Nemises

Advanced Member-

Posts

2,784 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Nemises

-

Causes of High Electricity Bills in Thai Apartments

Nemises replied to CharlieH's topic in General Topics

Just passing on what the Sleep Foundation say. If you disagree with them, tell them not me. Here it is again what they say: “most doctors recommend keeping the thermostat set between 65 to 68 degrees Fahrenheit (15.6 to 20 degrees Celsius)for the most comfortable sleep.” -

Causes of High Electricity Bills in Thai Apartments

Nemises replied to CharlieH's topic in General Topics

So the Sleep Foundation have got it all wrong. Got it! -

Causes of High Electricity Bills in Thai Apartments

Nemises replied to CharlieH's topic in General Topics

Not sure if you know how to use a search engine but if you did you would learn; “most doctors recommend keeping the thermostat set between 65 to 68 degrees Fahrenheit (15.6 to 20 degrees Celsius)for the most comfortable sleep.” https://www.sleepfoundation.org/bedroom-environment/best-temperature-for-sleep -

Causes of High Electricity Bills in Thai Apartments

Nemises replied to CharlieH's topic in General Topics

Not sure what a TOG is, but yeah whatever you reckon 👍 -

Why Do You Enjoy Posting Here in The Pub So Much?

Nemises replied to Terrance8812's topic in ASEAN NOW Community Pub

Because missing Bob. Hoping he might return to here one day. -

Warning issued on eve of White Lotus series in Thailand - video

Nemises replied to snoop1130's topic in Thailand News

✅Koh Samui removed from future holiday destinations. -

Using Wise to pay for things

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

Other tax threads? Do you mean the scaremongering threads by expat Tax Agents trying to make a quick buck about a tax that's never going to happen? -

Using Wise to pay for things

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

... you already paid a fee to Wise when converting your currency to THB -

What to do when you have more money than sense?

Nemises replied to BarBoy's topic in ASEAN NOW Community Pub

Easy, travel! Upgrade destinations, seat class and hotel standards to suit your so-called “significant” wealth. -

