-

Posts

10,604 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sometimewoodworker

-

Gifting the Spouse

sometimewoodworker replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

That is a problem of the commingling of funds. The simplest way is to maintain the principal of the gift amount in 1 account and pass all increases of any kind to a second account. If it is possible to gift from one foreign account to another foreign account held by your wife and be in compliance with the TRD rules on the tax free status of the funds when remitted is not at all clear, I can find nothing in writing on the rd.go.th website. Also any remittance will be governed by the rules in force in the year that it is remitted, so holding funds outside Thailand has the potential of the rules changing so making them assessable, even if they are actually not assessable this tax year That you or your wife had a conversation with a TRD officer is a good indication. It certainly is no guarantee, you need to get a written opinion from the TRD to have a reasonable confidence that the verbal opinion is correct. It is all too easy to claim a misunderstanding occurred and that the remittance is all assessable income, this would make a 20% gain into a net loss. -

Gifting the Spouse

sometimewoodworker replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

However gifts from gifts from (to?) ascendants, descendants or spouse are tax free up to 20 million -

Gifting the Spouse

sometimewoodworker replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

Gifting children is a rather strange idea, but as long as it’s legal in your jurisdiction and all parties agree and it’s in the interests of the children it is probably OK. 😉 -

Those are a copy of the newer style. The copies are available in many configurations on AliExpress they have been tested to over 5 x the rated current after that they heated enough to melt the insulation, the connections never failed. the latest clip together https://assets.aseannow.com/forum/uploads/monthly_2024_12/IMG_1999.thumb.jpeg.cedc0932c8c6a3133f56642a9d2ec7fc.jpeg https://assets.aseannow.com/forum/uploads/monthly_2024_12/IMG_1999.thumb.jpeg.cedc0932c8c6a3133f56642a9d2ec7fc.jpeg

