Thailand J

Advanced Member-

Posts

1,561 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Thailand J

-

Time to do a Roth conversion?

Thailand J replied to JimGant's topic in US & Canada Topics and Events

Pay tax now or pay later the results are the same. if you invest in the same investments and if the tax rates are the same. Say Balance=B, Tax=T, Growth=G Conversion means tax the balance and let it grow in Roth and withdrawal tax free, Yield=B x T x G, tax comes first. Let the balance grow in traditional IRA and pay tax at withdrawal. yield=BxGxT, tax comes last. My math teacher told me AxBxC=AxCxB, so BGT=BTG, if you invest in the same investments( same growth G) and if the tax rates (T)are the same. Tax rate is the tricky part, you'll need to compare your present tax rate to your anticipated future tax rate to see if conversion is for you. -

Creating IRS account with ID.me for verification

Thailand J replied to Galong's topic in US & Canada Topics and Events

I don't think you can eFile 1040 on IRA account. The only site I can create an account to eFile without a US phone number is OLT.com. Now that I have an IRS account I don't mind filing 1040 by mail. I will know if something went wrong and if it didn't reach the IRS. -

Creating IRS account with ID.me for verification

Thailand J replied to Galong's topic in US & Canada Topics and Events

It's useful to have an IRS account. Paying tax is simple, as bank information can be saved. Good bye Direct Pay and EFTPS. -

Form 7162 Anybody Received Theirs Yet for 2024?

Thailand J replied to John Drake's topic in US & Canada Topics and Events

Not yet. Jomtein, Pattaya. -

Time to do a Roth conversion?

