The Cyclist

Advanced Member-

Posts

2,156 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by The Cyclist

-

Yes, that was my understanding right up until today And it takes my back to the Op Which I have previously said makes complete sense to me from a tax avoidance / evasion perspective. The PND she gave me, appears to be the same one for last year, but I didn't study it in detail. I'm still mided to do nothing and file nothing, I will make a decision when 2024 tax filing forms go on the TRD website. If they do not have a separate secrion for non - assessable income. my original plan goes into play. bank printout / P60 / statement of future payments into an A 4 envelope and filed in a drawer for safekeeping.

-

Pak Chong. And here is the kicker. I am not convinced that she knew what she was talking about. Despite me going through the DTA and not being taxable in Thailand. She initially started talking about the UK tax already paid and Personal deductions and showing me how these should be put on the form. Perhaps just how they work, but was totally stumped when I asked what difference any of that made when the top line figure is not taxable. Blank look. So I am hoping that the updated PND 91 has a separate section for non - assessable income or the small RD office gives me the same answer as last year. I am now currently in limbo until the new PND's are released into the public domain.

-

Which is the information that I got last year from the small Revenue Dept Office. This morning I went to bank for annual printout. Took car for its annual inspection and went into the big Revenue Office, which is next door to the testing station. Different info. Where I was told that I do have to file, even though not taxable due to DTA. Nice girl filled in the PND 91 in pencil for me, where the figures need to go. I'll post a photo when I get home I dont think the PND 91 is an updated version, so I wont actually be doing anything until an updated PND 91makes an appearance. She did tell me to file at the small office, rather than coming back out to the big office. Interesting times indeed.

-

Go woke - Go broke Really nothing more to say.

-

Yes, I get that, and that is not in dispute. Americans also have FATCA that they have to comply with, or whatever is called. We can ignore Americans for the rest of this post. Up until Thailand adopted CRS ( The OECD equivalent of FATCA ) There was nothing for other Western Nations to comply with. They now have CRS to comply with if they move monies across CRS Country borders.Given the main aim of CRS is the avoidance and detection of Tax evasion / avoidance, a system that was not a closed loop did not really make sense to me. Which is why I said right at the start. The people who who remit money through things like Wise and other platforms will probably have some explaining to do. Not so with people who direct deposit to a Thai Bank account things like Government Pensions, or others exempt thai taxation by way of DTA. Very easily checkable, the transfer code will tell the bank, the RD what the transfer is for. A transfer code that includes Paymaster is a Government Pension. A transfer code that includes DWP will be a State Pension. Private Pensions will use a transfer code that is specific to the Pension administrator. The above is UK specific. I would be surprised if other Western Nation was not using something similar. I dont have a Thai Pink ID, Neither do I have a Thai TIN and I also will not be filing a tax return as my understanding is that I have no need to file a tax return, due to my remitted income being exempt Thai taxation bynway of DTA. I was merely pointing out, that from a tax evasion / avoidance point of view, this makes sense. Not that I am saying that the article is correct, only that it makes sense from a tax evasion / avoidance angle.

-

The Tories ? Here is just 1 case that was reported to the Police in 2003.. I will say that again 2003. https://www.bbc.com/news/articles/c8rxp6jv77xo Taken from the The Executive Summary of Professor Alexis Jay That would include members of the Police, members of Labour run Councils and members of the Labour Party, including a former DPP who is now the Prime Minister.

-

No, I meant the lunatics that do not believe that there was a Labour cover up, some of them posting on this thread. The criminals are the ones who ignored the Children and their parents. I wont bother listing them, I believe both the Jay Report and Maggie Oliver have both provided extensive lists, that carry far more weight than I do.

-

YouGov Complex Start to Labour’s New Era in 2025 Public Opinion

The Cyclist replied to Social Media's topic in World News

Of course it is https://www.theguardian.com/business/2025/jan/02/uk-factory-output-falls-at-fastest-rate-since-february-amid-tax-rise-fears Time to open your eyes and face reality. -

YouGov Complex Start to Labour’s New Era in 2025 Public Opinion

The Cyclist replied to Social Media's topic in World News

That misery will not start until April, for the reasons that I highlighted above. But in the 6 months months that Labour have been in power, GDP growth has went to zero and probably negative. Not bad going considering GDP growth Q1 & 2 was 1.2% -

YouGov Complex Start to Labour’s New Era in 2025 Public Opinion

The Cyclist replied to Social Media's topic in World News

The damage caused by the Labour budget of October 2024. The full effects will not be felt until April, when the 1. Rise in minimum wage kicks in. 2. The rise in employer NI kicks in 3. The reduction in NI threshold from £9000 down to £5000 kicks in. And people start losing their jobs, and the double whammy of less tax reciepts and more welfare benefit payments kick in. Its not rocket science or hard to work out. Unless you are Rachel from Customer Complains -

YouGov Complex Start to Labour’s New Era in 2025 Public Opinion

The Cyclist replied to Social Media's topic in World News

Starmer & Reeves will be gone by June at the latest. Streeting and Rayner are already positioning themselves. It will be too little too late. The damage will have been done and will be irreversable. IMF bailout to follow. -

