-

Posts

7,277 -

Joined

-

Last visited

-

Days Won

21

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by ballpoint

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

Just watched a pirated movie. On a scale of 1-10 I'd have to give it 3.14159265359 -

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

I have a mate who has been engaged to 9 different women, but never married any of them. That's a lot of near Mrs! -

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

A man and woman meet at a bar and over a few drinks they get along so well that they decide to go back to her place. A further few drinks later, the guy takes off his shirt and then washes his hands. He then takes of his trousers and washes his hands again. Watching him, the woman says, "You must be a dentist." Surprised, the guy responds, "Yes... how did you figure that out?" "Easy," she replies, "you keep washing your hands." One thing leads to another and they make love. Once they're done, the woman says, "You must be a really, really good dentist." The guy, now with a hugely boosted ego, says, "Well yes I think I am, how did you figure that out?" "I didn't feel a thing!" -

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

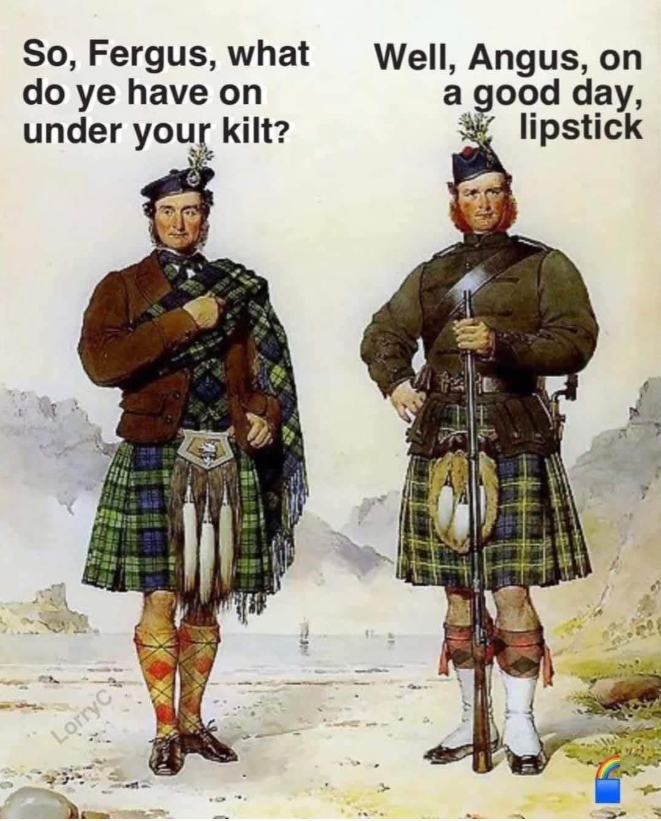

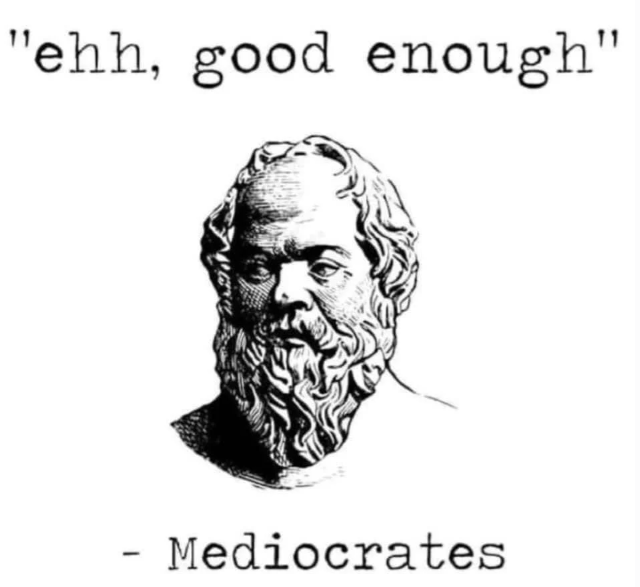

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

It looks like countries that have a lot of citizens working in the UK make these deals to protect their rights. So the large number of Filipina nurses in the UK could very well be the reason. I can't see Thailand doing such a deal to protect UK citizens here unless they get something out of it too. "The UK has agreements with some other countries to protect the social security rights of workers moving between the 2 countries. These are sometimes known as ‘bilateral agreements’ or ‘reciprocal agreements’. If you live in one of the following countries and receive a UK State Pension, you will usually get an increase in your pension every year: Barbados Bermuda Bosnia-Herzegovina Gibraltar Guernsey the Isle of Man Israel Jamaica Jersey Kosovo Mauritius Montenegro North Macedonia the Philippines Serbia Turkey USA The UK has social security agreements with Canada and New Zealand, but you cannot get a yearly increase in your UK State Pension if you live in either of those countries". Countries where we pay an annual increase in the State Pension - GOV.UK And, in order to "unfreeze" your pension, you must return to the UK, not to one of the agreement countries, such as the Philippines. "Your State Pension will only increase each year if you live in: the European Economic Area (EEA) Gibraltar Switzerland countries that have a social security agreement with the UK (but you cannot get increases in Canada or New Zealand) You will not get yearly increases if you live outside these countries. Your pension will go up to the current rate if you return to live in the UK". If you later return to, say, Thailand, your pension will go back to the old frozen amount. State Pension if you retire abroad: How your pension is affected - GOV.UK

