-

Posts

10,000 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by blackcab

-

Super Rich have cash counting machines that are visible by the customer. The teller will put your Thai Baht into the machine. The machine will count your cash and there will be a visible electronic counter for you to observe the machine's progress. You can then watch the teller's hands as they pass you the cash or put the cash in an envelope and pass it to you.

-

@ripstanley Please PM me the name of the person you are trying to ignore.

-

An unhelpful post has been removed.

-

Fortunately all of those people, you included, have the ultimate solution. You can use this forum. Thank you for contributing and continuing to make aseannow.com the number 1 place to discuss Thailand immigration issues.

-

I would encourage you to take the matter up with immigration directly and explain to them how they can better correct themselves, either in terms of translation or else reworking the entire visa and extension system so that it accords with your understanding.

-

The explanation is that your visa cannot be reused to enter Thailand (unless it is a multiple entry visa), however you are permitted to stay in Thailand for the time indicated on the ink stamp placed in your passport by the Thai immigration officer at your port of entry. A TM86/TM87 is used to when you apply to extend the initial length of stay you have been granted by the immigration officer.

-

Dory

-

The fine is 500 baht. If you want to you can take your ticket, make your own way to the police station (your car will remain clamped), wait in line at the police station, pay your 500 baht fine, make your own way back to the car, call the police officer to release your car, wait until the police officer is available and in your area and then go. That will be a minimum of half a day of your time and probably two taxi fares/win fares. Or you can pay an extra 200 baht to have the clamp removed then and there. The 200 baht is the payment for someone else to take the ticket to the police station and take care of your business.

-

The Land Office are not remotely interested in house books. You do not need to present them to sell property. There is no requirement from the land office to do anything at all with the house books. Normally the seller will not remove themselves from the house books before a sale, just in case the sale does not happen. There is nothing stopping the seller doing this in advance though if they so choose. This is a matter for the seller. They need to be proactive and find a house book to move into. Otherwise if they try and stay on the tabien baan of the house they have sold, they will eventually find themselves removed without their consent, and you can almost guarantee this will happen at an inconvenient time.

-

Why would that matter? The seller will in all likelihood be present on the day and can arrange everything for the other people in the house books. It's really not difficult and thousands of Thai people do this on a daily basis. Just check with the District Office what documents they need for the seller to act for the other people listed in the house books.

-

The house registration is nothing to do with the Land Office. What usually happens is that immediately after the sale at the Land Office the buyer and seller proceed to the District Office and empty the Blue and Yellow books. At that point the seller needs to know which blue book they are moving into and have things in order. The same for the yellow book holder. If this process isn't done the seller and everyone else will remain in the blue/yellow books of the property that has been sold, however the new owner can apply to have everyone removed from the house books at any time.

-

The owner needs to enquire at the Land Office and get a replacement title deed. Without that she would just be storing up problems for the executor and the beneficiary. If the family is hostile she can always transfer the land to the intended recipient before she dies. A sale in this manner cannot be contested.

