Thailand J

Advanced Member-

Posts

1,563 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Thailand J

-

Don't know about VT2A, my condo is in VT5D. I paid 2500B to run fiber optic cable from the utility room to my unit in 2021. TOT, which is now NT is the only choice. Once you have fiber optic cable connected to your unit, you can pay yearly for the service.

-

Costco's new idea; Investing in Gold and Silver?

Thailand J replied to GypsyT's topic in US & Canada Topics and Events

This is interesting. https://www.livemint.com/money/personal-finance/if-you-buy-gold-etfs-you-can-get-physical-delivery-of-gold-11587013567895.html -

Costco's new idea; Investing in Gold and Silver?

Thailand J replied to GypsyT's topic in US & Canada Topics and Events

right. Instead of gold EFT, you should buy solid gold, have your elephant haul it back to your cave. -

Costco's new idea; Investing in Gold and Silver?

Thailand J replied to GypsyT's topic in US & Canada Topics and Events

You don't have to buy barrels of oil to invest in oil. You don't have to hide gold bars to invest in gold. https://etfdb.com/etfs/commodity/gold/ -

Your SS benefits will continue after you've renounced US citizenship. You don't have to sell US stocks, properties or any US investments. You may have to pay tax on a " pretend sales" of your US properties. See IRS form 8854. You can only renounce US citizenship outside of US by showing a valid passport or citizenship of another country.

-

I filed last month still waiting for the refund. Yesterday went to Jomtein Revenue Office 4th floor confirmed I can no longer use e-money card to receive refunds. I was claiming tax withheld at Bangkok Bank, I asked if I can get refund deposited in Bangkok Bank the answer was yes. I'll take the refund check to Bangkok Bank to try my luck once I got it in the mail.

-

Colonoscopy Tests Costs In Thailand

Thailand J replied to Mitkof Island's topic in Health and Medicine

The Red Cross Queen Vadhana Memorial hospital in Sriracha has to be the most beautiful hospital in Thailand. https://maps.app.goo.gl/a39SWip4wvgNKTYc9 They offer selected services in the evenings at higher fees. I was there on Feb 9. Registration was 50B, 4pm doctor consultation plus NIFLEC 1350B. EGD ( EsophagoGastroDuodenoscopy) plus colonoscopy on Feb 14 was 20392B, of which 350B was for removing one benign polyp. -

The Investing Year Ahead

Thailand J replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

You are right, it can be nerve wrecking when the market is down. The biggest danger is panic selling , which has not happened to me yet 55. -

The Investing Year Ahead

Thailand J replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

Learn to invest with the patience of a tiger. identify the mother lode, buy a few index funds, hold for years. NOt like a curious cat, distracted by anything shinny all over the world. That's was how I manage accounts but NVIDIA is too "shinny". -

The Investing Year Ahead

Thailand J replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

-

The Investing Year Ahead

Thailand J replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

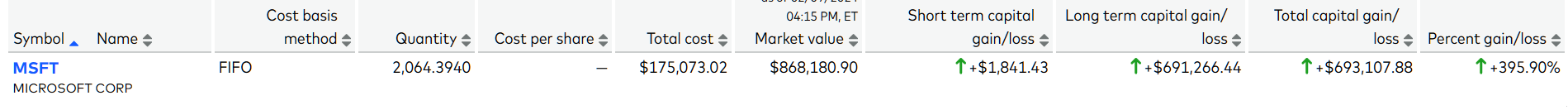

US tech sector is the mother lode. Make sure you have some exposure in your portfolio. Probably I have overloaded but the risk is rewarded. I cant resist NVIDIA, bought 440 sh at $598/sh 3 weeks ago, it's up 20% closed at $720. -

It was simple and fast since I had reported TM30 online. Wiith the online reporting screenshot printout, no copies of prove of address documents were required since I had uploaded them online. The worst part was the line getting the queue number, depending on your luck.

-

TM30 or not ? the best place to ask is your immigration office. While we all know the rules the enforcement varies. I was required to get a new TM30 receipt in Jomtein for going out side of Thailand and returned to the same house with re entry permit.

-

Looking at Thai Tax Code Section 42 (10) and (12), inherited income should be tax free here. She will need to show that the money originated from inherited ROTH. I don't know about joint ROTH accounts but if it is your individual ROTH, the account name will change to " Inherited ROTH" once she inherited it from you, and the statements will show " inherited ROTH", so it's not difficult for her to show it's inherited. If she would like to keep the inherited ROTH in US but worries about the bank may close her account for not having a US address, consider Schwab or Interactive Brokers brokerage accounts which accept Thai addresses.