Nationwide International refusing new accounts for Thailand-based savers

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

-

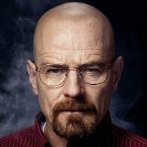

Popular Contributors

-

-

Latest posts...

-

52

Older Retirees and Younger Partners in Rural Thailand: Accepted or Not?

That's pretty good. I like that. I think you could probably turn that into an entire forum topic of its own. Here are half a dozen possible titles you can use for it: “Village Idiot or Prince Charming? A Farang Fairy Tale” “The Town Bike Diaries: Farang Edition” “Mushrooms, Teeraks, and the Art of Staying Clueless” “Why the Village Cheers When You Take Her Home” “Buying Love and Renting Respect in Nakon Nowhere” "The Village Idiot Chronicles: Life as the Oblivious Farang Husband" -

34

Travel AirAsia’s Game-Changing Leap: Low-Cost Flights from Southeast Asia to Europe & the US

They are , I just used two random Indian cities as an example and mistakenly used the same city twice . The point is still the same though, that you need an India visa if you travel internally on a International flight that stops over -

79

US CDC report shows no link between thimerosal-containing vaccines and autism

I am done wasting bandwidth over ignorant trolling. You are wrong, viruses exist, and vaccine work. -

116

Trump has abandoned the Ukraine.

Funny how you all MAGA's always blame previous democratic presidents. Looks to me like your god POTUS have not exactly made himself popular with anybody apart from Putin. What is it going to be now? United States of Russian Empire? -

1

TM30 with LTR VISA question

TM30 was requested when I transferred my LTR visa to a new passport. Haven't done yearly report yet. -

33

USA Rumbling in the Swamp: Quiet Talks Begin to Launch a Viable Third Party in U.S. Politics

Is there already with Maga. There should be room though for a social democrat party. Maga to the right, social democrats to the left and what's left of the democrats+rino's center.

-

-

Popular in The Pub

.thumb.jpg.82631abb512ae61a745d964452c5b1b9.jpg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now