-

Posts

22,700 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Everything posted by connda

-

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

The Thai government is shooting themselves in the foot. How many foreigners are now going to defer or simply not make purchases they had planned to make? Thailand can chose to make it's money from foreigners in one of two ways: Sales taxes or income on remitted foreign funds. Start taxing remitted funds and foreigners stop buying and they keep their funds transfers under the tax threshold - so all the Thai government is doing is screwing itself out of foreign funds transfers as well as losing sales tax revenues. It's a lose-lose proposition. These are not the brightest bulbs in the box of light-bulbs. I absolutely understand 100% - Tax your own citizens. But start categorizing foreigners who have no rights to permanent live in Thailand or become citizens as "tax resident" and watch what happens in the long-term. They will lose tax revenues in the long-term. -

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

I agree with you. So in that case, start looking at the US-Thai DTA for guidance. Actually I just looked at it. There is next to nothing regarding capital gains. Realistically, when you cash out a Roth, your brokerage isn't going to show an assessment for capital gains because they don't exist for a Roth IRA. So what are you showing on a brokerage balance sheet? A debit from a non-taxable account that doesn't show capital gains. The Thai Revenue department can only work with what you give them. Anyway - probably a good question for an accountant. I only have a traditional IRA. It will probably go to my wife when I die so I'll let her figure it out. -

Yes sir I have. But that doesn't mean that I understand what it means and how to apply it correctly. Which is why I asked the question. "No such thing as a dumb question," right? As an ex-instructor (English, computer systems engineering), I always thought that way and urged my otherwise reticent students to speak up when they are confused or didn't understand something I presented. So thank you for the clarification. It's truly appreciated as is your efforts to take the lead to provide members of AN with this information. Kudos!

-

Just being Captain Obvious here, but if Thailand really wanted to collect tax revenue they would start with their own citizens. Honestly, outside of Thais who work for incorporated businesses and businesses who actually file income taxes (as many small Thai business do not - think massage shops) I personally don't know any Thais who file income taxes other than my son who has a corporate job and I'm sure they withhold taxes. Filing taxes is not exactly the first thing on the minds of people (poor villagers) who are making 300 to 500 THB per day (cash) doing day labor - like a lot of those in villages and even in cities. What they are thinking about is surviving day to day and making ends meet. So in a discussion on tax evasion, which here in Thailand is being so poor that driving to file your taxes is going to cost you a days wage which you can't really afford, the first place to start is with average Thais. Of course that would expand their tax base but at what social and political costs? It's much easier to just ramp up the VAT taxes, like the new VAT on foreign goods. So instead? Go for the deep pockets - foreigners whom you will never allow to be permanent residents or citizens, but still class as "tax residents" because - "Foreigners are rich!" Slightly off topic and yet, tax evasion is probably much more widespread than the Thai government is willing to let on. Just saying...

-

@Mike Lister So let me do a "back of a napkin" calculation to determine the top threshold of what I can theoretically remit to Thailand this year just using exemptions: Here are the exemptions listed from the article: a) Personal Allowance for self (PA1) - 60,000 b) Personal Allowance for wife (PA2) - 60,000 c) Over age 65 years exemption (OAE) - 190,000 d) 50% of pension income received, up to 100k (PD) - 100,000 e) In addition, the first 150,000 of assessable income is zero rated and free of tax (ZR) Am I missing anything here? The way I read it is that I can bring in upwards of 560,000 that is exempted income - in my case US pension income. Any flaws in my calculations? I'm I missing anything? Making assumptions that are incorrect?

-

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

Deleted -

Anyone who places movie stars on a pedestal and worships their views need to have their head's examined.

