-

Posts

10,579 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sometimewoodworker

-

Another Wise problem

sometimewoodworker replied to Furioso's topic in Jobs, Economy, Banking, Business, Investments

-

4M baht taxable?

sometimewoodworker replied to Barney13's topic in Jobs, Economy, Banking, Business, Investments

Your understanding is incorrect according to advice from one of the big four accounting firms, if it doesn’t touch your account. That is correct, she pays no tax. It has a detailed guide on gifts, have you read it? Professional advice is that gift contracts are advisable as proof for TRD -

Amorn that is usually with BigC will be likely to have them, you should get one that is rated at least 50% above the rating on the item you want to connect. That is where I got mine.

-

Amazon USA will usually have 120v machines and they are always going to be less powerful than a 220v machine, you can’t beat physics, If the cooked chicken is that tough it rather suggests that your cooking process could do with considerable adjustment. It is certainly possible that you are either getting the chicken too hot or possibly not cooking it for long enough or both. since I have a sous vide machine I would start at 65C for between 2 and 4 hours, the longer time if cooking from frozen for regular chicken breast I would start at 60C for 1 hour if not frozen. Once cooked correctly you shouldn’t need the Incredible Hulk of blenders. as an alternative you could also use a Jaccard that is more usually used with steak.

-

Doing it now is probably the best option and you can just let the extension expire during a trip overseas, this could be specially important if you have an existing reentry permit. Don’t forget that the only way to swap passports is to do it on a flight. Because all land borders will check that you have a departure stamp from Thailand when you enter Laos, Cambodia or Malaysia. It is also very likely that you must do it on the flight out of Thailand, as when you return you must present your boarding pass, I don’t like to think exactly how you can convince a Thai IO how you arrived in Thailand from Laos, Cambodia or Malaysia with a passport that has no stamps in it. It certainly maybe possible and maybe no problem but I, for sure, would not want to take that chance. Since I don’t have a dual nationality nor do I know anyone who does and haven’t seen reports on this scenario this is just educated speculation, apart from the need to swap passports on a flight.

-

Pipe Joint Compound PERMATEX P-51D Capacity 16 Oz Black Perfectly prevented leakage With pipe spiral water Permatex which can penetrate the gap between the spiral. Resistant to severe solutions and chemicals. Prevents looseness from vibrations. Helps lubricating during the spiral assembly to prevent the feeling effectively. there is nothing that restricts the kind of material that the compound is used for Spiral pipe number 51 is a leak for pipe connection with general spiral. Water leakage prevention lubricant And gasoline. Can be used in the temperature range from -54 to 204 degrees Celsius. Suitable for use with spiral joints. And tap water pipes https://www.thaiwatsadu.com/en/product/น้ำยาทาเกลียวท่อ-PERMATEX-รุ่น-P-51D-ความจุ-16-ออนซ์-สีดำ-60364046

-

Nong Khai Border Bounce 2025

sometimewoodworker replied to DrJack54's topic in Thai Visas, Residency, and Work Permits

You are stretching. If you are being asked for missing documents you are probably only going to be refused if you can’t provide them. My observation of the interaction was that the application had been submitted and was denied (I am not going to give the details of exactly why apart from the fact that it was not missing documents) An application not being accepted because the applicant is not qualified is not a refusal. So once again it is unusual for an extension with correct documentation for a qualified applicant to be refused, but it does happen. -