Thailand J replied to JimGant's topic in US & Canada Topics and Events

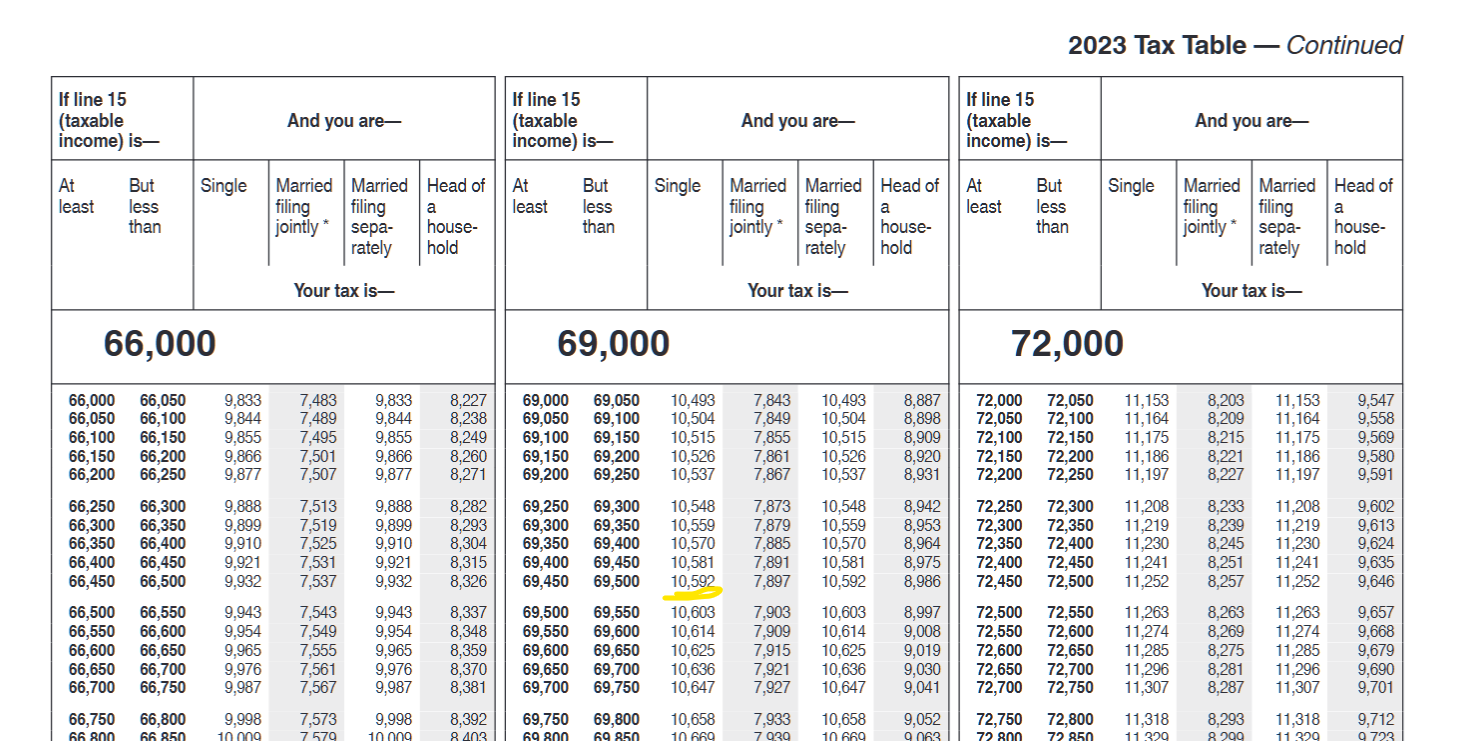

IRA distribution or conversion to ROTH pushes up to $47000 of my long term capital gain and dividends (pretty much all my incomes nowadays) from 0% tax to 15% tax. The table below is the additional tax when I do a conversion. Might as well go up to 24%, about 190K a year. -

AXA told me I can renew until 99. I have a lot less than 100K cash at anytime. I move my cash and bond into Berkshire Hathaway which has a 1 year beta 0.55. For example if the market drops 10% BRK will drop 5.5% in theory. Over the years the stock price has increased many folds, making it almost impossible to lose money.

-

Buying insurance or keeping 100K to qualify makes no difference to the visa. As long as you qualify. To me buying the insurance which the premium is a small percentage of 100K and invest the money is the obvious choice. Each to his own. If you have a habit of keeping cash instead of investing there is no reason to venture into investing. I have my money in stocks no way I am going to keep 100K sitting around.

