-

Posts

2,132 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by oldcpu

-

Bank Savings Interest Rates 2023

oldcpu replied to kiko11's topic in Jobs, Economy, Banking, Business, Investments

In the past 12-months, the exchange rate difference (comparing the money kept in Australia (Aus$) instead of Thailand (in THB)) , that money in Thailand could have netted one 9% to 12% (timing dependent) due to a BIG drop in the Aus$. So if one adds to the benefit of a strong THB, with 1.5% in a Thai bank, that is 10.5% to 13.5%, or 84,000 THB to 108,800 THB better than cash in AUS$. That is 44,000 THB to 60,000 THB more than the 40,000 THB (AUS$ equivalent) that makes you happy by having your money in Australia. And that is with no agent. Lets consider the agent - If one subtracts say 15,000 THB for an agent, and your 40,000 THB has shrunk to 25,000 THB, while those with their money in Thailand are ahead 84,000 to 108,000 THB due to the strong Thai Baht. The simple financial fact is that if your money is in the wrong currency at the wrong time (such as the past 12-months in Australia) , your approach will cost you a LOT more money if you keep your money outside of Thailand (in Australia). But hey - if it keeps you happy ... -

Am I Required To File A Thai Tax Return

oldcpu replied to shortstop2's topic in Jobs, Economy, Banking, Business, Investments

There is no appropriately labelled line to claim the remitted tax income, is tax exempt ,due to a Double Tax agreement. Hence the viewpoint of many of us is if the Double Tax Agreement (between Thailand and the source country of your foreign income) states the income is only taxable in the source country of the income, then per that DTA (and per Royal Decree-18 which calls up the DTA), that remitted income is exempt for the purpose of the tax calculation, and should not be included on a Thai taxation form. There is at least one case where a user on this forum phoned up the Thai Revenue Department (RD) (talking to their help line) and they confirmed what I typed above. However given the amount of attention drawn to Thailand taxation as a result of Ministerial instructions Por.161/162, many more foreigners are now assessing if they have to file a tax return. From what I read many of the local Thai RD offices are not conversant with the content of DTAs, and hence one can not be 100% certain the advice provided by the local RD officials is 100% accurate. ... I tend to believe in the reported phone call to the Thai RD help line, which confirms what I typed ... but others on this thread (and even some youtube bloggers (with a possible conflict of interest)) dispute the Thai RD help line. Best wishes in your approach. My view is IF you are 100% certain your remitted income is tax exempt in Thailand (due to a specific DTA) and if you have no Thai sourced income, nor other remitted income (not covered by a DTA), then there is not need to file a Thai tax return, as in such a case the assessable income threshold for filing a Thai tax return will not have been reached by you. Note - I am not a tax expert. I am just an ordinary expat. Do take care as to whose advice you follow. There are some posting (and advertising) who IMHO have either financial , or simple scaremongering motives. -

I think your assumption very very very unlikely for LTR-WP, LTR-WGC, and LT-WFTP where Royal Decree states those visa holders are exempt Thai tax on foreign remitted income, and both BoI and also the RD ( help line) state no income tax return is required for those visa holders if local Thai income less than Thai tax filing threshold.

-

Warning about TTB bank

oldcpu replied to CallumWK's topic in Jobs, Economy, Banking, Business, Investments

A factor here is also the foreign exchange rate. The Thai Baht is up 9% vs the Euro in the past year. Pre-1-Jan-1954 Euro savings I brought into Thailand i Dec 2023 and converted to Thai baht is up about 9% ( due to strong Thai baht vs Euro). Add 1.5% earned in a Thai bank and subtract 2.5% average Germany bank interest for Euro and that means I am 8% better off had I left that money in Germany. However this dynamic, and if it is not planned to spend the money now in Thailand, then in such a case now may be a good time to move the money out of Thai baht to another currency. It's very difficult to time such .. but the point I wish to make is when looking at interest rates of different countries, one also has to consider the currency exchange rate. Don't just blindy assume country A is a better place to keep one's money due to their higher interest rate. The relative movements of the currency to the Thai baht is also a big factor. -

Warning about TTB bank

oldcpu replied to CallumWK's topic in Jobs, Economy, Banking, Business, Investments

I would very very surprised. Thai banks want and need the foreign money to retain solvency. If foreign money left ( due to foreigners having no Thai tax ID ), banks would be at more risk of not being solvent. The top level bank managers have massive influence over politicians. They will ensure this doesn’t happen. Money to the banks talks here. -

Warning about TTB bank

oldcpu replied to CallumWK's topic in Jobs, Economy, Banking, Business, Investments

No. It's because we don't share your view and we may or may not have family here, and further unlike you, we may like Thailand. Is everyone in the world compelled to share your view? especially if we believe you wrong? No one is compelling you to stay. Go in the world where you are most happy, and please allow us to do the same. -

