-

Posts

15,335 -

Joined

-

Last visited

-

Days Won

7

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by ukrules

-

Recommended Crypto brokerage for Thai Residents?

ukrules replied to Fiskebolle's topic in Cryptocurrency News

Use Kraken.com in the US if you have no ties to the US, are not a US citizen and have never been a green card holder. The US have many tax rules for anyone who's ever been a taxpayer inside the US - but for the rest of us - things are far easier. Also Kraken are international and they offer some special services to non US residents which are not available to US residents - like interest on cash balances. Oh, and they do not care that you are in Thailand one bit. I used a Kasikorn bank statement which I had printed with my address in English to prove my place of residence and they don't even mention a tax id. -

Thailand Yet to Finalise Policy on Taxing Expats’ Overseas Income

ukrules replied to webfact's topic in Thailand News

Nonsense, what do you think an audit is? -

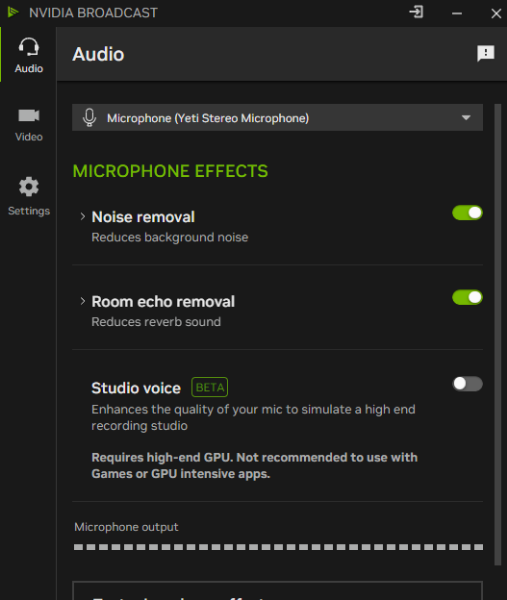

The best thing about voipstudio is the 2000 minutes per month plan which costs just £17 a month and comes with a local number - I do make a LOT of calls every month and could use most of those minutes. I also setup a secondary account with 'SipGate' which allows pay per minute in case the first one stops working for any reason. both accounts have separate local numbers in the UK for me but have worldwide options. I found that I can also add an additional piece of software to my computer which cleans up the audio automatically so it's incredibly clear on the other end and on the recorded calls - there was a lot of air conditioner related background noise when I first used it as the VOIP software contains no way to remove background noise at all, I believe Skype does some kind of processing but it's not that good. In case anyone is interested and has an Nvidia graphics card I used something that's free called 'NVIDIA Broadcast' and it has these options which completely remove any background noise / hiss / echo - also keyboard typing sounds - it just sounds like you're sitting in professional a studio speaking into a high end microphone. Now my microphone is on the better end of the home user scale - it's a 'Yeti' by Blue but even so the sound quality sitting right in front of the microphone with this free app named 'NVIDIA Broadcast' is perfect - the best I've heard. So I have my full Skype replacement solution and it works better than the previous setup - I'm all set for years to come.

-

Yeah good point - there are varying zero rate allowances depending on circumstances and even age - these are generally lower than the allowances we get in the west - hence this overlap concept which exposes pretty much everyone to taxation if they submit for example the monthly requirement to meet a retirement visa for a single person. Anyway my point about any money earned 'back home' being taxable in Thailand still stands and they do tax anything that isn't excluded by the DTA and hasn't been taxed abroad - in theory. In practice I've been hearing a lot of people reporting they they don't tax pension income - at a local level.

-

Yeah this is where Teams falls apart and it fails badly. Only Teams for business with the multiple associated business software licenses and subscriptions will allow landline and mobile calls - you can't get the phone software or subscription to work with a personal account - it simply rejects it immediately and instantly - believe me - I've tried to do it. This is what made me reconsider the real VOIP services which have really been around for a long time now. Just try and use Teams to call a land line and you will see a kafkaesque path of licensing and subscriptions open up in front of you. Unless Microsoft make big changes to Teams and how it handles Skype type accounts or open it up for use with personal accounts then there's going to be big problems. None of the apps are worth anything if you need to call a landline, mobile phone without apps or a government office or bank in a foreign country - not one of them are suited to the task.