-

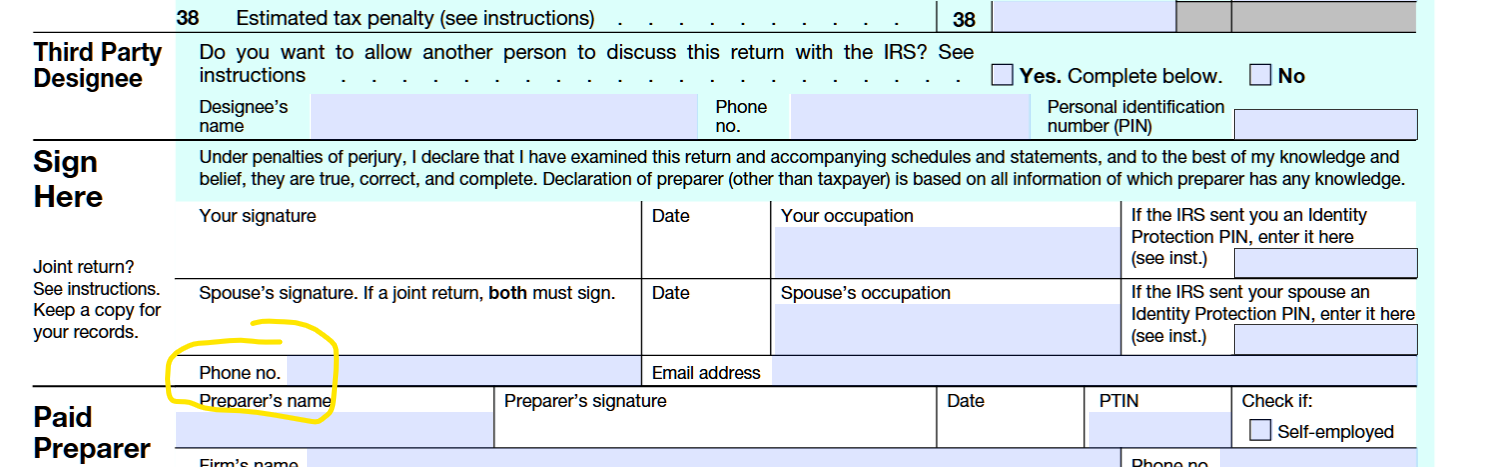

Creating IRS account with ID.me for verification

Thailand J replied to Galong's topic in US & Canada Topics and Events

Only ID.me works with IRS, not Login.gov, so this morning I create an ID.me account. I used my US passport, SS card and SS-1099 . Uploading files and video interview included, took less than an hour. Thai address and phone number are acceptable. I wasn't able to sign in to my IRS account on my window laptop, facial scan failed. After I had successfully signed in on my android phone for the first time, I am able to do so on my laptop. -

Thailand to tax residents’ foreign income irrespective of remittance

Thailand J replied to snoop1130's topic in Thailand News

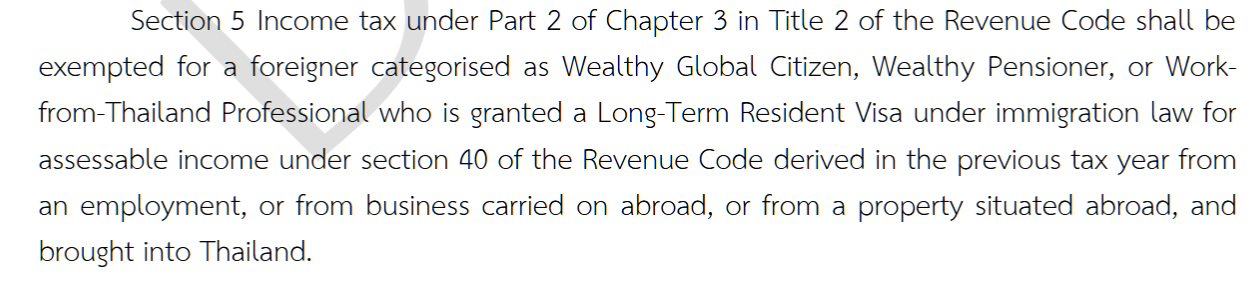

Depends on the DTA between your country and Thailand. US SS benefits and government pensions are not taxable here according to US-Thai DTA. Unfortunately US private pensions are taxable here, such as IRA's and Roth IRA's. Exemption from tax, Thai Revenue Code Section 41(12): "Special pension, special gratuity, inherited pension or inherited gratuity." I wish I can get someone in the RD to clarify what is special pension. -

Thailand to tax residents’ foreign income irrespective of remittance

Thailand J replied to snoop1130's topic in Thailand News

I got you. I hope you see my point that Thai tax could be alot more than what we are paying back home, could be many times more. Are you sure he's paying 25% effective rate back home? may be he was talking about his tax bracket. Also the 35% Thai tax he mentioned is more likely tax bracket, not effective tax rate. -

Whats the difference bt Mpass, Mflow and Easyflow?

Thailand J replied to advancebooking's topic in Thailand Travel Forum

Easy Pass / M Pass are useful when you don't have enough fiber in your diet. M Flow is for you when you have enlarged prostate. One is for number 1 the other is for number 2. Different lanes. -

Thailand to tax residents’ foreign income irrespective of remittance

Thailand J replied to snoop1130's topic in Thailand News

In 2023 If a US person had $83333 short term capital gain, which is taxed as ordinary income, after standard deduction of $13850 taxable income would be $69483 and the tax would be $10,592, about 318,312 B. Compare that with 617000B in your example. Thai tax is almost double the US tax. -

Thailand to tax residents’ foreign income irrespective of remittance

Thailand J replied to snoop1130's topic in Thailand News

If a US person earned that income in US from capital gain or dividend, the personal exemption is $14600, next $47025 is taxed at 0%, above that the tax rate is 15%. assuming US1=36B. Bt3,000,000 is about $83333. The tax would be ($83333-$14600-$47025)x.15 =$3256, about Bt117,000 Bt117000 US tax compared to Bt617,000 thai tax in your example. That is additional Bt500,000 for the tax payer even with tax credit. -

I was at Pattaya City Hall to pay condo tax, 1256B for a 140sm condo. QR code payment doesn't work this year. The front desk said next year it'll work, we'll see.

