-

Posts

3,193 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by TroubleandGrumpy

-

Can I wean myself off Windows, for good?

TroubleandGrumpy replied to GammaGlobulin's topic in IT and Computers

I hear you and will give a brief reply - busty today catching up on 'paperworek' as they say here. The first and biggest issue is the device itself. Phones just do not have the ability (Os etc) to preclude intrusion by other apps and when browsing online - such as that a computer can have. I was a business guy so I cannot give all the technical details, but as an example it is very easy for pros to hack into a nearby phone than into a nearby computer that has been setip well. I have used iPhones for many years because they are a lot better than Android devices, just for their security - lets alone their control over the apps that can be downloaded. But even they are prone to being hacked by the smarter guys out there. The second is that the phone is an obvious physical target - why break into a house for a laptop when you can just steal a phone. They are the preferred device for those that steal to sell to those that hack - and on it goes up the chain. Not only can they wipe clean your device and re-sell it - they can take out much of the information stored in there - if they think you have money. Does this house have a laptrop - versus - there is a new Samsung Galaxy. In Thailand the IT systems are 'less than optimal' and apps on phones from Thai organisations can be very problemmatic. It is not just the app for the phone - which are inherenbtly much weaker than the apps developed and managed in the west - it is also the other apps which can get access to info on the phone. It astounds me people using online services to buy things on their phones not realising the risks involved - like seeing an old Expat riding a bike without a helmet - why? When you access an internet website on a computer, you are being 'protected' by both the device itself and the web browser you are using - plus any other added software etc. When you do that on a phone you are using the app direct to the network - not a browser - and most phones (as above) just cannot be protected like a computer. When an app is given access on your phone it is given access to read all data on your phone - the access permission cannot be set to 'only this data'. Last one - the banks etc want you to use their app. Why - no it is not because it is easier - it is because it is cheaper for them to maintain an app, than a website accessed by 'complicated' computers. VPNs on wireless networks being used by computers. Yes VPNs are 'more secure' because they encrypt what you are sending over the network. But an open network can be used by a hacker to access other devices on the network - not just to see the traffic you send receive. Just dont ever use a laptop on a public network - problem solved. But when out and about you can use your mobile data network - it is fully encrypted and if yopu set it up right, others cannot gain access. Plus always use https sites only - many modern browsers will only access them - because the transmissions are encrypted - unlike the old http sites, which some still exist in Thailand. -

Being pressured to pay off wife's mother's large debt.

TroubleandGrumpy replied to Aust24R's topic in Family and Children

Gen Z basement dweller type for usre 🙂 -

Where to buy new golf shafts - test and buy

TroubleandGrumpy replied to TroubleandGrumpy's topic in Golf in Thailand

I think Covid crashed a lot of Thai shops and stores. There are still a lot of empty places all over Thailand. We are in rayong and in the last year we have been all over Chonburi and up to Khon Kaen and over to Ubon - the economy is still not back and will take a lot longer than they think. No idea about Pantip as have not been there a while - it hopefully will/is get back to its former state. -

Can I wean myself off Windows, for good?

TroubleandGrumpy replied to GammaGlobulin's topic in IT and Computers

I found this topic very interesting. Thought I would throw in my 2cents worth. I worked in IT&T for 30+ years and I know the issues, but I want to just use the things not manage and run them - too old/grumpy to do it. I have 3 laptops - one running Win10 and totally locked down with full security etc - I use that for banking etc. One running Win7 that I use for online movies youtube etc. The third is sitting waiting for stand alone Win12 - if not, then whatever I decide later. All software is either free or bought online - much much cheaper. The virus/malware industry is a nowadays a bit of a scam - only corporates really need it - and even then it is not guaranteed - but when using online banking it would be foolish not to be 'secure'. I never (will) use a banking app on the iphone, or any other app that has/requires details of my banks - they are not computers and are inherently insecure - using those sort of apps in a place like Thailand is very risky. The malware industry is a bit like the VPN - when all most people really need is an IP clone network - just dont use public/open networks. My Win 7 laptop is totally open and has never had a problem - only a hardware fail - just reloaded from the backup. Linuc etc are great for bare bones machines for gamers and others who dont want CPU wasted running a bloated OS. Chromebook was a great concept and works fine - except when you want an app they dont have or does not run well - plus I like local storage. -