-

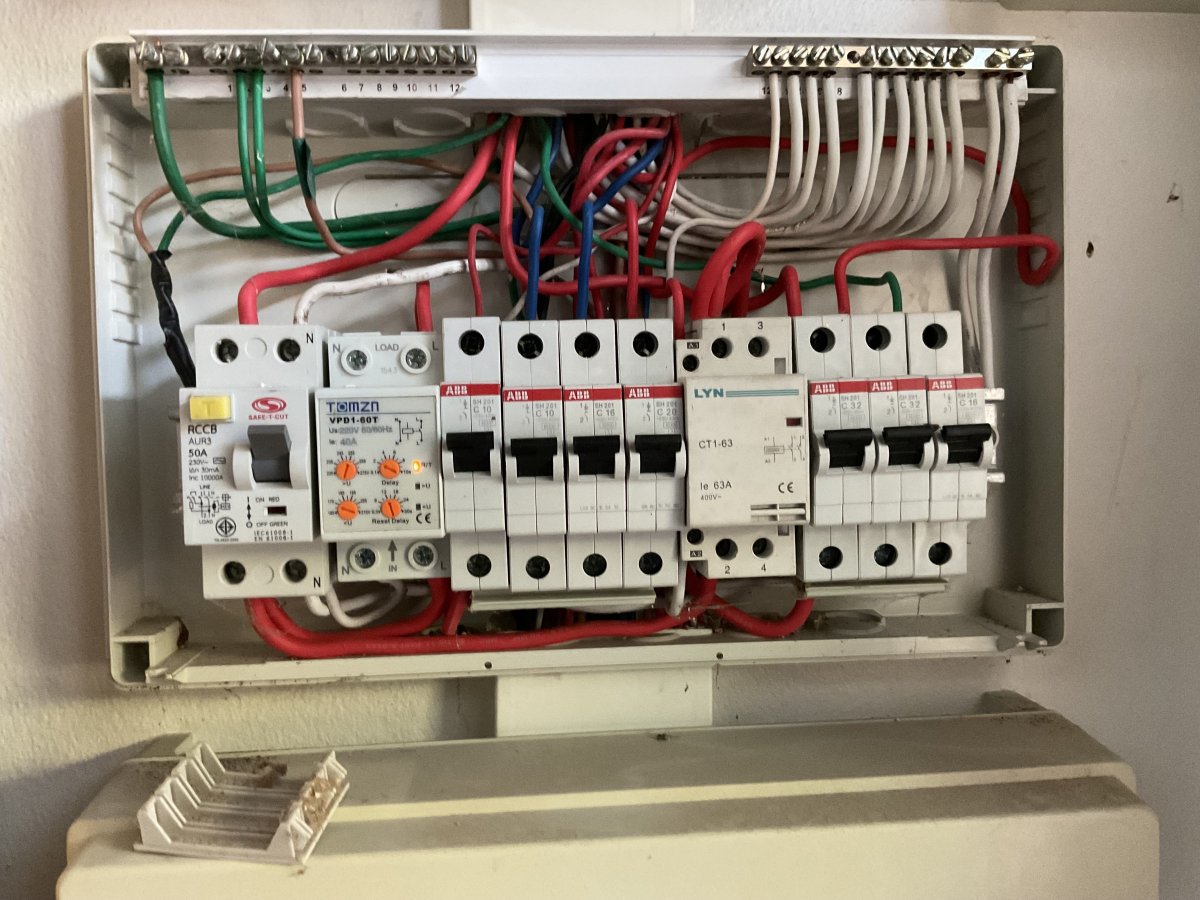

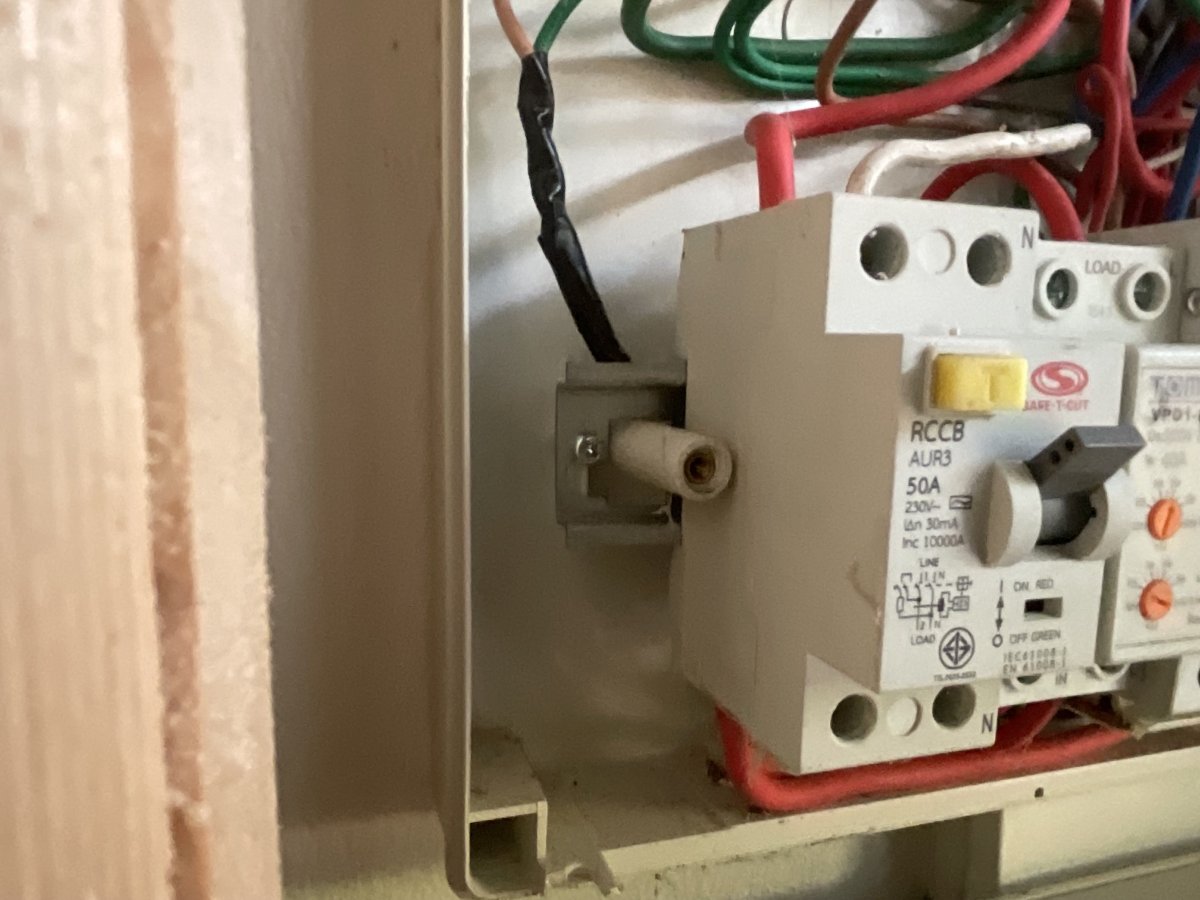

As @Crossy said it’s a total mess as are the cables coming in. None of the wires have brittle insulation. There is no code enforcement in Thailand and often never an inspection. you don’t say where you are located, in the northeast I have the contact information of an electrician. Your install looks to have been done by a blind plumber in the dark. It certainly isn’t the worst but it is getting there.