-

British Tourist Tricked in Pattaya Herbal Remedy Scam

ukrules replied to webfact's topic in Pattaya News

This is hilarious, a 'bump' like this is so obviously a scam only a complete fool would fall for it. If you're a bit dim then remember this : Don't talk to anyone who does a 'cold approach' when you're out and about, if you don't know then already then they are almost certainly up to no good. -

I believe there is an overlap between the two very different thresholds and if they wanted to they could apply some tax to the bit inbetween the lower Thai tax free threshold and the higher tax free threshold in the UK and most other countries. Taxation kicks in at 10% between 300k and 500k and £12570 is worth 551k Baht right now So technically that untaxed 200k Baht between 200 and 500k would be taxed at 10% and the 51k above 500k stretches into the 15% band. Because it's not taxed in the UK then it won't be double taxed..... So in theory at least they could demand 10% of the 200k between 300 and 500k and 15% of the 51k between 500k and 551k which would be 20,000 Baht + 7,650 = 27,650 Baht. Now this money would not be double taxed as it's untaxed in the UK so should be fair game for them to come after - but I haven't seen many people speak about this. Is it excluded by the double taxation treaty? Who knows - I doubt it because it's not taxed is it - or if it is consdiered taxed at a zero rate - does that count at all? Also I doubt it. It doesn't apply to me as I don't pay any tax anywhere else due to being non resident anywhere that I could pay tax so they would want to tax the lot in my case if I were to stay more than 180 days - which I don't. You do mention a good point though as this 'overlap' as I'm going to call it is the first thing that came to mind when reading about this change long ago and I figured it would automatically affect every tax resident and bring them all into the tax net as the allowances in Thailand are very small compared to 'the west'..... So it would likely come down to - where does the income come from and is it covered by the double tax agreement - and that gets complex fast - hence - see an accountant to confirm. Edit - there is a lower 5% band as well which may or may not come into play depending on age.

-

I was personally only looking for Windows solutions but yes, there are plenty that have apps. The Zoiper software is available on desktops, Android and IOS so yes, that's why I mentioned it even though it doesn't fit my use case. It is a professional piece of software and works just fine - however it's not for me - but for many people this a very usable option - it's available at zoiper.com Check it out : https://www.zoiper.com/en/products It's worth noting that there are many many different pieces of software for desktop and mobiles that do this kind of thing and some of them are free with the phone service provider subscriptions - there's also 1000s of companies providing the phone service.

-

I've been doing some research recently and as Skype is apparently going to be turned off I decided to look into the various VOIP systems that exist. These are a little more complex to setup - not much but more than just installing some software and entering the user/pass like you do on Skype However some of them do appear to be very straightforward but to get an incoming number the process differs between providers. I have quite a specific requirement in that I want to record phone calls and do so in MP3, not WAV format. With this type of system you get some VOIP SIP software and configure it to connect to the 'SIP gateway' which is a separate paid for service and not related to the software - some of the gateways offer software as part of the package - but my MP3 recording requirement made this useless to me. First I purchased a Zoiper 5 Pro license which is a piece of software that connects to a VOIP/SIP account - this works but it only records in WAV format - so that's out - wasted money there - for me - however it does appear to be a decent piece of software if you don't need to record or are not too fussy about disk space usage when you do record - WAV files are not small compared to MP3 files. I only use it for voice calls to landlines and mobile phones and for this to work reliably you do need to obtain a phone number for the account. So I then download MicroSip which is a free cilent and offers recording in MP3 format - note this is from microsip.org - don't use any other domain to download this piece of software. It's free, works well and offers auto recording in MP3 format. Then I setup a VOIPStudio account over at voipstudio.com - it was some hassle to get a number attached to the account - I wanted a local number in the UK, they needed some kind of proof of ties to the country where you get the number, I did a ticket with them and mentioned that surely my uk registered credit card would be enough and they agreed. Now I did the same with another SIP provider and after setting it all up they said they had put a verification code in the mail - as in normal old fashioned letter mail - it still hasn't arrived after half a week so they're out. Anyway I managed to test MicroSip with VOIPStudio and it works just fine, call recording and all. Now this type of system is more of a business orientated system - the kind of setup that callcenters often use but it is widely available for single users like myself and the VOIPStudio has a 2000 minute per month calling plan which should be enough for most months for me. So for those of you who are looking for this kind of solution - this is it, as described above. It's for calling land lines and mobiles in different countries at heavily discounted prices / included minutes - which is exactly what I used Skype for to mostly speak to elderly relatives who are not altering their phone systems in their lifetimes. this type of setup is the solution - forget Microsoft Teams - it's pure garbage and requires a business account and subscriptions to Microsoft 365 plus a Teams Phone license and even then subscription plans on top of all this - there seems to be like 4 levels of accounts, software and config to get through before getting Teams to do voice to landlines / mobiles so I quickly gave up on that.