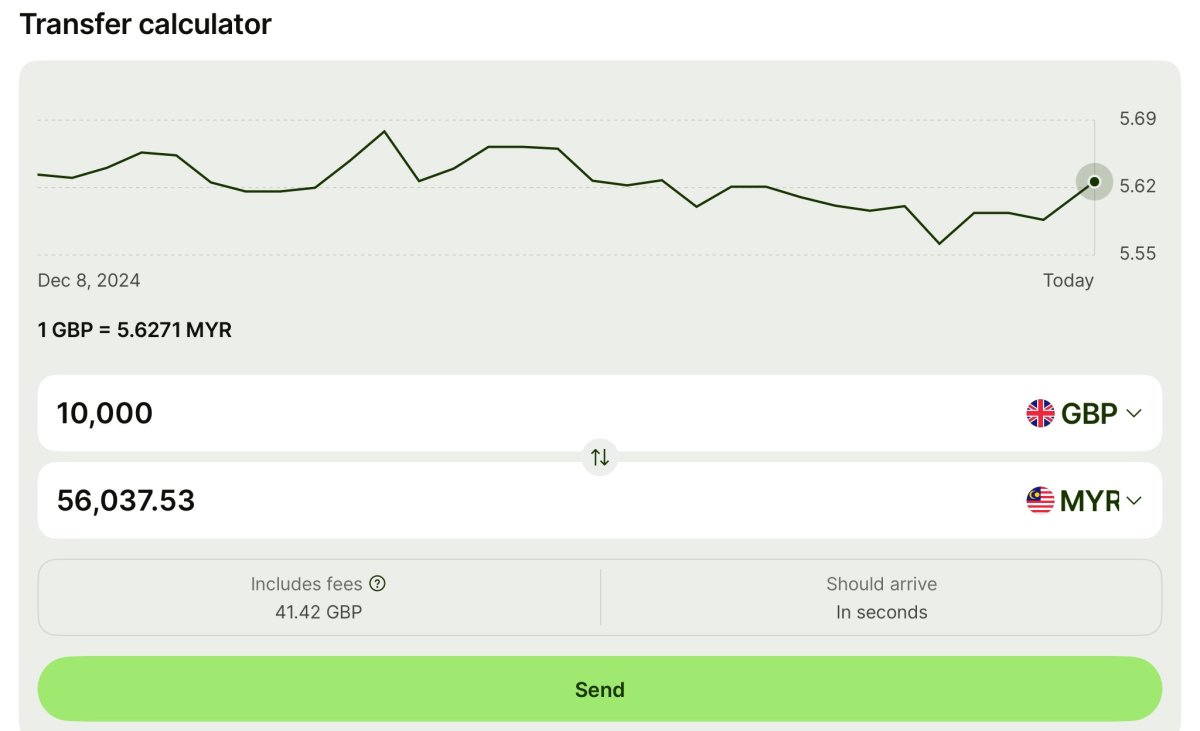

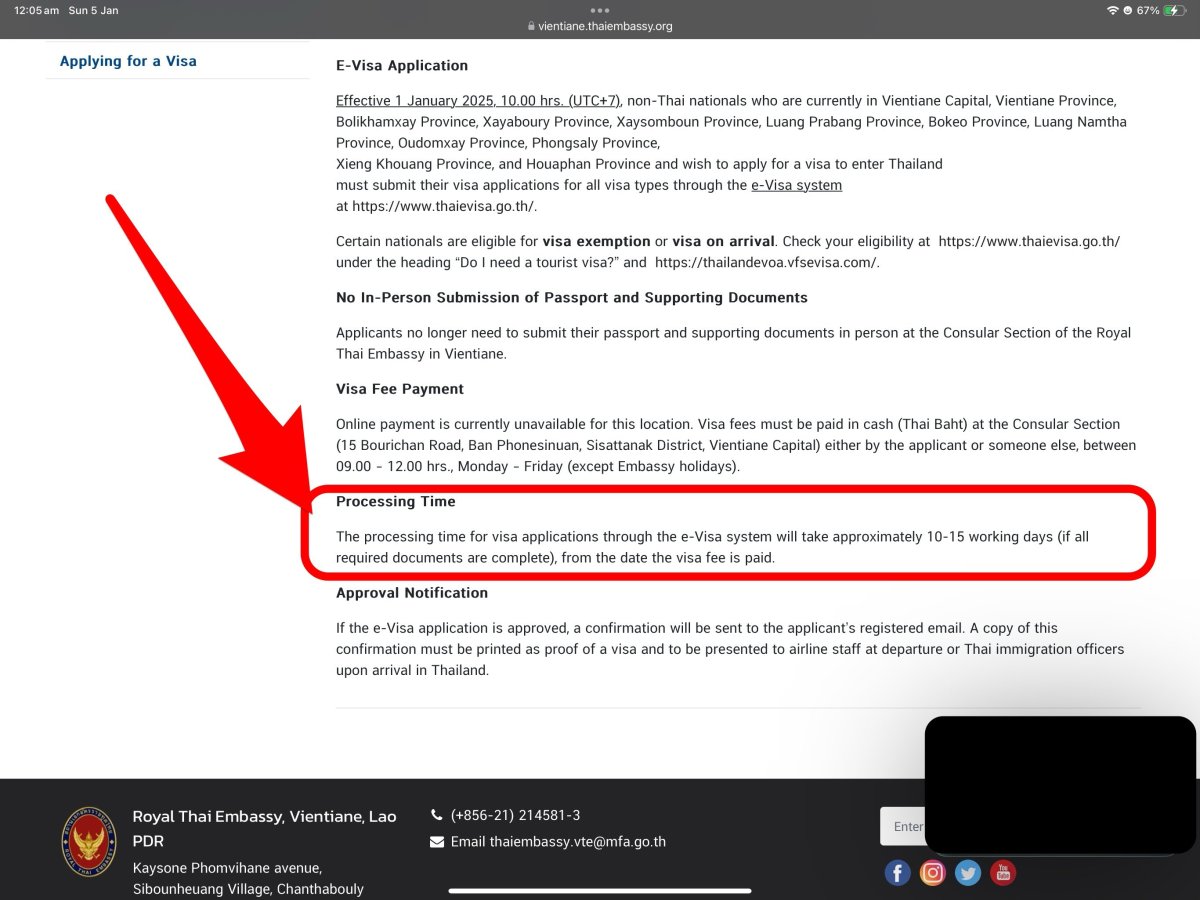

The couple of days is the minimum time for a land border crossing for Vientiane if returning visa exempt. i was unaware that the time for issuing a visa had drastically altered and the Thai embassy does not seem to know that the approval time is unclear unless you mean between if it is 10 and 15 working days of course this makes the process untenable for anyone who is not planning for a long visit to Laos and makes my suggestion in my previous post void

-

Nong Khai Border Bounce 2025

sometimewoodworker replied to DrJack54's topic in Thai Visas, Residency, and Work Permits

Please explain exactly how my post illustrating my observation of an interaction I witnessed is incorrect? I assume that you were not actually present during that interaction. The posts of others are not relevant. That you are usually given a 7 day deadline on leaving Thailand after being refused an extension application is for all intents and purposes a 7 day extension. It is purely semantics to say that it is not 7 day extension, I have never been denied so I do not know the details that are stamped into a passport. If you have an example please provide a scan (suitably obfuscated of course) so the correct exact terminology can be used. -

Returning or trying to return on a visa exempt stamp is IMHO a bad idea, as is waiting until your current extension finishes if you want to keep your original timeline. A couple of days in Vientiane to get a visa is, in my opinion, easier than spending the same time (you will not be able to return on the same day from Laos unless you are paying for a visa trip van) and coming back visa exempt. Of course the requirement for a couple of days outside Thailand may not be the same if you fly or if you use a different exit point. I am only familiar with the Vientiane embassy requirements and Nong Kai border. You can get a train directly to Vientiane from Bangkok now so it’s an easy boarder to reach. This is due to to the likely requirement that you are on a Non immigrant visa or extension, it was certainly the case when I got married, though of course being Thailand the requirements maybe different today. Of course if your timeline is completely flexible and you need to get the maximum time from your existing extension and consider the ฿800 that you will have to abandon by cancelling your extension important then your proposal is certainly workable.

-

The check for outbound tickets is a Thai immigration requirement for some entries, specifically visa exempt that immigration very seldom asks is well known but it can be used as a reason for refusing entry. If you will be required to show it to the airline checkin staff is highly dependent on where you board. For some countries you will always be asked, for others you will never be asked, for the LCC & VLCC airlines they are more likely to require a ticket

-

Nong Khai Border Bounce 2025

sometimewoodworker replied to DrJack54's topic in Thai Visas, Residency, and Work Permits

Really! I did not say that. It was not that was clear as was the unhappiness of the applicant. Of that I am well aware. Did you actually bother to read the post before reacting to your assumption? -