-

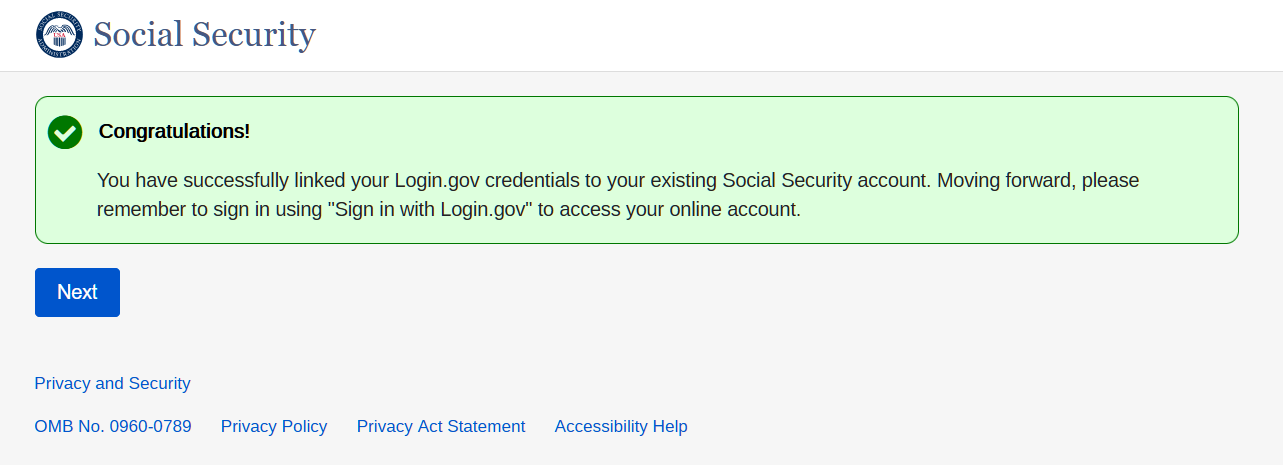

Thanks Pib. Yesterday when I tried to login with Login.gov, I was asked to fill in US address and phone number which I don't have. Today I login my SSA with old password, after login, clicked on login.gov. All i needed to do was enter my login.gov email and user ID, and enter a back up code, am in. I already have a Login.gov account which I have created a few months ago for EFTPS, created with Thai address and phone number.

-

The Investing Year Ahead

Thailand J replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

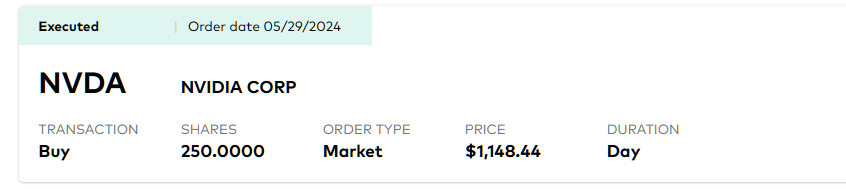

Unbelievable. NVIDIA closed at $1224 per share ahead of 10:1 stock split. I bought another 250 sh last week at $1148. Together with the 440 sh I bought at $598 in January, my 690 shares will become 6900 shares next week, though the total value will stay about the same, depending on the market.. Playing with house money in my tax exempted retirement account. Don't do as I do. -

