-

Posts

3,403 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by TroubleandGrumpy

-

He has been an embarrassment since 'elected'.

-

I am more than happy to see this 'debate' continue in its current direction and form. Plus I would point out that this thread Parts 1 and 2 was done to consolidate all other existing discussions on separate threads into the one thread. I would prefer not to have another bunch of threads appear whenever a new issue is raised- as they inevitably will be, as this thing goes forward. I know where to go to for the latest information and discussions on Thailand taxing Expats - and it is to this thread.

-

Sorry - that was formal advice provided to myself on the basis that it was not 'published'. The usual legal caveats as comes with any legal advice given to anyone else - you are not allowed to publish that advice. However they are well known and have been referred to several times in this and other related threads.

-

Exactly, and IMO they are the experts in what they want us to do. But just to be clear, IMO they are not referring to an Expat who earns money either in Thailand or through doing anything in Thailand, they are referring to Expats that are retired/married and bring their previously taxed money to Thailand (just like all Tourists do). When/If TRD provides their updated advice later this year as to how any change affects retired/married Expats, and/or any subsequent statements are made by TRD, The Finance Ministers, The PM or Cabinet, then and only then will we all know for certain what is expected of us retired/married Expats (not earning money in/from Thailand. Until/unless that happens, I am taking the advice as provided to Expats in Regional TRD Offices and to myself by a Thai Accredited Tax Company (based upon my current financial situation), I will not be lodging a tax return in 2025 for 2024.

-

The 'education' system in Thailand is their biggest problem - it has been holding them back for decades and it is now biting them big time on their butts as they struggle to cope with a changed world post-Covid. The Thai workforce is not efficient, flexible or educated - they dont know how to learn new things. Anyone from overseas opening a large business here nowadays is either ignorant, linked to certain Thainese families, corrupt or extremely brave. As that Thai man said (the one from BOI who never spoke again) Thailand needs to offer much more than beaches and girls and rip-off Visas to attract business investments - and certainly not income tax nightmares.

-

Total BS - if a kid does not fight back, they will be teased relentlessly by some bullies. Most school mass shooters (and Trump's shooter) were teased very badly at school and were mentally damaged by it. All my kids were taught from a very young age, that you never hit anyone at school unless they hit you first, and this is how to throw a punch (hitting Dad's bag). I told them all that if anyone does hit you, then you hit them with everything you have and dont stop until they are down - and then say nothing to the teachers, other than they hit me first. Youngest daughter was a friend of someone that was being bullied - she defended her and told the bully to go away. The bully slapped her face and the daughter did as taught. The call to attend school sounded like she had killed the kid - but she fell and hit her head when punched and had some blood from a cut. The VP immediately starting yelling at me when I arrived and I immediately told her to back away and let me talk to my daughter alone - now. She reluctantly did so, and after listening to what happened I told the daughter that she was was all good but she needed to stay quiet while I then spoke to the VP and sorted it all out. Done - no suspension and no apology. My daughter and her friends were never touched again. Turning the other cheek is BS and sometimes results in mentally damaged children who become mentally damaged adults.

-

Not saying that guy is right or wrong - but IMO he is wrong. The Revenue Department has adjusted the criteria for collecting taxes from income sources outside Thailand (Part 2) | Publications | Knowledge | Nishimura & Asahi Furthermore, for income that is exempt from tax in Thailand according to a Double Tax Treaty (“DTA”) - or if the DTA specifies the other contracting states (foreign countries) that are designated as the tax collectors and Thailand has no authority to collect tax according to the DTA - if such income is brought into Thailand in the case mentioned above, the Revenue Department has not yet issued clear criteria or guidelines to determine whether or not such income is subject to tax according to Section 41, paragraph two of the Revenue Code. If tax exemptions are not applicable, the Revenue Department will need to determine measures or methods to eliminate the double taxes and how to use foreign tax credits if such income is brought into Thailand in a different tax year from the year in which the income was received. The ambiguity in this law contradicts the principles of good tax collection and is a crucial issue which the Revenue Department must expedite in setting clear guidelines; otherwise, the collection of such taxes could become an obstacle to the development and enhancement of Thailand's tourism sector, which is a significant revenue source. If the Revenue Department pursues taxation on foreign-sourced income, it may bring a small amount of revenue inflow into the system. However, it could impact the tourism sector and employment in the tourism industry, including elderly care services and other sectors that heavily rely on income from foreign tourists who plan to be long-term residents in Thailand. Some tourist operators and those reliant upon the tourism sector may decide not to continue their businesses if the criteria for collecting such taxes are unclear and unfair. Navigating Foreign Pension Income Tax for Expatriates in Thailand - Pattaya Mail Role of Double Taxation Agreements (DTAs) Thailand’s network of Double Taxation Agreements (DTAs) plays a crucial role in the implementation of these regulations. These agreements, designed to prevent the same income from being taxed by two countries, ensure that pensions are taxed only in the country of origin. Under the new rules, DTAs will continue to protect expatriates by preventing Thailand from taxing pension incomes that have already been taxed abroad or are set to be taxed by retirees’ home countries. However, should there be any discrepancy in tax rates, additional taxes may still be collected in Thailand, although such measures are not yet officially declared and enforced. What this shows to me is that this whole can of worms and every point of concern in it, is far from certain and there is as yet no final decision and may never be until a precedent occurs. Anyone stating 'definites' based upon Tax Codes or Guides, or as above from tax professionals' websites, is not absolutely correct - nothing is certain and that is the only certainty. Until TRD make definitive statements about each and every point of concern (if they do), then no one is absolutely certain of anything - other than that TRD changed their tax rule for income seasoned for 12+ months, and had little idea of the downstream ramifications from taking that action (or they did and told the Minister and he said 'do it anyway'.

