-

Posts

15,336 -

Joined

-

Last visited

-

Days Won

7

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by ukrules

-

Not a chance. This is indeed the issue which prompted me to relocate to Cambodia for most of 2024 Savings is funds from prior to Jan 1, 2024 or in a year after 2024 prior to you becoming a tax resident - now this is the important bit if you already live here in Thailand - also in subsequent years where you are not a tax resident. Everything else is income or partial income (mix of old savings and interest payments compounded over time) and I believe if audited they will want to see the source of the savings and will perhaps according to some people want to look back as long as 10 years - or THESE DAYS that seems to have been reset to Jan 1 2024. So it won't be too much of an issue for now but as the years go on it will be an increasing burden on people living here.

-

Reinstall image using the Paragon software.

ukrules replied to John Smith 777's topic in IT and Computers

I haven't used it but asked an AI about the procedure and it seems it required USB booting into a special recovery OS in order to do the recovery. Are you in a situation where you've lost a disk and hence all the live date and replaced the computer with a new one? -

coming to thailand in february for 6 months

ukrules replied to parafareno's topic in Thai Visas, Residency, and Work Permits

I've been asked and it was the one time I had a one way flight into Thailand with no planned exit AND no valid visa. Coincidence, perhaps? I had a special letter with me from Thailand Elite explaining in English that I will be met at the arrival gate and taken to immigration where a 5 year visa would be inserted into my passport and I would be admitted into the country with a 1 year stamp. At the end of the day that's all they care about - that they don't have to transport you back without a booking as it becomes an issue for them. -

coming to thailand in february for 6 months

ukrules replied to parafareno's topic in Thai Visas, Residency, and Work Permits

Yes they do and if you don't have the right type of visa they may deny boarding so better to have some kind of onward travel ticket. -

This is not correct, it does not matter what anyone else has written on this forum.

-

lol

-

Not really, I use Kraken in the US. Nothing Thai involved at all. I would however like to read this law which specifies that foreign purchased crypto assets are taxed using a cost basis of zero Baht instead of the actual cost.