-

K bank E-mail with Tax Forms attached ?

ballpoint replied to offset's topic in Jobs, Economy, Banking, Business, Investments

Deleted. Incorrect version of form quoted. -

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

^^^ Which reminded me of this: -

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

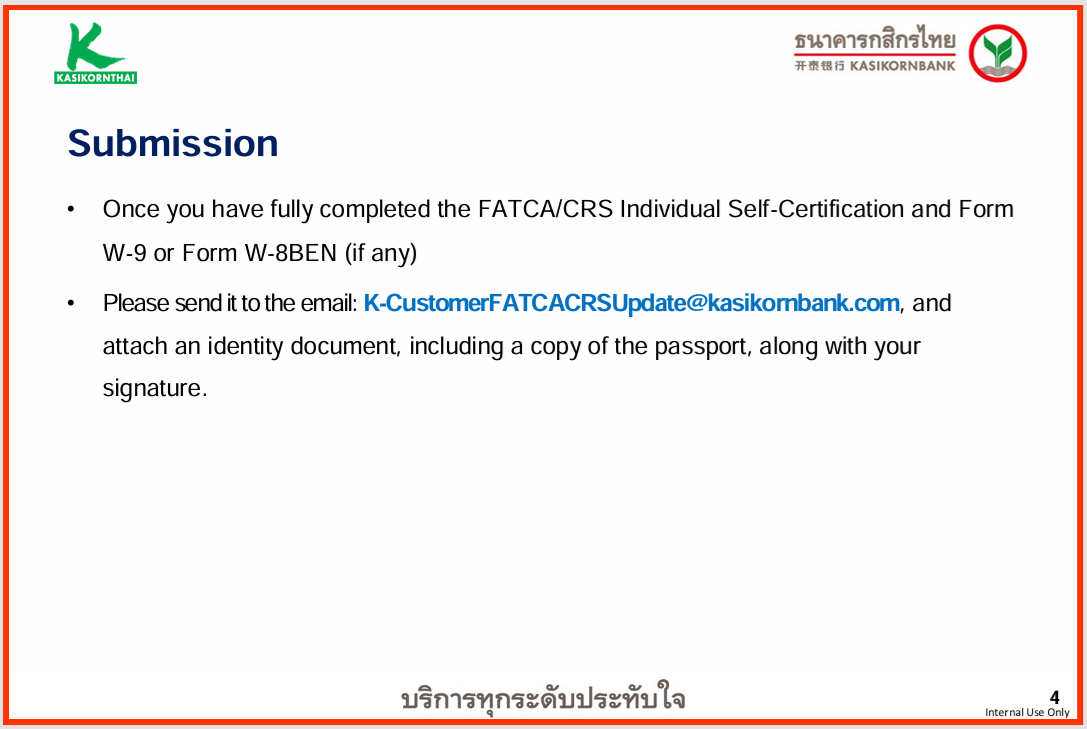

K bank E-mail with Tax Forms attached ?

ballpoint replied to offset's topic in Jobs, Economy, Banking, Business, Investments

I'm a NZ citizen, and haven't received this email either, and have never filled in any of these forms. I've had an account with KBank (or Thai Farmers Bank, as it was back then) since 1988. Going through this thread it appears that long term account holders haven't received it. It's definitely real though, as their website contains the following pdf file (5 pages in total, this is the one with the email address): FATCACRS-Self-CertificationCompletion-and-Submission-for-Individuals-en.pdf I've been asked to do similar with banks / financial institutions in other countries, but in each of these cases, the forms were submitted via their secure websites, not by email. The self certification form for individuals is here on their website: https://www.kasikornasset.com/DownloadDocument/FATCA_IN_TH.pdf?utm_source=web_own&utm_medium=direct_mass&utm_campaign=none&utm_term=kbank!www.kasikornbank.com/th/search&utm_content=none!www.kasikornbank.com/th/personal -

The Russians are sending Ladas to attack the front line now, using the cunning trick of someone hiding in the boot to surprise the enemy. Needless to say, it doesn't work and both occupants are killed. Meanwhile, another Russian, seemingly standing to the side watching this unfold, decides to make a run for it and is taken out by a Ukrainian drone. All quite bizarre.

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!