- 219 replies

-

- 48

-

-

-

-

-

-

-

-

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

Hello Dubai. Guess that isn't so "green", but it is very welcoming to the Uber-Riche. Or London. It's nice and green, well, when you can see through the fog. -

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

I just reread the definitions and terms of the US-Thai DTA that are applicable to pensions. The language is explicit, but there is some contentious language: Article 3 Definitions h) the terms "a Contracting State" and "the other Contracting State" mean the United States or Thailand, as the context requires; i) the term "tax" means United States tax or Thai tax, as the context requires; ARTICLE 20 Pensions and Social Security Payments 1. Subject to the provisions of paragraph 2 of Article 21 (Government Service), pensions and other similar remuneration paid to a resident of a Contracting State in consideration of past employment shall be taxable only in that State. 2. Notwithstanding the provisions of paragraph 1, social security benefits and other similar public pensions paid by a Contracting State to a resident of the other Contracting State or a citizen of the United States shall be taxable only in the first- mentioned State. So my Social Security is exempt (Article 20, 2.) The tax status of my US pension is interpreted as per "residence" and in my case I can be declared a "resident" of both the United States and Thailand. That is defined here under Article 4, Residence) Article 4 Residence 2. Where by reason of the provisions of paragraph 1, an individual is a resident of both Contracting States, then his status shall be determined as follows: a) he shall be deemed to be a resident of the State in which he has a permanent home available to him; if he has a permanent home available to him in both States, he shall be deemed to be a resident of the State with which his personal and economic relations are closer (center of vital interests); b) if the State in which he has his center of vital interests cannot be determined, or if he does not have a permanent home available to him in either State, he shall be deemed to be a resident of the State in which he has an habitual abode; c) if he has an habitual abode in both States or in neither of them, he shall be deemed to be a resident of the State of which he is a national; d) if he is a national of both States or of neither of them, the competent authorities of the Contracting States shall settle the question by mutual agreement. Now my US pension as per Article 20, 1) The sticky question is, where are you a resident? In my case, both the US and now according to Thailand I'm a "resident" of Thailand BUT only for taxation. So - which takes precedence? See below: (a) Bingo - I only have a permanent home in US. Read my visa stamp - I am only a visitor temporarily visiting my wife. And, my "personal and economic relations" are closer to the US: My permanent address for finances, taxation, ID, and voting is in the US, SSA and pension come from the US, my biological family is in the US, I am only a "temporary visitor" in Thailand, and if forced to leave Thailand, I will return to the US to my US "permanent home" to reside with my biological (US) family. (b) This is Non-applicable as I have a permanent home in the US so I'm deemed a resident of the US as per sub-paragraph (a). Sub-paragraph (a) superceded sub-paragraph (b). And as per sub-paragraph (a) I have no "Permanent Home" here in Thailand as I'm only a visitor, I only have a "Permanent Home" in the United States. (c) I have a habitual abode Thailand, but sub-paragraph (a) supercedes sub-paragraph (b) so sub-paragraph (c) is Non-applicable. And as a "visitor" is it actually my habitual abode? (d) Read that - which boils down to if there is a problem, then I go on a letter writing campaign. Possible problems: What takes precedence under Article 4, paragraph 2? I assume that (a) takes precedent over (b) which takes precedent over (c) which takes precedent over (d). There is a possible point of contention because it is not clearly defined. But they logically seem to be written in precedent order. And "Permanent Home" and "Habitual Abode" are not defined in Article 3: Definitions. They should be. That could be another point of contention. So for you US pensioners out there - this is the thought exercise you're going to individually need to do based on your own home-county's DTA. The tax experts aren't going to do it for you unless you pay them. -

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

For anyone who is interested, here's the US-Thai DTA. US-Thai-DTA-Agreement.pdf -

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

Absolutely correct. As I said, it will be a pain-in-the-butt, but not the end-of-the-world. -

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

I'm going to go back and re-read the DTA and look up the definitions. The Devil is in the details, and the details are in how individual terms are defined at the beginning of the document. Those are the legal definitions and it is on those definitions that the laws supporting the DTA are based. -

