-

Posts

10,604 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sometimewoodworker

-

Also watch a few pressure washers in action on YouTube

-

It very much depends on your future use case this will do to test the waters it will cost less than 2000 baht there are various different names on Lazada after that we spent over 20,000 with attachments for this, the base machine is about 16,000 but then there are extras. It depends on the size of the roof and the length of hose , with our 30 metre hose it’s no problem, bit the other one is 3~5 metres so not so easy this is the baby one Start with a 40 degree one (white) or a 65 degree one and practice on the ground first

-

Quit a bit of misinformation there. Many pressure washers allow the pressure to be changed (mine normal one does), the cheapest one I have doesn’t (it was about 2,000) but then the pressure is lower. All pressure washers allow jets of different widths, I have 0 degrees to 60 degrees. I also have a rotating jet head along with a foam head for vehicle washing, and a drain cleaning head. you can get heads that allow you to add bleach to the spray, this will kill off the algae so you can then clean off the roof after that with a regular pressure wash. if they are experienced there is no problem, but walking on the roof can damage the tiles, this is much more likely than the pressure washer damaging them. But give them some practice on your concrete walkway first But do be a little careful, pressure washers can clean off old paint and cut concrete, so can damage a poor condition tile.

-

I have never had a work permit, I recently opened a new account. I probably have about 7 in current use in 4 different banks, and have had a few more. TLDR you can certainly open an account with no work permit. I’m not going to go into the other requirements as they will vary depending on the amount you’re going to deposit who accompanies you, if anyone, and where you are trying. You may get refused but just keep trying, personally I have never been refused but there are numerous accounts of people who have, some gave up others kept trying and were eventually successful. I have never had a foreign currency account, all my accounts in all the countries I’ve had accounts in were in the local currency.

-

I received 2 TCT bandsaw blades by mistake, the company that supplied them does not want them returned. They are excellent quality and I am purchasing other blades from them to replace the incorrectly supplied sizes. If you have a saw that uses this size and are interested please send me a PM

-

Pre-paid Credit Card

sometimewoodworker replied to connda's topic in Jobs, Economy, Banking, Business, Investments

That information is extremely suspect, I can be virtually certain that your understanding is not correct. If you have written information that supports your understanding then please post it. If not it is incorrect. -

That is ancient history, the case was brought in 2017. It wasn’t obsolescence. It was to extend the life of the iPhones without needing a battery replacement. Now Apple has a reasonably priced battery replacement program.

-

Double Wood Doors - Problem with wood expanding in wet season.

sometimewoodworker replied to EVENKEEL's topic in DIY Forum

All wood, without exception, will change dimensions with moisture content changes. That said plywood will change dimensions the least as the change in orientation of the fibres with different layers will reduce the problem. You can get good quality plywood and with a solid wood frame there will be little to no noticeable movement. The alternative is to get doors built in a traditional way where the panels are free floating in the frame and the construction of the join between the doors will mask the small amount of seasonal movement. All of this is obtainable in Thailand if you know where to look. -

Investing in a currency that you are not actively using is a fools game. To be successful you must be able to either have your money mobile and be actively monitoring the situation, be very lucky, or be able to predict currency movements. Personally I find it way to boring to watch the markets and actively monitor them, but if that floats your boat then go for it.