-

- 112 replies

-

- 20

-

-

-

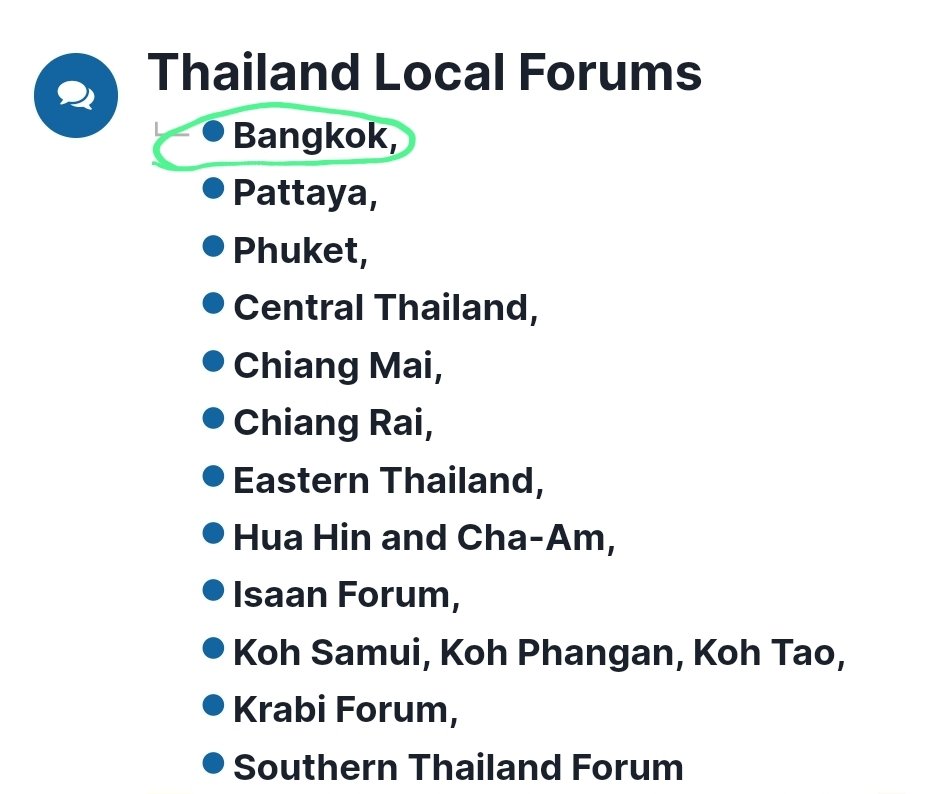

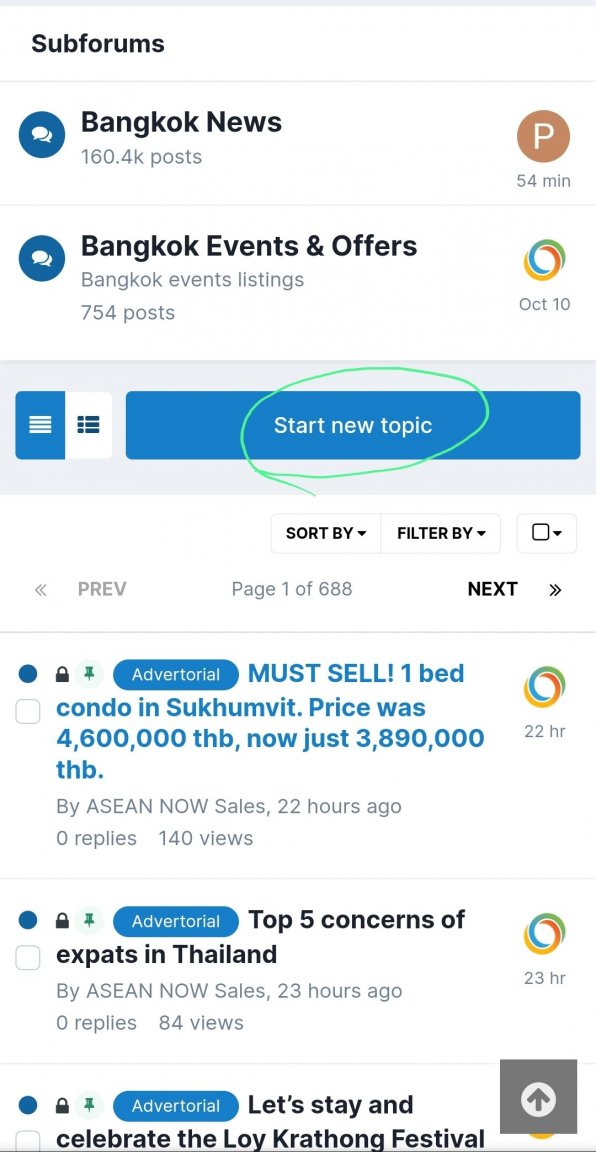

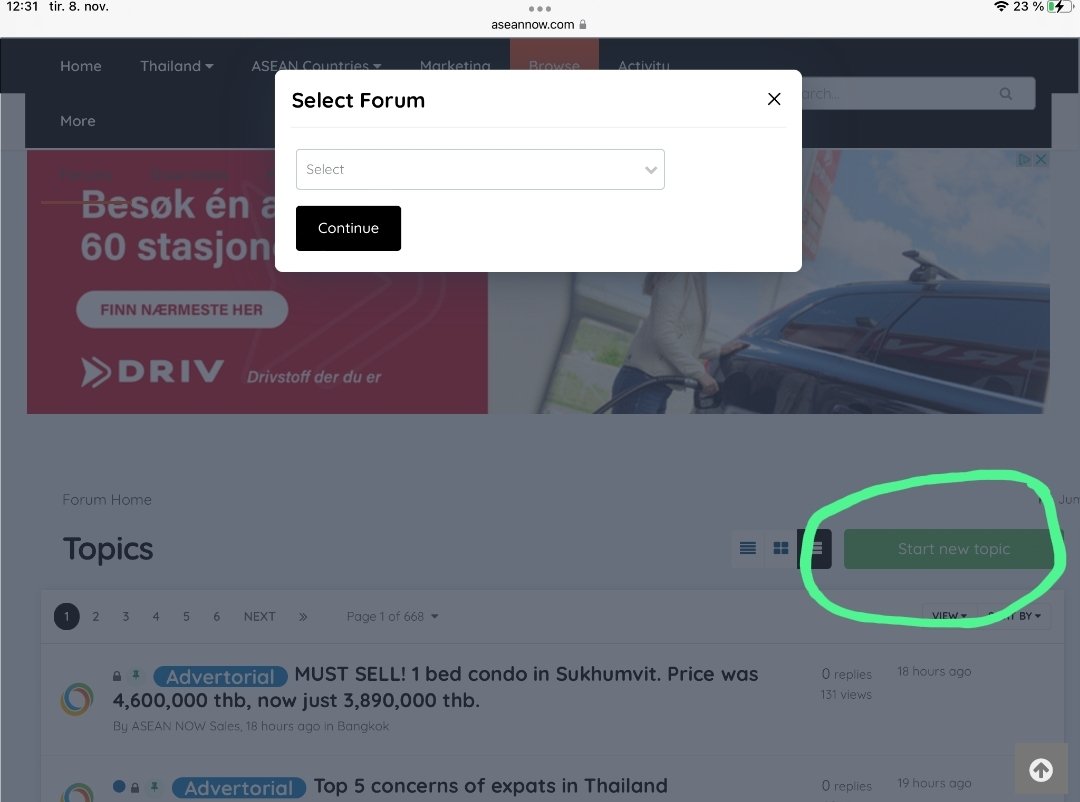

Alternatively, go to the forum home page: https://aseannow.com/ Then click the word, "Bangkok" which you will find under the heading, "Thailand Local Forums": Then click, "Start New Topic":

