-

Posts

8,381 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by david555

-

Is your Gold really Gold?

david555 replied to swissie's topic in Jobs, Economy, Banking, Business, Investments

https://www.gold-analytix.com/ Professional authenticity test of gold and silver devices -

"was absolutely packed last night. Some real good looking girls, good band," Damn....!! So too many farang competition for getting one of those real good looking girls .... ! 😒 😉

-

Depositing 800k for retirement extension

david555 replied to Issanraider's topic in Thai Visas, Residency, and Work Permits

no swift , as i carry it myself i am sure it arrives whiteout any delay or compliance at my Thai bank depositing it in person with my documentations , swift works too but "can" have any hassle , and even a customs red channel reporting gives you the proof it came cash way foreign way to Thailand if that would be needed for the depositing purpose ....... ONLY do not bring gold !(even when reporting it ) as monetary gold importing to Thailand needs import license ,..... not for gold jewels -

Depositing 800k for retirement extension

david555 replied to Issanraider's topic in Thai Visas, Residency, and Work Permits

Why ? as you have the proof of withdraw , AND if you reported it when entering Thailand on the RED channel of customs . as i did that , even whiteout red channel reporting as the sum was under the value of 15000 us dollars ( in Euro bills ) Only thing you need is traceable documentation(s) -

Depositing 800k for retirement extension

david555 replied to Issanraider's topic in Thai Visas, Residency, and Work Permits

if you withdraw the amount cash from bank , you can ask a proof of withdraw i guess , and can show to the depositing bank teller ......or do i missing something here....? And if bringing it cash from your home country same procedure , and eventually reporting out , and in to Thailand reporting by the RED channel following regulations make it easy you know 😉 -

Depositing 800k for retirement extension

david555 replied to Issanraider's topic in Thai Visas, Residency, and Work Permits

same for me , just keep awake and aware you carry it on you ....., don't take taxi but take bus (Safe as many people on board 👍) to your destination ......and FORGET the thought to visit a bar before the bank 😏 -

Swedish Man Arrested for Exchanging Counterfeit Money in Patong

david555 replied to webfact's topic in Phuket News

500 Euro notes are still valid , but not printed anymore by national E.U. banks , but still in use as easy for cash transport -

Swedish Man Arrested for Exchanging Counterfeit Money in Patong

david555 replied to webfact's topic in Phuket News

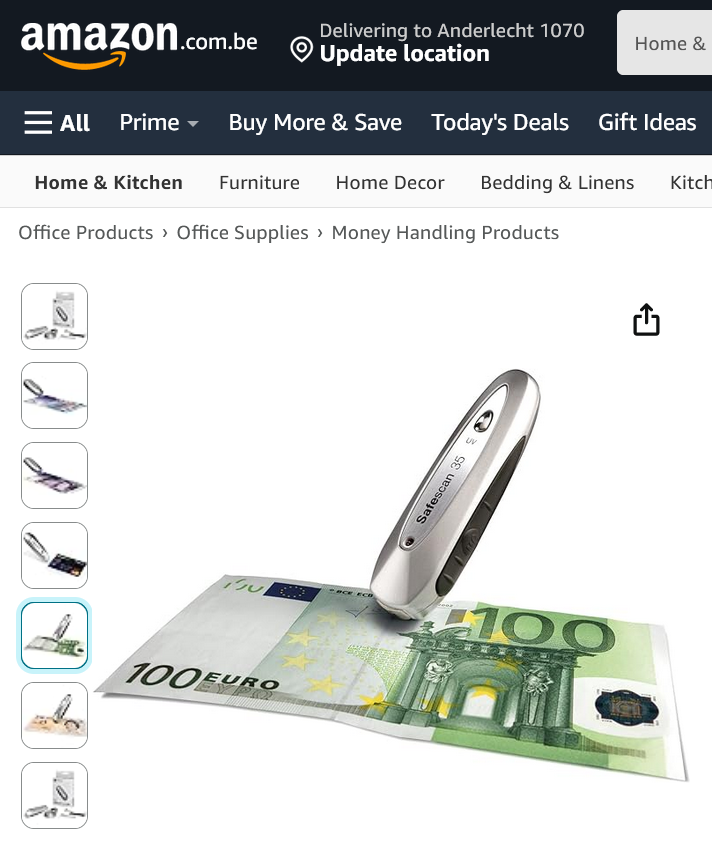

I have sauch one many years , it has a UV light and a metal strip reader who give a beep for a correct Euro bill , probably exist for $ or U.K. pound too https://www.amazon.com.be/-/en/Safescan-35-Counterfeit-Detection-Verification/dp/B002IT17SU?language=en_GB -