-

Do you know what really gets on my nerves?

ukrules replied to Robert_Smith's topic in ASEAN NOW Community Pub

Saville is not a good example, he got away with it while alive but lets make no mistake here, many thousands of people who knew him knew exactly what he was like and what he was up to. Then there's his victims, they all knew as well and they likely spoke to various people about his 'goings on' - and reported him. He was protected from 'up on high' for whatever reason which is why he got away with the things he did until he was dead, then the protection ended. -

German Man Behind Violent Tirade in Korat Dental Clinics

ukrules replied to snoop1130's topic in Isaan News

Yeah, he's gonna be in real trouble if one of those dentists knocks his teeth out for him while he's on the rampage. What would he do then? 🤣 -

Thailand Yet to Finalise Policy on Taxing Expats’ Overseas Income

ukrules replied to webfact's topic in Thailand News

People don't seem to understand that CRS is useless to the Thais unless they enact global taxation. It's a tool for use by the west to keep tabs on your foreign accounts. Most of us are non resident 'back home' and as Thailand only taxes remitted income for 180+ day residents then CRS does literally nothing useful for them at all - they can already see remittances should they request information from Thai bank accounts. So CRS for Thailand only makes sense in the scenario where taxation on global income is in place, even if it's not remitted. We know some people who work in the Revenue Department want this - but they're not in a position to do it - only government can do that and it would be a contentious issue - many would leave. Not just foreigners - I would expect a mass exodus of wealthy Thais as well. -

Perhaps the US should give France back to the Germans while they're at it?

-

Portugal doesn't need billions worth of fighter jets anyway. I really wonder why these dumb governments spend so much on this worthless crap which they will never get to use. Kind of like wanting submarines when you don't have a ready to go nuclear arsenal to hide or at least make it look like you have it.

-

The brand is not your problem here, they sell millions of units per year. Either it's a dud or they broke it.

-

Thai Tourism Grapples with Declining Chinese Visitors

ukrules replied to webfact's topic in Thailand News

Chinese tourists will come when instructed to do so by their lords and masters. They are wielded as a weapon. Some Uyghur deportations here, an unofficial police station somewhere else and before you know it the flood gates are opened again. But only once they bend the knee and provide whatever it is that's being demanded will the tourists flow. -

British Embassy Faces Rising Consular Case Demands in Thailand

ukrules replied to webfact's topic in Thailand News

I didn't realise they still had a consular services section, from what I heard they closed it down years ago - it's all spies, police and diplomats. -

Media Players need to buy Codec to watch???

ukrules replied to JeffersLos's topic in IT and Computers

This one's been around for so long I can't even remember when they first launched it - 20+ years ago though! The old k-lite codec pack, still going after all these years, of course they update it along the way. -

British Retirees Escape Thai Jail After Violent Land Dispute

ukrules replied to snoop1130's topic in Thailand News

It is unusual for the victim to not have the name published in a small time case like this. Also where are the photos of the victims pointing to the scene of the crime -

British Retirees Escape Thai Jail After Violent Land Dispute

ukrules replied to snoop1130's topic in Thailand News

So what, they clearly leased it or something similar. I have a couple of land leases myself, it's no biggie. By the time those 30 years are up I'll likely have moved on or really moved on.- 97 replies

-

- 11

-

-

-

-