American Expats using Medicare as a way to cover medical needs

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

-

Popular Contributors

-

-

Latest posts...

-

79

Trump merchandise sold at Fort Bragg for president's speech. The sickening graft continues.

"Official Joe Biden Merch Store. The official Joe Biden merch store has released new merchandise since the president-elect's win, including a "Victory fist bump" T-shirt featuring an image of Biden and Harris at the victory party, selling for $30". As I said, there's plenty more evidence (including the White House gift shop). https://www.whitehousegifts.com/products/biden-bobblehead Silly you. Again. -

21

Accident Cement Truck Crushes Two Girls Outside Petrol Station in Prachinburi

The assumption there is that the parents can afford a car... they most likely couldn't. I made no such assumption. I addressed my comment to AN members who have money and kids of driving age. I've seen decent beaters in Thailand for well under 100K baht. Look hard enough and you can find one for 30-40K. In better shape than the cars I drove as a poor student at that age. Even with western standard driver's ed, scooters are 20-40x more dangerous per km driven than cars. That's from studies done in the USA and Aus. Drivers ed and helmets help, but they don't equalize the risk. Not even close. -

-

110

Traffic Public Skepticism Persists as Thailand Enforces New Traffic Fine System

Most of the posts on this topic show no understanding of road safety, just people taking the opportunity to declare how superior they consider themselves to Thai people - hiding their ignorance behind a fog of cynicism -

-

3

Oi Mate, That Ain’t Your Missus — That’s Proper Rented Property, Innit.

Your authentic Rolex must have entranced her Bob!

-

-

Popular in The Pub

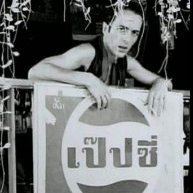

.thumb.jpeg.d2d19a66404642fd9ff62d6262fd153e.jpeg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now