-

Posts

12,522 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by khunPer

-

They are attracted to females or both; however, there might be variations. It seems to be common that many girls seek relationship with a tom before getting engaged or married, rather than having boyfriends. I've read that Thailand in general talks about 18-gender identities (Straight) Male A man who likes women. (Straight) Female A woman who likes men. Tom (Tomboy) A woman who dresses like a man and likes women or Dees. Dee A woman who likes manly women or Toms. Tom Gay A woman who likes women, Toms, and Dees. Tom Gay King A manly Tom who likes Toms. Bi(sexual) A woman who likes bisexuals, Toms, lesbians, and men. Boat A man who likes women, Gay Kings, and Gay Queens (does not include Ladyboys). Gay Queen A womanly man who likes men. Gay King A manly man who likes men. Tom Gay Two-Way A Tom who can be both a Tom Gay King or Tom Gay Queen. Tom Gay Queen A womanly Tom who likes Toms. Lesbian A woman who likes women. Kathoey/Ladyboy A man who wants to be a woman. Adam A man who likes Toms. Angee A Kathoey who likes Toms. Cherry A woman who likes gay men and Kathoey (Ladyboys). Samyaan A woman who likes Toms, lesbians, and women, and can also be any of them.” Source link HERE.

-

The reason is, that the TM30 database is a new system from September 15th. No data from old database is transferred, so the house owner or host must make a new registration and register tenants/guests/yourself (if foreign owner of home or host) again. Read more from news (The Thaiger) HERE. They do check the TM30 database. Samui Immigration do not accept the part of the announcement for expats in Section 2.2 of section 38 of the Immigration Act, which means that if you leave Surat Thani province, you need to make a new TM30 registration. I had that problem, when renewing my extension of stay in October. Also, in the new TM30 system your starting date cannot be earlier than "today" and your stay is stated to be for your validity of stay; i.e., the date stamped in your passport. I'm a house owner and therefore TM30 host. Earlier I used to report the day my present extension of stay ended, and with the new extension of stay's date as the end of stay; i.e. once a year if I didn't leave the Kingdom. If I left, I made a new registration upon entry to my home. I stopped doing that when section 2.2 of section 38 became valid in 2020; however, this was not accepted by Samui Immigration, which is well know to have stricter rules than most other immigration offices. At present 90-days reporting is a separate database from TM30, and it also work different in various immigration offices. At some – probably most places – the 90-days reporting is an individual system counting from date of entry. By Samui Immigration the 90-day-system both resets upon entering the Kingdom and when applying for extension of stay. When your extension of stay is approved by Samui Immigration, there is a new 90-days report-date slip in your passport, counting 90 days from you approval.

-

TM 30 How long to file ?

