-

Posts

3,387 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by TroubleandGrumpy

-

My name is Colin Neville from Dorset, I am not ‘Bob’

TroubleandGrumpy replied to BarBoy's topic in ASEAN NOW Community Pub

I am not dead, And my mates (2) called Bob back in Australia are not dead either 😁 Or so I think anyway 😉 -

My name is Colin Neville from Dorset, I am not ‘Bob’

TroubleandGrumpy replied to BarBoy's topic in ASEAN NOW Community Pub

Ah ha - a different crowd to what I was expecting. They are all good blokes - most of them. Same as the ones doing mining work in the outback. By bad. -

My name is Colin Neville from Dorset, I am not ‘Bob’

TroubleandGrumpy replied to BarBoy's topic in ASEAN NOW Community Pub

If you say so - met them in bars in Pattaya ?? Asking for a friend. -

My name is Colin Neville from Dorset, I am not ‘Bob’

TroubleandGrumpy replied to BarBoy's topic in ASEAN NOW Community Pub

Surely not no one - my wife is for a start - but clearly not you and all your Pommy mates. -

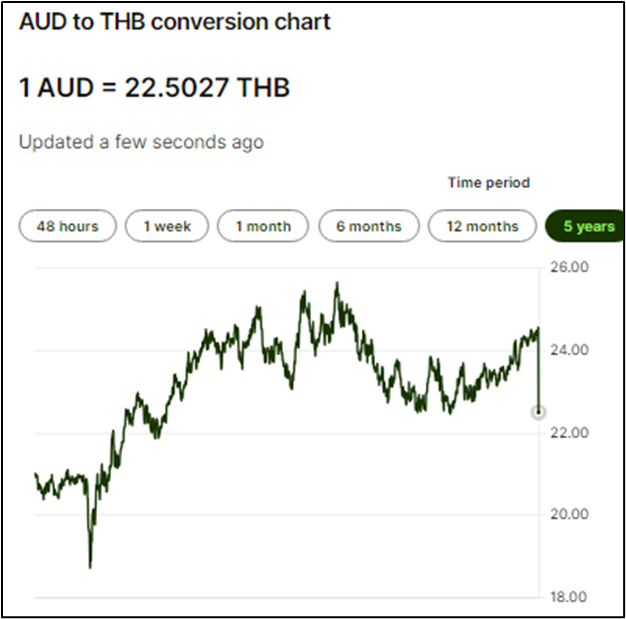

Clearly there was a quick and large drop in the value of the USD that triggered the drop in the value of the USD against most currencies (but not all). But the question remains, why? Look at the long term comparisons over 12 mths and 5, 10, 25 years. The recent drop was extremely fast and extremely quick - bigger than during Covid - why?? Something happened that we do not know about - that is what I would like to know.

-

My name is Colin Neville from Dorset, I am not ‘Bob’

TroubleandGrumpy replied to BarBoy's topic in ASEAN NOW Community Pub

Me too - love the Poms. They are always such nice calm and non-complaining people. -

Agree 100%. Plus I have read that a retired Expat in The Philippines does not have to report to the Police every 90 days and does not have to re-apply for a new Visa (Extension to Stay) every 12 months, and can leave and re-enter the country and the Visa remains active. It seems like The Philippines is very much like Australia was to my Thai Wife when she moved there for a few years - including she had all the legal rights and privileges of being an Australian Resident after 2 years. Plan B for us is to move there if this tax thing goes sideways, and just visit Thailand for less than 180 days each year. The very thought of paying a large amount of income tax to Thailand (if they do want to tax my Pension and Super payments) in return for nothing and with all the same Immigration Police impositions over my personal life, makes me extremely angry. I pay more in VAT than the majority of Thais pay all taxes - by a long way - very annoying. If I was not married to a lovely Thai lady I would have already left. Right now, if time travel took me back 12 years and I knew about all the khrapp like this tax stuff, my decision would be The Philippines and not Thailand. If you know Aussies well, we always put sheite on each other when we screw up - I have been copping a bit ever since this tax rule was announced. Coulda Shoulda Woulda.

