-

Posts

12,522 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by khunPer

-

Clarification on Retirement Visa

khunPer replied to Slinky1958's topic in Thai Visas, Residency, and Work Permits

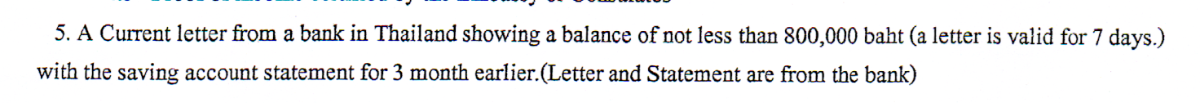

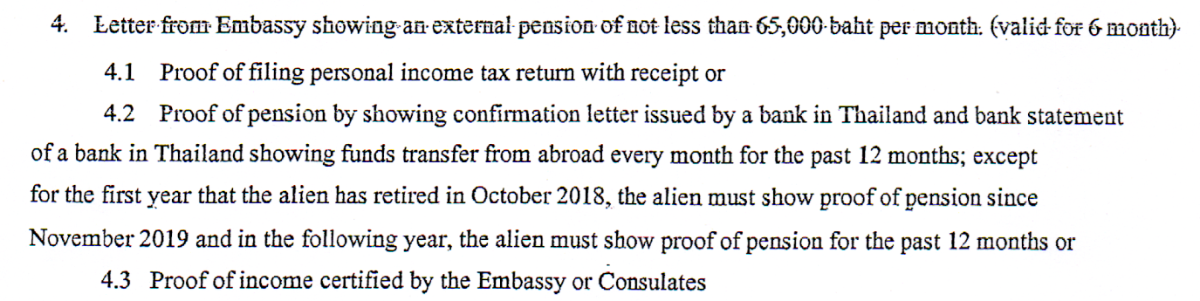

First year with monthly bank transfer of not less than 65k baht, you need to show proof of two months transfers, all following years full 12 months transfers when extending your stay. -

Clarification on Retirement Visa

khunPer replied to Slinky1958's topic in Thai Visas, Residency, and Work Permits

I haven't heard about that possibility, sounds interesting. Normally the rule is that if a joint account is used – two names – it need to be 1.6 million baht instead of 800,000 baht. -

Clarification on Retirement Visa

khunPer replied to Slinky1958's topic in Thai Visas, Residency, and Work Permits

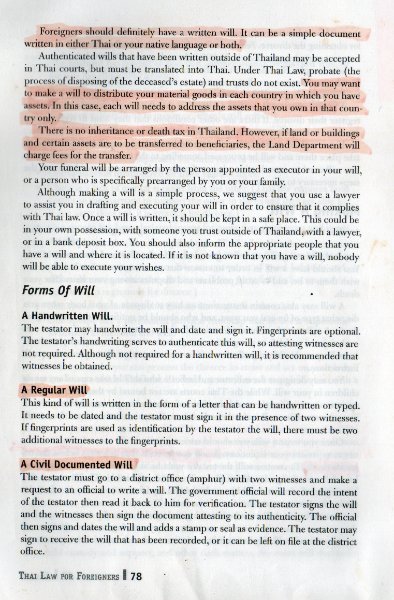

1. Maturing period of deposit. The 800k baht need to be in deposit 2 month before application of extension of stay and 3 month after extension is granted. Then the deposit can be reduced to not less than 400k during the following almost 7 month until 2 month before next application for a one year extension of stay. 2. Fixed deposit. The normal 12-month fixed deposit – same rule for 3-month and 6-month – in Thai banks allows you to withdraw funds during the fixed period, but you lose the earned interest. The immigration states that you shall be able to withdraw fund, id needed. I – and others – have used a 12-months fixed deposit for several years. 3. Income letter from embassy. The letter is valid for 6 month. Some embassies do not issue an income-letter anymore. -

Clarification on Retirement Visa

khunPer replied to Slinky1958's topic in Thai Visas, Residency, and Work Permits

The easiest way to sleep well without thinking about next extension of stay is to leave the 800k baht in a 12-month fixed deposit and cash the interest once a year, so the balance of 800k baht is kept. Using monthly transfer method might require little more statement from the bank as proof of monthly transfers. If you a any point transfer less funds than stated in your opening post, exchange rate deviations might be an issue, so you never get below the 65k baht each month. Even the cash interest rate for fixed bank deposit is 1.5% p.a. – around that level at present – or little lower, it might be worth the interest difference from other investment, to stay free from financial worries for next extension of stay. With a budget in the area of 100k baht a month, the interest difference in money – between for example 4% p.a. and 1.5% p.a. of 800k Baht – is relative small. -