khunPer replied to teecee's topic in Thai Visas, Residency, and Work Permits

Officially 24 hours. -

Written " owner " in a yellow tabian ban

khunPer replied to Aforek's topic in Thai Visas, Residency, and Work Permits

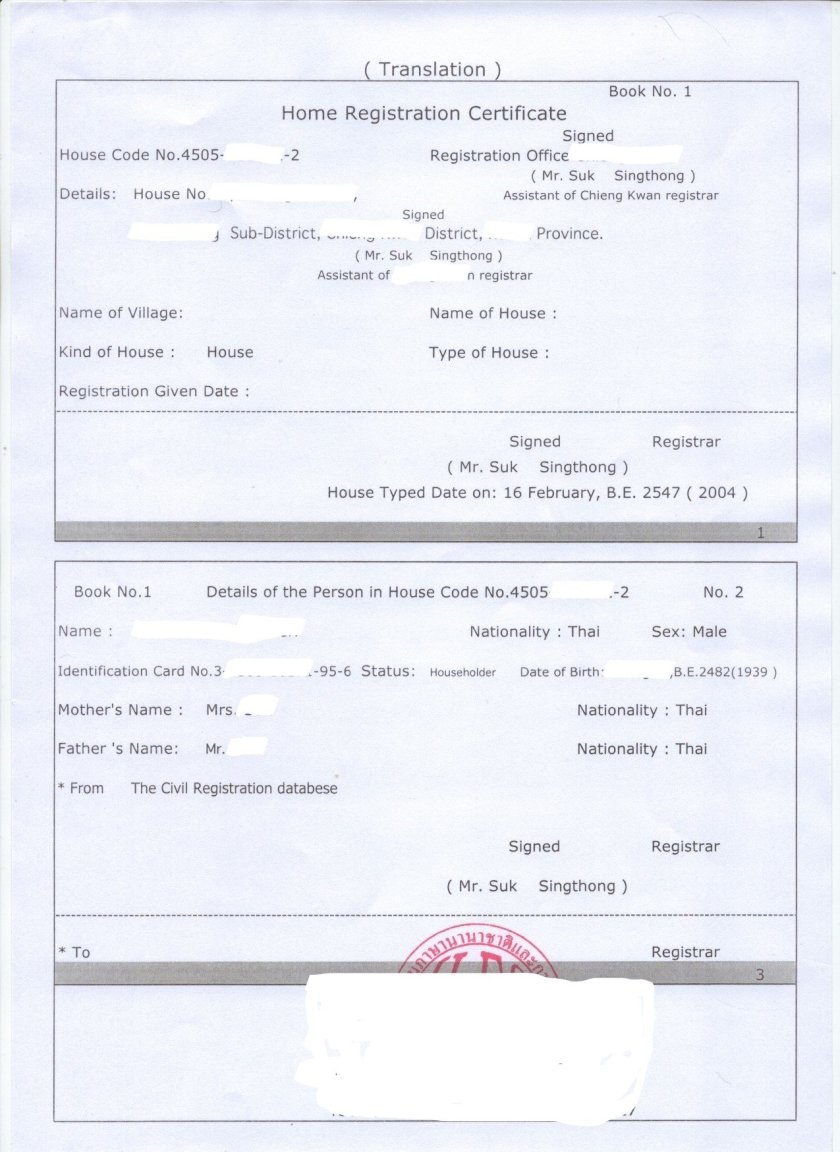

I have one answer, because I'm also listed in the field "status" as "owner" – i.e., "house-owner" – in my yellow house book. I'm living here as retiree on annual retirement extensions. You can own a house in Thailand, but you cannot own the land under the house, exempt in very few cases. Being registered as house-owner id not a proof of ownership, mere that you – or in my case I – is the person that can allow others to be listed in the house book(s), the blue for Thai nationals and permanent residency, the yellow for aliens (i.e., foreigners, I'm not sure about if them for space are also listed here). You can also be listed as house-master, if you are not owner, but the person that can allow others to be obtained in a house-book. The image is one borrowed from the Internet – might even be from an ASEAN NOW forum – with an English translation... The yellow book has same fields as the blue. "Kind of house" – here listed as "house" – can also be "home", which it is in my books. "Type of house" is blank in the example here, in my book it says "Building in 3 floors". -

Fee might depend of where/province. I've done it a couple of times – DL and a lost mobile phone – each time it was 20 baht, but last time was 4-5 years ago.

-

Yes, that's correct: You need a police report – I think it's still 20 baht in fee – and the go to Land Transport Office to get a new Driver's License, which will cost you a fee in the area of 200 baht. It will be same period, as you lost DL. A photocopy might not work, so better get it done.

-

The child would be heir after Thai law, not the mother, if there is no last will. There need to be a lawyer or a by court appointed executor handling the estate; they will get access to information. Official record as father to a child is not enough with a name on a birth certificate, by that age you also need a DNA-test, when not registered married to the mother.

-

It must be a purely matter of taste that Scottish women are better than other women... I've been to Scotland – and many other countries – but I found out that I prefers Asian women... I presume – as I'm not Scottish – that the reason might be the same as why numerous other men comes to Land-of-Smiles to find love. Some of the common answers I've heard through the years are: In general, the women are more feminine; from young folks that the girls are less demanding about "the perfect boyfriend" than Western girls; from middle-age to elder men that it's easier to find love here than at home, especially a younger partner – might be useful to have one to take good care of an elder man – and a young model is especially needed if you wish to expand your family. And finally, from a commercial point of view (which might due to legend not apply for Scottish men...): It's easier for some to find a spouse from Thailand than finding one at home, as you can find one that loves you – or something that seems exactly like that – based on being provider for a family. It might be a combination of above – and a lot of other good points – when men from Scotland and other parts of the World finds a partner from Thailand and other South East Asian countries...

-

You can drive on it right after the heavy roller or drum has made the black tarmac compact. It's cement/concrete that needs protection during a curing-period, preferably 28 days and not less than three days.

-

Thanks for your comment. Others than the OP can have benefit from answers in the forum; I have found a lot of very useful information without ever asking one opening-post question. That is why I bother to answer OPs and comments with questions – the ASEAN NOW-threads even shows up when asking Google for help.

-

The only conflicts or discussion my girlfriend and I had, was about child issues. Where I was more Western-style, she was more Thai-way-of-thinking. Not so much about what might be dangerous – I'm rather into "learn by experience" – but rather setting limits. I might be a bit more old fashioned, but I wanted fixed routines and limits – as you mention by sweets – where a "no" means "no". The easy solution is to give in, I chose the "no"-way, which caused a few short problems and the the child – our daughter – quickly understood, that when dad says "no", it's "no". However, mom was always a second option, which was worth trying... Despite of that, it seemed like we have managed – our daughter is now grown up and my girlfriend and I are still together...