-

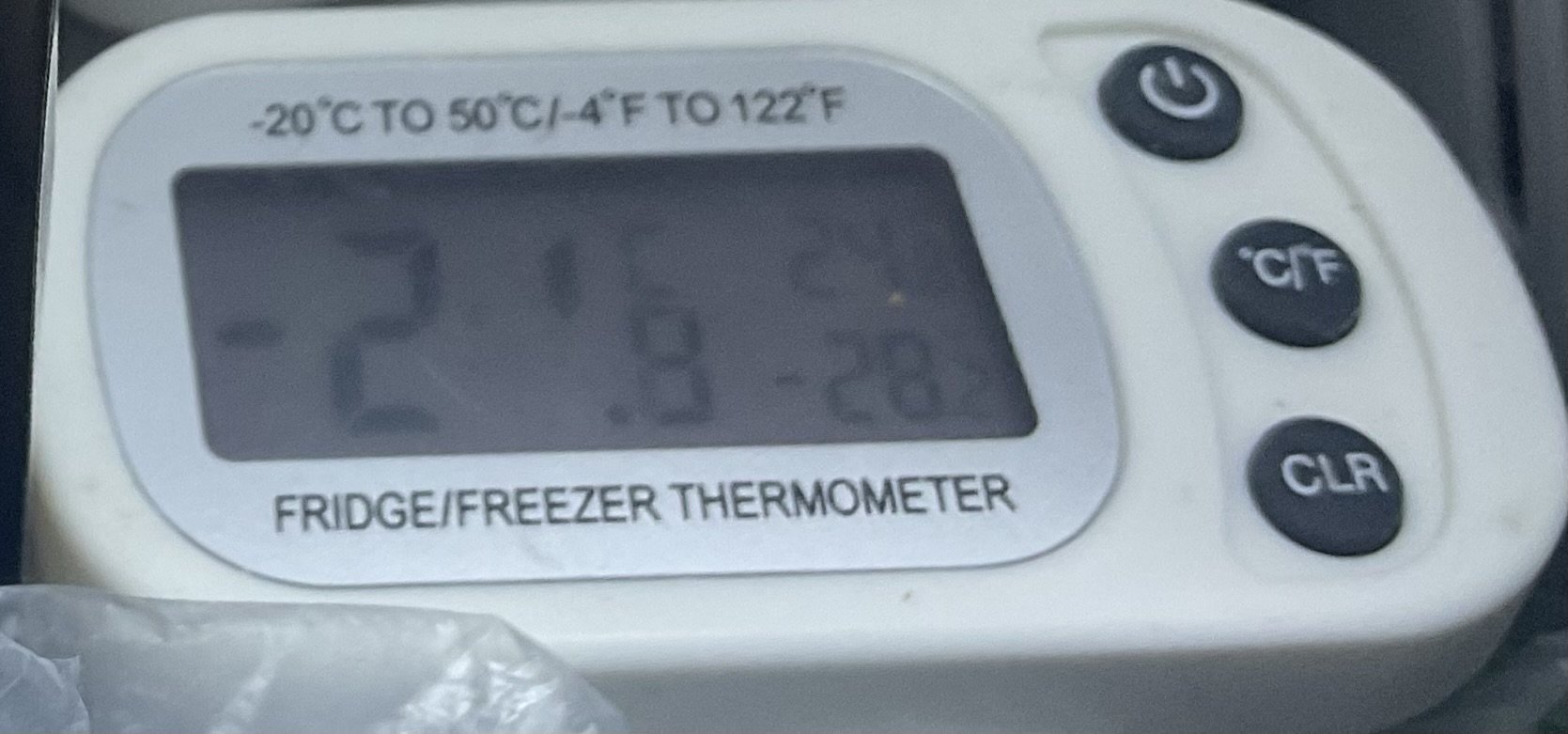

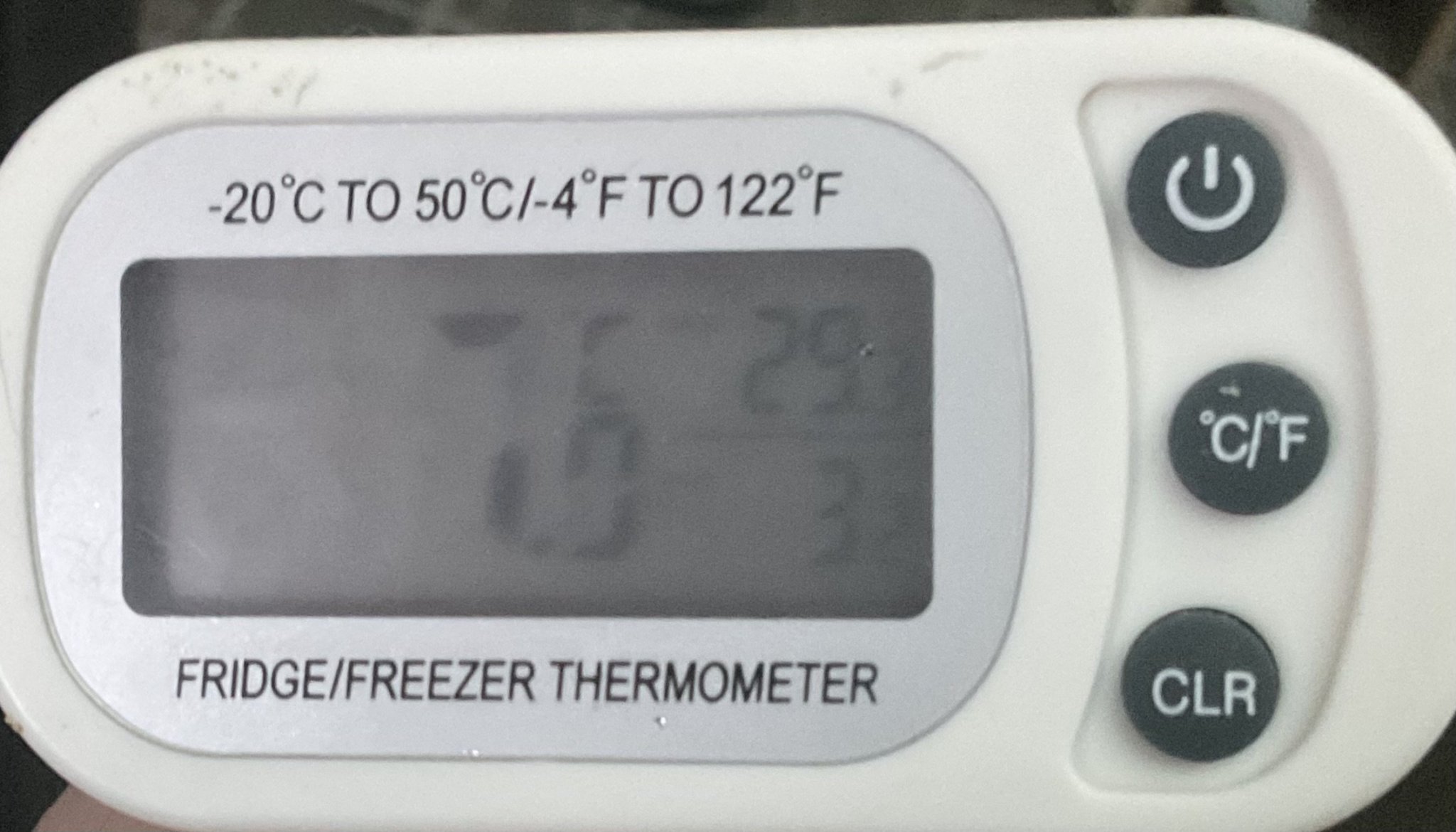

Beko, Hitachi, Bosch and Häfele all have the kind you want and if you buy from HomePro they will replace a faulty unit. We didn’t want your style but it doesn’t matter they should all be able to maintain -20C and 3C~4C tend if they can’t they are faulty and should be returned. You should get fridge thermometers before you buy so you can document the temperatures.

-

It’s easy enough to achieve your requirements and the other fridge this is in the door and is as required, but in the body it’s well below this however your current unit is definitely faulty

-

The RTB polyurethane finishes are the best I have found, I’ve been using the for around 15 years (they were Rothenburg, AFIR, when I started using them) and they now supply from their own Lazada store, they used to be available from HomePro but the availability has dropped.