You can read the official rules and details here: https://www.customs.go.th/cont_strc_simple.php?ini_content=individual_F01_160426_01&ini_menu=menu_individual_submenu_02&lang=en&left_menu=menu_individual_submenu_02_160421_01 I've imported household from Europe some years back. It's worth to carefully consider what is needed – like non easily replaceable items and items of affective value – compared to buying new stuff locally. Be carefull with electronic items if not prepared for 220 volt/50Hz. You are eligible for one air consignment and one surface consignment for tacfree import of personal household items. A (very) detailed packing list is expected and a reasonable value of the items. Be prepared that you might pay a small amount of import tax and v.a.t. upon custom clearence. If it's a smaller consignment it worth checked with an international door-to-door transporter that will handle custom clearence and might give you a quote in advance for the total cost. You need to be in Thailand when to shipment arrives, as your passport – with non-immigrant visa – is normally needed for custom clearence.

-

So many food item prices continue to increase every few weeks

khunPer replied to steven100's topic in ASEAN NOW Community Pub

International market sets price for coffee, and coffee is increasing a lot... -

Tourism Thailand Vows to End Dual Pricing Amid Growing Tourist Backlash

khunPer replied to webfact's topic in Thailand News

Entrance to Grand Palace in Bangkok is free for Thais, while foreigners pay. In a way fair enough, it's the Thais' culture, while foreigners are tourists – and most of us foreigners can afford to pay for the ticket. Generally I'm okay with dual pricing. -

Politics Supreme Court Dismisses Lawsuit Against Thaksin Shinawatra

khunPer replied to snoop1130's topic in Thailand News

Reminds me of my kind Thai neighbour of Chinese origin, who invited me on green tea. He gave me a small piece of paper with his phone number and said: "Khun Per, if you ever get into troubles in Thailand, call me; one phone call from me can clear everything." I presume Thaksin either also knows someone importnat that can make a phone call, or perhaps he is himself such an important person... -

1) You need to go to the revenue department – the branch hyou need will be in the customs house, where you register for vat and TIN – and apply for a TIN. You will get a little matrix-written slip with proof of your TIN. It should be fairly easy to apply now, when all foreigners staying 180 days and more need to pay income tax of transferred fund. 2) A Yellow House Book includes a Thai ID-number for aliens, which is same number used for TIN and on a pink ID-card. I'm not sure if you still need to visit the revenue office to activate the Yellow House Book ID-number as TIN, or you just do it online when register for the tax return form. 3) Where I live it's easy and kind service in the revenue office. The online tax return dorm also works well, if you don't have any foreign paid income tax to deduct.

-

Advice?? Bank accounts on death

khunPer replied to rasalvaje's topic in Jobs, Economy, Banking, Business, Investments

-

Report Thailand Waves Goodbye to Costly Scout Uniforms, Eases Parent Woes

khunPer replied to webfact's topic in Thailand News

TIT (This is Thailand) and so is the subject of the thread, I'm referring to what happen here, not what Google stores for the rest of the World... -

Crime Brit Caught with Cocaine Stash While Overstaying Visa on Samui

khunPer replied to webfact's topic in Koh Samui News

C'mon, "always look on the bright side of life", it's Samui and the prison has a great sea-view to cheer you up...👍 -

Crime Brit Caught with Cocaine Stash While Overstaying Visa on Samui

khunPer replied to webfact's topic in Koh Samui News

Samui is generally expensive, so why not also cocaine... -

Bank proof of money in the bank

khunPer replied to CPH's topic in Thai Visas, Residency, and Work Permits

And that is why you need to show copies all pages in your bankbook to prove that you had the correct funds during the past year. The 3 month is for statement, the fund deposit is 2 month prior to application for one year's extension of stay; i.e., 800k baht 3 month after granted extension of stay and again 2 month before next application, and in between not less than 400k baht. And yes, we old grumpy retired folk indeed needs to show a health statement – this is party island and the immigration have to make sure that we are healthy enough to survive for another year's Full Moon Parties... -

Report Thailand Waves Goodbye to Costly Scout Uniforms, Eases Parent Woes

khunPer replied to webfact's topic in Thailand News

This thread is about Thailand, and so was my answer about the schools' former mandatory boy-scouts and girl-guides. -

I'm using AI for knowledge – Perplexity is a good source for that – and for some photo editing and restoration, where I bought an application (program). The latter shall be critically used, as not always an improvement.

-

Has your girlfriend got a joke or ever said anything funny ever?

khunPer replied to Chris Daley's topic in General Topics

Thais are well known for humor and small practical jokes. My lovely girlfriend and I shares lot og humor and laugh daily, and I also share humor with other Thais... -

Report Thailand Waves Goodbye to Costly Scout Uniforms, Eases Parent Woes

khunPer replied to webfact's topic in Thailand News

Girls are not scouts, they are called "guides", so "boy scouts" is correct... -

Bank proof of money in the bank

khunPer replied to CPH's topic in Thai Visas, Residency, and Work Permits

No, it's depending of the immigration office. I'm staying on extension of stay based on retirement, and the immigration office that extends my stay every year asks for three month bank statement... However, if you use the monthly transfer of minimum 65,000 baht method, you need statements for all previous 12 months... -

If you apply for an O-A visa you need to show proof of income of at least equivalent to 65,000 baht per month or savings of at least 800,000 baht. Your income can be from Belgium, and your savings acn be in Belgium bank – that's the benefit of the O-A visa, you don't need to deposit funds in Thailand – the Thai embassy in Belgium probably have clear information on their webpage about documentation requirements. An O-A visa has 12-month durability. It means that every time you enters Thailand within that 12-month period period, you will get a stamp with 12 months permitted stay. You need a health insurance approved by Thai authorities.

-

Bank proof of money in the bank

khunPer replied to CPH's topic in Thai Visas, Residency, and Work Permits

And some immigrations asks for 3 month statement for retirement extension. 12-month statement from Bangkok Bank can be ordered in a local branch, but they can only print up to 6 month and need to reorder it from the head office. It takes from three days to about a week to get it. It costs 200 baht; while a 3-6 month statement issued by the branch office costs 100 baht. -

What's happened with cannabis in your areas?

khunPer replied to DontDoubtMe's topic in Thailand Cannabis Forum

Got no idea about prices, but many sells "buy 2 get 1 free"; however, the price for two might be normal price for 3... More and more stores open – there are about double as many in the area where I live, as there are 7-Elevens. There are 3 convenience stores in my close neighbourhood and 6 cannabis shops...😉 You can even get a "free joint" if you dine in one of the local restaurants...👍 -

Beachside bungalows Koh Phangan.

khunPer replied to DrPhibes's topic in Koh Samui, Koh Phangan, Koh Tao

Take a look on Thong Nai Pan, both Lek and Yai. Google Map let you take a virtual walk on both beaches... However, if you look for other activities than rustic bungalows, cosy restaurants and a Bounty-style beach, then you don't need to check these two bays... -

Trhailand is normally a safe place to visit. Of young ladies I see most them travel in pairs or smal groups together as 3-4 girls, but there is also some singles. In general it's a question of common sense and a bit of preparation – i.e., reading/searching – to choose safe areas. It might be a benefit for you, when not an experienced traveller and first time to Thailand, to visit places where other youg people – mainly girls – flocks to. You could have a great chance to meet new friends and fellows that way to share your experience with, or even follow. If you arrives in Bangkok, then Khaosan Road will be such a place, where young people and backpackers use to stay. You can book hotel in the area in advance using common booking sites. Many young folks takes a trip up north to Chiang Mai – once the historical capital of the ancient Lanna Kingdom – which you can reach either by train or plane. Chiang Mai offers lot of great stuff to visit and see, both old buildings, temples and nature. The city is also kind of artistic and cultural center. Two more places the youngs visit are Phi Phi Islands – famous for Phi Phi Lee with Maya Bay, the set for the film "The Beach" – and the islands Koh Phangan and Koh Samui. In Bangkok's Khaosan Road you will for sure meet numerous other young ladies or pairs that are planning to visit those places. Koh Phangan is know for it's monthly Full Moon Party, which is a great cool experience. It was on an invented island close to Phangen that "the bay with the secret beach" in the novel The Beach was situated. Phangan has lots of nature and excellent beaches. Neighbouring Koh Samui – where there is an airport, otherwise you can get there by train from Bangkok on a combination ticket with ferry transfer to the island or combined Lomprayah-express bus and catamaran-ferry – is known as a young folks destination all way back from the early bachpackers arrived during the happy hippie era. Today, it is mainly Chaweng Beach young folks visit. But there are also many other nice beaches on the island where many young folks and both single ladies and small groups of young females stay. You can even live in a cosy beachfront bungalow for a relative affordable price. I live on Samui and I meet lots of young folks here. When you visit tourists areas you can manage fine with English language – most signs are in both Thai and English – and Thais are in general smiling polite and ready to help tourists.