-

Posts

1,240 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Smokin Joe

-

Plant-based meat popularity fuels new ventures in Thailand

Smokin Joe replied to snoop1130's topic in Thailand News

You should also suggest that meat eaters be required to read The Jungle by Upton Sinclair. It has been known to turn meat-eaters into vegetarians. -

Plant-based meat popularity fuels new ventures in Thailand

Smokin Joe replied to snoop1130's topic in Thailand News

I love that clip fro Yellowstone. Great rebuttal to the non-meat eaters whose primary motivation is that they don't want to kill anything. -

Plant-based meat popularity fuels new ventures in Thailand

Smokin Joe replied to snoop1130's topic in Thailand News

It would be interesting to see a legitimate poll taken. I am an average person, I've never hunted but am not opposed to it. I have no desire to personally kill an animal. But if it was required to kill a cow or pig occasionally I would have no problem doing it. I wouldn't enjoy it, but I am never going to switch to fake meat. -

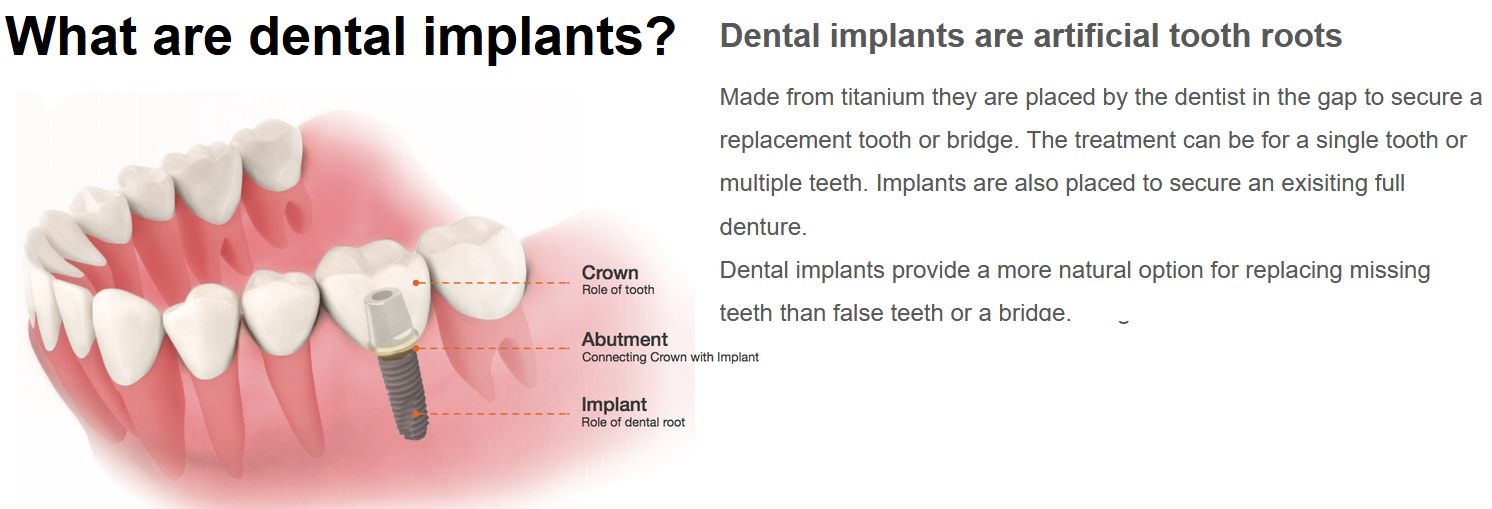

Dentures and implants are totally different things. I think what I referred to as dentures may actually called a bridge. An implant is when you drill a hole in the jawbone and screw in a titanium insert. Then the gum is sewn shut above it and it is allowed some time to fuse with the bone. After the wait time is up the gum is opened back up and a post with a crown is installed in the hole at the the top of the implant.

-

I just had a new tooth issue come up where a 30 year old crown fall off. What is left of the tooth is in bad enough shape that a root canal and new crown is not possible. I also had a false tooth that was attached to the crown on one side so the crown and false tooth fell out together. 1st step is having the remains of the one tooth extracted leaving me with two missing teeth side by side. I was given three options: Two implants with crowns - Approx 60,000 Baht Permanent denture - Approx 20,000 Baht (I actually forgot the price but I think this is ballpark what I was told) Removable denture - Approx 4,000 Baht Since the removable denture is so cheap I decided to go with that to see if I can get used to it and not have problems. If I don't like it I'll probably get the two implants for a permanent fix. Dentist agreed that that was not a bad idea. I am already in the process of getting another implant on the opposite side and need to wait four months for the implant to fuse with the bone so this new issue leaves me with a couple of big holes that make eating difficult. This was at Dr. Warin's office on Central Pattaya Rd (Pattaya Klang).