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

And then the question becomes: "Why isn't that clarification forthcoming?" You are correct. The Thais with foreign investments will be the most affected. As such, perhaps it will be wealthy Thais who force the issue either administratively or judicially to obtain the clarification (which one has to question - Is this deliberate obfuscation?). Well - TIT, right? -

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

Ahhh, but it is. The money that goes into a Roth is "earned income" and subject to taxation - BEFORE - you put it in the Roth. Any income that Roth generates after that point is "tax exempt." This is why I'm going to keep pounding on this point. Is this entire fiasco about side-stepping the deductions and exemptions of your home-country's tax code in order to lay claim to funds that are tax exempt in your own country, therefore effectively taxing that income both in the US and Thailand. If that's the game they are going to play, then I'm going to ask cognizant officials in US government to do the same to Thai citizens in the US who are tax residents in the US who remit Thai income to the US. Now - that will only affect the rich and wealthy Thais, which in turn will get the attention of both the US and the Thai government when the Hi-So Thais are dual-taxed as well and begin to squawk to their own elite leaders. -

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

That's probably because it takes a international tax lawyer to understand them. I've read the US-Thai DTA. I don't see anywhere within that agreement where Thailand can double tax income that has been declared as taxable income with the IRS, just because I'm a Thai tax resident. This entire fiasco boils down to an interpretation of term "taxed income." I'll be honest with you Mike - the DTA makes my Social Security payment untouchable. That leaves my pension which I receive in the US and transfer to Thailand. If push comes to shove, I'll limit the amount I remit to Thailand to keep it under the personal exemption ceiling of the Thai tax code, I'll take every exemption and deduction I can find, and I'll start to claw-back the 15% that my banks take out of my account for taxes on "earned interest." I still won't pay anything - well - other than the PITA time that it takes to have to file. Actually - Thailand will pay me. I'll rake back all the taxes I've paid on earned interest that I've let slide up to this point. I started out here on a business visa and I filed taxes the first three years I was here. I don't want to do it - but I can - and I'll remain unaffected by this "money-grab." It's not the money Mike. It's the principle. I don't like greed or amorality. And I see the potential that both are driving this fiasco in the first place. Again - it's a PITA, not the end-of-the-world, well, at least for me personally. Now for all these expat members who claim they are independently wealthy. Well, this might affect them. But if they are that rich then they can afford tax lawyers and brown-envelops (the latter unfortunately being a reality in Thailand that truly sucks). -

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

Because of how it may be interpreted. I can see it now. "Did you pay taxes. Let's see the taxes you paid." In the US, everyone receives deductions and exemptions, including the Standard Deduction. If your taxable income is above the deductions then you paid the IRS. If your taxable income is below the deductions then you get a refund of those taxes which have already been withheld. Either way - you have declared your "taxable income" on a 1099 filed with the IRS in the United States making all of that income "taxed." It's not about whether your income is greater or less than your deductions - it's the fact that you filed your taxable income in the United States. I don't feel like being stuck between Thailand playing word-games in order to tax income they have no right to tax. In other words, if they chose not to recognize the deductions and exemptions all US taxpayers are afforded by their own country. At the simplest level this entire fiasco should boil down to: If you declare earned income in the US, file a 1099 with the IRS which is accepted - none of that income is taxable in Thailand under the US-Thai DTA. So regarding "letter writing?" Yeah - if Thailand says they are going to tax income that has been declared and filed and accepted by the IRS, and do so in violation of the DTA - it's time to write letters. If Thailand refuses to recognized the tax deductions and exemptions of the tax codes of other countries that it has DTAs with, then why should those countries recognize the deductions and exemptions of the Thai tax code either. It's not the bottom-line of your tax return that determines your tax liability, its that fact that you declared your taxable income with the tax institution (the IRS in the US) in your own country. How that tax liability is assessed is the jurisdiction of the home-country tax agency or institution. So basically Mike - I don't trust Thailand or the intentions of their Finance Ministry. Everything I see here points to their intention to side-step their DTAs with other countries in order to increase their tax base by taxing foreign income they have no right to tax. -

