Thailand J

Advanced Member-

Posts

1,561 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Thailand J

-

Fees for cardless withdrawal coming

Thailand J replied to digbeth's topic in Jobs, Economy, Banking, Business, Investments

That will be 30 to 50B per year for me, no big deal. I have not been carrying any ATM card for years and I don't miss them. -

Motorbike road trip to Malaysia & Singapore

Thailand J replied to banglay's topic in Motorcycles in Thailand

..don't forget the stickers, it's the translation of your registration plate, available at Tour 168. -

Motorbike road trip to Malaysia & Singapore

Thailand J replied to banglay's topic in Motorcycles in Thailand

Don't know about Singapore. To enter Malaysia make sure you bring along original car book and a translation. The single page translation is available at any Land Transportation office including the one in Hat Yai. 30B or 35B, don't remember. Before stamping out of Thailad you must first get the insurance near the border. I suggest you contact Tour 168, they will help you with insurance and help prepare and double check your documents. Malaysian Road Trasportion Department(JPJ) office is between the two check points, get your free permit there before stamping into Malaysia. If Tour 168 or any agent offer to get the permit for you, you can decline. Just get the insurance from them, and get the permit yourself. https://maps.app.goo.gl/W3uJuKujqhWvdyvB7 https://maps.app.goo.gl/XWRjyGRGhmsgNJNd6 -

Why you shouldnt carry cash in Thailand

Thailand J replied to CharlieH's topic in Thailand Travel Forum

I carry some cash just in case my phone run out of battery or mulfunctioned and unable to pay with QR code scan or True Wallet.- 135 replies

-

- 11

-

-

-

-

-

The pink card may not be very useful but I wouldn't say it's useless. I managed to open a new bank account at KTB with yellow book and pink card without a residence certificate. Now you need a KTB bank account to deposit tax refund from Jomtein Chonburi revenue office.

-

I make Moo Ping sandwich often. Recipe: 2 slices of toast, Moo Ping, McDonald style steamed egg learned to make from youtube, Bar-b-Q sauce. Optional: cheese, chopped onion, lettuce, tomato.

-

https://maps.app.goo.gl/oeXDqw4k3pzuYjyq9 mini van to poipet 270B

-

Normally when I scan a QR code to pay, the payment is a direct debit from my savings account. I noticed since April 26 some, but not all payments were charged to my Bangkok Bank credit card. This is something new and I don't remember changing any settings on the bank app. The charges were from different stores. Fascino, HomePro, Power Buy etc. Anyone has the same experience?

-

BOI e-mail reply may tell you that transfers of incomes in the same year are tax exempted for LTR-W visa holders, but the claim is baseless. When you dig deeper the only thing you can find is Royal Decree 743. Tax exemptions for all types of LTR visas come from Royal decree 743, which does not cover income in the same year for LTR-W visas. I will not base my tax planning on an unsubstantiated statement from BOI. I am transferring only incomes from the previous year.

-

Wind direction: https://www.ventusky.com/?p=12.675;101.183;11&l=temperature-2m

-

Talk to SCG Homes. My Pattaya house is in a mostly farang moo ban. SCG Homes installed my neighbors new roof over the new kitchen and also replaced the old roof over his patio. A big job done right.

