-

Posts

3,480 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by gamb00ler

-

The only circumstances where SSA has a "substantial earnings" requirement is for reducing the impact of the WEP (Windfall Elimination Provision) on a person's retirement benefit. A very small percentage of those receiving SSA benefits are impacted by WEP.... unfortunately I'm one of them. To earn a single credit for 2024 requires income of $1,730. That figure rises every year... it was $1,640 for 2023. I earned 1 credit in 2020 on income of just over $1,700 which was the year COVID shutdowns led to my retirement.

-

no neutral line in light switch... recommended practice to add

gamb00ler replied to gamb00ler's topic in The Electrical Forum

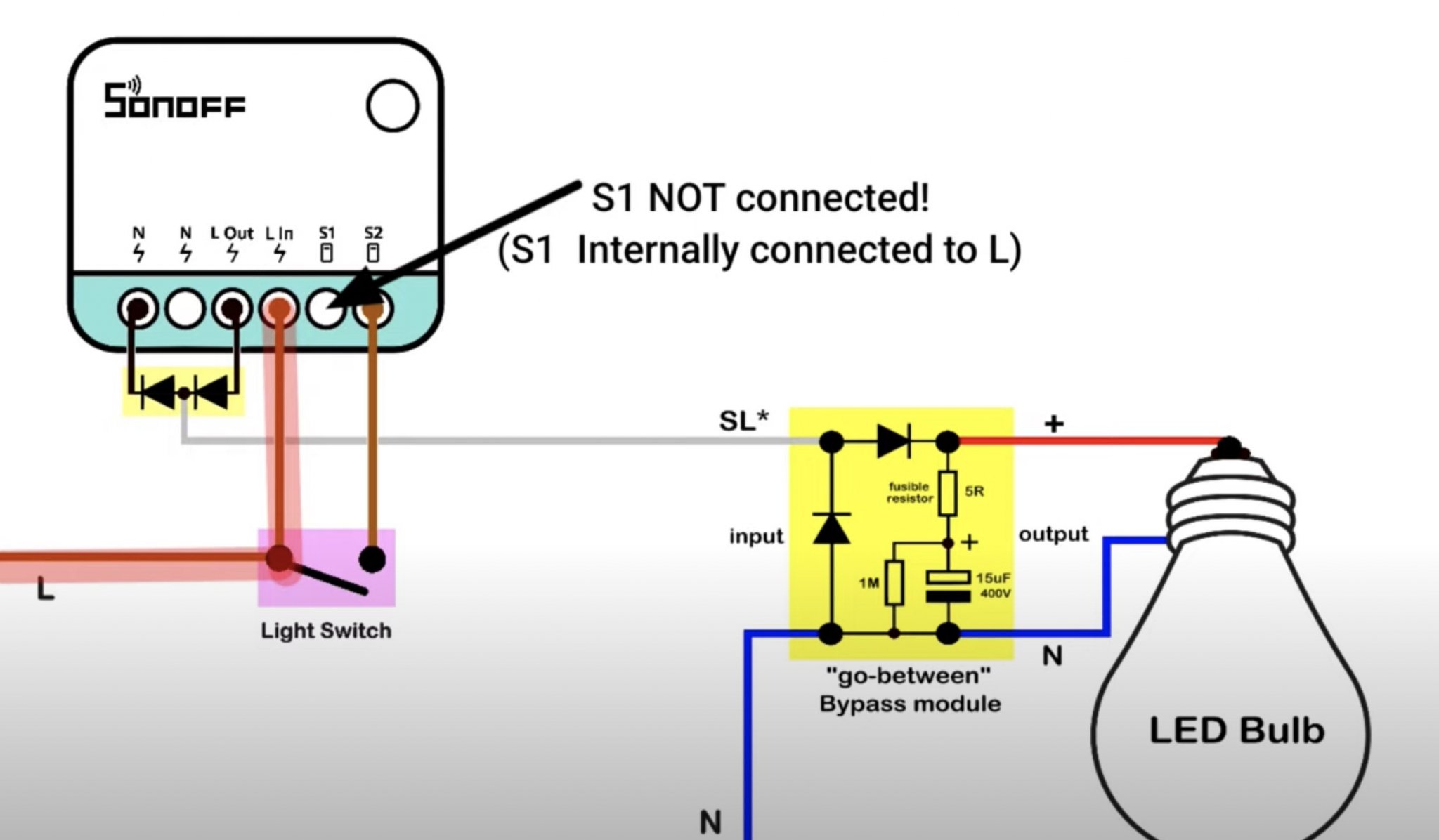

The circuit I need to use at the light socket looks fairly simple to make. It requires 2 diodes, 1 fusible resistor, 1 regular resistor and a capacitor. I've never done any soldering so I would like to hire someone to make 3 or 4 of these circuits. What kind of shop should I look for in CM to fabricate these simple circuits? I'm attaching a schematic and a picture of a completed circuit. -