-

I have to say that in response to your "may no longer be a value for money retirement destination" that the fact is that for many people Thailand IS no longer a value for money retirement destination. When I first started looking at where to retire overseas in 2010, the number 1 or 2 in the World Lists for SEAsia was always Thailand. Now Vietnam, The Philippines, Malaysia and Indonesia (and even one list Cambodia) are listed above them on most lists. This change started happening after the Junta started making it less attractive for retired Expats (remember - bad guys out). This new tax situation has now placed Thailand last - because no one else taxes their incomes from overseas - every single one of those other countries either excludes retired Expats specifically or provides them an exemption (as long as the money brought into the country is not for 'activities' in their country). Thailand is clearly hell bent on no longer being the chosen destination for retired Expats in SEAsia. I think of it this way - when a Tourist enters any country he/she and brings with them their money to pay for things while on holiday. That money they bring in can be in currency, or transfers, or credit cards, or ATMs, or into a Thai bank account, etc. What sort of idiot country would try to apply income taxes to Tourists who stay more than 179 days in the country over a one year period, bringing in and spending their money - and paying all the local country taxes such as VAT etc. Well, that is what we are in Thailand - long-stay Tourists who 'report' every 90 days, because that is the longest legal stay in Thailand for a Tourist. If this was 2010, I would be looking at The Philippines or Malaysia - absolutely - planned visits to Thailand only.

-

IMO no. You only liable for taxes on money in your own name - brought to your own account. But if they are 'gifts' for the purposes of supporting family - then she does not have to declare them. But she may one day in the future be asked to account for those transfers - highly unlikely IMO - but keep detailed records. Below is TRD Tax Code - up to 20Million baht per year allowed - 10million to family (kids etc.). Section 38_64 | The Revenue Department (English Site) (rd.go.th) Go to Section 42 - Paragraphs 27, 28, 29 In fact have a good read of all those Paragraphs that detail what is exempt from income taxes. IMo everyone should read the whole Section in detail - I have found several more exemptions. I know some people say "but this/that/it only applies to Thais and Thai things" But I say BS - there is nothing that says it does not refer to Foreigners. TRD is going to provide an updated Tax Code and Guide to Personal Income Tax Return for 2024 later this year. Link below to last year's Guides (and those previous). Year 2023 | The Revenue Department (English Site) (rd.go.th) Please not that the Guide to Personal Income Tax Return (ภ.ง.ด.90) is the PIT Guide for people "who received incomes not only from employment" and that Guide to Personal Income Tax Return (ภ.ง.ด.91) is the PIT Guide for people "who received incomes from employment only." As I have said before, and been advised, IMO unless you have to pay income taxes, after all exemptions and allowances and DTA provisions, then you do not have to lodge a tax return. But the Code and Guide will help you calculate if you do have to pay income taxes, but the DTAs are a specialist area and each Country's DTA with Thailand does vary somewhat. My advice to all, is that many people (laymen and professionals) will point to one clause/part and then say "see you do have to ........" I have read a fair bit of the Thai Tax Code and Guides and they are full of contradictions and confusion. IMO there is not one TRD Officer who fully understands how those DAT documents apply when a PIT person is using their Country's DTA to claim exemptions/allowances. There are 61 DTAs and they have been clearly written for Companies with PIT provisions tacked on. As far as I have been told, TRD overall relies on the professional tax companies who use those DTAs for the Company taxation returns that they receive and process.

