Thailand J

Advanced Member-

Posts

1,621 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Thailand J

-

Trump's "Big Beautiful Bill" Passes The House.

Thailand J replied to dinsdale's topic in Political Soapbox

To impose 3.5% ( or is it 5%) tax on foreign remittance on poor immigrants is just heartless. US citizens may be exempted. -

Hydrogen Peroxide is all you need.

-

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

Thailand J replied to snoop1130's topic in Thailand News

This is good news for those of us who have Roth IRA in US. -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

Thailand J replied to snoop1130's topic in Thailand News

If i sell US stocks and transfer the proceeds to Thailand, the entire amount will be tax free, if i read the OP correctly. The cost basic was money from prior to 2024, and the capital gain is recent income. -

US Charles Schwab Residency?

Thailand J replied to BKKKevin's topic in Jobs, Economy, Banking, Business, Investments

International account registered to non-US person is subject to US estate tax because the investment is in US. The exemption is only $60K. Please see IRS form 706NA and the instruction. For US citizens, the exemption is about $14M. -

I just had lower spine MRI on 3.0T machine at Bangkok Pattaya Hospital at the promo rate of 8000B whithout contrast, great value.

-

The elephant in the room is the IRS transfer certificate, Form 5173. I believe IRS rule is that this certificate only applies to decedents who are non citizen and non resident. But it appears that Schwab reqiures this form from the IRS in order to transfer your account to your heir after you've kick the bucket outside of US, even if you are a US citizen. What about other brokerage firms such as Vanguard, Fidelity or Interactive Brokers? May be I'll sell all my stocks, transfer my money into a Thai bank and make a Thai will.

-

Psyllium husk. Lazada or Shopee.

-

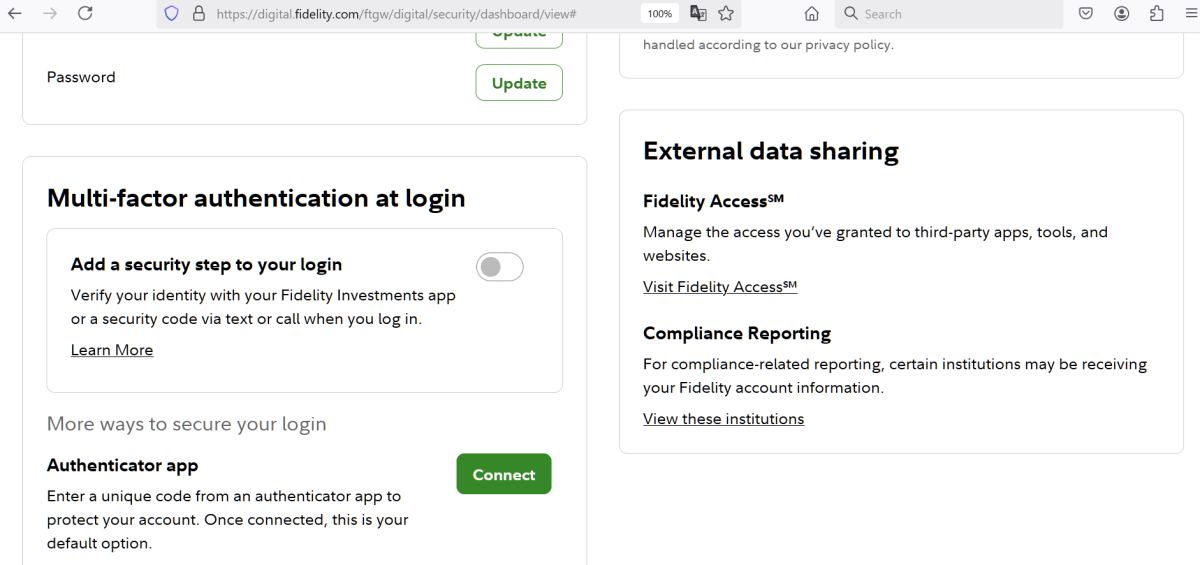

I called Fidelity yesterday to deleted the first zero of my Thai phone number. I am able to receive the passcode now. Thank you for the valuable info. I had turned off 2FA in the account and was able to log in without a passcode. Some how it was turned on in mid February. I am going to keep the option on now that I can get the passcode.

-

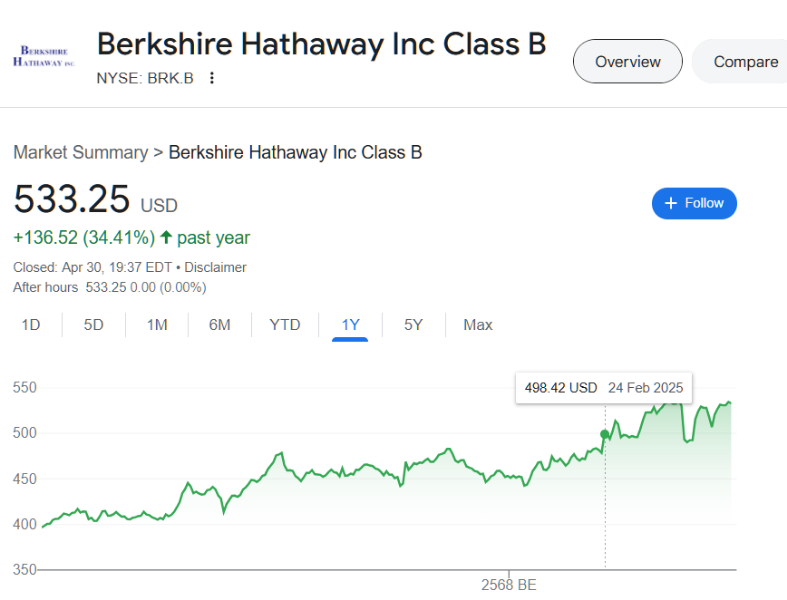

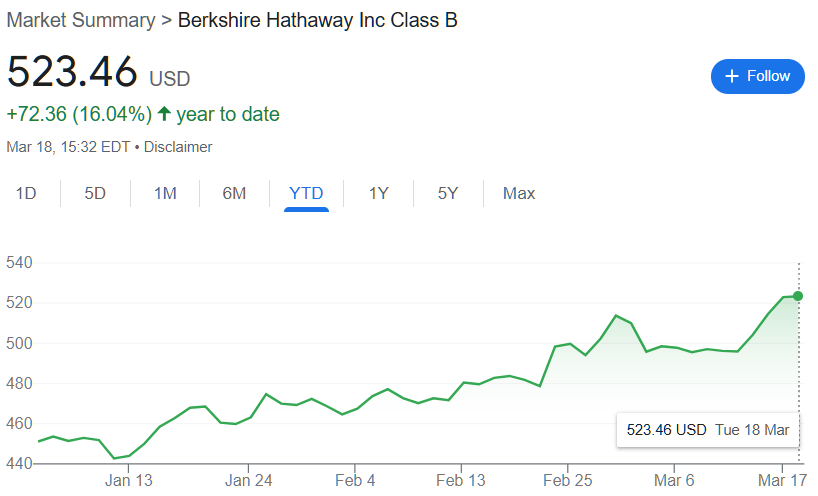

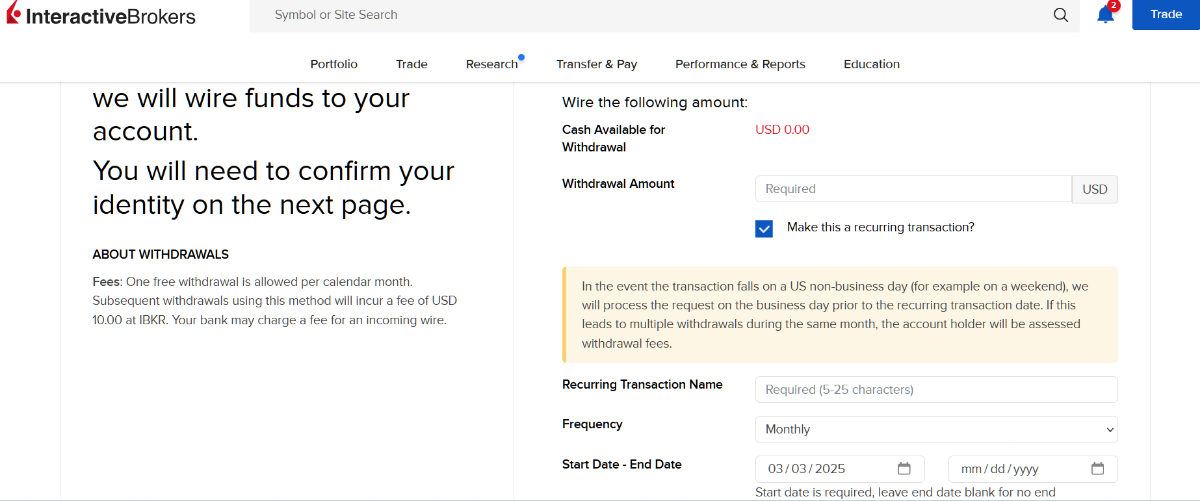

First withdrawal of the month is free at Interactive Brokers and it can be International transfer. No minimum to open a Lite account, no maintenance fee. It comes with a linked bank account that you can deposit SSA benefit into. Thai address acceptable. Request transfer online or set up auto monthly transfers. There are other brokerage firms with free international transfers.

-

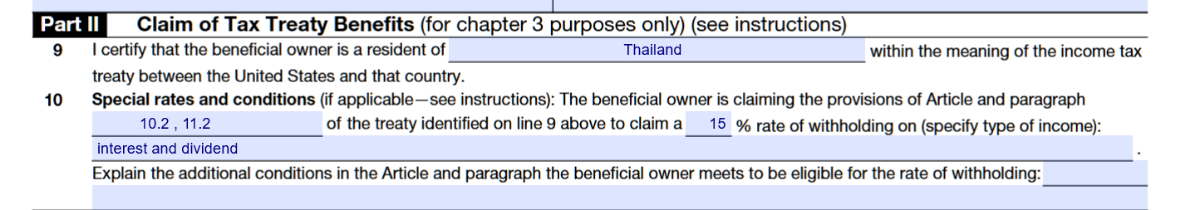

If you are Non-US citizen, Non-US resident and if you are a Thai resident. US tax: File Form W-8 BEN with IBRK to have correct withholding of 15% on interest and dividends. If the withholding is correct, you do not need to file US tax, unless you have other US income. File form 1040NR with Schedule NEC to pay the difference or claim a return if the withholding is incorrect. Form 1040NR is tedious but there is a short cut for this purpose, it's in the instruction. Capital gain from the sale of US stocks are tax free for you. Thai Tax: only if you bring the proceed into Thailand, I don't know anything about Wise let others help you there.

-

Using 3 Tesla MRI to investigate prostate cost 63,000B at Bumrungrad, 32,000B at bangkok Pattaya Hospital. Using 1.5T cost a lot less at Payathai Siriraj. 1.5 T with endorectal coil is good enough for prostate examination: https://ajronline.org/doi/10.2214/AJR.04.1584

-

To enjoy the river view, you can go through Starbuck on the left , or enter Napalai Terrace through the small door on the right.

-

Keep it simple. Logitech M90.

-

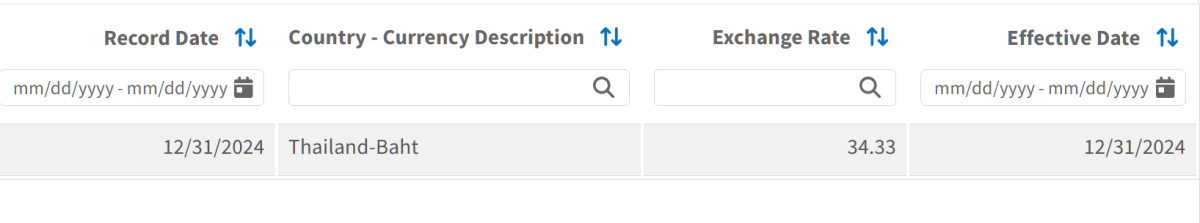

U S Topic. Exchange rate for FBAR reporting.

Thailand J replied to Thailand J's topic in US & Canada Topics and Events

-

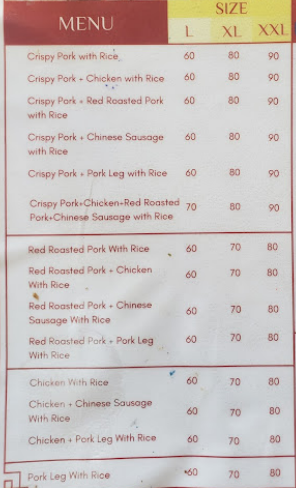

Ji Hong has kao mun gai plus more. Try the "everything" platter. https://maps.app.goo.gl/7JMbkvKYf5HMLgZt5