-

You're not allowed to do that any more 🤣

-

Is the harsh criticisms of Sir Keir Starmer fair and justified

ukrules replied to Rimmer's topic in Political Soapbox

Right, just like Boris, Liz and Rishi 🙄 -

When I paste am getting tiny letters I cant read

ukrules replied to 3NUMBAS's topic in Forum Support Desk

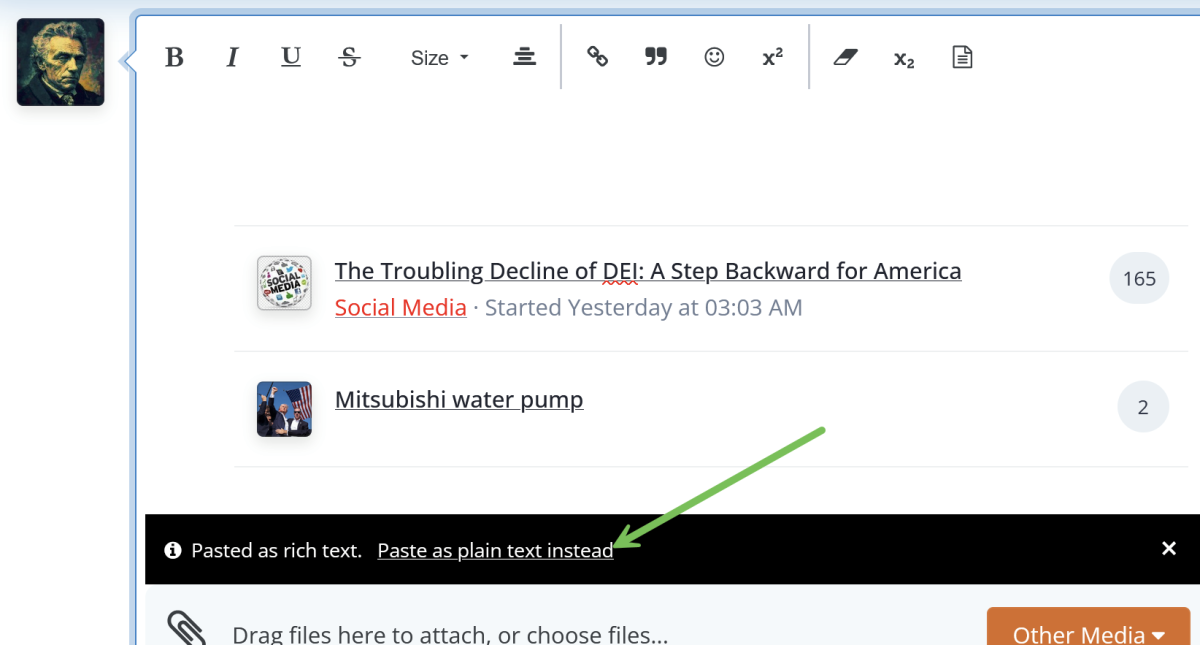

When you paste something it brings fonts with it but you can get rid of them by clicking the 'Paste as plain text instead' thing that pops up at the bottom in the black line. This is on the website version - here's a sample screen shot - click the link at the end of the arrow : -

Thailand as a Future Destination for Relocation

ukrules replied to kevozman1's topic in General Topics

I've been here since before 2010, easily doable. -

Thailand as a Future Destination for Relocation

ukrules replied to kevozman1's topic in General Topics

So what? You don't need to mix with such people. Avoid the absolute dumps of places and you never see all the above. -

What they're speaking of here is not what you think it is - an 'Enrolled Agent' for the IRS does not work for the IRS. It's an approval rating for a tax accountant granted by the IRS and must be maintained with some ongoing training, etc. Similar to a CPA but with more focus on taxation issues then general accounts - that is my understanding. They are not employees of the IRS.

-

Additional Visa Requirements ?

ukrules replied to Rich the Robin's topic in Thai Visas, Residency, and Work Permits

Unless you want that stamp, some people like it to prove travel history in various contexts, including Thais. -

Well the initial policy was created by a memo back in the 1980s and then rescinded with another memo in 2023. I believe they attempted to go after someone going against the grain of the 1980s memo but failed in court - and that's what made it official. I'm still expecting someone to challenge this new memo / series of memos but that might take a very long time. You are completely correct though - they alter their interpretations of the laws by issuing memos here.

-

"Climate Change" is causing the LA fires...or is it?

ukrules replied to connda's topic in Off the beaten track

What do you mean? Some of these devices were placed in the wrong locations, the others would have been burned and melted. There were fires. -

"Climate Change" is causing the LA fires...or is it?

ukrules replied to connda's topic in Off the beaten track

I've seen images of simple little devices found around raging forest fires which are designed to start them. They consist of 2 or 3 'twig' like branches of wood from trees stuck into the ground and have a magnifying glass held in place on them - they hold it in place perfectly to focus the sunlight when it comes the next day. These are found in many places where wildfires 'break out'. Some of them fail and they get found but I can not find the images on the internet anywhere these days - they have been 100% scrubbed from existence. Now I guess it's not a great idea to provide instructions to would be arsonists but this is the level they are operating at - for many many years. -

It's a little nuts, but then again - in this show so is the John Brown character.

-

British Skincare Brand 'The Body Shop' to Close All Thai Stores

ukrules replied to webfact's topic in Thailand News

Something similar happened back in late 2023 just weeks before it went into administration. Seems a little odd. -

Indeed, this guy went from a bit part actor to a major script writing machine including big hits like Sicario and it's sequel.

-

Have you watched 'Deadwood' and 'The Good Lord Bird'. This one reminded me of Deadwood in a way. One thing about this American Primeval is that it is largely based on real events with fictional details added of course to pad it out. Things sure were brutal back then!