It is certainly broken for some, however the report is submitted to you local office. As a data of data points I use Udon immigration, I have submitted numerous online reports, some in person, I have never had one rejected apart from 2 where I gave an incomplete passport number (I had just replaced my passport), however the 3rd attempt (they were all within ½ an hour)with the complete number was accepted

-

Just a point of clarification. Airlines are fined they are also required to fly you out of Thailand even if you are unable to pay for your flight. That immigration almost never checks and refuses entry is true. That immigration does refuse entry occasionally is also true. If you are refused entry you can be held in immigration detention in the airport for days if you can’t get an immediate flight out that is acceptable to immigration is also true. There are some countries where the airlines never check for onward/return tickets. Equally there are some where you will always be asked.

-

Nong Khai Border Bounce 2025

sometimewoodworker replied to DrJack54's topic in Thai Visas, Residency, and Work Permits

You may not have seen reports, I however have witnessed at least one person who was not given a 30 day extension, I am not certain that they were given a 7 day extension as I did not eavesdrop on the full conversation, they were denied a 30 day extension. That this was unusual is true, that 30 day extensions are almost always granted is also true. That they are always given is not true. -

It is rather unlikely that anyone here can answer your questions definitively. Your best course of action is to contact the Irish embassy, it is possible that they may have a phone number that they will answer. As you have Irish nationality the embassy will certainly talk to you, if they can assist you is a rather different question My opinion is that even if it is no problem for the Irish embassy it could easily be a problem for the ministry of foreign affairs and the Amphur or Ket where you wish to get married. You will have to prove that you are in Thailand legally, if you provide your Irish passport you cannot prove you are here legally, if you provide your U.K. passport you will be required to get married as a U.K. citizen as passport details are required on the marriage documents. You probably have enough time to take a flight out of Thailand to cancel your current extension (unless you have a reentry permit) and return with a new Non-O visa on your Irish passport. To swap passports you must fly out of Thailand, you cannot do a land crossing Note the above is not based on first hand knowledge, I could be wrong but doubt that I am

-

Am I doing something wrong?