Poll - New Tax Rule, What Will YOU Do?

connda replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

My sources of income are Social Security, a US-based pension, and I'll eventually have some income from my IRA when I'm forces to begin cashing it out due to age. All of these income sources are filed with the IRS via an annual 1099 and are declared as taxable income in the United States. I'm not doing anything as under the US-Thai DTA all of my income is already "taxed" in the US. I will keep copies of my annual tax filings. I have copies of my US 1099 filing going all the way back to 2007, and If Thailand suddenly says that they have a right to tax my US income that has already been filed with the IRS (i.e., "taxed" in the US) - then I'll begin a letter writing campaign to my State Senators and Congress-person. I'm sure there are other bureaucratic entities in the US who deal in enforcing the Dual-Tax Agreements between the US and foreign countries. We collectively need to figure out who those entities are before hand and add them to the list of those to notify. I have no problem paying Thai taxes that are their due, which are Thai VAT and the taxes they automatically take out of my Thai bank accounts. So they get 7% of all money from my US sources, and then 15% of any money I "invest" in an interest bearing bank account in Thailand. They want more? **** them. It's greed and it's in violation of the DTA tax treaty as they really are looking to dual tax income that is already taxed in the US (speaking as a US citizen). Which is wrong and amoral. So, coming after US citizen's income that is filed annually with the US IRS and taxed in the Untied States? That's going to be a problem that needs to be addressed by those in the US government who are responsible for enforcement of the US Dual-Tax Agreements. Otherwise those agreements aren't worth the paper they are written on. The same for those who annually file their taxes in their home countries. So let's put our heads together here guys and gals. What we are really worried about is Thailand taxing US income that is already filed with the US IRS and taxed in the US - and - if that happens then it is in violation of the US-Thai Dual-Tax Agreement - and - it is morally wrong. What we should be thinking - collectively - is: if that happens, who in the Untied States do we collectively contact. Because the noise the Thai government is making is: "We don't care about Dual-Tax Agreements and we are coming after your income that has been taxed in your homeland." Untied we stand, divided we fall - so we need to act as a collective in unison if this nonsense goes sideways next year. Plan now - together. @Mike Lister -

Airline Insider Reveals Economy Class Seats to Dodge

connda replied to webfact's topic in Thailand Travel Forum

The title should be: Captain Obvious Talks About What Every Airline Traveler Knows -

Microsoft Set to Launch Its First Data Centre in Thailand

connda replied to snoop1130's topic in Thailand News

My guess is that this will be the same as large corporations which need fresh water to create its profits. Take public water, make water scarce, pollute it. Less water for the commoners means higher water costs if water is available at all. Privatize the profits; socialize the losses. So - what kind of breaks does MS get on the massive amounts of electricity that will be needed to be sucked out of the current (soon to be "green" we're told) grid infrastructure to power an AI-based data center which need enough power to power a city? I can't count the number of times our power goes off each year. So I wonder - will MS get to tap into the current grid at a discount? Yeah? Do they get guarantees of consistent service even if the surrounding public areas lose power perhaps? Less grid capacity means higher prices for the commoners? Privatize the profits; socialize the losses? Just wondering. These public-private partnerships are often spun as a win for society but are more often a win for the rich and wealthy, and table-scraps for the commoners and the public in general. -

Thaksin Enjoys a Busy Walking Street in Phuket on Monday Night

connda replied to snoop1130's topic in Thailand News

Hallelujah brothers and sisters - It's A Miracle! (but completely expected) -

Thaksin Enjoys a Busy Walking Street in Phuket on Monday Night

connda replied to snoop1130's topic in Thailand News

Break out the golf clubs and tennis rackets - the medical props have come off as Tony's miraculous recovery is right on schedule! -