-

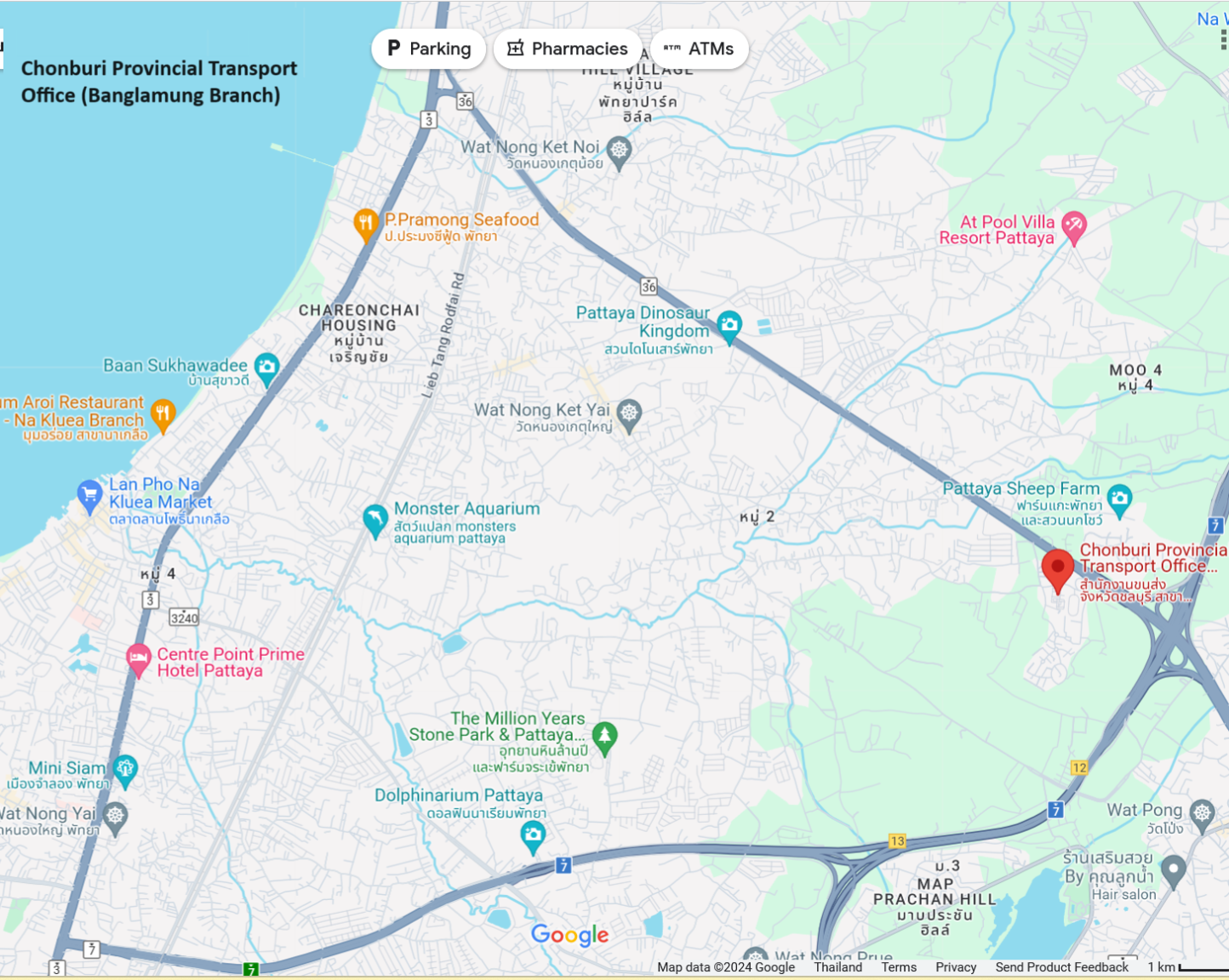

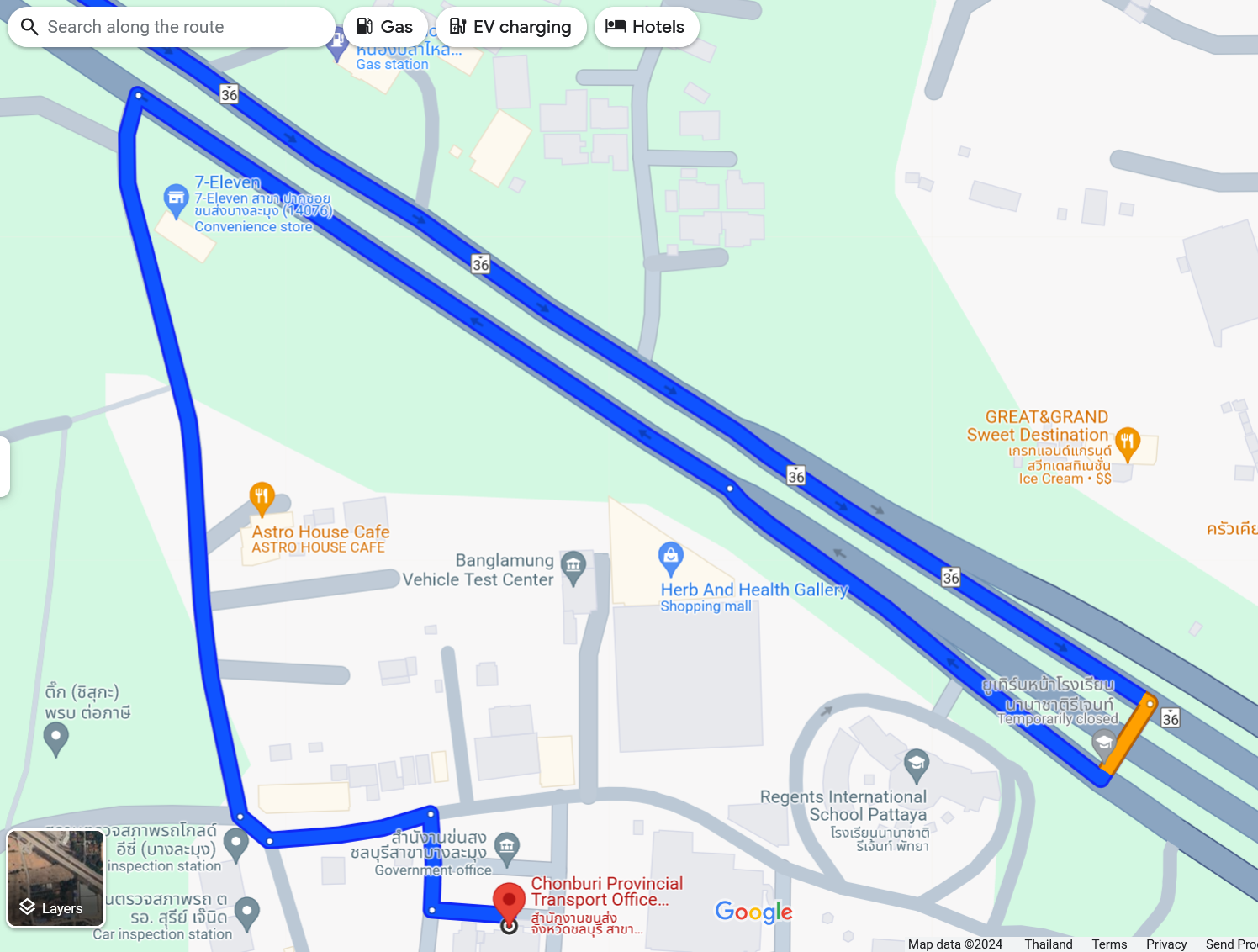

Sukhumvit to Hwy 36 or Hwy 7 (Expressway) to Hwy 36. It is just west of Regents School. Use GPS as signage is poor. You can go by motorbike on Hwy 36 but not on the expressway.

-

Phuket car rentals must verify tourist driving licenses

Smokin Joe replied to webfact's topic in Phuket News

Do you have a reference for that. And I mean a real reference. like a quote from a Thai law? I can show you where to look. Everything that Thai law says about using a foreign license is in Section 42 of the Motor Vehicle Act. Section 42. A driver shall be licensed and shall, while driving or controlling other driving trainee in driving, possess driving license and a copy of vehicle registration certificate for producing immediately to the competent official, except the driving trainee under section 57. In case of a driver who is an alien temporarily permitted to reside in the Kingdom under the law on immigration may possess a driving license under section 42 bis while driving in the Kingdom. In this case there shall be accompanied such driving license with the document prescribed in the existing Convention or Agreement between Thai Government and the Government of such country for producing immediately to the competent official45. [The word “vehicle” is amended its spelling in Thai version under section 3 of the Vehicle Act (No. 12), B.E. 2546 (2003).] Section 42 bis 46. In the case where there is a bilateral agreement between the Government of Thailand and a foreign Government concerning reciprocal recognition of domestic driving licenses, an alien temporarily permitted to stay in the Kingdom under the law on immigration having a driving license issued by the competent official or a driving society recognized by the Government of the country under such bilateral agreement may use the driving license of such country in driving in the Kingdom in accordance with the category and type of vehicle specified in such driving license; provided that the existing Conventions and/or Agreements between the Government of Thailand and the Government of such country and all the provisions relating to the obligations of a driver under this Act must be complied. 45 Section 42 paragraph two is added by the Vehicle Act (No. 8), B.E. 2530 (1987). 46 Section 42 bis is added by the Vehicle Act (No. 8), B.E. 2530 (1987). -

Has anyone heard of a new law ??