sometimewoodworker replied to Peterphuket's topic in The Electrical Forum

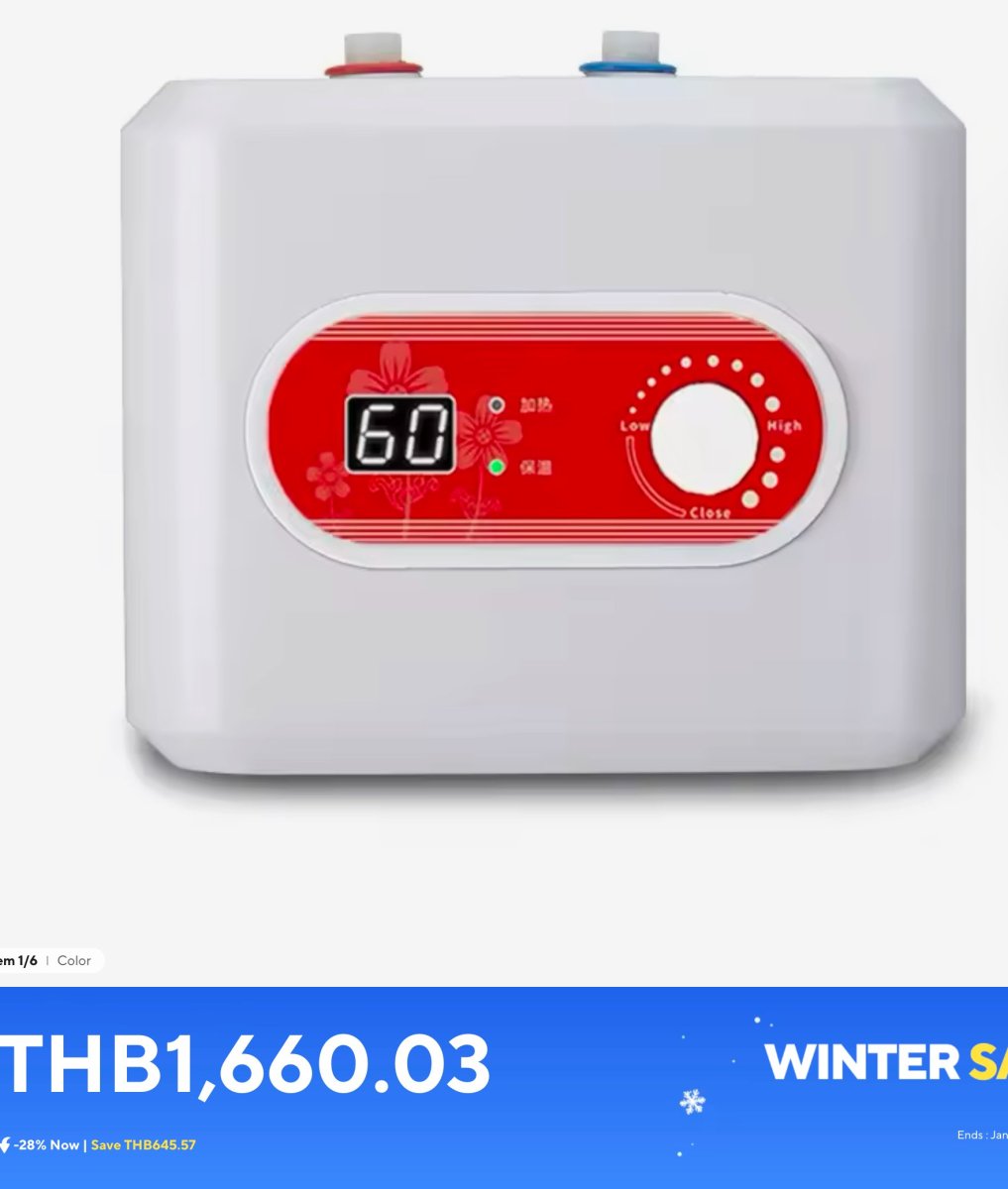

In my experience you either buy cheap and need to replace it again and again and again, or you buy expensive and it will often just keep on going almost forever. I learned this lesson over 60 years ago. I have very occasionally bought cheap and it has almost always been more expensive than buying quality, or it was for very short term usage. so if you are going for cheap then something like this, from AliExpress 10L stored water heater, will be good enough (maybe) it certainly should be cheap enough! -

Avoid to pay tax

sometimewoodworker replied to Jack1988's topic in Jobs, Economy, Banking, Business, Investments

That is too sweeping a statement and not sufficiently explained. There are a few scenarios in which a non tax resident (ie under 180 days in Thailand) still has a Thai tax obligation. a better statement would be; never spend more than 179 days in any calendar year, never earn money in Thailand or from a Thai company and you are probably (almost certainly) immune to Thai taxation. -

It’s the same as most banks, go in and ask apart from all the usual documents like passport etc. they will want a deposit of between 20k and 40k, probably on the lower end. It will probably take about thirty minutes to an hour. however though I do have several credit cards I never need to use them in Thailand. I also have 2 bank ATM debit cards and virtually never need those, I use “Scan to Pay” on 99% of transactions, I have a small amount of cash that I virtually never use, SWMBO will use it and pay me back. SWMBO Has a credit card that we use to build a credit score for herself and to use for the zero interest payments for some products, she doesn’t have debt or ATM cards and uses the “card-less ATM cash” option TLDR there is little reason to get a low limit credit card.

-

[QUIZ] 23 Aug 2024 - High School Science Quiz

sometimewoodworker replied to Crossy's topic in The Quiz Forum

I just completed this quiz. My Score 71/100 My Time 70 seconds -

I just completed this quiz. My Score 70/100 My Time 122 seconds 5 guesses, 2 correct

-

Gifting the Spouse

sometimewoodworker replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

When, or more likely if, you can find an official statement that supports your statement it will directly contradict the opinions of all the professionals I have talked to or read. However I suspect that there were conditions in the question or the opinion that you don’t remember Under the present regulations and the understanding of those professionals you can certainly reduce your tax liability and your wife doesn’t incur a tax liability, if you and your wife are careful of the uses she makes of the gifted funds. Do the gift badly or use it badly and you will both have a tax liability