The "green energy" trope is a house of cards waiting for a gust of wind to blow it over. As the Thai government is planning to force the commoners to give up ICE vehicles and all purchase EVs, the fact is that the Thai electric infrastructure - especially an infrastructure where coal, gas, and oil are no longer allowed as sources of electric power - will not be able to handle the massive new load of existing electric demand - PLUS - electric vehicles - PLUS - new data centers - PLUS - industrial expansion. Heck - look at any city in Thailand. They are still in the stone-ages when in comes to electric cable infrastructure. They are going to magically change all of this? I've been here 17 years and it still looks like it did in 2007. Another 16 years gets us 2040. "We fix all electric by 2040. Jing jing!" 💩 Of course! They are going to upgrade all of this to support electric vehicles? AI data centers? Manufacturing infrastructure? No - they are not. Nor will a bunch of solar panels and wind turbines produce enough constant, uninterrupted power either. It's magical thinking. And now we are talking about Thailand becoming an AI hub? This is from a speech by the CEO of Blackrock, Larry Fink, regarding AI given at the World Economic Forum1 (highlights are mine for emphasis): "I do believe to properly build out AI we're talking about trillions of dollars of investing. So data centers today could be as much as 200 megahertz - and they're now talking about data centers being one gigawatt. That powers a city," Fink also referenced a discussion with the head of an AI data center who told him that their data center needs 5 gigawatts of power which will increase upwards of 30 gigawatts by 2030. "The amount of power that's needed to use AI has a huge impact on society." And here the situation summed up by Fink: "The world is going to be short power - short power - and to power these data companies you cannot have this intermittent power like wind and solar." Yep, Thailand will have a green future where deforested mountains and agricultural land are covered with solar panels and wind turbine in order to "Save the planet from the scourge of CO2." Freaking think about that. 🤔 Cutting down forests and covering up crop producing land (plants and trees being natural CO2 to O2 scrubbers) to install solar and wind (it's already being done and it's a hot topic [no pun intended] within state legislatures like Rhode Island1 ) So debt burdened, inflation ravaged Thailand is going to spend how many trillion THB on "green energy" and promoting AI data centers and all the other futuristic whiz-bang technology that requires massive increases in electric power - and run it all over electric infrastructure that was built 30 or 40 years ago and has been upgraded when? Like Fink stated, "you cannot have this intermittent power like wind and solar." Which means <drum roll> nuclear. So - how many nuclear power plants does Thailand have in operation? None, nada, zip, zero, "0". Yeah - there is plenty of lip-service about how they are going to do this and that with nuclear3 and usher in a sustainable wonder-age for Thailand - but how often in Thailand does "lip service" turn into actionable results? Within budget, on schedule, and within scope? How's that few kilometers of High-Speed Rail coming along up North? More electrically driven whiz-bang tech of course. Of course! While completely renovating the electrical grid to handle EV and AI with "green energy" while turning off "fossil fuel" generation power plants - by 2030, 2035, 2040 - Thailand will be a power-house of electrically run manufacturing and futuristic technologies and blah blah blah, yada yada yada <more hot air added to the atmosphere> Whatever. One thing I've learned in 17 years here in Thailand. Thais live in the present moment, which is great for meditation practice, but totally sucks for project management and long-term planning. The only place those plans will take fruition is after a hit on an opium bong (soon to be taken off the Schedule 5 drug list for medical purposes) as the rosy-glow of an "Green Electric Utopia" to rival a Philip K. Dick novel shapes up as nothing more than essentially another Thai Hi-So, ruling-class pipe-dream. 1. Speech by Blackrock CEO Larry Fink at the WEF regarding AI and the need for new electric infrastructure, https://youtu.be/PoRVYFHNc6k?t=2787 2. Leveling Forests for Solar: Advocates for Green Energy Square Off Over Trees vs. Panels, By Mary Lhowe, ecoRI News contributor, June 22, 2022 3. Thailand To Adopt Nuclear Energy To Achieve Carbon neutrality By 2050, NBP, Apr 19, 2024