-

The TRD definition is if you live (or stay) in Thailand for an aggregate of 180 days or more you are tax resident. You may be taxed on foreign remittances even if you are not tax resident the TRD lists the classes of money remitted into Thailand that are classed as assessable for taxation. Remitting the proceeds of the sale of your car could be argued as non-assessable but it could also be assessable depending on the origin of the funds used to buy the car. Just because you sell an asset does not make the money non assessable when remitted to Thailand. The TRD is well aware of the mechanisms used in money laundering. Though if you are going to get challenged and audited is probably rather dependent on how much money gets remitted, 200k almost certainly not, 2 million, unlikely, 20 million and there maybe interest, 200 million is going to be intriguing, 2,000 million and you are a person of interest.

-

What you really need is the toaster that you add water to that’s where you add about 5cc of water. I get crunchy brown outside with fluffy soft insides. 1 peace of thick toast takes 5:30 at 230C from frozen. If I used a regular toaster it would be crunchy all through. its a Chinese copy of the BALMUDA and is roughly ⅓ the price if your spoken mandarin is good enough the QR code will provide information videos

-

My name on the chanot

sometimewoodworker replied to Aforek's topic in Real Estate, Housing, House and Land Ownership

Having a Usufruct is probably the strongest protection for a non Thai. While you do not/can not own the land you can do things like renting out the land and that can last beyond your death. With an usufruct almost the only thing you cannot do is to sell the land. However it depends on the local head of the land department if you will be allowed to get an usufruct on the piece of land. A Chanote title, also known as a Nor.Sor.4.Jor (NS4J) is a land title it is not possible to have a land title for a house so that is not correct. -

Vents Bathroom Exhaust Fan recommendations

sometimewoodworker replied to stupidfarang's topic in The Electrical Forum

Better to wire it on a time delay switch so that it always comes on with the light but stays on for 15~30 minutes after you switch the light off. These are hard to impossible to find in Thailand but Amazon UK will ship them to you in a few days, mine took just over a week to arrive. -

Upgrade Main breaker box

sometimewoodworker replied to bearded_bluto's topic in The Electrical Forum

If you reread my post you will see The 2 bus bars have a plastic sleeves on them they are in the first picture feeding the groups of MCB’s It is! That is the builders way, 😉 an electriction will know that you can loop the connections a bus bar is nothing more than a conveniently shaped wire, faster and safer to install than wire. -

Not at all, however the saying “it’s better to have and not need, than to need and not have” is one I have based my life on, we also have a couple of dogs and 4 cats so we can communicate wherever we are, SWMBO liked watching them from 6,000 miles away, when we were in the north of Scotland. The most expensive cable is the one that is 5cm too short! the external cameras have either an enclosed Ethernet cable (4 of them) an exterior cable outdoor cable that is strung beside our our power conduit or an integral wire supported external cable. Any junction has 3M amalgamating tape encapsulation and so is 100% water proof What do you think! I don’t pressure wash them. But I do have the TrackMix behind a support for a lean-to roof Don't install them under a waterfall! A near strike will fry the camera with or without lightning protection. A direct strike will probably melt the camera The TrackMix has no earthing requirements.

-

+1 on those. I have 6 outside PoE cameras 2 indoor wired or wireless cameras the Reolink 16 port NVR all powered through a big ish UPS that is probably good for almost a day of power cut for out doors I have 4 fixed RLC-842A cameras, a RLC-823A camera for the gate area and a TrackMix for the outside kitchen. Inside I have 2 X E1 Pro’s. I am thinking of adding a second TrackMix or RLC-823A to cover most of the garden and possibly another E1 pro so the workshop has full coverage and maybe an E1 pro for the paint room we have 3 rooms with no coverage, our bedroom, computer room and outside paint room All of these have been running 24/7/365 for about 2 years AFIR

-

Completely covering house with PU Foam Metal Sheets?

sometimewoodworker replied to JeffersLos's topic in DIY Forum

it might, it depends on how much heat is being transmitted by the walls. If they get direct sun, the yes’s it will. Our house walls never get hot as we have double cavity AAC block walls, our windows let in most of the heat but use low-e double glazing and they mostly don’t get direct sun after 9:30. The house, without using AC is usually 10C lower that the daytime high -

Upgrade Main breaker box

sometimewoodworker replied to bearded_bluto's topic in The Electrical Forum

No, the usual is 2, one for the protective earth and one for neutral. you can, most will, add bus bars to groups of units as above. just a FWIW AFIR the 4 circuits on the left are lighting and are unprotected by the under over voltage protection unit on the left. The 3 on the right are for power machinery that may be damaged if the power is too low/high and the power goes through the contactor in the centre but is controlled by the second from the left unit also of course there is the DIN rail that is isolated from everything Because DIN rail is so popular there are hundreds of different modules available from thousands of suppliers so usually DIN rail units are less expensive than plug in units These are at the top, the incomer box with lighting protection and the isolators for the workshop and house the next 2 are for the workshop, (I have too many power circuits in the workshop for a single box to be logical) the bottom one is for the garden the house has its own boxes. All of this is far more than is strictly necessary but units are cheap and when building it’s simple to add circuits for versatility, I can easily have too many high power consumption tools to overload a single, or 2 or 3, circuits -

Upgrade Main breaker box

sometimewoodworker replied to bearded_bluto's topic in The Electrical Forum

They maybe a USA product, that however doesn’t answer the question of the fittings not being DIN rail components. Also what is so good about being made in the USA? that of course doesn’t address the point that the products are probably made in China, Vietnam, Thailand etc anyway. Being a USA product is no guarantee of quality. -

Upgrade Main breaker box

sometimewoodworker replied to bearded_bluto's topic in The Electrical Forum

Those statements are mutually incompatible. Schneider Is a French origin company and uses DIN rail Square D is a USA company that mostly uses their own non DIN rail components A box from the USA is not automatically one of the highest quality. Also using a single box may not be the best choice depending on the number of circuits you have. -

There are various allowances and deductions available along with possible deductions from your countries DTA you tax bill will be some amount under ฿275,000 how much under depends on your personal circumstances it is possible, though unlikely, that you may owe no tax. The TRD has 10 years to decide if they want to audit you (only 3 if you file a return), the penalties for deliberate evasion can be severe and include prison time. One almost immediate action is to hold you in Thailand until they are satisfied that any tax due is paid. Your travel can be restricted, even if you owe no tax, until the TRD happy that your filings, or non filings, are correct and any tax due is paid.

-

As has been noted by numerous posters, despite your spreading of FUD there is ZERO evidence of the claimed proactive general move to close actively used accounts. That some accounts in some banks have been closed is an acknowledge point, if they were being actively used is unknown. This point was never contested. While it is difficult to impossible for most non U.K. residents of modest means, to open a U.K. based account it is not impossible if you have sufficient liquidity. The inescapable conclusion is that you are dressing up your speculation as fact as is @quake

-

The rules for offshore accounts while of some slight academic interest are totally irrelevant to U.K. onshore accounts. There are three of Crown Dependencies along with a number of British Overseas Territories that are mostly totally independent of the U.K. onshore banking system. These have nothing to do with U.K. bank accounts that are located in one of the 4 countries of the U.K.

-

FWIW if you have an active U.K. bank account some banks will not require that you close it. So far they include RBS and HSBC that allow overseas addresses. Some banks have closed accounts, I don’t know that the accounts were actively being used at the time. These include Barclays. Anecdotal evidence could be useful. This would need to include the activity in the accounts, along with the bank name, possibly original opening location. as a starter For reference my Royal Bank of Scotland account was opened in Watford in the 1970’s, it had 12 transactions in October, sometimes more sometimes a few less, my address is in Thailand. I also have an RBS credit card, it has a U.K. accommodation address, it has less than 10 monthly transactions. I have not updated to my Thai address as I suspect it is likely to be closed if I do, I have no evidence, just a suspicion.

-

I opened the account with their predecessor (Williams and Glyn’s) in the mid 1970’s. I have only been a U.K. non-resident since the 1990’s. You will find that virtually everyone (over 99%) who has an active U.K. bank account without being a legal U.K. resident has maintained an existing account. See my post above, also added under for information At the present time Bank of England and HMRC controls over the U.K. banking system while technically not stopping banks from allowing non U.K. residents from opening a U.K. account make it so difficult that only those with high net worth find it possible. So unless you have a few, to many, millions of pounds in cash and assets or are U.K. resident, you cannot open a U.K. account