Using Wise to pay for things

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

When does this tax commence please? -

Using Wise to pay for things

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

What tax? -

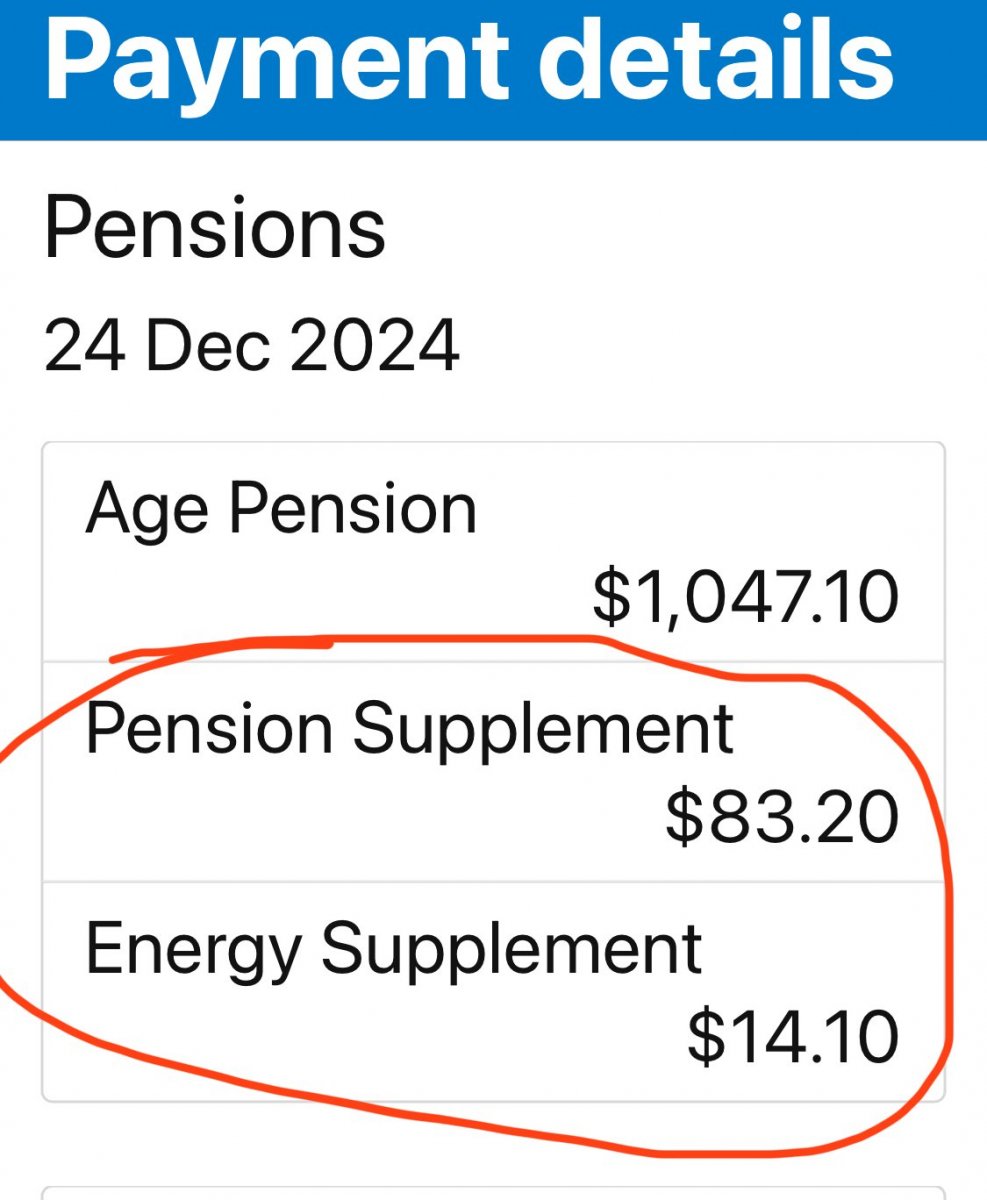

Australian Aged Pension

Nemises replied to VOICEOVER's topic in Australia & Oceania Topics and Events

Here are the current fortnightly supplement amounts. Shame they’re not higher, otherwise they could cover the airfares back to Aus to claim them every six weeks 😁 -

Australian Aged Pension

Nemises replied to VOICEOVER's topic in Australia & Oceania Topics and Events

You're welcome. I'm also a stickler for the rules and I also frequently return to Aus for holidays, but am not bothered to tell them when they state on their website that immigration tell them anyway. -

Australian Aged Pension

Nemises replied to VOICEOVER's topic in Australia & Oceania Topics and Events

You need to tell us if you’re leaving Australia and any of the following apply, you: are going to live in another country will be away for more than 6 weeks get Age Pension under a social security agreement with another country are leaving Australia within 2 years after coming back to live and started getting Age Pension since then or your partner are getting income from employment. If your Centrelink online account is linked to myGov, you can tell us about your travel plans online. If you don’t have these, you’ll need to create them. You can also use your online account to get information on how your travel could affect your payments and concession cards. If you can’t use an online account, tell us your travel plans by either: calling the Older Australians line going to a service centre. Australia’s immigration department will tell us when you leave. They will also tell us when you return. https://www.servicesaustralia.gov.au/when-and-how-to-tell-us-about-overseas-travel-if-you-get-age-pension?context=22526#:~:text=Australia's immigration department will tell,tell us when you return.&text=To get your payment or,qualification rules at all times. -

Australian Aged Pension

Nemises replied to VOICEOVER's topic in Australia & Oceania Topics and Events

Although they ask you to, it's not important to inform Centrelink of overseas travel as Australian immigration will tell Centrelink every time you leave and return to the country. -

Australian Aged Pension

Nemises replied to VOICEOVER's topic in Australia & Oceania Topics and Events

Didn’t think it mattered whether you informed them or not? -

Sukhumvit Nightlife: Who’s Keeping It Alive?

Nemises replied to 123Stodg's topic in ASEAN NOW Community Pub

Not just Sukhumvit. You need to get out more. -

FACT: You will die sooner if you rent! …from the age of 65 the life expectancy of renters was 2.3 years shorter than owner occupiers,” Dr Kiely said. https://www.uow.edu.au/media/2024/older-australians-who-rent-their-homes-have-shorter-life-expectancy.php

-

Why do so many Thai prostitutes marry their customers?

Nemises replied to MalcolmB's topic in ASEAN NOW Community Pub

Wedding pics or it didn’t happen.- 301 replies

-

- 11

-

-

-

-

Jake Paul vs. Mike Tyson - Hardly A Spectacle

Nemises replied to SoCal1990's topic in ASEAN NOW Community Pub

Yes, a lot more! It increased my bank account fourfold as I knew for sure that the fight would last the (much shorter) distance with shorter rounds and that the younger guy would win. Mentioned that to a few mates as well before the fight, we all are now much wealthier, by a factor of four! Amazing odds for something so predictable. -

No one said expat workers in Vietnam are not allowed to purchase a car! The post you quoted clearly states retired expats. Furthermore the topic is about where you retired to - not where you’re going to work at.

-

Certifier for offshore bank account

Nemises replied to BenCrew's topic in Jobs, Economy, Banking, Business, Investments

Yes I used a Thai-based expat fund manager, just showed them my passport from memory.- 1 reply

-

- 1

-

-

Health insurance is needed for DTV. No thanks, prefer to stay Non O

-

Retired expats cannot own a car in Vietnam, so if you like the “freedom”, safety (compared to a motorcycle) and convenience of having car, then avoid this country.

-

Simply go the TV station’s website using a VPN. Enjoy.