Australian Aged Pension

TroubleandGrumpy replied to VOICEOVER's topic in Australia & Oceania Topics and Events

I agree - please do not close this thgread - ban those who keep breaking the rules, but dont punish the rest of us for their sins. This is an important thread to all Aussies. The Pension is always changing and Aussies need to be aware of it. Unlike most other countries where the Pension is a done deal and somewhat locked in when first given, in Aust if the Pension changes, it changes for everyone - including those living overseas - but they dont tell us of the changes. And I guarantee that the Aust Embassy does not give a rat's rear about Pensioners in Thailand and will not take any steps to keep them informed of any changes in the Pension rules. Services Australia publishes a newsletter in October each year - but that is about all they do to advise of changes. Australian Pension News - Retirement years - Services Australia Most changes are mentioned and discussed on forum's like this, well before they are officialy published online. -

Being pressured to pay off wife's mother's large debt.

TroubleandGrumpy replied to Aust24R's topic in Family and Children

Mate are you for real?? I sometimes question members on this forum for their 'reality'. It is clear to me that some are just BS (GenZs in their Mum's basement type people). There are some that just do not know about things because they never experienced them or know someone that has, but they still make comments. I must say I am tending to put you in the latter, as you have been here 10 years? But perhaps you just misunderstood. Let me go through this one step at a time (the worst case). A Thai wife can give you debts by taking out a loan or whatever - and you as husband are legally liable. If those loans/debts are 'called in' - such as by a bank or 'Thai person' shall we say, you are accountable. Given you are accountable, they can get a Police Order and you will not be able to leave the country. They will seek to reach an agreement/deal. You can deny and refuse to make a deal all you like, but the next step is a Warrant to arrest you for unpaid debts. The next steps are not so good. Yes that is worst case scenario - but it has happened a few times (allegedly). I know of one bloke that lost 'his' house because the Thai wife had taken out loans against the house they lived in, to pay her and her family's gambling debts - and to buy the Brother a new bike etc. That is why I am advising the OP that if things are as bad as they seem they are - get the hell out of dodge - only then can the statement be made that they cannot get a dime out of him, because he aint in the country (and never will be again). -

Where to buy new golf shafts - test and buy

TroubleandGrumpy replied to TroubleandGrumpy's topic in Golf in Thailand

We went there late last year - not what it used to be (if it ever was). There are lots of shops in the Mall (Thaniya Plaza), but they have no real 'expertise' in the sales staff and the prices in every shop were very high (cheaper at local Pro shop and driving range). At the Ping store they could not help us with anything related to clubs and clearly did not know the products - we did not ask about shafts back then, but they had none there anyway. We spent a bit of time in the Plaza and did all 3 floors - the whole place was like a bad Thai retail shop full of disinterested staff who have no idea and high prices listed for everything (all the balls are cheaper in local stroes). I think it has been given its 'name' by all the online grifter-vloggers walking around and showing all the stores on Youtube etc. There were not a lot of people there and it was clear the staff were used to doing nothing much all day - anyone who paid for a franchise/shop in that place was ripped off. -

Getting OaP with Super

TroubleandGrumpy replied to georgegeorgia's topic in Australia & Oceania Topics and Events

Check your assets and income limits - easy to calculate if you will still get a partial pension. You get a partial pension but full medical benefgits as logn as you are not too far over the base limits. When living in Australia is is good to not have too much Super - when you are over assets/income limits for Pension that means no free/subsidised medications when you are going to need them - 70+? 75+? Either study up or get financial advice - or both. -

