Pattaya57

Advanced Member-

Posts

2,769 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Pattaya57

-

I did my extension on June 24 at Jomtien and they gave me the financial check form to bring back September 21

-

To be an Aussie non-resident for Tax, or not?

Pattaya57 replied to Pattaya57's topic in Australia & Oceania Topics and Events

My Mate just changed to non-resident for tax purposes after 2 years living in Thailand. He basically decided there's no way he could justify saying he's a resident going forward (married to thai, child in thai school, owns a condo and just bought a house) so he declared it in this years tax return. This makes sense for him as it was stressing him out and he's happy to pay the 10% withholding tax on interest (he's also only 57 so a long time to fly under the radar) He worked out the best time to transition based on his shares value for each month and chose January 1st when his shares were the lowest (so less capital gains to pay tax on). This means his Aus shares are considered sold on that date and is now free to sell those shares as he likes with no further tax implications. The only difficult part was he had to spend 40 minutes on the phone with Westpac to change to a non-resident with an overseas address to get them to withhold the 10% tax on interest. As for having to provide a Tax Identification Number (TIN) they accepted his answer that he didn't have a Thai TIN as he earned no income in Thailand so he didn't need to file a tax return. For me, I've decided to stay "on holiday" for a year remaining as a Resident for Tax, while next year I'm likely to extend that "holiday". Hopefully the new proposed tax laws are in place by then and I can use my 45 days spent in Aus during the 2024 tax year to maintain resident status for 2025 & 2026 tax years (then go back to Aus for 45 days holiday in 2027 to keep me good until 2030) -

To be an Aussie non-resident for Tax, or not?

Pattaya57 replied to Pattaya57's topic in Australia & Oceania Topics and Events

Just had a thought for the over 60's. The only way to declare yourself a non-resident for tax purposes is by declaring so in your tax return. However if you have < $18,200 per year taxable income you are not required to submit a tax return (noting Super pensions are tax free for over 60, so not part of the $18,200) Same as if you're on the aged pension, with the Seniors and Pensioners Tax Offset (SAPTO), you are not required to submit a tax return if taxable income is < $32,279 for a single (or $28,974 each for a couple). Unless I'm missing something, it seems like a nice loophole to never be questioned as to tax residence as if you don't have to submit a tax return you can't declare yourself a non-resident 😀 -

Aus Mobile Phone Provider

Pattaya57 replied to StevieAus's topic in Australia & Oceania Topics and Events

Wondering if OP noticed my earlier post that you can get a $2 Telstra sim from Woolworths and then pay $12 per 7 days of unlimited calls and 3GB of data. Seems perfect for what was asked in OP about 2 weeks of cheap phone calls while visiting Sydney. Not sure if the last 40 back and forward long posts between only 2 members arguing with each other has offered a better solution 😉 -

DTV e-visa 'pending approval'

Pattaya57 replied to toums's topic in Thai Visas, Residency, and Work Permits

Doesn't your passport have your middle name? That's what they would check so pretty silly not to state middle name when you have to include passport bio data page? At €350 that's an expensive mistake to think the rest of the World ignores middle names -

Sorry but the two sentences in bold contradict each other? You said you could take your super pension as it's tax free but havent taken it because it would be taxed? Most Super pensions are tax free once you are 60 and as they are tax free they do not form part of taxable income and are not included in a tax return. You could be missing out on some nice tax free income? Note: The reason I say most is that I have an old fixed benefit Defence/Commonwealth Super which has 43% of pension tax free, while the other 57% forms part of my taxable income like the aged pension would.

-

You don't add $2230 SAPTO to $18,200 tax free threshold. $2230 is a tax rebate for tax due, whereby it takes about $14,000 income above threshold to get $2230 tax due (at new 16% rate) Using your figures of $29,021 Pension - $18,200 tax free = $10,821 taxable @ 16% = $1731 tax due. As this is less than the $2230 SAPTO rebate, no tax to pay

-

To hopefully clarify the above, according to the ATO the aged pension is taxable income, however they provide a "Seniors and Pensioners tax offset" (SAPTO) of $2230 for a single. This means a single pensioner can have a taxable income of $32,279 without having to pay any tax (after tax free threshold + $2230 tax rebated)

-

What are the chances part 2

Pattaya57 replied to worldtraveler3's topic in Thai Visas, Residency, and Work Permits

Why would anyone ever get a METV again if you can get the same 60 days entry on visa exempt for free? By the way, they recently dropped the financial proof for tourist visa. This is the current e-visa requirements -

Ok, well that would be proof of source of funds and maybe why they insisted you go to your home branch where the funds came into? I'm screwed. I opened Krungsri in the Avenue, it closed and I was transferred to big C branch on 2nd road which also closed. No idea where my new branch is now as they never told me 😆