-

You, and many others, are IMO reading it wrong. Look more closely at the words, and then read my other post in the Aussie section. https://aseannow.com/topic/1334092-australian-aged-pension-income-taxes-in-thailand/ Plus check out the tax expert's statement in the below video (38 min). https://youtu.be/K-2sAgFNgVE?t=2297 I am not demanding you agree with me/us, all I am asking is that you agree I could be right or wrong (and vica versa). Unless TRD provides a specific statement that the Aust Age Pension is taxable income, then it is a matter of opinion. Besides the tax expert in the video above, I have seen other opinions saying it is not taxable - but I have also seen others saying it is taxable. IMO the reason for that (in the absence of any TRD statement) is because the Clause is very ambiguous. As per my post in the Aussie Home Forum, other DTAs have been written, or re-written, with clear and unambiguous language - and they all state clearly that a Government Pension paid by one country is not taxable by the other - unless the person is both a tax resident and a citizen of the other country. That last point means a Thai citizen who lives in Australia for an extended period and qualifies for and gets the Aust Pension and then moves back to Thailand and gets 'portability', is liable to pay income taxes to Thailand on the Aust Pension payments.

-

You are correct - but you are also wrong. Firstly I never said that 'the US cannot monitor a US credit card usage overseas'. I was referring to the TRD not being able to check/trace US bank records. They can get the BOT records from each local Bank, but they cannot (yet?) get the bank records from US Banks. All of what you said is correct regarding money exchanges between country, but wrong about what the TRD can use to track/check money transfers between Thai/USA. It is the CRS system that Thai TRD can use to track/trace financial transactions for the purposes of tax evasion. The USA is not a member of the CRS, because they went their own way in 2015 and started their own Foreign Account Tax Compliance Act (FATCA). That is used by USA only for their own tax evasion purposes - because as you might know all US citizens must pay income taxes to USA whether they live in USA or not. TRD has no immediate access to FATCA data held by USA Banks, unlike the bank records that they can get (Raw data) using the CRS system.

-

IMO the TRD do not and cannot 'monitor' a USA credit card - the USA not a part of CRS. Regarding large transactions IMO the only way TRD will 'monitor' is that each Thai bank will provide TRD with a list of all bank accounts with international receipts over a certain number (5 mill 10 mill who knows). Then TRD will have to (randomly?) go through those bank records and seek to match them up to tax returns. Where there is a large amount of money remitted and there is a tax return, TRD can (maybe) check the tax return and see if it looks like that money was declared. If not they will then have to decide if it was likely to be taxable income or not. And then maybe decide to send the person a letter requesting more information regarding those remittances. The bank records do not differentiate between savings, income already taxed or not, or earnings already taxed or not - or indeed if the money was taxable income or not. Where there is a large amount of money remitted and there is no tax return, they can (maybe) decide if it was likely to be taxable income or not. And if they do then maybe they will send the person a letter requesting more information regarding those remittances, because the bank records do not differentiate between savings, income already taxed or not, or earnings already taxed or not. Plus of course they have other avenues and reasons why TRD might send someone a 'please explain' - and that includes being reported by some Thai because they dont like you, or maybe you a ditched GF who wants to cause you trouble, or whatever reason that might exist - yet another reason to stay quiet and keep the head down. If/when you get that letter, or maybe a call, then there are some obvious steps - give them the information because you are 'all good' - or take off immediately because you are 'not all good' - or go see a tax lawyer and get things ready to make sure you are 'all good'.

-

I dont have to lodge a tax return in Australia because all I get is the Govt Pension - the vast majority of my Super Fund money was already taxed - sold the house etc and put it all in Super years ago (before they changed the rule and stopped that). But I do because it is basically automatic - ATO already calculates it all - zero tax - I lodge it for the records. I dont have to lodge a tax return in Thailand because I have no income tax to pay - that is what TRD views is OK to do, as advised to me by a tax lawyer - and that is why 30+ million Thais dont lodge a tax return (no taxes to pay). If you want to lodge a Thai tax return, then you go right ahead - not what I would recommend though.

-

Sure - but you asked what is a provident fund - and you did not provide a link showing that the TRD Laws exclude overseas provident/mutual funds. In the absence of any definition of a Provident/Mutual Fund that specifically excludes any Mutual/Provident Fund overseas setup under that Government Laws, then I will run with what I previously posted. Plus - I will add Clause 25 of the Thai-Aust DTA that provides for non-discrimination. National s of a Contracting State shall not be subjected in the other contracting State to any taxation or any requirement connected therewith, which is other or more burdensome than the taxation and connected requirements to which nationals of that other State in the same circumstances are or may be subjected. There is more 'exemptions' in the DTA - but that will do it for me for now, in the absence of any specific ruling or statement from TRD. On that basis I have self-assessed that I believe that I do not have to pay income taxes in Thailand and I will keep all information and records that show why I made that self-assessment on funds I withdraw from my Australian 'Provident Mutual Fund' (Superannuation). I have done the same regarding the Australian Government Pension money I remit into Thailand, and any bank savings money in Australia that I remit into Thailand.