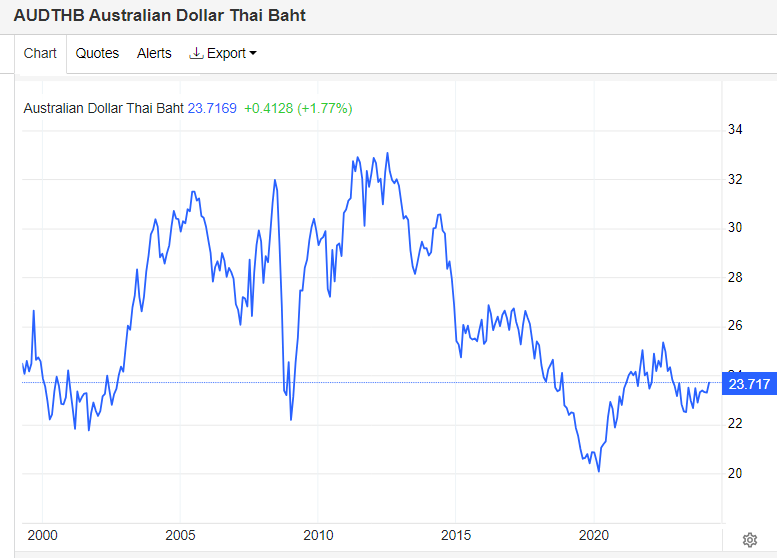

Aussie Dollar, Thai baht.

TroubleandGrumpy replied to Olmate's topic in Australia & Oceania Topics and Events

You can thank Keating et al for taking Aust down that path. Clinton did it for US as well. But many benefits did flow - much cheaper products and a solid economic strength - until China crashed - but now showing signs of recovery. IMO Yes - the Baht might go back to a more 'reasonable' level this year I think - 26-28 ? -

Being pressured to pay off wife's mother's large debt.

TroubleandGrumpy replied to Aust24R's topic in Family and Children

No mate- Expat is liable for debts incurred by wife if they are still married. File for divorce means no more liability. -

Where to buy new golf shafts - test and buy

TroubleandGrumpy replied to TroubleandGrumpy's topic in Golf in Thailand

Cheers mate - much appreciated. -

Being pressured to pay off wife's mother's large debt.

TroubleandGrumpy replied to Aust24R's topic in Family and Children

Not about you - not about me. Grow Up. -

Being pressured to pay off wife's mother's large debt.

TroubleandGrumpy replied to Aust24R's topic in Family and Children

Just a quick point to try and set you straight - this is not about you and how you feel. Plus - I dont believe a word you said - 'my wife owns several businesses' - 'I work during office hours' - ROFLOL - faker. Quit while you are behind mate - that hole will only get bigger. -

Nail on the head HIT !! The elephant in the room !! The use of a DTA is not automatic as some people seem to think. You can only use a DTA as a claim in your tax return and YOU must PROVE you have already been taxed to the satisfaction of the TRD. How you can do that is not detailed or explained - and it will probably not be (there are 61) - it will be IMO decided based on 'legal precedent'. Before I go into what legal precent is, IMO the best strategy to take going forward for the vast majority of Expats is to avoid TRD at all costs - at least for a few years while this all sorts itself out. Gather your own personal information and calculate why you do not (IYO) have to lodge a tax return (eg. My country DTA states Pension not taxed, etc etc). Keep records of all of that information you based that decision upon - reasons, pension payments, bank statements, etc etc etc. IF you are ever asked by TRD to explain why you have not lodged a tax return, immediately go see a tax accountant/lawyer and provide them with your documents and information. IMO very very few Expats will ever be asked to explain. However, if you are earning money from overseas (investments, rentals, etc) and are a Thai tax resident, then IMO you should go and see a tax accountant/lawyer and ask what they think you should do. Legal Precedent is how a lot of issues are resolved in the Thai taxation system (and the vast majority of those are by businesses and wealthy individuals). TRD makes a decision - the tax payers disagrees and lodges an appeal - TRD accepts or rejects the appeal - if rejected the taxpayer takes the matter to Court - the Court listens to both sides and decides - that becomes the 'legal precedent' for this particualr issue - unless the TRD lodges a higher Court Appeal in which case it goes a few steps further. TRD rarely appeals - the matter is handled very amicably (not confrontational like in western Court) with both sides politely asking the Court to help them settle a misunderstanding and/or something that they both are not sure of how it should be decided.

-

Being pressured to pay off wife's mother's large debt.

TroubleandGrumpy replied to Aust24R's topic in Family and Children

Yes worst case scenario - but it sounded like he was in the deep stuff - separated for many months and wife screaming for more money and mother scamming him too. Somehow he is married? Sounding like a bloke that has been ripped off for a long time and finally woken up - he needs to escape. If he is listening - you do not need to be in Thailand to get a divorce - perhaps to lodge it initially - he should talk to an Expat focussed lawyer (and if it is as bad as it sounds, get the hell out of here). -

Southeast Asian Journalists Unite Against Corruption

TroubleandGrumpy replied to webfact's topic in Thailand News

What we in the west call corruption, is seen in SEAsia as how things are done - what we call graft and nepotism is a just an accepted way of life here and it goes back a very very long time. -

Where to buy new golf shafts - test and buy

TroubleandGrumpy replied to TroubleandGrumpy's topic in Golf in Thailand

Thanks mate - much appreciated. -

Being pressured to pay off wife's mother's large debt.