-

Yes indeed Jim - he takes it far too personally. Here is my latest take on one of those issues we disagree about - Gifts. Section 38_64 | The Revenue Department (English Site) (rd.go.th) Go to Section 42 - Paragraphs 27, 28, 29 IMO everyone should read the whole Section in detail - I have found several more exemptions. I know some people say "but this/that/it only applies to Thais and Thai things" But I say BS - there is nothing that says it does not refer to Foreigners. TRD is going to provide an updated Tax Code and Guide to Personal Income Tax Return for 2024 later this year. Perhaps that will also detail and explain those things Expats have been 'discussing'. Year 2023 | The Revenue Department (English Site) (rd.go.th) Please not that the Guide to Personal Income Tax Return (ภ.ง.ด.90) is the PIT Guide for people "who received incomes not only from employment" and that Guide to Personal Income Tax Return (ภ.ง.ด.91) is the PIT Guide for people "who received incomes from employment only." As I have said before, and been advised, IMO unless you have to pay income taxes, after all exemptions and allowances and DTA provisions, then you do not have to lodge a tax return. The Tax Code and Guide will help you calculate if you do have to pay income taxes, but the DTAs are a specialist area and each Country's DTA with Thailand does vary somewhat. As a person that dealt with Contract Law for over 30 years in business, I have some experience in reading detailed lengthy technical and legal documents. My advice to all, is that many people (laymen and professionals) will point to one clause/part and then say "see you do have to ........" I have read a fair bit of the Thai Tax Code and Guides and they are full of contradictions and confusion. IMO there is not one TRD Officer who fully understands how those DAT documents apply when a PIT person is using their Country's DTA to claim exemptions/allowances. There are 61 DTAs and they have been clearly written for Companies with PIT provisions tacked on. As far as I have been told, TRD overall relies on the professional tax companies who use those DTAs for the Company taxation returns that they receive and process.

-

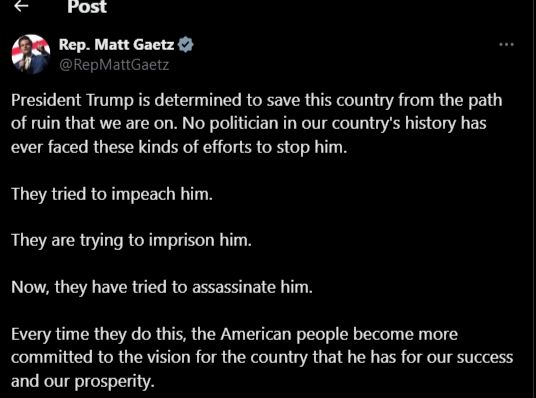

Trump rushed off stage after possible assassination attempt

TroubleandGrumpy replied to DPat's topic in World News

-

Trump rushed off stage after possible assassination attempt

TroubleandGrumpy replied to DPat's topic in World News

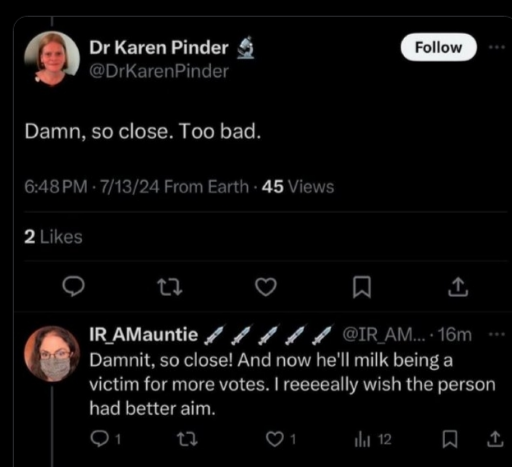

Anyone thinking that the delusional left are not mentally 'challenged' needs help - but not from this 'Doctor'. -

Trump rushed off stage after possible assassination attempt

TroubleandGrumpy replied to DPat's topic in World News

100% true. I will explain for the liberal thinkers. You are not saying that Biden caused the shooter to do that. You are saying Trump would be blamed by media and Dems, and that Trump would be indicted by a rabid Democrat AG. Obviously true 100%. Obviously. -

Trump rushed off stage after possible assassination attempt

TroubleandGrumpy replied to DPat's topic in World News

-

Trump rushed off stage after possible assassination attempt

TroubleandGrumpy replied to DPat's topic in World News

There is plenty of details - a nutter tried to kill Trump - I also do not think he was a right wing supporting Jan 6 invading election denier. -

I have an estimate from 2 tax companies - including the use of a DTA - and their estimates ranged from 70K to 90K. I think a simple basic online lodgement would be 20K - not one involving as DTA claim for exemptions/allowances as per my estimates. But as I said before, the 3rd company I asked actually said that because I had no taxes to be paid, there was no need to lodge a tax return.

