userabcd

Member-

Posts

2,523 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by userabcd

-

It is a big deal, that roads is a main thoroughfare in Bangkok Everybody using that road will now be inconvenienced to benefit a few. They could have held their important meeting at a venue outside Bangkok, that would have also injected some much-needed revenue into the outside Bangkok local economies.

-

Is it only the keyboard and mouse getting stuck? If they are wireless devices then check the batteries, maybe new batteries needed. If it is USB then try other usb ports and/or uninstall all USB drivers in device manager and reboot the PC.

-

It seems many have moved on and are using reddit to discuss Thailand/Bangkok and other places.

-

Use the parking at Central World or Paragon and then its a short walk.

-

Kasikorn Bank - expired ATM card renewal

userabcd replied to simple1's topic in Jobs, Economy, Banking, Business, Investments

What else...Driving license. -

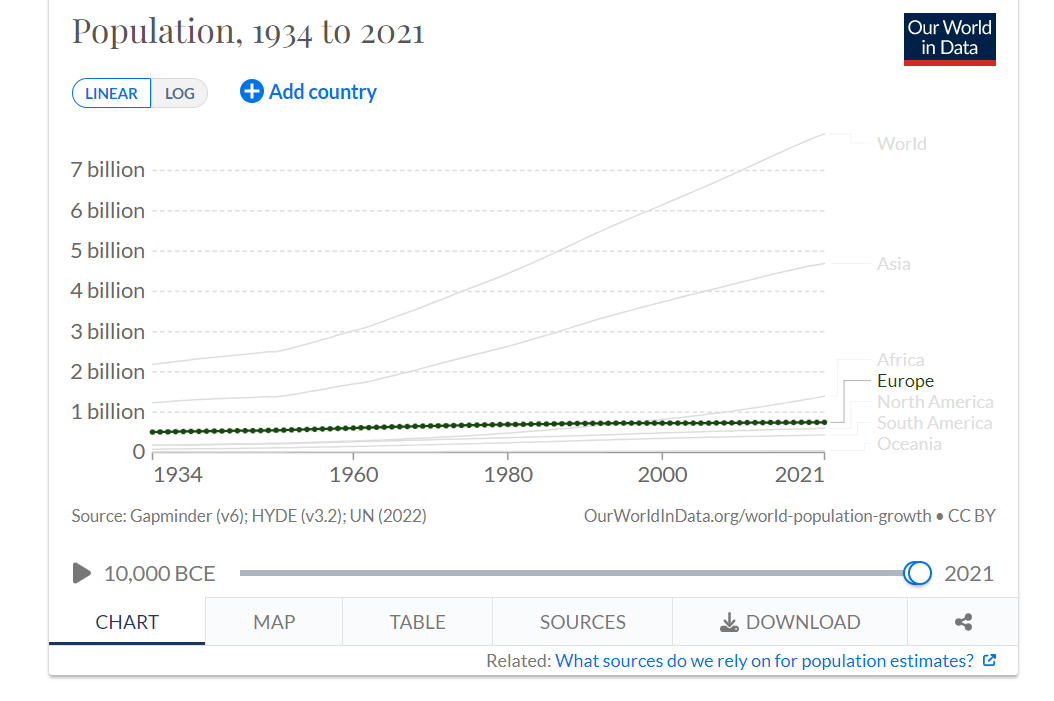

Worlds baby boom never stopped. Every new initiative implemented by govt and private industry contributes additionally to global warming. There are just too many consumers the world over all wanting global warming stuff (making more babies, controlling and restricting wildlife, housing, land, travel, cars, phones, jobs, water, electricity holidays, offices, farms, etc..) Deforestation in SE Asia Similar is happening in South America.

-

Rental Exit Strategy

userabcd replied to Padthaigoong's topic in Real Estate, Housing, House and Land Ownership

You need to read the lease/rental agreement you signed and see what is states there. It seems there is a revised version of consumer protection rights issued in 2020. From a website: "On 31 October 2019, a New Notification of the Contract Committee Re: The Stipulation of Residential Property Leasing as a Contract-Controlled Business was issued. The New Notification went into effect on 30 January 2020 and repealed the Previous Notification. And although the New Notification largely followed the provisions of the Previous Notification it significantly revised and reduced the rights and protections of the lessees (and, thereby, increased the rights and protections of the lessors) covered by the New Notification. Unfortunately, however, the New Notification did not resolve some of the most significant unanswered questions raised by the Previous Notification. The New Notification provides the following: “Residential property leasing business” means a business that leases five or more property units to individual lessees for residential proposes. “Lessor” means anyone who leases property for residential purposes and receives a rental fee from the lessees in return. This remains unchanged from the Prior Notification. “Property” means a house, apartment, condominium, or other residential property. However, dormitories, hostels, and hotels that are regulated under separate statues are excluded. This too remained unchanged by the New Notification. A tenant or “lessee” can terminate the lease agreement by giving 30-days’ notice. However, unlike the Previous Notice, the New Notice requires that at least half of the lease term be expired before the lessee can exercise this right. With regard to termination by the landlord or “lessor”, the terms under which he can do so must be displayed in the lease agreement in a format that is clearly visible, such as typed in red or bold and black font, or font that italic and underlined. But the New Notification further provides and categorizes the landlord’s termination rights as follows: if the lessee breaches a provision in the lease contract the lessor can terminate the lease by serving a written notice to the lessee at least 30 days in advance; if the lessee’s action directly disturbs the peaceful living of other tenants, the lessor can terminate the lease by serving a written notice to the lessee at least seven days in advance; or if the lessee does not comply with the law relating to public order or good morals, the lessor can terminate the lease, effective immediately. These new provisions make it much easier for a landlord to terminate the lease contract than under the Previous Notification, which required the lessor to provide the lessee with 30-days’ notice of any breach of the contract during which the lessee could cure the alleged breach. The New Notification has also significantly revised, in a largely landlord-friendly manner, what a covered lease agreement is not allowed to include as follows: Under the Previous Notification, the lease agreement could not exclude the lessor’s liability for breach of the agreement or tort against the lessee. However, now the lease agreement may exclude the lessor’s liability for any “non-material” breach of the agreement or any “justifiable” tort against the lessee. The New Notification allows the lessor to require a total advance rental payment plus security deposit in an amount equivalent to three months of rent payment. This provides more security for the lessor than the Previous Notification’s one-month advance and one-month security deposit limitations. Under the Previous Notification, the lessor could not confiscate the security deposit or advance rental payment. However, the New Notification allows the lessor to do so if the reason for doing so is due to the lessee’s fault. The Previous Notification did not allow the lessor to enter the property without prior notice to the lessee. But the New Notification allows the lessor to do so to avoid harm to the lessor or others. Under the Previous Notification if the lessee defaulted on the lease agreement, the lessor could not prevent the lessee from entering the property nor could the lessor enter the property and seize the assets of the lessee. Under the New Notification, however, the lessor can do so as long as the lessor first properly terminates the lease agreement." -

There is a potential tap of 62 million millionaire sources from these top 40 countries in the world and a significant number of Chinese investors are the top national who buy property in Thailand. Extract from an article on a news website last year: "Nearly 730,000 condominiums throughout Thailand are owned by Chinese nationals, just shy of 52% of all foreign-owned condos in Thailand. China topped the list by a huge margin with nearly 10 times more condos being owned by people from the nation than any other country. Figures like this help explain Thailand’s China-centric tourism schemes, often heavily focused on bringing in the Chinese new middle class and their tourism and investment money." Numbers of US dollar millionaires by country per Credit Suisse (2022)[3][2] Country or subnational area Number of millionaires Share of global millionaires (%) Percentage of millionaires (% of adult population) United States * 24,480,110 39.1 9.7 China * 6,190,394 9.4 0.6 Japan * 3,365,616 6.5 3.2 United Kingdom * 2,849,344 5.3 5.4 France 2,796,334 4.4 5.6 Germany * 2,638,056 4.4 3.9 Australia * 2,176,868 3.2 11.2 Canada * 1,681,969 3.0 7.6 Italy * 1,412,789 2.6 2.8 South Korea * 1,289,917 2.0 3.0 Switzerland * 1,151,960 1.9 15.5 Netherlands * 1,148,740 1.9 8.5 Taiwan * 869,210 1.8 4.4 India * 769,416 1.2 0.1 Hong Kong * 631,860 1.1 10.0 Sweden * 610,214 1.0 7.3 Belgium * 588,968 0.9 6.5 Denmark * 384,828 0.9 8.5 Russia * 352,801 0.6 0.3 New Zealand * 347,478 0.5 9.6 Mexico * 318,298 0.5 0.4 Saudi Arabia * 313,298 0.5 1.3 Singapore * 298,650 0.4 6.1 Austria * 271,014 0.4 3.7 Brazil * 265,782 0.4 0.1 Norway 236,023 0.3 5.6 Israel * 203,623 0.3 3.6 Indonesia * 191,103 0.3 0.1 United Arab Emirates * 176,780 0.3 2.1 Ireland * 175,791 0.3 4.8 Portugal * 159,006 0.3 1.7 Iran * 146,638 0.2 0.3 Finland * 100,786 0.2 2.3 Kuwait * 100,746 0.2 3.2 Poland * 100,129 0.2 0.3 Egypt 87,206 0.1 0.1 South Africa * 86,175 0.1 0.2 Thailand * 82,466 0.1 0.2 Luxembourg * 81,915 0.1 16.3 Greece * 81,383 0.1 1.0