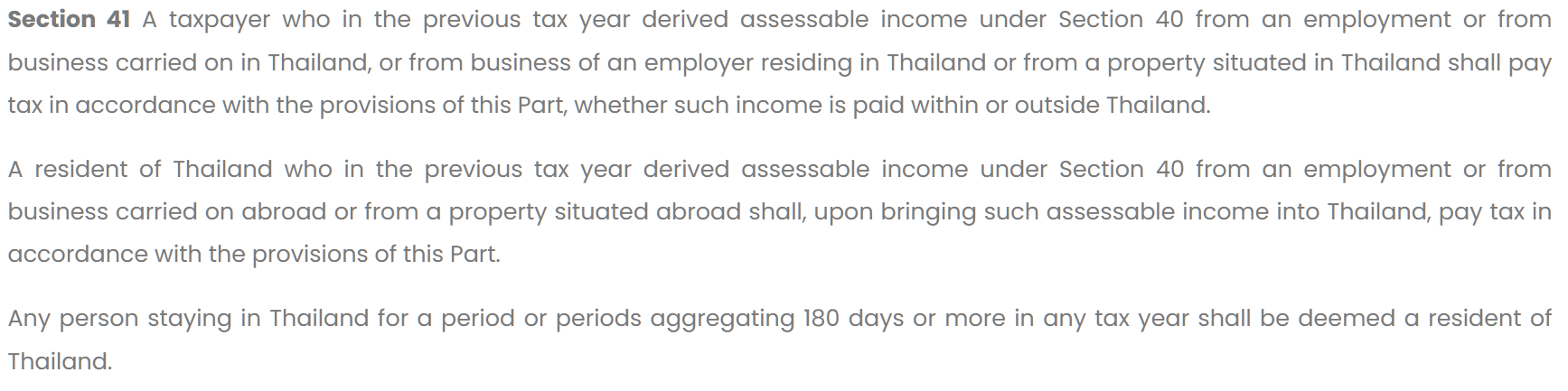

with a LTR-WP visa is my same year income transferred into Thailand taxable? In reach of clarity I went to re read section 41 of Revenue Code . It appears that " previous tax year" actually means the tax year being reported. As we are reporting 2024 tax in 2025, " previous tax year" means 2024 tax year. This fact is clear in Paragraph 1, and the same term shall mean the same in Paragraph 2. Can we assume it meant the same in RD 743? I don't know. I would rather err on the safe side by only transferring old income for the time being.