I left Thailand 1 Sept 2022 , kept KK account alive with 20 000 baht , and check online (login) regular , load my AIS from it , al seems still working , card go expire June . So activity is on it by AIS loading from account . Only my K+ not working anymore because my to KK connected Smartphone has only Android 8, and K+ plus is now needing Android 9 because update .... But by Laptop /Tablet still working ,

-

That is exactly what i try to say .......so impossible to use a newer Smartphone OR upgrading the older linked Smartphone .....GRRRR ! hence a problem for the outside Thailand foreigners now with Android 8.0 , as needed to be at KK branch to do the new phone with higher Android ( minimum 9.0 ) linking ..... So after 6 February only possible using by PC/Tablet online banking , and hoping in case a OTP needed watching that on the dumb phone (no wifi or data possible ) as before worked ) as that received always sms or OTP

-

oh no problem to reach them as i kept my AIS sim alive aswel as my KK bank regulary checking from my home country sim ....., strange enough by using my European sim ....,( as Thai sim in a spare dumb phone )...., so on my originall used smartphone from years ago to present time is linked with that Thai sim at KK branch . Now working on same Smartphone using KK app with home country sim (?) ....and working by WIFI using ,(not by phoneline however ), so must be the imei number seems recognized by KK app And on "dumb old phone with originnal Thai sim receiving OTPasword and sms messages ..... That is making probanly the problem to starting using a newer O.S android phone as i am 8000 kilomere away from Any KK branch to link the phone i guess .... I load regulary my Thai sim by KK money

-

Yes , but when outside Thailand you can not add your new phone to the App as you need to link that on your KK bank Upgrading yes ..., but a new phone you could only add on your bank , not just online . My problem now as my oldie Snartphone Android *8.0, and my latest o.s 12.0 , of course i can use KK by pc online

-

AIS and True reinforce identity checks for multiple SIM card owners

david555 replied to webfact's topic in Thailand News

But my access to any of my local Belgian providers was with a red mark no access until i did put roaming on again .... AIS DATA roaming putting OFF was no problem as i had acces to my local Be. Wifi Just mentioning like situation was ,not making a point -

AIS and True reinforce identity checks for multiple SIM card owners

david555 replied to webfact's topic in Thailand News

I put it of ,and i could not use myAIS app anymore .... but could be that in Off position sms can be received ... I do not know -

AIS and True reinforce identity checks for multiple SIM card owners

david555 replied to webfact's topic in Thailand News

those adverting sms you can opt-out in the MyAIS app (several options to opt-out ....) in menu "notification settings " Keep in mind you need to keep roamning ON when outside Thailand !! https://play.google.com/store/apps/details?id=com.ais.mimo.eservice&hl=en_US -

AIS and True reinforce identity checks for multiple SIM card owners

david555 replied to webfact's topic in Thailand News

Any messages I get from AIS are in Thai language..... *700*9*7*2# seems to be the code by AIS to put sms to English , -

AIS and True reinforce identity checks for multiple SIM card owners

david555 replied to webfact's topic in Thailand News

Maybe they destroyed them each after Bar-GF annoyed them too much after stopping the bar relation.... (count as-well for the freelancers on multiple Thai Friendly profiles some guy's would / could not keep the sim alive by leaving Thailand..... -

AIS and True reinforce identity checks for multiple SIM card owners

david555 replied to webfact's topic in Thailand News

my Thai number is already more than 15 years in their AIS files , as years later at that time we needed to register at AIS with I.D. in Central Mall in Pattaya basement floor shop , so why now again ? Even connected on Kplus for mobile use at KK branch done . -

AIS and True reinforce identity checks for multiple SIM card owners

david555 replied to webfact's topic in Thailand News

Could be a problem for us foreigners being temporary outside Thailand in home country ...... -

I got Pneumovax 23 at age 70 , and now at 75 a second Pneumovax , no bad implications by the vaccinations . Both when visiting my E.U. home country

-

‘Big Joke’ Jeered For Literally Kneeling Before Potjaman

david555 replied to webfact's topic in Thailand News

Any doubts still who and which :group" go be the next PM as soon he is recovered and out of hospital ? oh ! i start having pity whit the anti Taksin brigade ...... keep strong guy's ! (said with tongue in cheek .....😉)