-

You could try Curaprox toothbrushes (they sell on Lazada and have sales carts in Emquartier and Mega Bang Na) แปรงสีฟัน Curaprox 5460 Ultrasoft | Lazada.co.th Another ultrasoft toothbrush which I find works is that Berman brand which can be found in Big C and Lotus's เบอร์แมน แปรงสีฟัน รุ่นคอมพลีท เอ็กซ์ตร้าซอฟท์ คละสี แพ็ค 2+1 | Lazada.co.th

-

Hehehe, how much time wasted opening a web page, press start to test internet speed to whatever location, then wait for it to complete and get result, then press again, wait get result etc... Maybe sometimes try a different one. The results are most always up and down or reaches the desired result and one finally closes the application.... satisfied or not satisfied. Usually not satisfied generates a post on this forum asking about internet speed and then making contact with the ISP to improve something.

-

Not often I have been held up by people paying cash, but definitely have been held up many times with people paying with their phones, sometimes the only 3 tellers available are trying to figure out something on someone's phone to pay and they are blocking everyone. Imagine the bank statement, if one has to print it out with hundreds of small purchases listed

-

Most people are not trying to hide anything, mostly it is just because they do not want to change. For the banks that already do not have this in place it is going to cost them time and money to upgrade all their systems to implement this change, there is probably some push back because of this. Anyway, the money is deposited into an account which banks already have an identity behind it (passport/ID card addresses) That person should be 100% responsible for what is going into or out of the account and should explain and have the backup evidence. The government should also start targeting and clamp down on banks opening accounts for foreigners on holiday visas who are only visiting for short periods. Govt should also clamp down on long stay non immigrant foreigners on long stay extensions, they should be limited to one bank account only to do all their banking and dealing with immigration requirements in Thailand (can also control the taxation of interest etc...)

-

0nline 90 day issue with netzero email account

userabcd replied to Toolong's topic in Thai Visas, Residency, and Work Permits

Do not know what a netzero acc is, but, Login to the immigration website for that account and look in there, the 90-day report in pdf format that was sent by immigration in their email will be available there and the status should be "pending" until it is approved. -

Fake Gillette razor blades SCAM on most online stores Now! !@#$%

userabcd replied to WaveHunter's topic in General Topics

Shave with those cartridge razor, shave with a safety razor. Not much difference really, only the tool used is a bit different. Safety razors come in different styles of aggressiveness so newbies should probably start off using a mild safety razor such as Merkur 34C or Feather AS D2, Merkur Futur (there is even a copy one available on Lazada for about 3-400 baht which has good reviews) and the Feather popular 800-1B The safety razor gives a closer shave though. -

6 months to live what would you do?

userabcd replied to Sparktrader's topic in ASEAN NOW Community Pub

Opt out. -

Hehe, received an item I returned as it was not according to spec or the details of what I oredered. Paid cash with COD. Lazada authorized the return and refunded the amount to my wallet, all of 232 baht. Now they want me to go through KYC before I get access to the cash I paid to them.

-

Many Foreigners Arrested with Drugs at Luxury Karaoke Shop

userabcd replied to snoop1130's topic in Bangkok News

Until some willing particpating victim gets very ill or dies, then everyone is baying for the blood of the drug peddlers. -

Fake Gillette razor blades SCAM on most online stores Now! !@#$%

userabcd replied to WaveHunter's topic in General Topics

Bought a tub of shaving cream from body shop, a little costly but it has excellent reviews and can highly recommend it. -

Fake Gillette razor blades SCAM on most online stores Now! !@#$%

userabcd replied to WaveHunter's topic in General Topics

Do you have a link to this Japanese razor.