TroubleandGrumpy replied to Aust24R's topic in Family and Children

Absolutely true - plus you must never visit the Mother/Family - the wife can go by herself (like she did before you arrived). Sorry to say this, but you better start checking things out in detail mate. She could be genuine and her mother/family is just using her to get money out of the Falang, or she is actually an active participant in squeezing money out of the Falang - and maybe has already done this before. Whatever happens, never allow her to access your money/bank - Thais are extremely 'compliant' and daughters will do what they are told to do by their Mother/Family. You need to keep a very close eye on things and keep her on a very short lead - and watch how things develop going forward. Plus - mate - you need a plan B - a quick exit strategy and plan in place - just in case. If it does all go to sheite one day, you must leave the country - you have no idea how things can be brought down on you by a Thai family in 'revenge mode' - everything from Police arrest and charges to being charged with some very serious crime. Now that might never goping to happen, but by the sounds of it and yourself, you need to have a Plan B in place. If that happens - go home and regroup and try another country - Philippines etc. Dont come back - you could be arrested at airport or just denied entry. -

Russian fighting it out with hotel guests and Police.

TroubleandGrumpy replied to roo860's topic in Phuket

What could possible go wrong with allowing citizens from a corrupt regime/country to enter Thailand Visa free for 90 days. I think they should do the same for Somalia and Yemen and Syria - they are all wonderful lovely people and their money will bring great wealth and happiness to Thais.- 54 replies

-

- 17

-

-

-

-

-

Does anyone know where I can take my newish Ping 425 woods and buy new upmarket shafts. The wife and I both got a new set of Ping clubs in Aust before moving here. Hers are great, but I have always been struggling with the woods (3, 5, 7, 9). I used to have 3 and 5 Wood and then Hybrids, but I got the 7 and 9 wood hoping they would work better - they did a little bit, but still not good. I have been trying all sorts of things to make them work better - but nothing worked (for long). Last week while playing I had a rare good thought and swapped over my wife's 3 wood shaft and put it on my 3 wood and hit a shot - boom boom. The shaft was too light and too flexible, but the ball flew high and straight well over 200 yards. I did it again from same spot with a slower swing and same result. Clearly I am too old to play with the standard regular flex shafts that come with Pings - so I want to go and try a few upmarket shafts and buy now ones. I dont need new clubs - they are great - and the irons are perfect. I clearly need lighter more flexibale shafts. There are plenty of places in Aust to do that - but I cannot find one in Thailand. We are in Rayong, so if anyone knows a place around Rayong or Chonburi (Pattaya) that would be great. If it means going into Bangkok then so be it. Thanks.

-

Lots of issues there mate - and I hear you - and no one knows everything that is for sure. I can say this - your Super is taxed at 15% of the nett earnings if it is in 'accumulation phase' - the Super Fund pays the ATO direct on its total amount of earnings in all accounts in the accumulation phase . But there is no detail on taxes paid by each account holder - so proving that tax has been paid to TRD would be extremely difficult, if not impossible. If or when you transition to 'retirement phase' and receive regular scheduled payments, your account earnings is tax free (but that money becomes taxable income for ATO and DHS purposes - not taxed but counted). The issues related to your property and capital gains taxes are far more complicated and you would need to get taxation advice from a tax specialist - when things pan out. Your idea to keep your head down and be quiet is very good - and all Expats should follow that advice. As things progress I am sure TRD will clarifiy things - if only through the Courts as this progresses over the next few years. Regarding other countries - both Malaysia and Philippines have stated that they have no intention of applying income taxes against the money that Retired Expats bring into their countries. However, how that actually plays out in each country, given that this is all about stopping global tax avoidance, is uncertain - clearly the 'wait and see' method is the best approach.

-

Foreigners condemned for spray-painting Phuket footpath

TroubleandGrumpy replied to snoop1130's topic in Phuket News

Yet another reason not to go to Phuket - and I thought the list was full.