 100. A stress test that, incidentally, the original portfolio failed. (Then OP turned out to have at least double the originally disclosed assets, so all's well that ends well.) In general though I'm aware that some retirees shouldn't necessarily be taking material amounts of equity exposure risk and I try and stress suitability in every piece of advice I give here. ---Warning: Going down the rabbit hole for a second--- Retiree portfolio positioning at this time is actually pretty challenging. A lot of people forget that cash is actually an asset class, and that cash heavy portfolios are going to be pounded by inflation in the short term (possibly for the next few years), doubly so for people whose pensions are fixed and don't track inflation. So staying in cash has risks (guaranteed loss in purchasing power). But we're looking at more restrictive policy at an uncertain future time, which tend to be negative for bond prices, equity values, and other risk-on assets. If tighter policy is slower or inflation higher for whatever reason than expected, you almost have to move up the risk curve to try and beat purchasing power loss. But a lump-sum allocation now, at values that may be elevated, followed by a rate rise or any kind of pullback shortly thereafter, would also be painful. Especially on the shorter timeframe that older people have to work with. I tend to think that the right move for a retiree who has missed the preceding bull run to this point would be to dollar-cost-average their stash into a diversified mix of traditional assets over the next few years (can be as simple as an 80/20 portfolio) , with specifics dependent on their individual financial situations. But the real lesson here should be: educate yourself on basic financial management and start investing early - tell your kids. -

So I actually had this (almost) happen to me in Thailand last year but have never had it happen in any other country. When I flew into Bangkok in December of last year I had an Omega in my backpack that was purchased in 2015. Wasn't even on my wrist. On the final security scan before leaving the airport, customs officer pulled me aside and went through backpack to find watch. Then asked a ton of questions. Finally let me go because I showed him some wear on the back of the watch, but I'm pretty sure also because convo was heading into more complex English and dude just didn't want to deal with it. When I fly back into Bangkok in a couple of weeks, I'm leaving that sort of stuff at home. This sort of import tax in general is dumb, but if someone has a suitcase full of new lux goods like ok fine. But like, trying to impose tax on a small numbers of items for personal use is stupid.

-

Move to Thailand permanently with 20M baht.

The Cipher replied to MrAscii's topic in ASEAN NOW Community Pub

This comment is not specifically directed at you and I am aware that you just answered the question that was asked. But sometimes I read the investment threads on this forum and I am concerned that incomplete information can actually be worse than no information. For example I see a lot of questions that are really rudimentary - and there's nothing wrong with that! - but the answers to these questions rarely consider the suitability of a recommendation made, which could be problematic. And because the posters aren't experienced investors, they don't know what they should be asking or the risks they may be assuming. Accordingly I've also noticed that there's a tendency to look at shiny return numbers without understanding the actual properties/characteristics of an investment. Also potentially problematic, and especially so for retirees. Sometimes I muse about the idea of holding a little 'investing 101 town hall' for retirees, to give an overview of the foundational principles of portfolio management as well as an introduction to the various asset classes and their characteristics. Would also be able to answer questions then too. I've wanted to do this for the local Thais also, but language barrier would be a bigger issue there. -

Move to Thailand permanently with 20M baht.

The Cipher replied to MrAscii's topic in ASEAN NOW Community Pub

ETFs that track broad market indices should get you to 5% net while providing portfolio diversification. Average annual return of the S&P 500 has been approx 10%, and average annual return of MSCI World has been approx 11%. Those numbers are gross, but net would've still returned above 5% most years (and on average). Equity volatility is generally higher than fixed income, so if you're thinking in terms of 'interest' then the asset class might not be for you. Would need more info on your situation to go into specifics. -

Move to Thailand permanently with 20M baht.

The Cipher replied to MrAscii's topic in ASEAN NOW Community Pub

This new info materially changes your case. If you could double your initial ฿20M by hitting the exit button on a biz, then you're good to go. You can try and run it if you want, or you can take the event income and straight retire with total (disclosed) assets of approx ฿40M - easily enough to withstand the stressed returns case in the quick financial model I built lol. Personally, I'd try running it first (since it sounds like you're good at it) and if it's too stressful or difficult to run from abroad, exit while the biz still has value. --- Quick final note: be careful with what you invest in and the advice you listen to. For investments, diversification and downside protection are your friends. You don't need to (and shouldn't) be speculating on risky investments with a material amount of your nest egg. Broad market exposure is fine. I wouldn't play in crypto or speculative momentum positions with more than 5% of a retirement portfolio of your size - just too risky. If you become a good enough trader to move up the risk curve, you'll know. For income, if you have a ton of free time in retirement and understand websites well, maybe look at starting your own niche website and earning some affiliate commissions. Indonesia's a growing market these days and there's bound to be increased demand for content in the local language. At the worst case it'll be a hobby that helps you pass the time. Best case, it'll throw off way more than a living income. If you incorporate overseas and earnings never directly hit a Thai bank account, I don't think you'll have any issues - but this isn't legal advice. If you have concerns about legality then consult a lawyer or other expert. -

Move to Thailand permanently with 20M baht.

