The Cyclist

Advanced Member-

Posts

2,192 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by The Cyclist

-

How DTA's actually work is immaterial to Thailand complying with Tax avoidance / evasion measures pertaining to CRS. Reportable does not mean taxable, it means checking that the appropriate taxes have been paid on the money remitted into Thailand., and still able to comply with DTA's. And in that sense, pertaining to tax avoidance / evasion, the word reportable is entirely appropriate

-

Sure, I agree, and a couple of estates have been danced around on the subject. And that has been the understanding, including by me, of what the deal was in the past. But the past is gone and we move on. And in the past 18 months Thailand has joined CRS and issued 2 POR's, and as I have pointed out previously on the thread, this makes total sense from a tax evasion / avoidance point of view CRS primary function being the detection and avoidance of tax evasion / avoidance. And I really do not see who Thailand can comply with CRS if this income is not declared.

-

No its not. It's money that moves across CRS borders that is of concern. The money I earn in the UK, pay tax on in the UK and stays in the UK is of no concern to CRS. Now remind me again, the reason why Embassy income Affidavits were stopped ? Was it not because people were caught lying about their financials ? Too much of a stretch to imagine that people might also be lying about the source of their income to avoid / evade tax. Especially those that remit income through platforms like Wise etc.

-

Wow I can read the form, I know what it says. I also know what the lady at the RD Office filled in and posted it on here. So keep sniping away to your hearts content. What you say is of no concern to me. I'll listen to what someone at the RD Office says. Or are you going to astound us all, and tell us that you actually work for the Thai Revenue Department ?

-

Which contains Pensions, agreed. I'm not disagreeing, but I am looking at from a Reporting / declaring angle, rather than a taxpaying angle. In the case of the UK Government Pension the word Exempt is not used in the DTA. The DTA also does not exempt from declaring / reporting that Government pension to comply with Thai Tax Law. A P60 attachment would cover the shortfall in Box B. The updated PND 90 / 91 might have that information, but would still require a paper submission to prove it. Possibly, possibly not.

-

Neither have I, but guess what, I will comply with what my local RD Office advises. Just like I comply with my local Immigration Office, who appear to have slightly different rules from other Immigration Offices. If there is 2 Offices that I'm not going to go out of my way to upset, it will be the Tax Office and Immigration Office

-

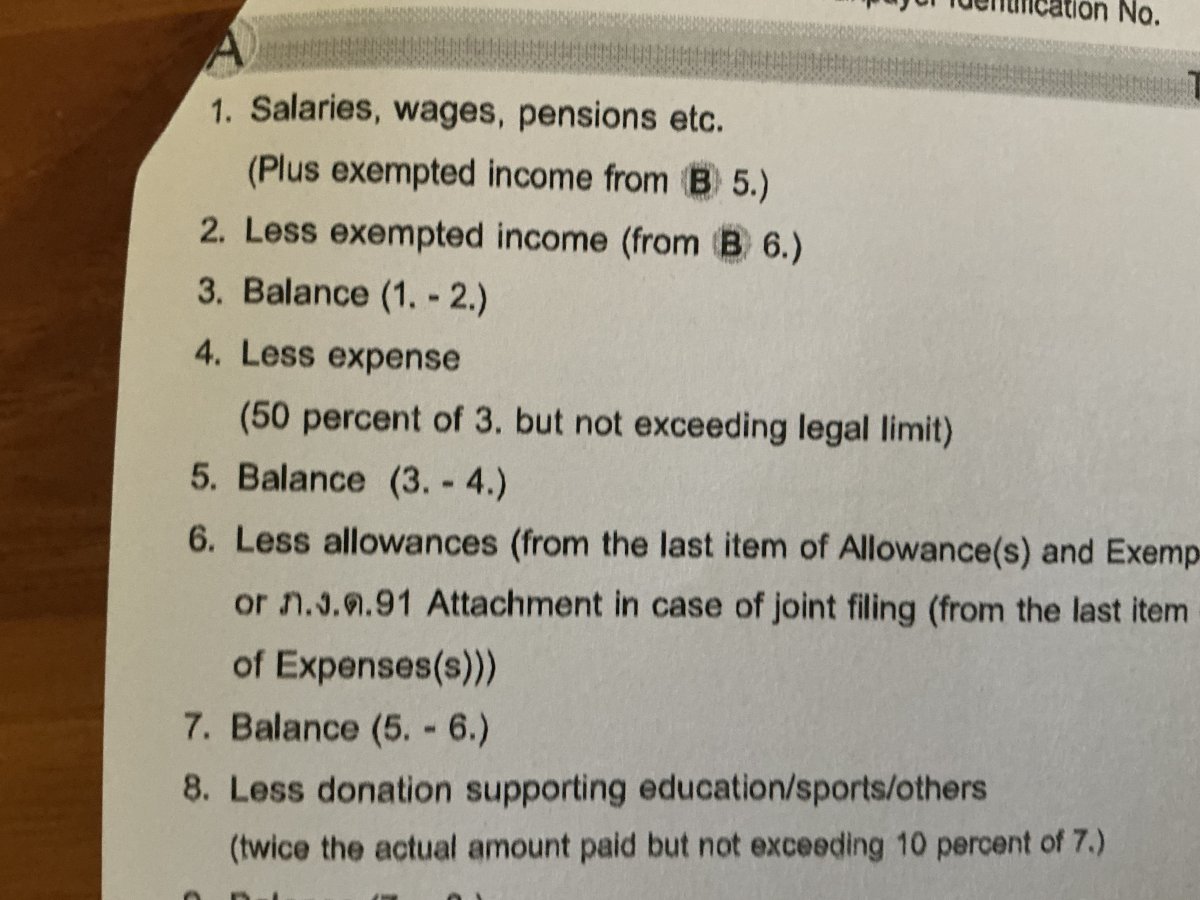

I haven't filed anything, yet. I went into the RD Office, as I was at the car testing station, which is next door to an RD Office, to explain my remittances ( UK Government Pension ) into Thailand and ask if I needed to file anything. Her answer was yes. She then went and printed off a PND 91 and filled it in for me in pencil, to use as a template. She again reiterated that I had to file and could do it at the small RD Office, rather than going back out to the large RD Office. Box 1 - Annual figure remitted Box 2 - Same figure Boxes 17, 19 & 20 - Zero tax to pay. Easy and straightforward

-

If you go back to my post of Monday, followed up by the more detailed post I made on Tuesday. The lady at the Revenue Office on Monday, on a PND 91 Box 1, Salaries, wages, pensions etc, - put my total annual remittance. After a bit of back and forwards Box 2, Less exempted income - Same figure as box 1 Box 17, 19 & 20 - Put a zero. She told me that I had to file, and this is how I need to fill in the PND 91. I know, understand and accept that none of us have done this before, myself included. I can also hold my hands up and say that right up until Monday, I was also of the opinion, stick with the status quo and dont bother filing. I have now changed my mind, based on the 3/bullet points that I posted in response to @chiang mai on the previous page.

-

No rant, just laying out facts. As they pertain to this Labour Government, and previous Labour Governments. Here is another fact. Big Broon ( Not the Labour Party ) has one notable achievement from the 1997 - 2010 Labour Government. Despite the wishes of the Labour Leader, Blair, he kept the UK out of the €. A tremendous achievement, and one that we should all be eternally grateful for.

-

The thread is about Kier Starmer Leadership, and by extension of that Leadership, the cluster that is currently befalling the UK under the Labour Stewardship. You might want to start your own " Have a rant about the Tory Party Here " thread. Otherwise people might think you are here to deny and obfuscate.