- 49 replies

-

- 12

-

-

-

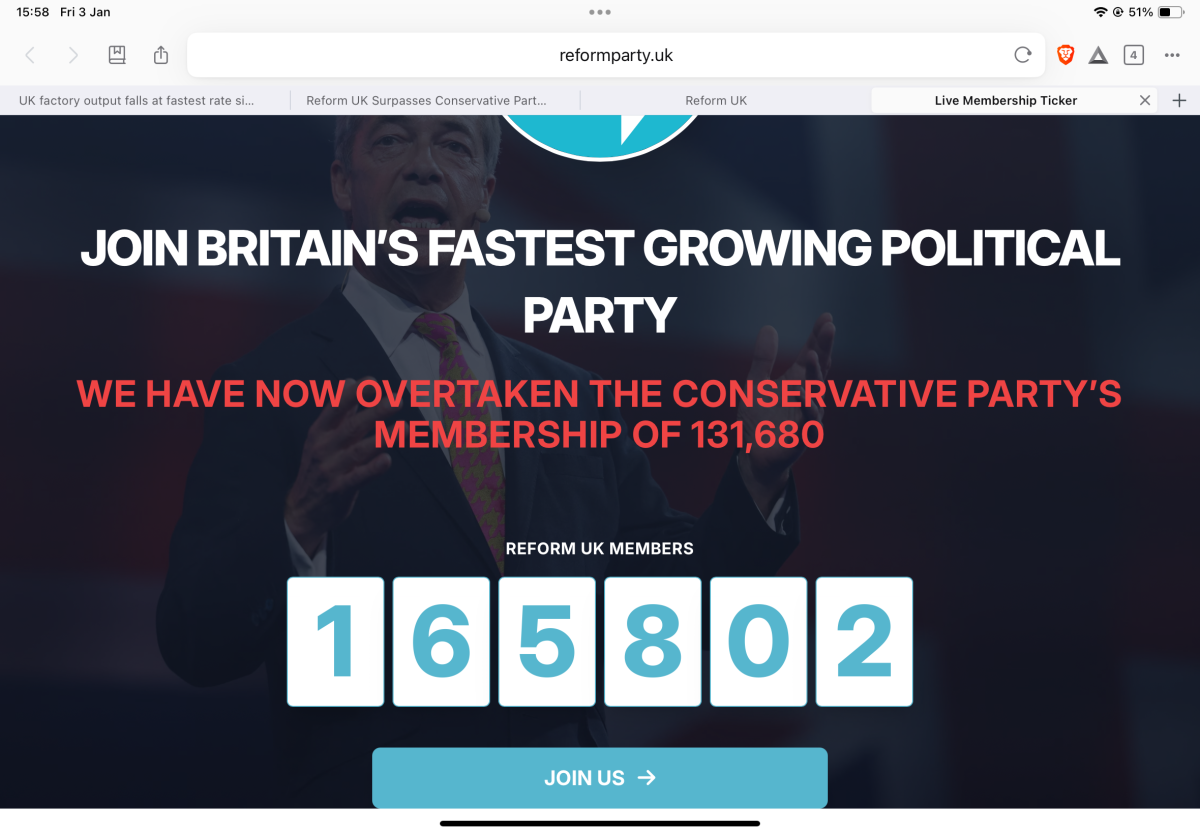

Reform UK Surpasses Conservative Party Membership in Landmark Shift

The Cyclist replied to Social Media's topic in World News

I think a couple of posters need to park Utopia and start facing reality Just like I said on the previous couple of pages. https://www.theguardian.com/business/2025/jan/02/uk-factory-output-falls-at-fastest-rate-since-february-amid-tax-rise-fears As for the actual thread, Membership is still rising -

It was covered up in the 90''s The current taskforce was set up only 2 years ago, and have arrested over 500. That you are trying to put forward deflection and obfuscation over this National Shame. Speaks volumes about you. Are you going to come charging out the blocks and say that this is fake news ? Or are you going to revert to type, and claim that it is a personal attack on you ?

-

Why is Musk on the warpath These are just some of the gangs convicted, not the full list. Under the current Taskforce, a further 500 individuals have been arrested. The current Government will not allow a National Inquiry into this sick scandal, as Labour are neck deep in the cover up. Any right minded individual should be going nuts at what has happened here.

-

Keir Starmer and Elon Musk Clash Over UK Investment and Policies

The Cyclist replied to Social Media's topic in World News

6 months in and its all falling apart for Starmer https://www.thetimes.com/uk/politics/article/twenty-labour-councillors-quit-over-keir-starmers-policies-knz6hcrs8 Starmer is a liar, incompetent, and makes turnips look like MENSA members. -

As I said before. There will be many, many expat retirees who legitimately have no reason to file a tax return. There might also be a large number of retiree expats who might have to file a tax return but have no tax liability. So the tax clearance certificate for extension purposes, would not work in theory, and it is not something that I have I seen mentioned from any other source, other than a couple of posters on here. Whilst it could be something that is introduced, they would also have to introduce something that covers the people mentioned above. Therefore it is not something that I envision happening until such times as they make a decision and then impliment worldwide taxation at some time in the future / if ever.

-

I have no horror stories to recite over Immigration. My single visit to the RD Office was polite and rather easy. I would take all my paperwork, a box of doughnuts, puppy dog eyes, a Thai speaker if needed and simply ask for assistance. I'm sure someone would assist you, rather than paying 15k baht or so, to an accountant.