-

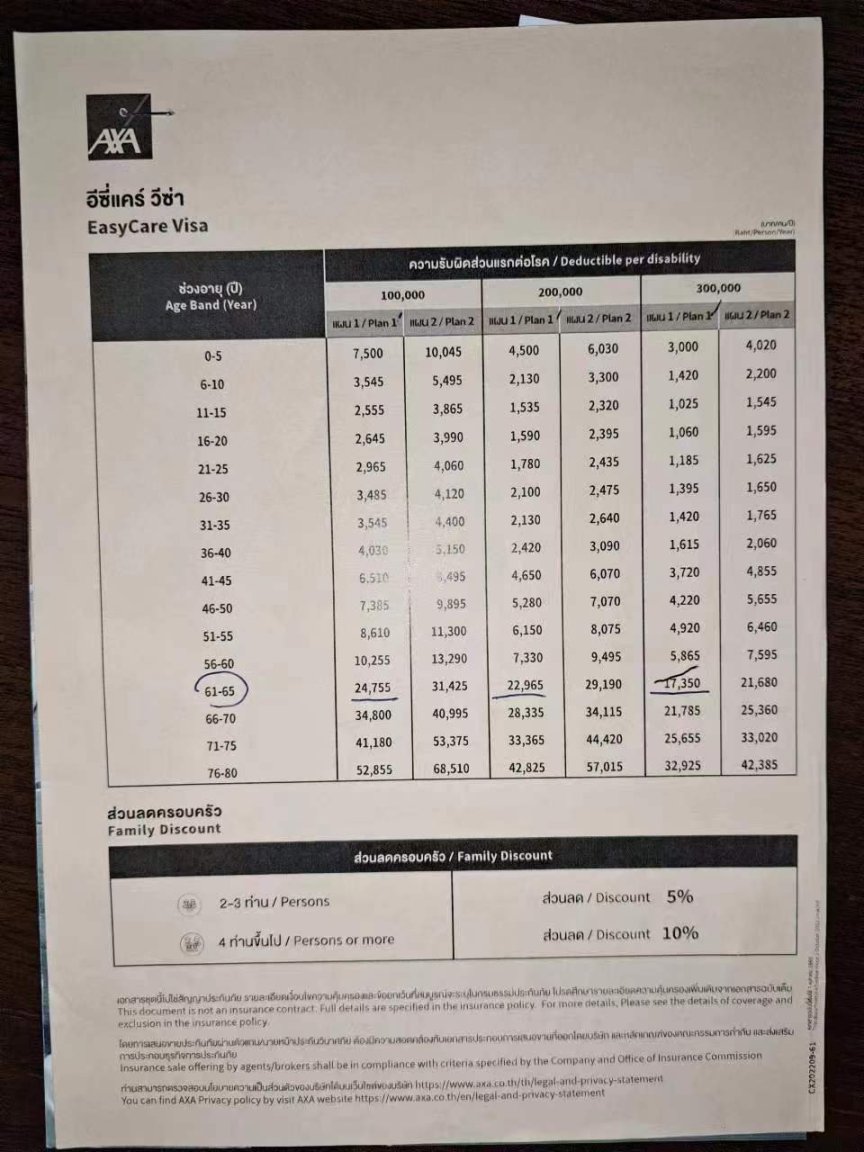

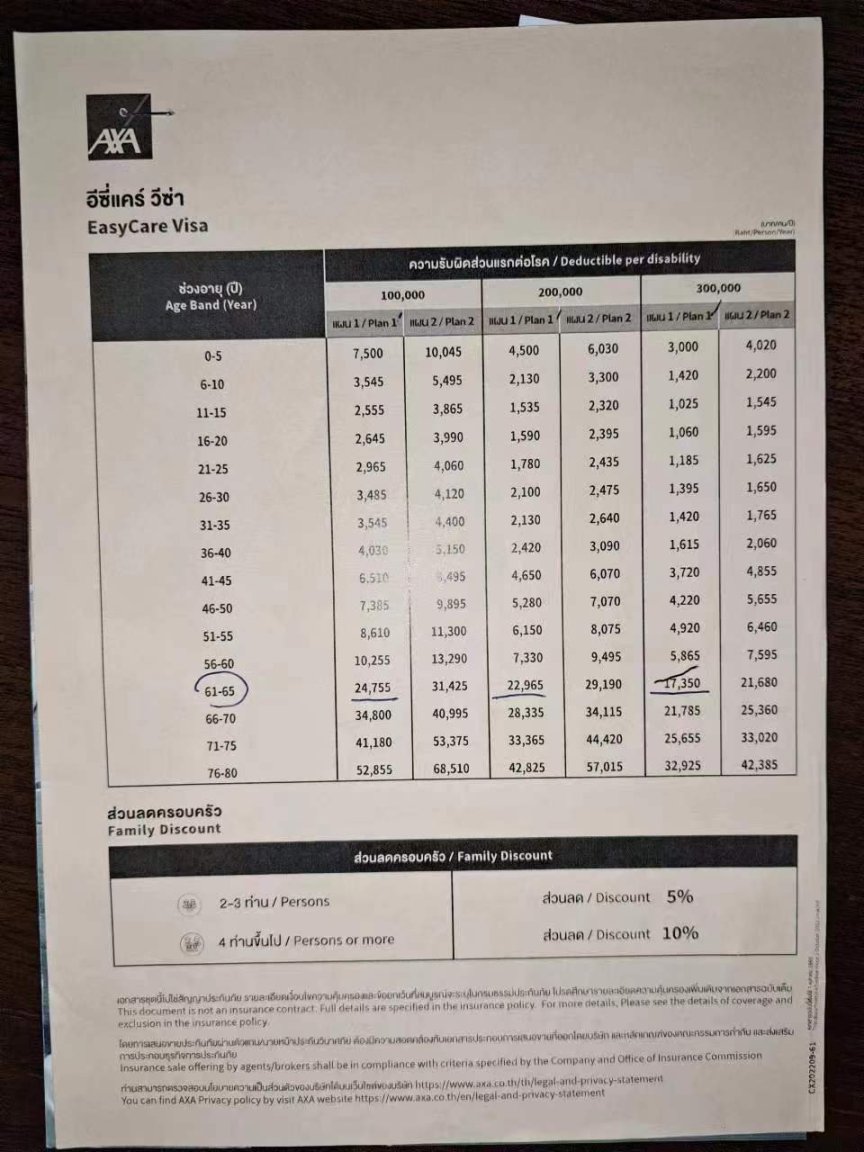

Plan 1 has a maximum benefit per disability of 2M which is above the $50,000 BOI requirement, so Plan 1 is acceptable. BOI does not care about the deductible, it can be any amount of your choice. I bought the policy just to meet LTR visa requirement, so I picked the highest deductible at a lower cost.

-

I am happy with the brand. May be they have changed the content? Try another brand. There are many to chose from online, used to be only two or three sellers.

-

From my experience in Nov 2023, it took 6 days from Step 4 to Step 8. The day after the status changed to " Consideration by Gov Agencies" (step 4) I was requested to submit insurance certification. Almost immediately after I had submitted that, I receive a request to submit insurance policy. 4 days after that I was able to make an appointment online to get the visa.

-

I didn't shop around. I bought health insurance for LTR visa from AXA, the only company I called. The premium depends on the insurer's age and the deductible. In the picture below , Plan 1 with 2M maximum benefit is good enough for LTR visas. I needed at least 10 months left on the policy at the time of visa approval, so I started the application without health insurance, and bought the policy when BOI asked for it.

-

Pattaya’s Newest Beachfront Market Prepares for Splashy Debut

Thailand J replied to webfact's topic in Pattaya News

Near Twin Palm Resort here: https://maps.app.goo.gl/SaMcRNNcVSrAGwLd6 -

Hong Hong Dog Cafe is on Pattaya Nua. https://maps.app.goo.gl/CGHrSScEq6UcAdyX7

-

You need to deal directly with NT, make and appointment to install fiber optic cable and the condo front desk will charge you 2500B for hooking up to their meter room cable. Go to their office across the street if you have problem with the front desk new staff.

-

There is a utility room or meter room on every floor next to the elevators. TOT tech ran fiber optic cable above the ceiling along the hallway from that room to my condo. 2500B was paid to the front desk, receipt issued by VT. The fee is the same no matter which floor you are on. I've just checked my record , it was in August 2020 when I was remodeling my condo. My crew worked with TOT tech to have the fiber optic cable run into my unit , and have the cable in the wall (not on the wall) of my living room. I have double units at the corner.

-

Don't know about VT2A, my condo is in VT5D. I paid 2500B to run fiber optic cable from the utility room to my unit in 2021. TOT, which is now NT is the only choice. Once you have fiber optic cable connected to your unit, you can pay yearly for the service.