Fauci Diagnoses America: 'A Degree of Schizophrenia'

gamb00ler replied to Social Media's topic in World News

Oh... you know... the one that some people drive into when they don't make the required course adjustment. -

I suggest you contact the SSA office that services the area where you live or call the 800#. After such a long gap in earnings they may request some documentation proving your self-employment. If you have an online IRS account, log in and verify your transcript's accuracy. It seem communication between IRS<-->SSA is not perfect as a year of earnings was lost for my wife and myself. We had to file an SSA-561 form for each of us to get the earnings recorded. Her's has been updated but mine has not.

-

Fauci Diagnoses America: 'A Degree of Schizophrenia'

gamb00ler replied to Social Media's topic in World News

It seems you're impressed with his position at Stanford while pointedly ignoring the views of other "Stanford scholars" ... to wit the quote from Stanford University's StanfordReport : The Stanford Faculty Senate on Thursday condemned the COVID-19-related actions of Scott Atlas, a Hoover Institution senior fellow serving as a special assistant to President Donald Trump for coronavirus issues. A resolution, introduced by members of the Faculty Senate Steering Committee and approved by 85 percent of the senate membership, specified six actions that Atlas has taken that “promote a view of COVID-19 that contradicts medical science.” -

Fauci Diagnoses America: 'A Degree of Schizophrenia'

gamb00ler replied to Social Media's topic in World News

It seems the grass in the ditch is too deep for you to have a good view. -

Fauci Diagnoses America: 'A Degree of Schizophrenia'

gamb00ler replied to Social Media's topic in World News

Think about what happens when you know where you want to drive to but you're in unfamiliar territory. You know accurately in which direction your goal lies, but you may turn down a street that starts in the correct direction but then turns into a dead end. It seems like you're one of those who end up in the ditch. -

Fauci Diagnoses America: 'A Degree of Schizophrenia'

gamb00ler replied to Social Media's topic in World News

I'm sure he would gladly accept it so as to ensure that it doesn't fall into the wrong hands. -

If I were you I would call the SSA @800-772-1213 and explain that you just filed 2023 taxes and earned 3 credits. Then ask them if you sign up for Medicare before those credits are recorded will they refund any premium you paid for being short on credits. I just had another idea that may help. I don't recall if the IRS makes transcripts available immediately after processing your return. If they do, you can use the IRS website to download an abstract of your 2023 filing and email it to Manila FBU. The biggest problem with this idea is that in my experience Manila is incompetent for anything but plain vanilla application processing. Even on that they screwed around on my wife's app for many months before getting off their butt. You can also trying faxing a letter and the IRS transcript to the SSA Division of International Operations in Baltimore @410-965-4648 or mail them : 6100 Wabash Ave., Baltimore, MD 21215-3757 I have successfully used online fax services that give you one free fax as a trial.

-

On what basis do you think the above is how TRD will assess capital gains that are the result of gains from both before and after Jan. 1, 2024? It is not a reasonable method that you're suggesting TRD will use. It is easy for stock holders to document their investment's value as of Dec. 31. That should become the basis that TRD should use for determination of gains. A taxing authority should accept that invested savings are still indeed savings and treat the investments as having a deemed disposition at the boundary between tax free and taxed holding periods.

-

A heads up for the OP. If you were ever married for 10+ years and your spouse or ex-spouse has also qualified for SSA retirement benefits you can collect on her work record. The caveat is that her benefits would have to be twice as large as yours to make it worthwhile. As a spouse or ex-spouse you're only entitled to 50% of her benefits. The math changes if you're planning on waiting until 70 to collect your retirement. If you collect as a spouse it has no effect on their benefits.

-

It's definitely a smart move on your part. The lowest tier of SSA retirement benefit gives a great inflation protected return on the employment tax you pay to receive it. Sorry I can't help with info on the time lag even though I checked my SSA record many times over the years I never paid attention to the processing time required. I presume you have an online MySSA account where you can check your earnings record.