-

I hear you - but according to Google (and as used in many countries). “Provident Fund” is a fund set up voluntarily by the employer and employee (member of the fund) to help employees save up for their retirement. The issue being TRD has not provided an absolute definition of what a provident or mutual fund is - in terms of Expats paying income taxes. Thailand's Tax Laws are very old and when it comes to matters overseas they are obsolete. Thailand is not ready to move to a global taxation system - not by a long shot.

-

What's going on with Dave Bautista?

TroubleandGrumpy replied to FriscoKid's topic in ASEAN NOW Community Pub

Throughout most of his wrestling career, the ex-WWE Champion weighed around 290lbs (21st), with his heaviest ever weight clocking up a staggering 370lbs (26st). However, the former World Heavyweight Champion shed it all for his latest role at The Killer's Game and dropped to 240lbs (17st). The Guardians of the Galaxy actor went on an intense diet a year and a half ago after wrapping up M. Night Shyamalan's Knock at the Cabin. The Marvel star revealed his unbelievable new physique on the red carpet and he now looks completely different to the behemoth that set the world of wrestling alight in the 2000s. Bautista told Chris Van Vliet: "I'm getting super trimmed, this is probably the lightest I've been since I was 19 years old. "The heaviest I've ever been is 370lbs (26st). When I started Deacon, I was about 325lbs (23st). Google and The Sun. -

ROFLOL Your own words :- There may well be some tax "experts" on this forum, but their expertise expired the day they left their home country. They should not be advising anybody to do anything regarding taxation here, one might as well take advice from a taxi driver I just noticed that this thread has now been designated as a "must read" personally I think nothing could be further from the truth. Unless one considers scaremongering clickbait essential reading matter. All these tax threads remind me of the various covid threads but without the censorship, So you think it is OK for you to comment and say what you like - BUT others are not allowed to do the same. You must be a very special person mate.

-

Then dont read other people sharing their thoughts and opinions on the matter !! I have done a lot of research etc etc but like everyone else I do not know or understand, and I can say with certainty that unless I had read these threads I would know a lot less. It was on this forum, in another thread, that I first heard about the 'gifting rule'. And many other things read here that ended up being good for me, and lots that was crap. IMO take the good with the bad mate - or get lost and dont read.

-

Yes indeed and done for 3. Philippines, Malaysia and Indonesia do not tax the remittances of retired Expats brought into their country - as far as my read is concerned. But that is not to say that they are not looking to change that - but when all three countries complied with the CRS and OECD tax changes, they all excluded the incomes/money of retired expats. It took me a long time to find that - and it will do again - and perhaps I should have kept the exact location of the relevant sections in their tax codes and Govt statements, but I didn't. I figured (wrongly) Thailand would not go full monty and target worldwide income - my bad. But I still think they wont fully implement this new tax regime - their tax laws and systems and methods are totally backward - and I think it will be too hard with all the appeals and complaints - I will stay away and watch what happens for a while.

-

True - and it is very confusing - and as far as I am aware TRD has not provided a specific statement or ruling on what is a mutual or provident fund - whether it is in Thailand or Overseas. However it has published one ruling on whether the money received by a retiree of a mutual/provident fund is taxable - and that ruling is that it is excluded as it applies to a tax return. Therefore the 'definition' used by TRD on its website as it being exempted, is what I am running with. If any money or benefits received by the Fund members from the Fund on an annual basis are in accordance with the Law on Provident Funds. By retirement or retirement according to the regulations, the applicant must be at least fifty-five years old and have been a member of the Fund for at least 5 consecutive years. If the member has been a member for less than 5 consecutive years, he must be a member until the membership period is not less than 5 consecutive years, and any such money or benefit shall be exempted from calculation according to Section 42 (17) of the Revenue Code, together with Clause 2 (36) of the Ministerial Regulation No. 126 and Clause 3 and Clause 4 of the Notification of the Director-General of the Revenue Department on Income Tax (No. 223) dated October 25, 2012 as follows: The Fund is not obliged to withhold income tax under Section 50 (1) of the Revenue Code. The Revenue Department (rd.go.th)