Smokin Joe replied to dauu's topic in Thai Visas, Residency, and Work Permits

That website is well known for having incorrect or out of date info. And their name is a blatant attempt to make people think it is an official government website. -

I feel sorry for you.

-

Mexico Retirement Visa From Bangkok

Smokin Joe replied to JimTripper's topic in Visas and migration to other countries

This is from the AARP website and gives the details of financial requirements and a link to the visa application form. You could fill out the form and makes copies of proof of adequate finances show up on their doorstep. Maybe call first. For retirees who want to live in Mexico, the first stop is to visit the nearest Mexican consulate and apply for a permanent resident visa. You’ll be required to: Fill out a visa application form and pay a $48 application fee. Provide a valid U.S. passport and a color picture. Provide proof of economic solvency — documentation that you have maintained bank or investment accounts with a monthly balance of $181,968 for at least the past year or that you have monthly income from work, Social Security or a pension of at least $4,549 after taxes over the past six months. -

Condos that are right on the beach rather than separated by a road may be the most important feature for the folks whose dream it is. I am no longer impressed with being right on the beach but I am as close to the beach as you can get. Literally two steps down from our back entrance gate.

-

I have lived in Naklua in an older beach front condo for about 17 years. I like my condo but otherwise I would pick Jomtien over Naklua. The one advantage for me is it is more convenient to go to central Pattaya from Naklua. It is also closer to major shopping such as T21, Lotus, and only a little farther to Big C Extra. But Jomtien has a more diverse selection of bars and restaurants. Naklua is dead in the daytime except for the beach.

-

Had a setback - how can I prevent a disaster?

Smokin Joe replied to RuamRudy's topic in ASEAN NOW Community Pub

The best thing to do once you have removed a cork is to replace it with one of these eco-friendly Frankencorks. Practical, and also delicious once the bottle is finished. -

This is the form that was being handed out at Pattaya City Hall on North Pattaya Rd a few years ago.

-

That would be fast. But first you would have to find an antique shop that had one in working condition. 😆

-

-

When referring to a CPAP as portable I think that generally means one that can operate on battery power and /or is allowed for use on an airplane. None of the CPAP machines I've seen are very large. I have only had a Phillips Dreamstation (The one that had the recall). It was replaced at no charge with the upgraded one. I looked for reviews for the Contec R100 and didn't find any with a not very in-depth search. The R100 does seems to be very reasonably priced. The ResMed machines are popular and ResMEd is a well established name so would be worth looking at. Edit: The Contec machine is made in China. ResMed machines are not. ResMed was an Australian company that is now international.

- 1 reply

-

- 1

-

-

Songkran festival ends with 243 deaths in traffic accidents

Smokin Joe replied to snoop1130's topic in Thailand News

It helps keep numbers down if they end the Safety Campaign early. -

This is apparently an advertisement for the business the OP posted a link too.

-

Don't be surprised if they don't open until Monday.

-

Overseas Police Clearance

Smokin Joe replied to youreavinalaff's topic in Teaching in Thailand Forum

I don't see that on the website. In fact it says that they can't "Authentication and legalization (apostille); Thailand is not participating in the Apostille Convention (The Hague), therefore, all Thai-issued documents cannot be apostille. If you intend to use Thai documents in some countries, you may need to have your document authenticated and legalized by the embassy of that country in Thailand." Edit: I just double checked and it does say they they offer "authentication - legalization or apostille services". It also states that they have an office in Canada and that may only apply to non-Thai documents authenticated in Canada. -

Did you know this about 7-Eleven (Thailand)?

Smokin Joe replied to george's topic in ASEAN NOW Community Pub

Anyone else notice that on the 7-11 logo the word "ELEVEN" has the letters in all upper case except the final "n" which is lower case, but in a larger font so it is as tall as the other letters. 7-ELEVEn -

Overseas Police Clearance

Smokin Joe replied to youreavinalaff's topic in Teaching in Thailand Forum

Link for Police Clearance Service Center: https://pcscenter.sbpolice.go.th/en It can all be done via mail. I had a friend who needed a police clearance for every country she had lived or worked in for the last few years.