-

For a long-stay as retiree, you need a non-immigrant O-visa – can be obtained domestically if you enter visa exempt – and the financial resources of either minimum 65k bah per month or a bank deposit of 800k baht. You can find affordable accommodation almost all over Thailand. Daily need are also priced quite similar due to expansion of chain stores and competition. My best best advise is always to get around to potential good places after your choice, and check them out for a couple of week or a month. Furthermore, also check them during rainy or monsoon season. Up north, also be aware of PM2.5 air pollution-season. Where to settle is up to a personal view and life-style. Tourist destination can be little more expensive for accommodation, but have have other benefits worth consider. Personally I chose a tourist destination – Koh Samui down south – mainly because of I can easily get what I want of Western-style products and it's "all year summer", never too hot and never too cold. Furthermore there is almost always acceptable air; i.e. low PM2.5. Also, the mix of Western foreigners and expats, makes contact easy – there are by the ways quite a number of Aussies living on the island. The recommended 65k per month fits quite well for a budget for good living – of course depending of personal life-style – but you can manage on less, like around 40k baht a month. You can often find acceptable accommodation for 10k-15k baht pr. month – also on Samui – and manage with 500 baht per day in livings costs for food etc.; however, excluded spending for bar visits and what might follow from that. Health insurance and some budget for local transportation – bus, song thaew, motorbike rent or buy – also needs to be included in a budget. Hope this short info might help you, please feel free to ask questions...

-

where to stay for one week in February

khunPer replied to hotandsticky's topic in Koh Samui, Koh Phangan, Koh Tao

Then you definitely should choose to stay in Chaweng Beach or Lamai Beach to save transportation cost to a McD... -

Survey reveals increasing homelessness in Thailand

khunPer replied to webfact's topic in Thailand News

A (very) small number compared to size of population and for example European countries like Britain with an almost equal number of citizens... New research from Shelter shows at least 271,000 people are recorded as homeless in England, including 123,000 children. Shelter's detailed analysis of official homelessness figures and responses to a Freedom of Information request shows that one in 208 people in England are without a home. Source link: At least 271000 people are homeless in England today. -

Onward Ticket Question

khunPer replied to leosmith's topic in Thai Visas, Residency, and Work Permits

You are entering visa exempt and granted 30 days of stay. The immigration normally won't check your ticket, but the airline might do it when checking in at departure. Your need an outgoing ticket from Thailand within the 30-days period to be safe. It can be a budget airline ticket to a neighboring country, like a ticket from Hat Yai to Kuala Lumpur – short distance, different prices depending on week day – the price range might be in the area of$30 to $50. -

It's a personal choice of preferences, but I would definitely choose "retirement extension of stay" – it's not a visa – as it's more secure and simple. Secure: Because you are not dependent of a marriage to stay in Land of Smiles. Simple: Less paperwork and documentation when applying for yet another year of extension of stay, and no need for a wife to be present. The only two downhill things in my view by choosing "retirement" instead of "marriage" are: 1) You need more money in a bank deposit – i.e., 800k baht instead of 400k bah for a limited period – or higher a monthly income of 65k baht instead of 40k baht. 2) You are not allowed to work as retiree, while you on a marriage extension of stay can obtain a work permit.

-

My long-time girlfriend has enough work by looking after a grumpy old man like me, so she don't have time to work. She however allows me having plenty of time on my own, so just as good if she was working...

-

Tax on 20,000 interest

khunPer replied to matchar's topic in Jobs, Economy, Banking, Business, Investments

You can adjust it or reclaim by the tax return form. -

What other interests do you have as you get older?

khunPer replied to georgegeorgia's topic in ASEAN NOW Community Pub

Wow, was the forum really down for a week... -

Can someone explain the Myanmar politics to me?

khunPer replied to georgegeorgia's topic in ASEAN NOW Community Pub

Military coup February 1st 2021, it's more like civil war at the moment. -

That's 116,000 baht a month after rent, or 3,800 baht per day in average. Depending of the price of ladies and drinks – and how much you spend for health insurance, food, electric, water, laundry, domestic help, transport and more – it might both be enough and way too little. Life-style is pretty much like a rubber band.

-

King Power not happy with talk of abolishing duty-free on arrival

khunPer replied to webfact's topic in Thailand News

Looked purely from a CO2-climate change point-of-view, tax free sales should always be on arrival. If the 360 passengers on a wide body jet in average each carry 1 extra kg of duty free on the trip, the cost in fuel is the same as 4 average "stand weight" (90kg) passengers with luggage...