-

I'm amazed by this. Everything I've read and been told is that it's impossible to transfer significant baht out of Thailand without a work permit or proving original source of funds. For me buying a condo 14 years ago I've pretty much written off ever selling it to send cash out as I no longer have any tranfer in source records. Sounds like now I might be able to send 800k at a time claiming I'm repatriating visa funds 😀

-

Well done getting the baht out but what documents did you show to meet these requirements posted on the Bangkok Bank website? FAQ's: Do I need to provide documents to declare my purpose of sending funds abroad? The Bank of Thailand requires every commercial bank to obtain documents from customers outlining the reasons for sending the funds abroad before completing the transaction. For example, you may need to provide an invoice if you make a funds transfer to pay for goods or services. If you are foreigner, you will need to bring a document declaring the source of your income (e.g. certification of salary) to complete your overseas funds transfer.

-

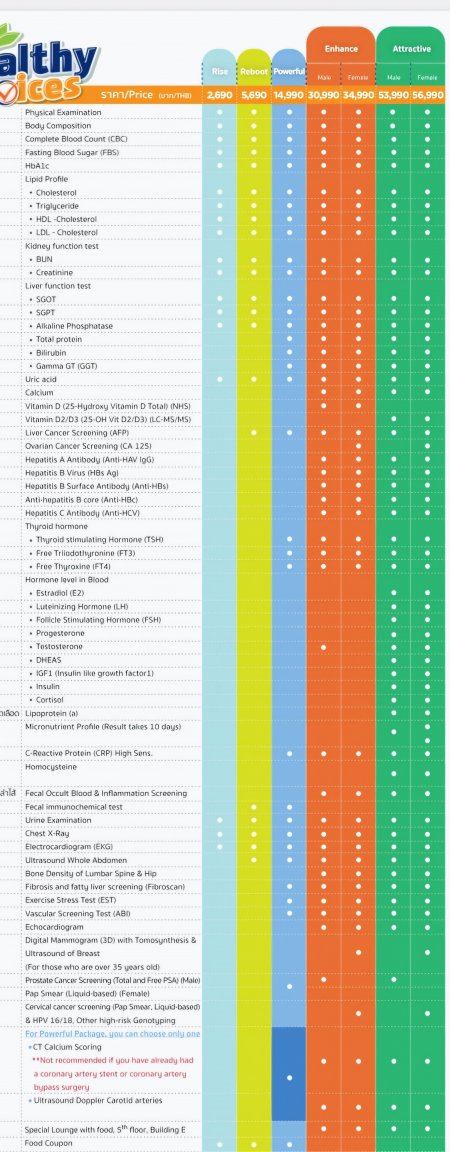

I don't know of any 2 for 1 deals but Bangkok Pattaya Hospital currently has 60% off until 30-Sep. I think the 2690 baht check looks really good value. I probably should do 5690 baht one to do extra liver cancer check + ultrasound of liver & kidneys 😉

-

Aus Mobile Phone Provider

Pattaya57 replied to StevieAus's topic in Australia & Oceania Topics and Events

You can buy a pre-paid Telstra Sim card starter kit for $2 at any Woolworths supermarket (so avoid having to go to dreaded Telstra office). You then pay $12 for 7 days unlimited calls/texts + 3GB data (so $24 for your 2 weeks) Another option is $35 for 28 days of unlimited calls/texts + 15GB data + 60 minutes free call to Thailand -

Haha I know it's only pre-season but I thought people would be more excited. I've set my alarm for 5:30 tomorrow to watch 49ers play. I'm retired 6 years and a niners game is the only reason I set an alarm lol

-

Quick Questions regarding Visa on Entry

Pattaya57 replied to dantho's topic in Thai Visas, Residency, and Work Permits

Well using that logic I'm European as I scored 100/100 in 43 seconds on Europe history quiz 😆 -

Quick Questions regarding Visa on Entry

Pattaya57 replied to dantho's topic in Thai Visas, Residency, and Work Permits

Maybe it is "Visa on Arrival" as that is currently 30 days as per what OP thinks he can get (can't extend VoA though). Without OP stating passport nationality it's pretty hard to help -

For UK citizens, it's US$35 or 1500 baht for a Laos visa. That's a 42.86 exchange rate whereas todays rate on the street is about 35, or $35 = 1225 baht. That's a difference of 275 baht Note: if you have to buy $35 that might be at 36 rate so could be 1260 baht. Still a saving of 240 baht. Not a huge amount but should buy a nice lunch 😀

-

Are all Aussie Sheilas really that ugly?

Pattaya57 replied to Kinok Farang's topic in Australia & Oceania Topics and Events

A little strange the OP is about a Brit sicko raping and killing dogs but most people are responding only to the thread title bashing Aussie Sheila's 😞