-

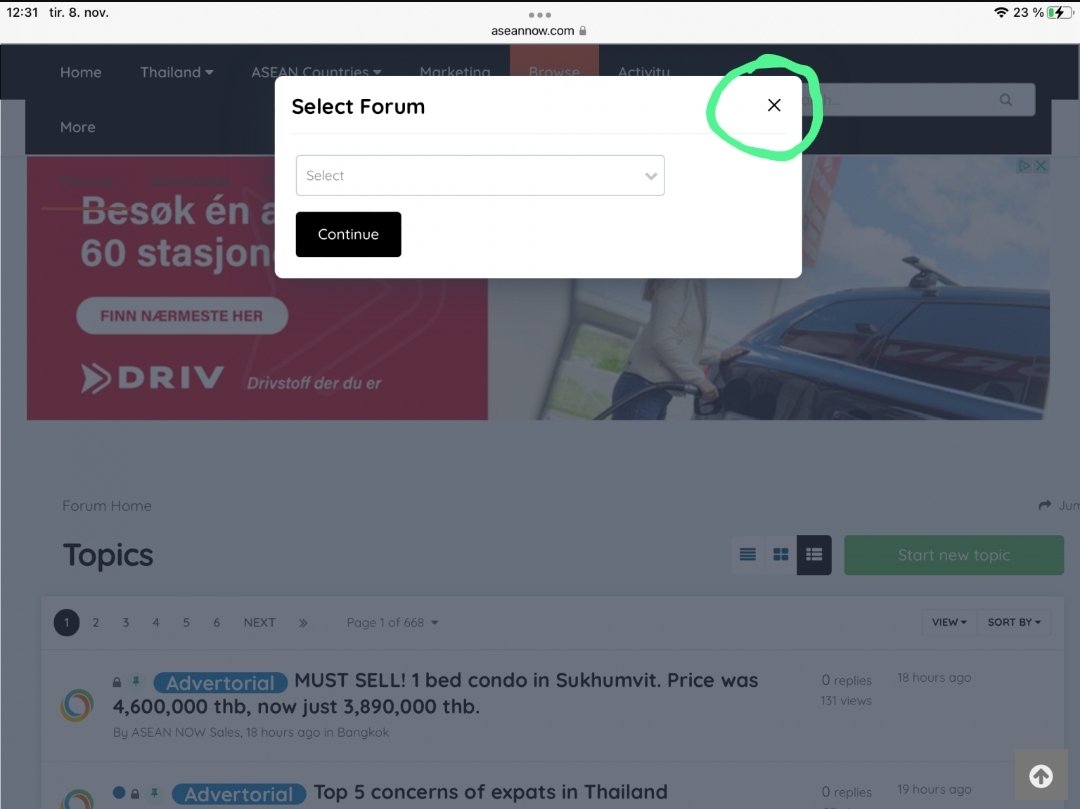

You can't select the Bangkok forum because you are already in the Bangkok forum. That is why that menu option is greyed out. Click the x on the select forum box: Then click Start new topic:

-

If you want your exposition to have any effect then you need to do it the right way. This would be for you to petition the relevant Thai authorities directly instead of using an internet forum. You may or may not be aware of the case of Andy Hall, which took many years to resolve. If you are not aware then I politely suggest you spend a few minutes googling and reading up on what that man had to go through before you start naming and shaming businesses in Thailand. You may not want to hear it, but I am telling you this for your own benefit. Defamation in Thailand is both a civil and a criminal matter, and no matter how right you are, and how much truth you speak, none of that is a defence. If you cause the business owner a loss then you are guilty. I will remind you of forum rule 7, which you agreed to abide by: You will not post defamatory or libelous comments. Defamation is the issuance of a statement about another person or business which causes that person or business to suffer harm or loss. A statement does not have to be false to be defamatory. Libel is when the defamatory statement is published either as a drawing, picture, painting, motion picture, film, or letters made visible by any means or by broadcasting, dissemination or propagation by any other means. Defamation is both a civil and criminal charge in Thailand and elsewhere in ASEAN.

- 1 reply

-

- 17

-

-

-

-

Hi Jimmy Moderator usernames are in red. Administrator usernames are in blue. Administrators can access different functionality. For example an administrator can create or remove a sub forum.

-

Moved to the Health forum.

-

Posts are removed by moderators, however every post that is removed must contravene our Forum Rules. The forum has a multi-stage appeal process, so if a member would like to appeal the removal then in the first instance they can PM the moderator to clarify matters. Members can also contact Support to review the moderator's decision. On occasion, when it is difficult to decide if a post contravenes forum rules then the moderating team will have a group discussion in order to form a consensus. I would also mention that posts are not deleted, they are instead removed from public view. Every removed post is labelled with the moderator's username and the reason it was removed, and a permanent log is kept of all moderator actions. The removal process is transparent and all moderating staff can view each other's actions. This enables the moderation team to be consistent with their actions over time.

-

I don't know any commercial businesses that would allow their competitors to place free adverts (that never expire) in their store.

-

You nailed it when you mentioned competitors. Forum rule 25 gives the reason: 25. You will not discuss or post links to other Thailand or ASEAN based forums, or forums which could be considered as competition to ASEAN NOW or our sponsors.