Nightmare at the Prachuap tax office

oldcpu replied to thesetat's topic in Jobs, Economy, Banking, Business, Investments

Indeed. The Thai-Canada DTA is such a DTA where Thailand is not to tax the pension, making it exempt (for tax calculation) per Royal Decree-18, and thus non-assessable in Thailand. In that DTA it states (where I added the word 'Canada' and 'Thailand'): In the case of Canada, it makes it pretty clear ONLY Canada can tax Canadian sourced pensions or similar remunerations, and hence NOT Thailand. And from experience I can confirm Canada does tax Canadian sourced 'pensions and similar remunerations' where the Canadian tax rate is not small. Likely it would be better for the person with the Canadian pension if it was only Thailand (and not Canada) taxing such pensions. -

Thanks ... i think you are the 3rd person who has posted such or something similar. It is DEFINITELY worth repeating. BoI are quite firm in their understanding. The Thai RD help line in essence said the same thing to one of our forum users. It still disappoints me (and gets me suspicious of ulterior motives) that some so called tax advisors on youtube (incorrectly) stay otherwise.

-

Kalasin tax office today- result!

oldcpu replied to Scouse123's topic in Jobs, Economy, Banking, Business, Investments

I think that a bit harsh statement. In addition to the tax code, there are RD ministerial instructions, and Riyal Decrees also governing taxation ( such as RD-18 which addresses Double Tax Agreements (DTA)) where there are dozens of different Double Tax Agreements. Addressing the tax situation of foreigners tends to more complicated than that of Thai locals. It's difficult for the average RD official to stay on top of all of this. -

Avoid to pay tax

oldcpu replied to Jack1988's topic in Jobs, Economy, Banking, Business, Investments

I don't know the precise reporting mechanism nor threshold levels. But I do believe above certain financial levels, global monetary transactions are recorded and per different existing agreements can be and are in cases reported to various governments. -

And if you had read further, you would also have noticed I typed the following: I made it clear that residency and accessibility were factors ... as the income could be considered not in the 'assessible' income category. i do thou, think it important, one has documentation to prove the income was earned when one was NOT a resident Yep. No argument from me there.

-

Avoid to pay tax

oldcpu replied to Jack1988's topic in Jobs, Economy, Banking, Business, Investments

My understanding is (for your case) only if your income comes from Thailand. If it comes from Thailand you need to file a Thai tax return and report that income. -

Nightmare at the Prachuap tax office

oldcpu replied to thesetat's topic in Jobs, Economy, Banking, Business, Investments

Only if assessable. You should not file if exempt under a DTA, otherwise you encounter the same problems as the OP. What's the point of a DTA if you're required to file for tax? I agree only if assessable income AND if above the Thai tax filing assessble income threshold for filing a Thai tax return. As to the point of there being DTAs? ... it is to avoid double taxation. Not to avoid tax completely. The DTA is to help determine cases where one county may have exclusive taxation rights (and the other country no taxation rights) and to help in the situation where both countries can tax an income (to avoid double tax). There can be cases where legally due to DTAs and Royal Decrees on taxation and due to the source of one's income that: (1) a person pays taxes in both countries (but not above the maximum that they would pay if only one country involved), or (2) a person ONLY pays tax in one country on their income, and not in the other country, or (3) a person pays tax in neither country on their income, or (4) a combination of the above for different income sources. It all depends on how the tax law is implemented, together with Royal Decrees on taxation (such as Royal Decree-18 and DTA contents), Royal Decree 743 (LTR visa) and Ministerial instructions por.161/162. If remitted income to Thailand is exempt in the tax calculation, then it is not to be included in the assessment as to the threshold for submitting a Thai tax return, nor (if threshold reached to file a return due to other income) is the DTA tax exempt income to be included in a Thai tax return. I am not a tax expert - but sadly, seeing some of the mistakes in some of the youtube blogger purported tax advisors, it appears at present, neither are they experts, as perhaps some time is needed to see how this all plays out. -