-

no neutral line in light switch... recommended practice to add

gamb00ler replied to gamb00ler's topic in The Electrical Forum

Here's a YTube video that uses the exact Sonoff module that I bought to test. This video shows in detail the wiring required to eliminate the need for a neutral line. -

no neutral line in light switch... recommended practice to add

gamb00ler replied to gamb00ler's topic in The Electrical Forum

With your switch you had to access the light and add the capacitor at that point ? I have a string of lights on the perimeter fence using one switch so I just need to add one capacitor for that circuit? Update: I found a YTube video that has answered these questions -

Despite asking our home builder to provide a neutral line in all circuits .... we only have a neutral at power outlets... none at light switches. I'm sure my lack of understanding of even the basics of residential wiring will be obvious from my questions. I only need the neutral to make home automation simpler. The "brains" and wireless hardware in the smart switches need a little power to operate wether the switch is open or closed. Many smart switches require the neutral to make a circuit to supply that power. I know there are smart switches that do not require a neutral. At this time I prefer to restrict my switch selection to those that support Matter and Thread protocols. If that doesn't turn out to be reasonable I can change my plans easily. If I understand correctly I can provide continuous power to the smart switch by adding wiring and a resistor to allow a trickle of power to flow to the load even when the switch is open. The flow won't be enough to light the bulb.... just enough to keep the smart switch functioning. The obvious alternative is to run a neutral line from the switch box(es) to the consumer unit. That isn't an easy job with our wiring embedded below the render on the walls. Possibly there may be room in the embedded conduit to make the job easier. Or... if there's a nearby power outlet can I just use the neutral line available there? I have read comments that sharing a neutral like that is not a good idea. Can I share a neutral between several lighting only circuits in the same wall box? Also one of the switches I want to replace is a momentary switch to open/stop/close the driveway gate. Fortunately there are only 3 or 4 switch boxes where I hope to install smart switches.

-

Tax ID Number

gamb00ler replied to Bluetongue's topic in Jobs, Economy, Banking, Business, Investments

This has been discussed before but unfortunately the search function for this forum software is not very useful. If you get your Pink ID before getting your Thai tax ID.... that number becomes your tax ID. If you get your tax ID first that of course will be your Thai tax ID. If you subsequently get a Pink ID the number on it will differ from your tax ID. I wouldn't bet my life on this info, but it is the best explanation for the experiences of several members (from the old thread) who have both a Pink ID and a Thai tax ID. -

Canadian Tourist Robbed During Night in Pattaya Hotel

gamb00ler replied to webfact's topic in Pattaya News

You started too late with your history lesson. We're all Africans, but that all happened long after we were pond scum. -

There was a period of a few months during the peak COVID disruption that pork and chicken were both high. I wasn't in Thailand before COVID so I don't know how current prices on those compare to pre-COVID.

-

I disagree. I remember prices very well and during my 3½ years in CM most staples that I buy are up 10% or less (about 3% a year). Prepared food prices have risen much more than the price of ingredients. Almost all my meals are home cooked so I remember the ingredient prices reliably. Makro's pricing sometimes seems strange. A package of Meiji brand individual servings of yogurt have alternated between 48฿ and 58฿ many times over the past couple of months. That doesn't make sense to me.

-

Years ago another poster mentioned that there was another Thai bank that will do "cash advance" using a debit card. I didn't pay much attention because Bangkok (BBL) bank was doing them also and had no fee at all. I did probably 20 cash advances at BBL bank when we were building our house. Now BBL bank has stopped so I'm happy that you mentioned that you are using Krungsri Bank. I'll go there tomorrow and see if they'll give me an account and let me do a cash advance to fund it. If they do, I'll say goodbye to BBL bank.

-

You can only avoid tax on the IRA/401k balance if you keep your withdrawals so low that your total income is covered by your personal exemption(s). That's not practical for many and may not be possible once you reach the age where RMD's kick in. The major downside of Roth conversion is the acceleration of taxation on the amount converted to the current tax year rather than later when voluntary or mandatory withdrawals are made. Also, withdrawal of the converted funds will incur a penalty if done before at least 4 years following conversion. To do a thorough analysis you need some tools to reduce the effort. I use a donation-ware Excel spreadsheet that will essentially do your taxes for a single year. With it I can easily manipulate my income level and see all the effects and the final tax total. For example, the spreadsheet will automatically calculate the change in tax on your SSA benefits for the different income levels. The spreadsheet will NOT total up your total tax over a number of years to facilitate comparison of different conversion/withdrawal strategies. https://sites.google.com/view/incometaxspreadsheet/home I have used it quite a lot for tax planning ... if anyone has questions about it I can likely help.