-

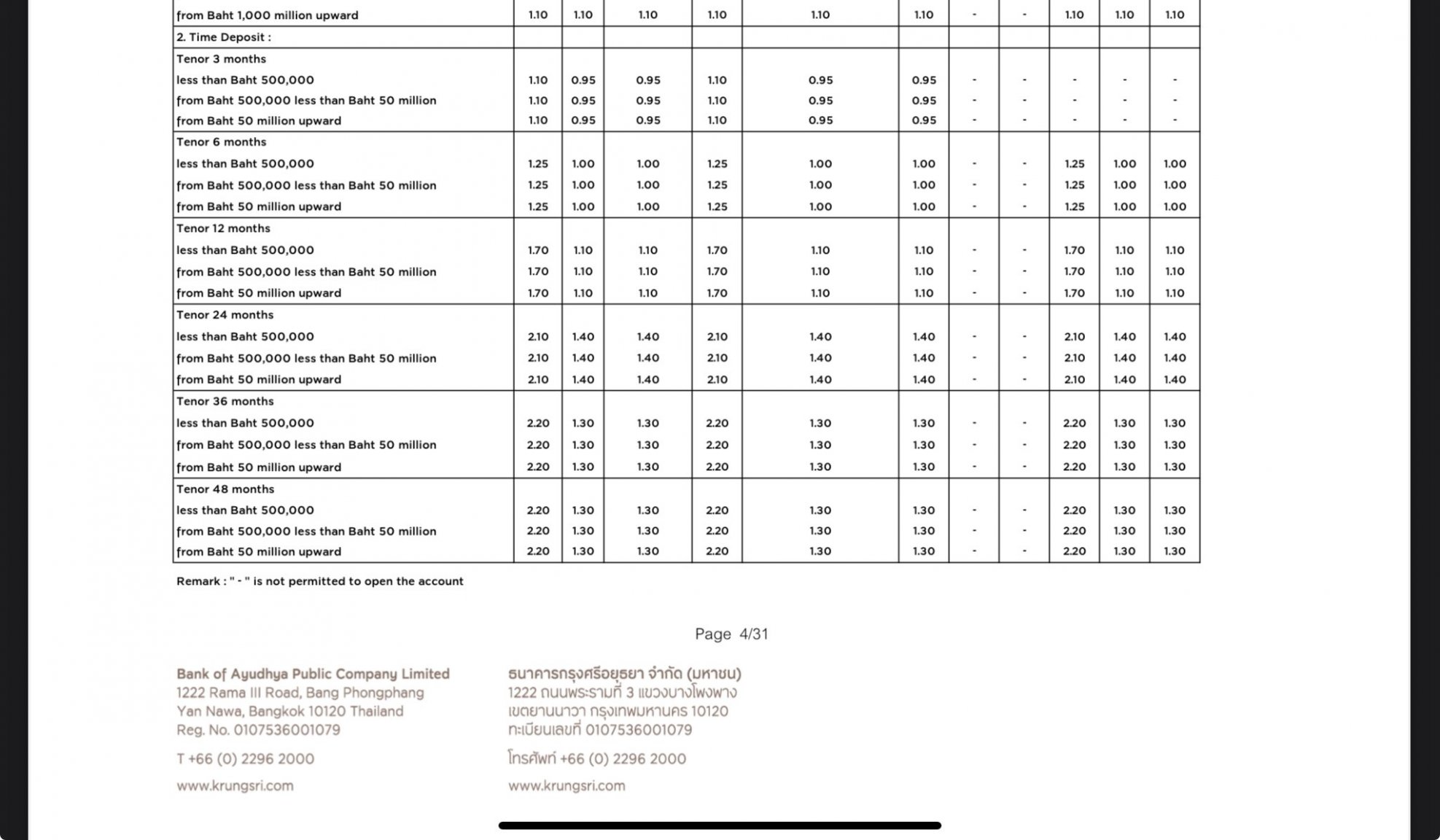

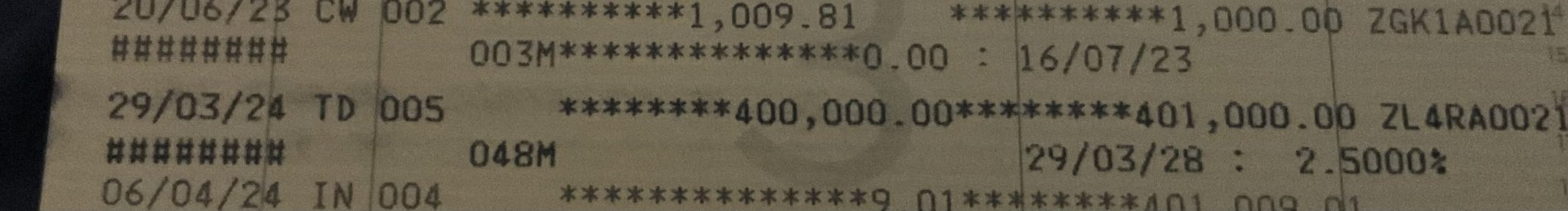

@couchpotato Interest rates are always given as the percentage that will be paid if you hold the account for one year, 365 or 366 days. So the longer more accurate term is “percentage per calendar year” The fact that the interest may be paid out for shorter periods, such as 1 month, does not change the the % per year rate. You can do the math to calculate the exact day, week or month amount but the %er annum is fixed

-

You and a lot of Thai “electricians” the principle of an RCBO is that the same current must flow through the line and neutral conductors many Thai electricians will disregard having a single pair of wires for a single circuit that is supposed to be protected by an RCBO and use any neutral or borrowing it from a different circuit. This means that the RCBO will either trip instantaneously or trip at random intervals. Finding and eliminating borrowed neutrals is a time consuming job and took a genuine election almost a complete day as our house had been originally wired up by a typical electrical fitter who had any neutral around.