-

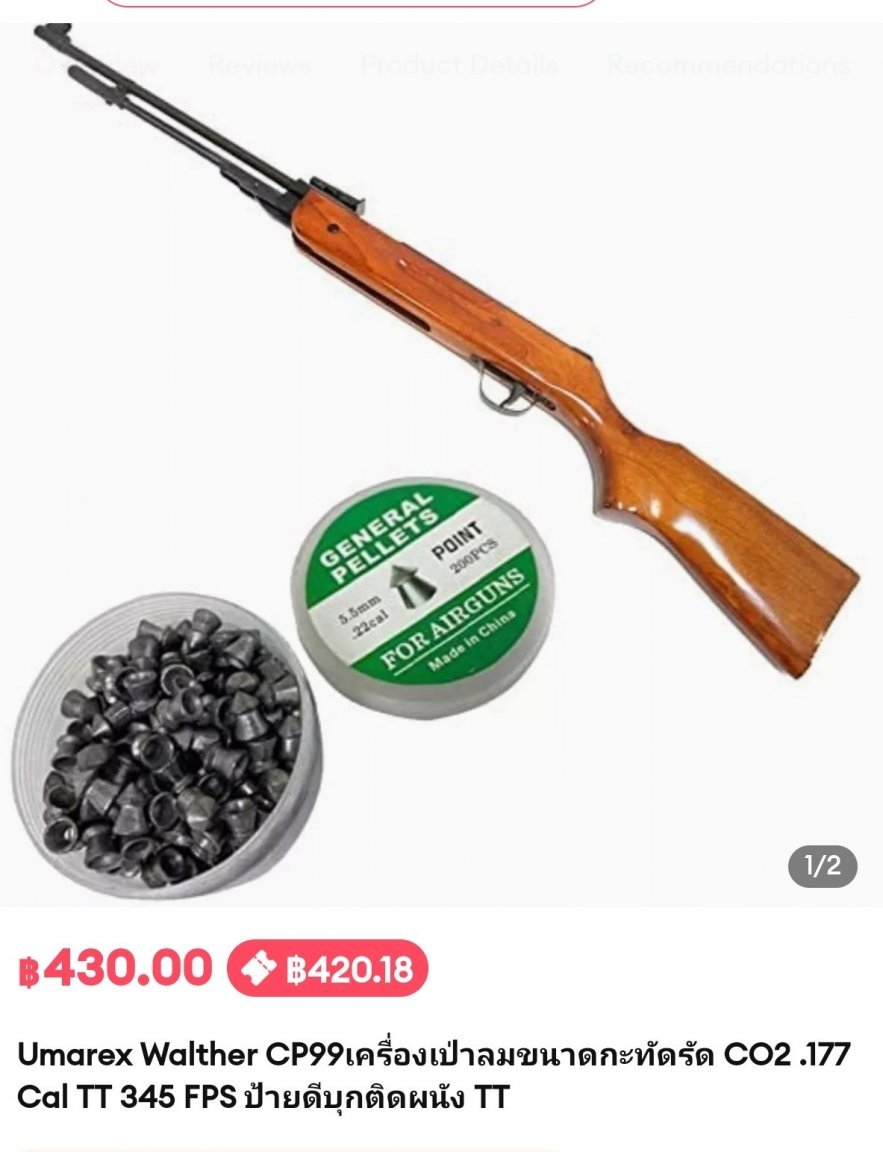

Couple in Bangkok arrested for illegal online ammunition sales

connda replied to snoop1130's topic in Bangkok News

-

A bicycle. Things that fly (kites, balsa airplanes). Chemistry kit. Models (no, not the 18 year old Thai girl variety) as the kind in hobby shops. Or an experience, like take him to an archery range or bowling or (if near the ocean) rent him a surfboard and an instructor for the day, or swimming lessons. Think outside the box so the kid will think outside the box.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)