Moving back to my home country and bringing offshore funds with me

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

-

Popular Contributors

-

-

Latest posts...

-

158

Do you know your wife/girlfriends body count?

I haven't seen any such behaviour from @atpeace. Can you point it out to me? Anyone who points out anything negative in your behaviour is subject to the same treatment. Are you telling us that you refrained from such behaviour during your relationships? -

21

Middle East American-Palestinian Man Beaten to Death by Settlers in West Bank

They will absolutely be held responsible! Mark my words! -

158

Do you know your wife/girlfriends body count?

Name 3 people who agree with you then 1... 2... 3... -

22

Economy Thailand's Digital Baht Plan Targets Big-Spending Tourists

Same im thinking.Dangerous sport.I wonder how many trillions they will imagine this time. -

1,477

What Movies or TV shows are you watching (2025)

Star Trek Strange New Worlds S03 e01 and e02 have dropped. -

8

Repair tiny gold chain BKK?

Understood. I want my wife to bring it. It's a very fine chain I don't think they can fix it. Maybe put in some sort of solid spacer like a fuser.

-

-

Popular in The Pub

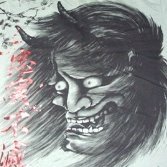

.thumb.jpeg.d2d19a66404642fd9ff62d6262fd153e.jpeg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now