-

Trump rushed off stage after possible assassination attempt

TroubleandGrumpy replied to DPat's topic in World News

No need for them to keep spewing their hatred - Trump has now experienced first hand what it results in. Unlike Reagan who let it go, Trump will become emboldened and will be embarking on a serious campaign of 'removal' unlike any POTUS before him. The Swamp and the Dems have come back hard, and their supporters have created an atmosphere in which a nutter has decided to take action. This will be a turning point in USA politics and I just read this quote and it is perfect:- “This is no small thing, to restore a republic after it has fallen into corruption. I have studied history for years and I cannot recall it ever happening. It may be that our task is impossible. Yet, if we do not try then how will we know it can’t be done? And if we do not try, it most certainly won’t be done. The Founders’ Republic, and the larger war for western civilization, will be lost.” “But I tell you this: We will not go gently into that bloody collectivist good night. Indeed, we will make with our defiance such a sound as ALL history from that day forward will be forced to note, even if they despise us in the writing of it.” ~ Mike Vanderboeg -

Nothing has changed as far as the Thai tax system is concerned - the rule change affects Thais who have been claiming tax exemptions. Last year it was the same rules - technically we Expats who remitted over 60K PA were supposed to lodge a tax return. Does anyone really believe that TRD are going to audit all Expats living in Thailand? TRD have no idea if anyone is Working, Education, Married, Retired, etc. If they do, then are they going to go backwards for all Expats who have lived in Thailand and have not lodged a tax return for the past 10 years? Obviously not. Going forward the TRD may take a more proactive approach - maybe. We have to wait and see what TRD provides by December 2024 - until then we do not know - no matter what the rules state - they have stated that since decades ago. Wait and see how it goes if/when releases their 'instructions' on how to do a tax return in 2025. I hope they will be giving retired/married Expats the same leeway that Philippines, Malaysia, Indonesia, Vietnam etc. offers - you are free to bring your money into our country and spend it here - we dont provide you any services and rights or representation - and you do pay VAT and other taxes when buying things. Thailand taxing Expats makes as much sense as Thailand taxing Tourists - we are technically and legally the same.

-

Nothing has changed as far as the Thai tax system. Last year it was the same rules - technically we Expats who remitted over 60K PA were supposed to lodge a tax return. But TiT and the rules are a guideline. Advice I have is simple - no taxes to pay - do not lodge a tax return. Does anyone really believe that TRD are going to audit all Expats living in Thailand? TRD have no idea if anyone is Working, Education, Married, Retired, etc. If they do, then are they going to go backwards for all Expats who have lived in Thailand and have not lodged a tax return for the past 10 years? Obviously not. Going forward the TRD may take a more proactive approach - maybe. We have to wait and see what TRD provides by December 2024 - until then we do not know - no matter what the rules state - they have stated that since decades ago. Wait and see how it goes if/when releases their 'instructions' on how to do a tax return in 2025.

-

Mate - IMO it will be difficult to 'declare correctly' any financial information to TRD under a global system - let alone a brokerage account. Just look at all the impossible BS Immigration requires from us with regards to their forms and documents - and from Immigration, Foreign Affairs, and the Amphur when we get officially married. I cannot see that TRD will just accept a bank statement made by a foreign bank printed out from an online download - just look at what they demand from their own banks. How about 'taxation records' from your home country's Tax Dept - from January to December when their financial year is July to June or May to April - and getting that in an approved format and quickly enough to lodge before end March? Good luck with getting all that done - I know mu Tax Dept in Australia will say No - because I already asked - and fair enough, imagine all their work if every taxpayer can get detailed records from any month to any month - they aint gonna do it. IMO under a global system it will be extremely difficult to provide 'correct' financial records to TRD for those reasons above, and because under the PIT system in each Province the TRD Officers have little to no understanding or knowledge of how overseas financial arrangements work in each country. If Thailand goes to a global system of taxation, and therefore taxes are liable on all money overseas, not just that remitted into Thailand, then that becomes a whole new level of difficulty. My advice from one of those legal/tax companies was that companies get that all done by accredited tax/legal agents (and pay big for it) and that TRD rarely ask for further details - but those same TRD Officers are not those in the Provinces doing PIT returns.