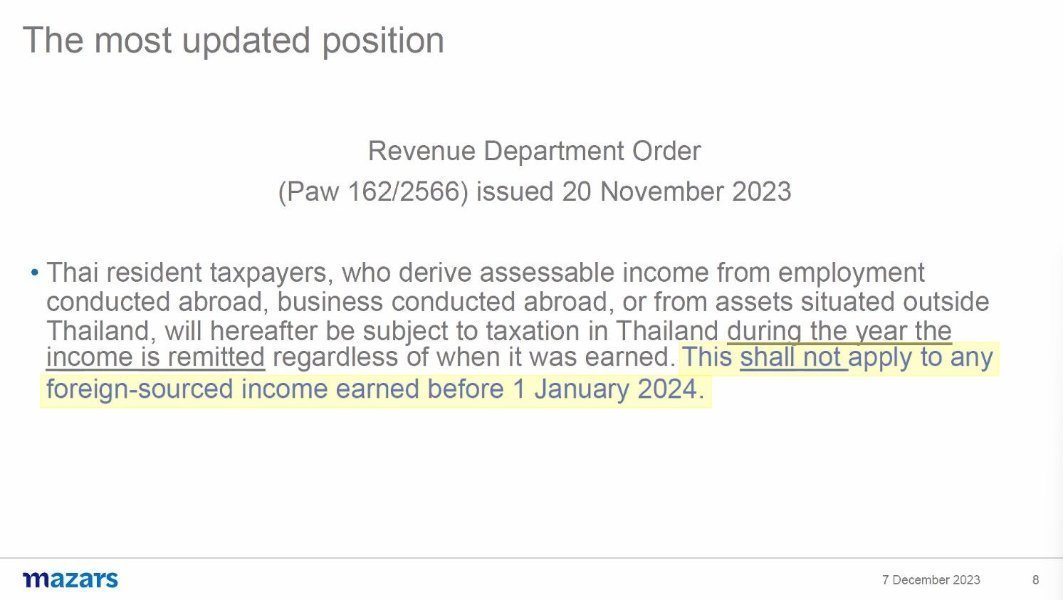

While that makes sense in terms of what I would like to see, sadly I am not so certain of that being accurate. Consider Thai RD Ministerial Instruction Por.162: The resident tax payer, who derive assessable income from ... assets situated outside of Thailand, will hereafter be subject to taxation in Thailand during the year the income is remitted, regardless of when it was earned. This shall not apply to any foreign-sourced income earned before 1-January-2024. So that suggests the income you earned (when not a tax resident to Thailand) can still potentially be taxed by Thailand in year 2026 or any later year if you remit that income into Thailand. But I am not certain there ... as (per what you note) one is NOT a resident tax payer when that income was earned. Having typed the above, dependent on the wording of the DTA of one's income source country with Thailand, the income earned may not be assessable in Thailand and hence not taxable in Thailand .... And further if that income earned (when one was not a Thai tax resident) was already taxed by the source country, then one nominally should have a tax credit if there is a DTA with that income source country that one can use to ensure that one is not double taxed by Thailand. So - sad to say ... this could be more complicated.

-

Kalasin tax office today- result!

oldcpu replied to Scouse123's topic in Jobs, Economy, Banking, Business, Investments

Last time an RD official said that to me was over 2 months ago. They never did phone. -

Nightmare at the Prachuap tax office

oldcpu replied to thesetat's topic in Jobs, Economy, Banking, Business, Investments

Thanks. Using that link and a bit of guessing, for those looking for Thai language versions of the Thai-German, and Thai-Canada DTAs: Canada-Thai DTA in Thai language https://rd.go.th/fileadmin/download/nation/canada_t.pdf German-Thai DTA in Thai language https://rd.go.th/fileadmin/download/nation/germany_t.pdf This may come in handy if needing to point out some DTA aspects to a local RD taxation office (in Thai language). Hopefully it never comes to that need. -

Sending money to Thailand, when not a Thai tax resident, should not be an issue (i.e. only in Thailand for 5-months). However when you are a Thai tax resident (ie in Thailand for 180 days or more), any money remitted into Thailand , - if not tax exempt by specific words in a DTA (reference Royal-Decree-18), or - if not tax exempt by an LTR Visa (reference Royal Decree 743), or - if not tax exempt by being pre-1-Jan-2024 savings (reference ministerial instructions por-161/162), then as a Thailand tax resident you are subject to Thailand tax on that assessable income if it meets the tax threshold. If the money you plan to remit is not exempt tax due to what I noted above, then to reduce your Thailand taxation exposure, its best to transfer money to Thailand when you are NOT a Thai Tax resident. That's my understanding, but note I am not a taxation expert. Honestly , some of the videos of those who claim to be tax/advisors/experts, are a bit questionable at certain specific locations in the videos, as efforts are being made to better understand the full implications of por-161/162 in relation to tax residency and DTAs. Even some local Thai RD taxation offices are challenged here , given there are many different Double Tax Agreements.

-

Swiss Pension - taxable?

oldcpu replied to patrickl's topic in Jobs, Economy, Banking, Business, Investments

You can also find the Thai-Swiss Double Tax Agreement (DTA) here: https://www.rd.go.th/fileadmin/download/nation/switzerland_e.pdf -

Nightmare at the Prachuap tax office

oldcpu replied to thesetat's topic in Jobs, Economy, Banking, Business, Investments

If LTR visa holders have local Thai income exceeding the tax reporting threshold then they are required to file a tax return reporting the local invome. I believe only LTR-WP, LTR-WGC, and LTR- WFTP are exempt tax on filing a tax return if no local income and only remitted foreign income. I have seen BoI statements confirming this, and also a user called the Thai RD tax help line and confirmed this as well. Only those initially uncertain and/or scaremongers and/or tax consulting firms (trying to drum up business) have been saying other wise.