The Cipher replied to MrAscii's topic in ASEAN NOW Community Pub

Can u keep running the company from Thailand? And/or are your programming skills current enough to possibly freelance or pick up a remote job? Focusing only on the financial side of your question (since that's what I know), ฿20M is probably enough to retire to Thailand but it's something that I'd advise you to think really carefully about. Assuming no income and only nest egg, you'd want to feel confident that your pot of capital could reasonably see you through old age. You're 45 now, so you'd basically need to feel confident that it could last the back half of your life. I quickly ran some spreadsheet cases, and if you earned a 4.25% net real return (after trading costs, taxes and inflation) and spent ฿70k/mth you'd be able to go indefinitely without touching principal. But if your net return drops below 4.25% or your costs run above ฿70k/mth (both inflation adjusted), then you'd start drawing down principal. In a scenario where, let's say, inflation runs hot and/or markets run cool and you earn a real net return of just 3%, you'd be net worth negative at age 87. I don't think that'll happen but if it is something to consider. Too many people seem to retire without considering that the world of tomorrow might be materially different to the world of today. All of that is a long winded way of saying that you can probably retire but there would be some risk. If you can continue earning income to grow your capital for a few years, that would be the best. For example if you retire at age 50 with ฿25M, you'd easily make it through 100 even in the 3% return case. There's a lot more remote jobs now post-Covid so you might be able to pick one up and live in Thailand while still working. My gf and I both work remotely from Bangkok for part of the year so it's definitely possible! -

Move to Thailand permanently with 20M baht.

The Cipher replied to MrAscii's topic in ASEAN NOW Community Pub

Need more info. What's your profession/employable skills; how much Thai, if any, do you speak; is ฿20M a net amount after relocation costs (including potentially living costs for several months) or a gross amount, and is it freely available for investment? If so, what sorts of investments were you looking at? In theory if you use ~฿1M as relocation capital and invest the remainder of the ~฿19M earning an average return of 5% net of trading costs annually, you'll be able to throw off income of ฿900-950k per year or ฿75-80k per month before taxes without touching principal. That's enough to live an okayish life. This is just based on quick spreadsheet math and is a smoothed model, so actual annual performance is gonna be more volatile. Generally choosing to relocate to a place that you visited once is probably not the best idea unless you're really in a rush. Maybe make another visit and spend 2-3mths on location before making up your mind.- 122 replies

-

- 13

-

-

-

-

Is this intended as a response to me? I'm not even an anti-vaxxer, I just don't feel the need to evangelize to the tune of hundreds of comments per day to satisfy my own self-importance ????. Was gonna bounce outta this chat but I guess I'll address this quickly in case it is regarding my comments. I'm actually Canadian by nationality and not-a-white-person by ethnicity (ie, I get to check the minority box, so um check your privilege I guess). Just to bust that narrative rq.

-

Tell you a secret. Well, maybe a couple of secrets. 1) You're not arguing against what I said, you're arguing against what you think I said because your position has become reflexive. I'm not an anti-vaxxer, ergo I care a lot less if the unvaccinated are subject to restrictions (no effect on me) than I do about general restrictions (significant effect on me). Preferably nobody would be locked down, but generally if it doesn't affect my quality of life = I don't care. ????♂️ 2) About 18 months ago now, I realized that it's a total waste of time to seriously argue a Covid counterpoint or to swim against the policy current. I might disagree with restrictions but am I gonna change even a single person's mind by arguing (especially on a message board like this where nobody has any influence) or by going outside to fight the government? No. Way more optimal use of time has been to build additional scalable sources of income and to learn new skills. People may agree with me or disagree with me or absolutely hate my guts re: topical issues, but as long as they pay me I'm pretty fine each way. If I still feel strongly about this in a couple of years it would be more meaningful to use the additional funds and credentials to bolster a political run or participate in discourse at a level that has a more meaningful chance of affecting the direction of policy. Not really sure who this comment is for now that I've written it. Maybe it'll turn the lightbulb????on for a lurker, although this ain't really the right audience. It's written now though, so I'll just hit 'Submit Reply.' ????♂️

-

Oh darn. Ok, I'll fish for a ‘like’. Here goes: I'm not particularly concerned about others and object to the impact of the lockdowns on me personally. I'll spare the audience hollow words of concern but will fill my statement out by being vaccinated and encouraging others to do so (just get it over with). However if people at this point are unwilling to be vaccinated, I will continue to occasionally (but strongly) object to the massive costs and inconveniences of lockdowns. I would support mandated vaccination and/or the higher death rates (within a threshold) of just living with the virus, but lockdowns at this point are ridiculous and the worst of all possible options.

-

To clarify: I've been fully vaccinated and think others should get it too. If only because full vaccine saturation gives gov one less excuse to lock down. Nevertheless, the situation is ridiculous and I'm calling it out.

-

This is a uncharacteristically bullish take from you, since this is what happened to the stock market since 2007.

-

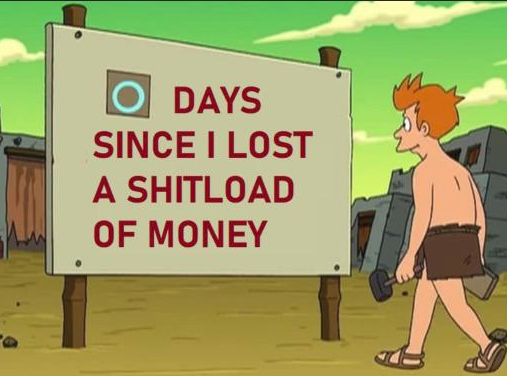

I find comments like this ridiculous. No one chooses to make bad choices. To most people they just happen. Sometimes it's bad luck and sometimes it's lack of knowledge. Is it ridiculous? Where's the lie tho?