-

The Investing Year Ahead

Thailand J replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

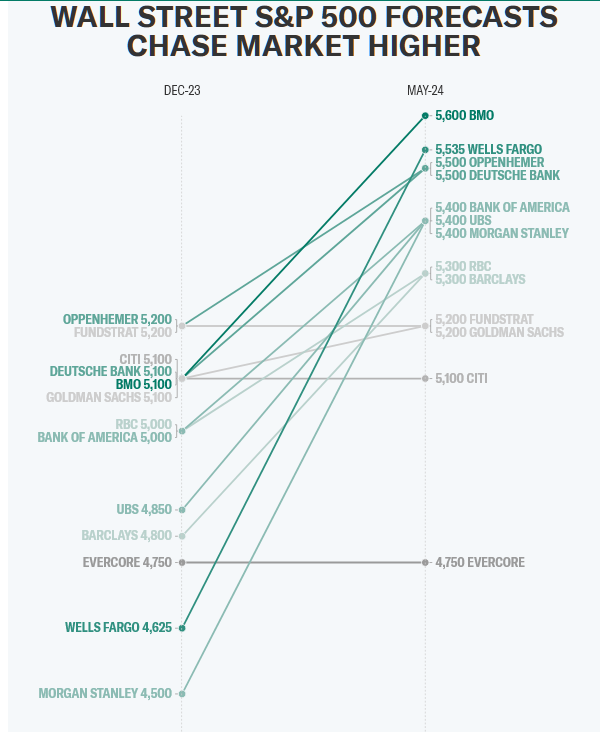

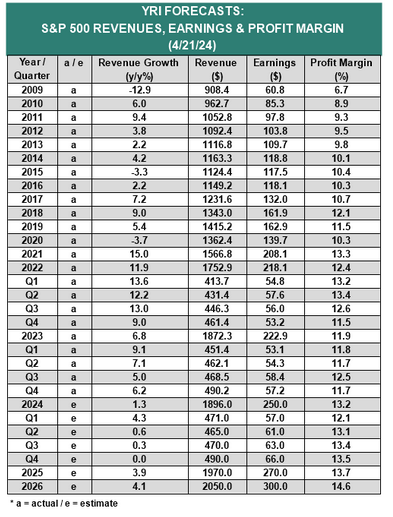

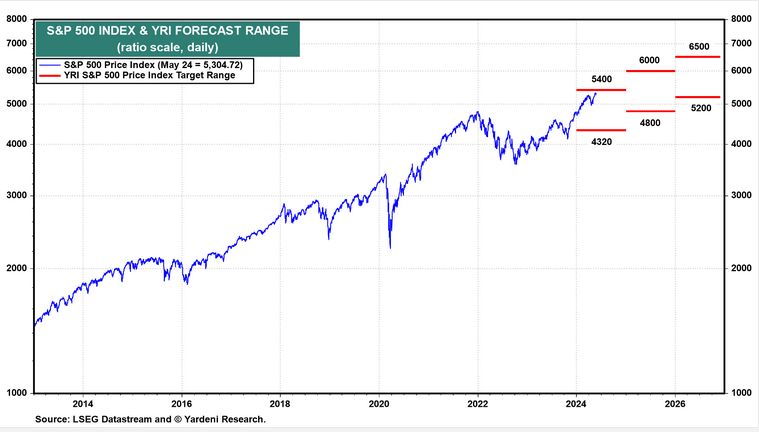

At mid year S&P 500 is above 5200, the level which was the market analysts' end of 2024 forecast. Yardeni now put it at 5400 at the end of the year, and in a TV interview claimed it could be 8000 in 2030. -

The Investing Year Ahead

Thailand J replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

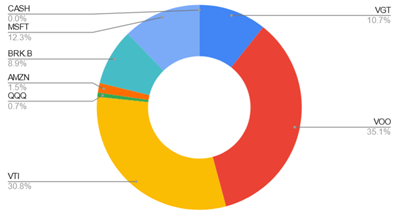

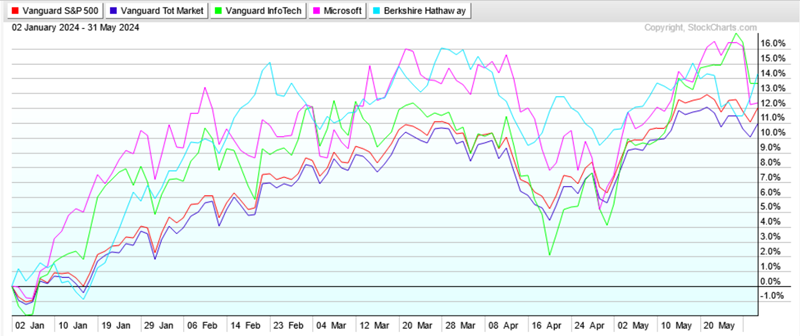

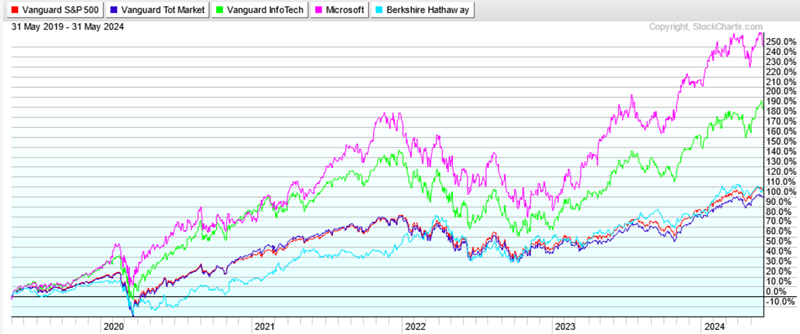

I held a 3 funds portfolio for decades: VOO, VTI and VYM. About 10 years ago I put my cash into BRK/A . Also sold VYM and bought VGT, dividend is just a gimmick. This is my YTD and 5 yr returns: