Thailand J

Advanced Member-

Posts

1,562 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Thailand J

-

Tax code may have some clue but Tax form is what you should look at to answer your question do you need to fill tax return with only one type of income. If you have not look at Thai tax forms it's time you do. You won't find any section or any line to report non-taxable income, the like kind as those in Section 42. Top of form PND 91 clearly stated section 40 income only. Every section on tax form PND 90 is clearly under subtitle correspond to 8 parts of section 40. Would you submit a blank tax form with your personal data and signature? The threshold of 60,000B or 120,000B income to file tax return is also section 40 income, it cannot be exempted income, again, where do you enter the 60,000B/120.000B exempted income on the tax form? Also my opinion :)

-

Cheapest/Best Way to Water My Lawn? (not including water price)

Thailand J replied to GammaGlobulin's topic in DIY Forum

-

"Section 42 The assessable income of the following categories shall be exempt for the purpose of income tax calculation:" SEction 42 is a list of nontaxable income, do not have to be reported. Section 5 of RD 743 exempts foreign income earned in the previous year and remitted into Thailand. This foreign income became non-taxable income,the same as those listed in section 42 , in Part ii of Chapter 3 of the Revenue Code. None of these non-taxable income needed to be included in your tax return if you had to file one for whatever reason. There is no line on tax form 90 or 91 for these non-taxable incomes and it's not correct to add them to taxable income. My opinion.

-

I knew my monthly payment when I sign in to My SS account and downloaded the letter in late Nov 2023. My January payment already shows COLA.

-

Motor Vehicle "Scratch and Dent" services in Pattaya

Thailand J replied to RemyDog's topic in Pattaya

https://maps.app.goo.gl/TPCBTn9y8YYqeH3A8 RS Terminal is behind PP Autosport. Insurance paid for the job and increased the premium, the reason why I changed insurance company, and pay out of pocket for small jobs. Been here many times, Mongkol Jaroenyont Garage, cheap and good work. https://maps.app.goo.gl/9n4d3TYMbFcfC3nE8 G Car is a big shop but will take small jobs. https://maps.app.goo.gl/pi7Ygsjz5quRaSdH7 My car was here for 3 months after a serious accident, drives like new after the repair, don't know if they accept small jobs : Ch P Garage https://maps.app.goo.gl/rSeUfkQacMyG275M8 -

The Investing Year Ahead

Thailand J replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

https://yardeni.com/charts/presidential-cycles/ Since 1929, 3rd yr of the presidency terms were the best for stock market, average 14% gain. Whatever that means. -

The Investing Year Ahead

Thailand J replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

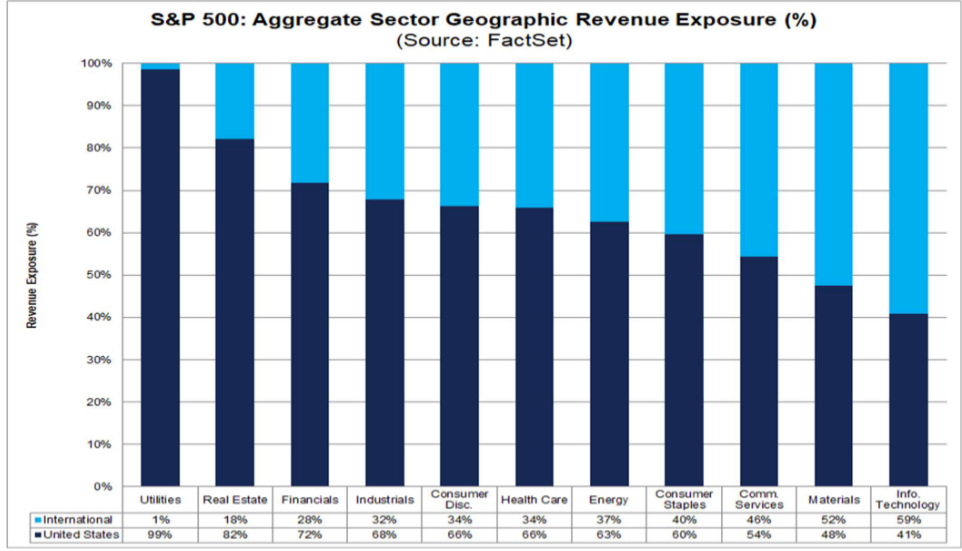

I am fully invested, my question is what to sell. I am invested in US stocks. US large companies derive up to 60% of their revenues overseas. -

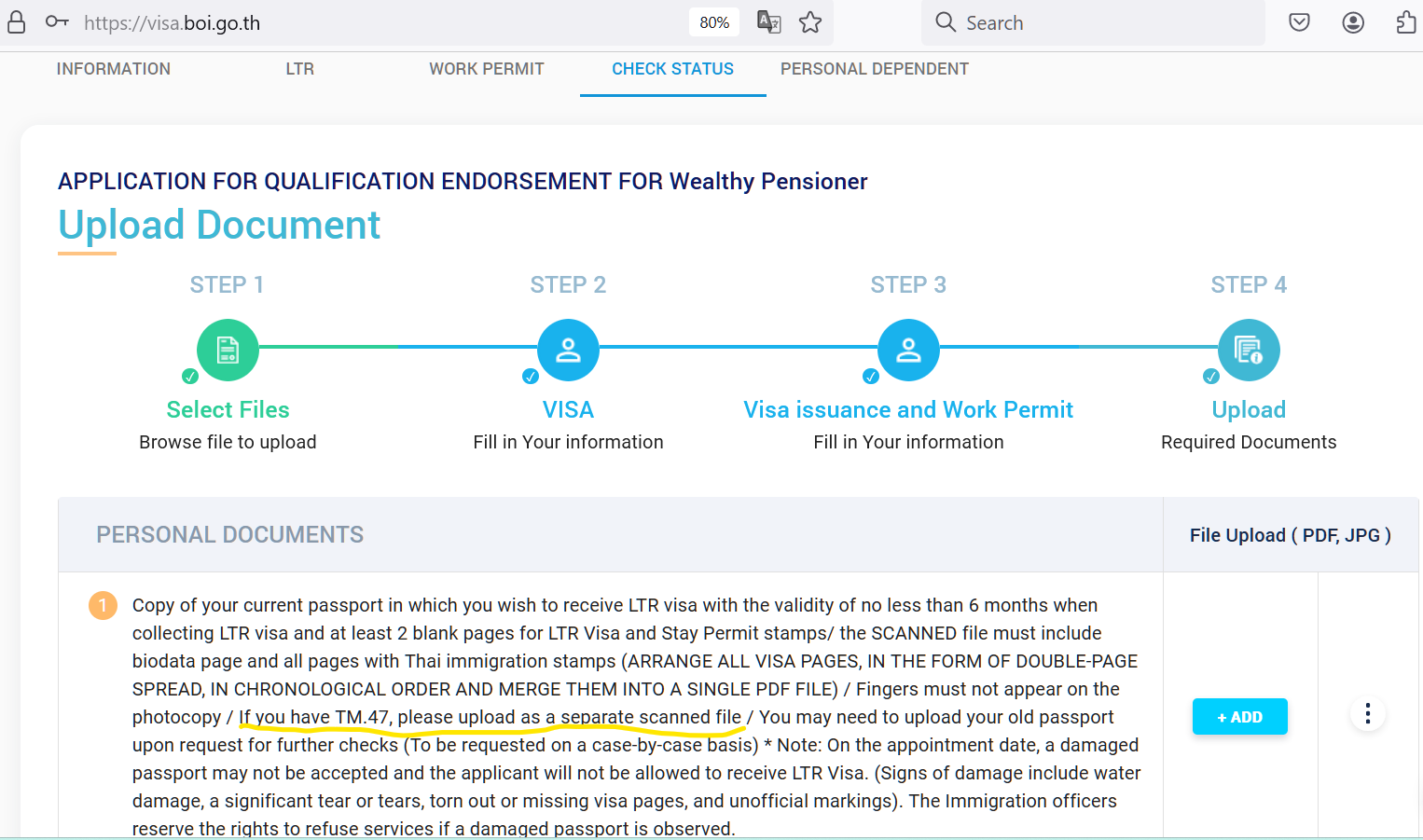

LTR and 90-day Reports

Thailand J replied to HerewardtheWake's topic in Thai Visas, Residency, and Work Permits

If you have filed online, sign in to the website, click on "Check the status of application". The page with refresh and you will see all the old receipts as small PDF icons which you can click and print. BOI requires an old TM47 ( 90days) receipt for LTR visa applications : -

You can get Part B, cancel when you are sure of not returning to US, doesn't matter what other expats do.

-

"Cancellation of benefit" (withdrawal of application)is when you started the benefit at say 62 and change your mind, you have 12 months to do so and have to pay back the benefits. "Suspension of benefit" is after 67 you can halt the benefit to have it restarted later with a bigger payout. For example in my case I have started the benefit at 62 more then a yr ago, I can't cancel but I can suspend the benefit when I reach FRA at 67. Good to learn something new. Thanks. https://www.aarp.org/retirement/social-security/questions-answers/social-security-going-back-to-work/

-

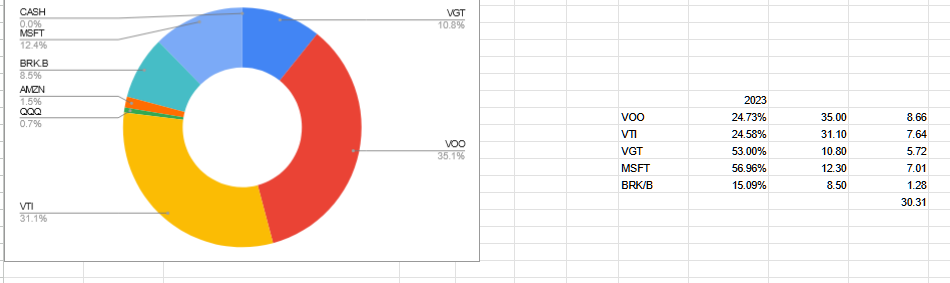

US Stocks, 2023

Thailand J replied to JimGant's topic in Jobs, Economy, Banking, Business, Investments

-

US Stocks, 2023

Thailand J replied to JimGant's topic in Jobs, Economy, Banking, Business, Investments

My best performing investment in 2023 was not any fund, it was Microsoft up 56.96%. Closed at $376. I bought in at $50. My investment in Vanguard VGT ( tracking Nasdaq tech stocks) was up 53%. Berkshire Hathaway was up 15%, no complains, better then keeping cash which I would have done if I didn't buy BRK/B. Overall up 30%, a quick rebound from 2022 downturn, not too bad long term neither. -

US Stocks, 2023

Thailand J replied to JimGant's topic in Jobs, Economy, Banking, Business, Investments

The longer the time span, the less likely active funds were to have outperformed the benchmark. https://www.spglobal.com/spdji/en/research-insights/spiva/ -

US Stocks, 2023

Thailand J replied to JimGant's topic in Jobs, Economy, Banking, Business, Investments

I recall it was Magellan manager Jeff Vinik who sold tech stocks in the fund in 1995/1996. He predicted a tech stocks correction 4 or 5 years too early and missed the rally. -

US Stocks, 2023

Thailand J replied to JimGant's topic in Jobs, Economy, Banking, Business, Investments

I believe fund managers do everything to help, not just that, but no thanks. The only non index fund i have is BRK/B where I moved all my cash reserve in my portfolio into, thinking that it is a stable investment. -

US Stocks, 2023

Thailand J replied to JimGant's topic in Jobs, Economy, Banking, Business, Investments

I used to have money in Fidelity Magellan under the management of legendary Peter Lynch. Did very well for a few years. That was where I learnt most managed funds don't beat the broadmarket in the long run and moved my money into index funds. Last decade Contrafund was good but not outstanding compared to the broadmarket. You must have got in before that. Contrafund vs VOO, 10 yr, 5 yr and 3 yr: